Russel Metals to Exceed Street Expectations for Second Quarter Earnings

11 Juni 2008 - 7:27PM

Marketwired

TORONTO, ONTARIO announced today that the average analysts

consensus earnings of $0.78 for the second quarter ended June 30,

2008 are understated by 35% to 45%. Russel Metals reported basic

earnings per common share in the second quarter of 2007 of $0.47

and $0.46 in the first quarter of 2008.

On-going steel price increases have enhanced our margins in all

three segments. Consistent demand in the service center segment and

increased activity in areas serviced by our energy tubular products

segment have favourably strengthened our projected results for the

second quarter of 2008. The current economic conditions and

uncertainty on the sustainability of the steel price increases make

it difficult to project the earnings levels for the second half of

2008.

Russel Metals is one of the largest metals distribution

companies in North America. It carries on business in three

distribution segments: metals service centers, energy tubular

products and steel distributors, under various names including

Russel Metals, A.J. Forsyth, Acier Leroux, Acier Loubier, Acier

Richler, Arrow Steel Processors, B&T Steel, Baldwin

International, Comco Pipe and Supply, Fedmet Tubulars, JMS Russel

Metals, Leroux Steel, McCabe Steel, Megantic Metal, Metaux Russel,

Metaux Russel Produits Specialises, Milspec Industries, Pioneer

Pipe, Russel Metals Specialty Products, Russel Metals Williams

Bahcall, Spartan Steel Products, Sunbelt Group, Triumph Tubular

& Supply, Wirth Steel and York-Ennis.

Statements contained in this press release that relate to Russel

Metals' beliefs or expectations as to certain future events are not

statements of historical fact and are forward-looking statements.

Russel Metals cautions readers that there are important factors,

risks and uncertainties, including but not limited to economic,

competitive and governmental factors affecting Russel Metals'

operations, markets, products, services and prices that could cause

its actual results, performance or achievements to be materially

different from those forecasted or anticipated in such

forward-looking statements.

The forward-looking statements in this document reflect

management's current beliefs and are based on information currently

available to management. The material assumptions applied in making

the forward-looking statements in this document include the

following: demand from the manufacturing, resource and construction

segments of the Canadian economy will be consistent with what we

experienced in the first five months of 2008, oil and gas prices

will not change materially, the recent stability in the price of

steel will either remain constant or increase, and the Canadian

dollar will maintain recent gains while not appreciating

significantly. Although the forward-looking statements contained in

this document are based upon what management believes to be

reasonable estimates and assumptions, Russel Metals cannot ensure

that actual results will not be materially different from those

expressed or implied by these forward-looking statements.

Contacts: Russel Metals Inc. Marion E. Britton, C.A. Vice

President and Chief Financial Officer (905) 819-7407 Email:

info@russelmetals.com Website: www.russelmetals.com

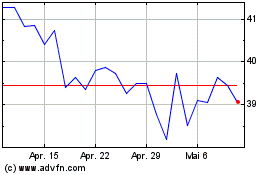

Russel Metals (TSX:RUS)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Russel Metals (TSX:RUS)

Historical Stock Chart

Von Jul 2023 bis Jul 2024