Russel Metals Inc. (TSX: RUS) reports third quarter net earnings of

$92 million or $1.45 per share. Net earnings reported in the

comparative third quarter of 2007 were $28 million or $0.44 per

share. Consolidated revenues for the third quarter of 2008 were

$955 million, an increase of 53% from the third quarter of 2007

revenues of $624 million and an increase of 12% from $856 million

reported in the second quarter of 2008. Net earnings for the nine

months ended September 30, 2008 were $200 million or $3.16 per

share which compares to $86 million or $1.37 per share for the same

period in 2007.

Revenues for our energy tubular products segment were $325

million for the third quarter of 2008 compared to $175 million for

the third quarter of 2007. Steel price increases and increased

volumes in all our operations within this segment led to record

high revenues and earnings. Increased demand from our two units

servicing the oil and gas drilling activity in Western Canada as

well as continued high demand at our U.S. energy operations and our

operation servicing the oil sands of Northern Alberta, produced

operating profits of $60 million for the third quarter of 2008

compared to $16 million for the third quarter of 2007. The high

demand for pipe product resulted in increased margins of 29%

compared to 21% reported in the second quarter of 2008.

Revenues in our metals service centers segment increased 50% to

$509 million for the third quarter of 2008 compared to $339 million

for the third quarter of 2007. Operating profits for our metals

service centers for the third quarter of 2008 were $68 million, a

significant increase from $23 million reported in the third quarter

of 2007. Results at our metals service centers strengthened from

the third quarter of 2007 due to steel price increases initiated

earlier in 2008.

Our steel distributors segment produced operating profits of $21

million for the third quarter of 2008 compared to $10 million for

the third quarter of 2007. The increase was a result of higher

margins, which more than offset reduced volumes. Volumes in this

segment were lower compared to 2007 due to lower import levels as

strong worldwide steel demand and pricing resulted in product

flowing to areas outside North America.

Bud Siegel, President and Chief Executive Officer, commented,

"Our record earnings of $1.45 for the third quarter 2008 is in

contradiction to current overall economic conditions. The financial

crisis has impacted both demand and steel pricing in most of the

industries we service, although there remain positive pockets of

business in the customer base of Russel Metals. Uncertainty in the

markets has had an impact on both our suppliers and customers, but

I strongly believe that Russel Metals has the flexibility,

expertise and a strong balance sheet that will enable us to react

to the changing conditions as well as any company in our

sector."

The Board of Directors approved a quarterly dividend of $0.45

per common share payable December 15, 2008 to shareholders of

record as of November 24, 2008.

The Company will be holding an Investor Conference Call on

Friday, November 7, 2008 at 9:00 a.m. ET to review its third

quarter results for 2008. The dial-in telephone numbers for the

call are 416-641-6130 (Toronto and International callers) and

1-866-226-1793 (U.S. and Canada). Please dial in 10 minutes prior

to the call to ensure that you get a line.

A replay of the call will be available at 416-695-5800 (Toronto

and International callers) and 1-800-408-3053 (U.S. and Canada)

until midnight, Friday, November 14, 2008. You will be required to

enter pass code 3271882 in order to access the call.

Additional supplemental financial information is available in

our investor conference call package located on our website at

www.russelmetals.com.

Russel Metals is one of the largest metals distribution

companies in North America. It carries on business in three

distribution segments: metals service centers, energy tubular

products and steel distributors, under various names including

Russel Metals, A.J. Forsyth, Acier Leroux, Acier Loubier, Acier

Richler, Arrow Steel Processors, B&T Steel, Baldwin

International, Comco Pipe and Supply, Fedmet Tubulars, JMS Russel

Metals, Leroux Steel, McCabe Steel, Megantic Metal, Metaux Russel,

Metaux Russel Produits Specialises, Milspec Industries, Pioneer

Pipe, Russel Metals Specialty Products, Russel Metals Williams

Bahcall, Spartan Steel Products, Sunbelt Group, Triumph Tubular

& Supply, Wirth Steel and York-Ennis.

Statements contained in this press release or on the related

conference call that relate to Russel Metals' beliefs or

expectations as to certain future events are not statements of

historical fact and are forward-looking statements. Russel Metals

cautions readers that there are important factors, risks and

uncertainties, including but not limited to economic, competitive

and governmental factors affecting Russel Metals' operations,

markets, products, services and prices that could cause its actual

results, performance or achievements to be materially different

from those forecasted or anticipated in such forward-looking

statements.

The forward-looking statements in this document reflect

management's current beliefs and are based on information currently

available to management. The material assumptions applied in making

the forward-looking statements in this document include the

following: demand from the manufacturing, resource and construction

segments of the Canadian economy, oil and gas prices, the price of

steel, and the value of the Canadian dollar relative to the U.S.

dollar will be consistent with what we have experienced at the end

of October 2008. Although the forward-looking statements contained

in this document are based upon what management believes to be

reasonable estimates and assumptions, Russel Metals cannot ensure

that actual results will not be materially different from those

expressed or implied by these forward-looking statements.

