Parkland Corporation (“Parkland”, “we”, “our”, or “the Company”)

(TSX:PKI) is pleased to announce, through its 75 percent ownership

in Sol Investments SEZC (“Sol”), two transactions in our

International business (the “International transactions”) which

provide additional scale in the Caribbean and strengthen our

position as a natural acquirer in the region.

“These transactions strengthen Parkland’s

network throughout the Caribbean and extend our portfolio of growth

opportunities in retail, commercial, LPG and aviation,” said Pierre

Magnan, President of Parkland International. “Our International

business currently spans 23 countries and provides a platform for

continued organic growth and consolidation in the region. We are

excited about the opportunity set in the International segment

which we expect to play a significant role in achieving Parkland’s

2025 growth ambition.”

Details of the International transactions are as

follows:

Creating the Dominican Republic’s

largest retail network

Through the contribution of our approximately 80

retail locations, commercial and aviation marketing operations in

the Dominican Republic ("DR") and a follow-on investment, Sol will

become a 50 percent indirect partner in Isla Dominicana de Petroleo

Corp. ("Isla"). Isla currently operates a high-quality retail

network with approximately 160 locations. The combined portfolio

will comprise 240 retail locations (the largest retail network in

the DR) alongside an integrated commercial and aviation business.

As part of the agreement, Isla will operate the joint onshore

marketing operations while Parkland will become the principal fuel

supplier to the combined network.

Strategic rationale includes:

- A market leading

retail network in all major DR population centers with operational

synergies

- Strong free cash

flow conversion with regulated on-shore margins in a high-growth

market

- Unlocks supply

synergies through improved scale and optimized shipping

logistics

- A new

partnership with a shared appetite for continued growth and

renewable opportunities

Becoming the leading fuel marketer in

St. Maarten

We have signed an agreement for the purchase of

an integrated fuel marketing business with operations in St.

Maarten. The acquisition includes retail, commercial, marine, LPG

distribution and an aviation business. The acquisition strengthens

our activities at the Princess Juliana International Airport (a hub

for surrounding islands and major North American and European

markets) and adds a complementary retail network.

As a result of the acquisition, we will become

the leading fuel marketer in the Dutch side of St. Maarten and are

well positioned to drive operational synergies.

Together with the Puerto Rico aviation

acquisition disclosed with our first quarter 2021 results, the

International transactions are expected to increase our

International segment’s annual run-rate Adjusted EBITDA including

non-controlling interest by approximately C$20 million (C$15

million attributable to Parkland), prior to additional growth and

synergy upside.

The International transactions will be funded

out of existing credit facility capacity. Subject to customary

closing conditions, the transactions are expected to close in the

third quarter of 2021.

Forward-Looking Statements

Certain statements contained in this news

release constitute forward-looking information and statements

(collectively, "forward-looking statements"). When used in this

news release the words "expect", "will", "could", "would",

"believe", "continue", "pursue" and similar expressions are

intended to identify forward-looking statements. In particular,

this news release contains forward-looking statements with respect

to, among other things: the successful completion of the

transactions and timings thereof; expected benefits of the

transactions, collectively and independently, as applicable,

including without limitation, expected increase to the

International segment's run rate Adjusted EBITDA resulting from the

International transactions, strengthening Parkland’s position as a

natural acquirer in the region and its network in the Caribbean,

extending Parkland’s growth opportunities, the projected growth and

synergy upside, organic growth and consolidation opportunities,

post-closing synergy opportunities, renewable opportunities, the

creation of the largest retail network in DR and the size thereof

and becoming the leading fuel marketer in St. Maarten; the

International segment’s expected contribution to Parkland’s 2025

growth ambition; and the anticipated funding of the

transactions.

These statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking statements. No assurance can be given that

these expectations will prove to be correct and such

forward-looking statements included in this news release should not

be unduly relied upon. These forward-looking statements speak only

as of the date of this news release. Parkland does not undertake

any obligations to publicly update or revise any forward-looking

statements except as may be required by securities law. Actual

results could differ materially from those anticipated in these

forward-looking statements as a result of numerous risks and

uncertainties including, but not limited to, failure to complete

these transactions; failure to satisfy the conditions to closing of

the transactions; failure to realize all or any of the anticipated

benefits of the transactions; general economic, market and business

conditions; competitive action by other companies; refining and

marketing margins; the ability of suppliers to meet commitments;

actions by governmental authorities and other regulators including

but not limited to increases in taxes or restricted access to

markets; changes and developments in environmental and other

regulations; and other factors, many of which are beyond the

control of Parkland. See also the risks and uncertainties described

in "Forward-Looking Information" and "Risk Factors" included in

Parkland's Annual Information Form dated March 5, 2021 and in

"Forward-Looking Information" and "Risk Factors" in Parkland’s

annual MD&A for the year ended December 31, 2020 dated March 4,

2021 and in the interim MD&A for the three month period ended

March 31, 2021 dated May 3, 2021, each as filed on SEDAR and

available on the Parkland website at www.parkland.ca.

Expected increase in our International segment’s

annual run-rate Adjusted EBITDA is based on anticipated full-year

impact of the combined Puerto Rico aviation acquisition (disclosed

May 3, 2021) and the International transactions; future performance

of such businesses may differ from expectations due to the numerous

risks and uncertainties as noted above. Due to closing date impacts

of the transactions and other factors, this does not represent the

expected 2021 Adjusted EBITDA impact for the International

segment.

Non-GAAP Financial Measures

Adjusted EBITDA is a measure of segment profit.

See Section 9 and Section 14 of the Q1 2021 MD&A and Note 13 of

the Q1 2021 FS for a reconciliation of these measures of segment

profit. Investors are encouraged to evaluate each measure and the

reasons Parkland considers it appropriate for supplemental

analysis.

Investors are cautioned that these measures

should not be construed as an alternative to net earnings

determined in accordance with IFRS as an indication of Parkland's

performance.

About

Parkland Parkland is an

independent supplier and marketer of fuel and petroleum products

and a leading convenience store operator. Parkland services

customers across Canada, the United States, the Caribbean region

and the Americas through three channels: Retail, Commercial and

Wholesale. Parkland optimizes its fuel supply across these three

channels by operating and leveraging a growing portfolio of supply

relationships and storage infrastructure. Parkland provides trusted

and locally relevant fuel brands and convenience store offerings in

the communities it serves.

Parkland creates value for shareholders by

focusing on its proven strategy of growing organically, realizing a

supply advantage and acquiring prudently and integrating

successfully. At the core of our strategy are our people, as well

as our values of safety, integrity, community, and respect, which

are embraced across our organization.

For Further Information

Investor InquiriesBrad MonacoDirector, Capital

Markets587-997-1447Brad.Monaco@parkland.ca

Media InquiriesSimon ScottDirector, Corporate

Communications403-956-9272Simon.Scott@parkland.ca

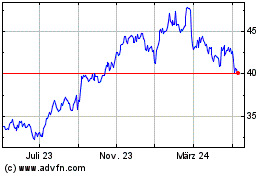

Parkland (TSX:PKI)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

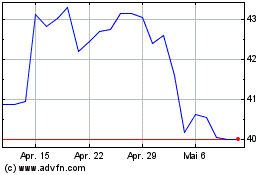

Parkland (TSX:PKI)

Historical Stock Chart

Von Jan 2024 bis Jan 2025