RUSSEL METALS INC.

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

September 30, December 31,

(millions) 2008 2007

----------------------------------------------------------------------------

ASSETS

Current

Cash and cash equivalents $ 173.6 $ 181.8

Accounts receivable 542.0 341.8

Inventories 747.4 572.6

Prepaid expenses and other assets 4.5 8.5

Income taxes 0.1 3.9

----------------------------------------------------------------------------

1,467.6 1,108.6

Property, Plant and Equipment 231.5 227.9

Deferred Financing Charges 0.2 0.3

Future Income Tax Assets 1.0 1.0

Other Assets 6.7 12.1

Goodwill and Intangibles 56.2 53.4

----------------------------------------------------------------------------

$ 1,763.2 $ 1,403.3

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current

Bank indebtedness $ 7.3 $ -

Accounts payable and accrued liabilities 522.0 294.2

Income taxes payable 37.0 2.8

Current portion long-term debt 1.1 0.9

----------------------------------------------------------------------------

567.4 297.9

Derivatives 33.3 39.5

Long-Term Debt 187.8 174.9

Pensions and Benefits 1.1 1.4

Future Income Tax Liabilities 7.3 5.8

----------------------------------------------------------------------------

796.9 519.5

Shareholders' Equity

Common shares 491.7 504.2

Retained earnings 485.3 411.7

Contributed surplus 9.0 6.2

Accumulated other comprehensive loss (19.7) (38.3)

----------------------------------------------------------------------------

966.3 883.8

----------------------------------------------------------------------------

$ 1,763.2 $ 1,403.3

----------------------------------------------------------------------------

----------------------------------------------------------------------------

RUSSEL METALS INC.

CONSOLIDATED STATEMENTS OF EARNINGS

(UNAUDITED)

Quarters ended Nine months ended

(millions, except September 30, September 30,

per share data) 2008 2007 2008 2007

----------------------------------------------------------------------------

Revenues $ 954.9 $ 624.3 $ 2,523.5 $ 1,960.8

Cost of sales and

operating expenses 810.0 577.5 2,205.1 1,819.1

----------------------------------------------------------------------------

Earnings before

the following 144.9 46.8 318.4 141.7

Other income (expense) (2.3) (1.6) (4.8) (1.6)

Interest expense, net (2.3) (1.5) (6.7) (4.9)

----------------------------------------------------------------------------

Earnings before

income taxes 140.3 43.7 306.9 135.2

Provision for income taxes (48.8) (15.8) (107.4) (49.3)

----------------------------------------------------------------------------

Net earnings for

the period $ 91.5 $ 27.9 $ 199.5 $ 85.9

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic earnings per

common share $ 1.45 $ 0.44 $ 3.16 $ 1.37

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Diluted earnings per

common share $ 1.44 $ 0.44 $ 3.15 $ 1.36

----------------------------------------------------------------------------

----------------------------------------------------------------------------

RUSSEL METALS INC.

CONSOLIDATED STATEMENTS OF RETAINED EARNINGS

(UNAUDITED)

Quarters ended Nine months ended

September 30, September 30,

(millions) 2008 2007 2008 2007

----------------------------------------------------------------------------

Retained earnings,

beginning of the period,

as previously reported $ 462.8 $ 415.3 $ 411.7 $ 411.1

Transitional adjustment

- financial instruments - - - (0.5)

----------------------------------------------------------------------------

Retained earnings,

beginning of the period,

as restated 462.8 415.3 411.7 410.6

Net earnings for

the period 91.5 27.9 199.5 85.9

Amount related to

common shares purchased

for cancellation (37.4) - (37.4) -

Dividends on common shares (31.6) (28.5) (88.5) (81.8)

----------------------------------------------------------------------------

Retained earnings,

end of the period $ 485.3 $ 414.7 $ 485.3 $ 414.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

RUSSEL METALS INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

Quarters ended Nine months ended

September 30, September 30,

(millions) 2008 2007 2008 2007

----------------------------------------------------------------------------

Net earnings for the period $ 91.5 $ 27.9 $ 199.5 $ 85.9

----------------------------------------------------------------------------

Other comprehensive

income (loss)

Unrealized foreign

exchange gains (losses)

on translating financial

statements of self

sustaining foreign

operations

(U.S. subsidiaries) 14.7 (12.6) 24.3 (31.1)

Gains and (losses) on

derivatives designated

as net investment hedges (2.2) 4.3 (3.9) 10.7

Gains and (losses) on

derivatives designated

as cash flow hedges 0.8 0.7 (1.8) 3.0

----------------------------------------------------------------------------

Other comprehensive

income (loss) 13.3 (7.6) 18.6 (17.4)

----------------------------------------------------------------------------

Comprehensive income $ 104.8 $ 20.3 $ 218.1 $ 68.5

----------------------------------------------------------------------------

----------------------------------------------------------------------------

RUSSEL METALS INC.

CONSOLIDATED STATEMENTS OF ACCUMULATED OTHER COMPREHENSIVE LOSS

(UNAUDITED)

Quarters ended Nine months ended

September 30, September 30,

(millions) 2008 2007 2008 2007

----------------------------------------------------------------------------

Accumulated net

unrealized foreign

currency translation

gains (losses)

Balance, beginning

of period $ (36.1) $ (29.7) $ (45.7) $ (11.2)

Net unrealized gain

(loss) on translation

of net investment

in foreign operations 14.7 (12.6) 24.3 (31.1)

----------------------------------------------------------------------------

Balance, end of period (21.4) (42.3) (21.4) (42.3)

----------------------------------------------------------------------------

Accumulated net unrealized

loss on cash flow and

net investment hedges

Balance, beginning

of period 3.1 (0.6) 7.4 -

Transitional adjustment - - - (9.3)

Unrealized gains (losses)

on items designated

as net investment hedges (2.2) 4.3 (3.9) 10.7

Unrealized gains (losses)

on items designated

as cash flow hedges 0.8 0.7 (1.8) 3.0

----------------------------------------------------------------------------

Balance, end of period 1.7 4.4 1.7 4.4

----------------------------------------------------------------------------

Total accumulated other

comprehensive loss $ (19.7) $ (37.9) $ (19.7) $ (37.9)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

RUSSEL METALS INC.

CONSOLIDATED CASH FLOW STATEMENTS

(UNAUDITED)

Quarters ended Nine months ended

September 30, September 30,

(millions) 2008 2007 2008 2007

----------------------------------------------------------------------------

Operating activities

Net earnings $ 91.5 $ 27.9 $ 199.5 $ 85.9

Depreciation and

amortization 5.9 4.9 17.3 14.8

Future income taxes 0.1 0.5 1.4 2.4

Loss (gain) on sale

of fixed assets 0.2 - 0.3 (0.6)

Stock-based compensation 0.4 0.5 3.3 4.4

Pension expense (funding) (0.2) 0.1 (0.3) (1.2)

Other 2.6 1.7 5.3 2.0

----------------------------------------------------------------------------

Cash from operating

activities before

working capital 100.5 35.6 226.8 107.7

----------------------------------------------------------------------------

Changes in non-cash

working capital items

Accounts receivable (59.1) (30.3) (192.8) (68.9)

Inventories (115.7) 62.8 (158.3) 72.4

Accounts payable and

accrued liabilities 70.6 (19.1) 216.4 (0.3)

Current income taxes 18.5 0.7 40.4 (12.0)

Other 1.0 0.7 1.2 0.8

----------------------------------------------------------------------------

Change in non-cash

working capital (84.7) 14.8 (93.1) (8.0)

----------------------------------------------------------------------------

Cash from operating

activities 15.8 50.4 133.7 99.7

----------------------------------------------------------------------------

Financing activities

Issue of common shares

- options exercised 0.2 0.1 2.7 10.9

Purchase of common shares (48.7) - (48.7) -

Dividends on common shares (31.6) (28.5) (88.5) (81.8)

Repayment of long-term debt (0.3) - (0.7) -

Increase in bank borrowing 7.3 - 7.3 -

----------------------------------------------------------------------------

Cash used in financing

activities (73.1) (28.4) (127.9) (70.9)

----------------------------------------------------------------------------

Investing activities

Purchase of fixed assets (3.6) (4.4) (14.1) (13.0)

Proceeds on sale

of fixed assets - 0.1 0.1 1.4

Purchase of business - (109.0) - (109.0)

Reclassification of cash

equivalents to other assets - (11.0) - (11.0)

Other (1.5) 0.2 (1.7) 0.4

----------------------------------------------------------------------------

Cash used in investing

activities (5.1) (124.1) (15.7) (131.2)

----------------------------------------------------------------------------

Effect of exchange

rates on cash 0.5 (1.0) 1.7 (3.9)

----------------------------------------------------------------------------

Decrease in cash and

cash equivalents (61.9) (103.1) (8.2) (106.3)

Cash and cash equivalents,

beginning of the period 235.5 206.7 181.8 209.9

----------------------------------------------------------------------------

Cash and cash equivalents,

end of the period $ 173.6 $ 103.6 $ 173.6 $ 103.6

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Supplemental cash flow

information:

Income taxes paid $ 31.3 $ 15.8 $ 67.0 $ 60.7

Interest paid $ 7.5 $ 7.2 $ 14.9 $ 14.8

Contacts: Russel Metals Inc. Marion E. Britton, C.A. Vice

President and Chief Financial Officer (905) 819-7407 Email:

info@russelmetals.com Website: www.russelmetals.com

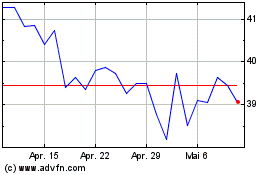

Russel Metals (TSX:RUS)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Russel Metals (TSX:RUS)

Historical Stock Chart

Von Jul 2023 bis Jul 2024