Parkland Corporation ("Parkland", "we", the "Company", or "our")

(TSX:PKI) announced today its financial and operating results for

the three months ended March 31, 2021 ("Q1 2021"). Highlights

include:

- Adjusted EBITDA attributable to Parkland ("Adjusted EBITDA") of

$314 million, up 64 percent year-over-year. Despite continued

COVID-19 impacts, we benefited from lower costs, continued strong

per unit fuel margins and Company C-store same-store sales growth

("SSSG") in Canada, U.S. acquisition growth, solid performance in

International and higher utilization at the Burnaby refinery.

- Net earnings attributable to Parkland of $31 million, or $0.21

per share, basic, an increase of $110 million relative to prior

year.

- Cash flow from operations fully funded capital expenditures,

acquisitions and net dividend payments in the quarter.

- Combined Operating and Marketing, General and Administrative

("MG&A") costs of $331 million, $52 million lower

than prior year, reflecting disciplined cost management and the

variability in our cost structure.

- Total Funded Debt to Credit Facility EBITDA ratio of 3.0 times

as of March 31, 2021.

- Further enhanced financial flexibility through an amended

credit facility agreement (maturing 2026) and refinanced senior

notes maturing in 2024, 2025 and 2026 with new senior notes

maturing in 2029. These actions reduce average annual interest

costs by approximately $20 million and extend our nearest senior

note maturity to 2027.

“We delivered a strong start to the year and

have high confidence in our 2021 outlook,” said Bob Espey,

President and Chief Executive Officer. “In addition to strong

underlying business performance, we progressed our enterprise-wide

organic growth initiatives, announced or closed five transactions,

significantly enhanced our financial flexibility and lowered annual

interest costs. We are well-positioned to advance our ambitious

growth strategy and sustainability journey."

Q1 2021 Segment Highlights

- In Canada, fuel margins, convenience store sales and lower

costs in our retail and commercial business lines drove Adjusted

EBITDA of $116 million, up $14 million relative to Q1 2020. Company

C-Store SSSG was 5.5 percent, our 21st consecutive quarter of

growth. We maintained retail market share, benefited from enhanced

digital pricing capabilities and surpassed 1.8 million JOURNIE™

Rewards members.

- In International, enhanced logistics, shipping optimization and

the continued benefit of cost control initiatives supported

Adjusted EBITDA of $67 million, in-line with Q1 2020. This strong

operational execution offset lower tourist activity and an

approximate $4 million negative impact from a weakened U.S.

dollar.

- In USA, Adjusted EBITDA of $20 million was up $4 million

relative to Q1 2020, benefiting from acquisitions announced during

the fourth quarter of 2020, our growing supply advantage and

national accounts growth. This was partially offset by reduced oil

and gas activity in our Northern ROC, lower marine activity in the

Southeast ROC and a weaker U.S. dollar.

- In Supply, Adjusted EBITDA of $136 million was up $94 million

relative to Q1 2020, primarily driven by Burnaby composite refinery

utilization of 91 percent, (31 percent in Q1 2020 due to the

scheduled turnaround). Supply benefited from co-processing

initiatives and blending optimization at the Burnaby refinery

coupled with solid performance from our integrated logistics

business.

- Corporate Adjusted EBITDA expense of $25 million, down $11

million relative to Q1 2020, driven by lower realized foreign

exchange impacts and disciplined cost management.

$2 billion ambition

Our growth platform is stronger than ever and we

have a proven track record of value creation. Underpinned by our

disciplined approach to capital allocation, the key pillars of our

strategy remain fundamental to our ambition for $2 billion of

run-rate Adjusted EBITDA by the end of 2025:

Grow OrganicallyRobust pipeline of organic

growth opportunities in retail, commercial and supply, across all

our geographies. Organic growth is supported by strong brands,

customer value proposition, loyalty programs and digital

insights.

Acquire Prudently & IntegrateDepth of

high-quality consolidation opportunities across all of our

geographies. Together with our disciplined approach, established

integration capabilities and synergy capture, we are

well-positioned to add incremental value to acquisitions.

Strong Supply AdvantageLeverage our growing

scale, product diversity and capital light infrastructure to

enhance margins. Continue to invest in safe and reliable operations

and renewable fuel manufacturing at our Burnaby refinery.

One ParklandPowering journeys and energizing

communities through our common values and behaviours. Safe,

reliable and local customer service underpinned by organizational

capability and a performance driven culture.

“As we continue to meet our customers' mobility

needs, we see growth opportunities across multiple business lines

and geographies,” added Espey. “In addition to what has made us

successful over the past decade, we see opportunity to grow our

renewable fuel business while harnessing our existing network to

provide electric vehicle charging options.”

2021 Investor Day

Parkland will host an investor day the morning

of November 16, 2021. The event will be held in Toronto, Ontario

(level of in-person attendance to be determined) and simultaneously

webcast with video, for those unable to attend in-person. Members

of Parkland's leadership team will provide updates on our long-term

growth initiatives, renewable fuel and electric vehicle charging

opportunities, capital allocation and financial outlook.

Registration and other details will be provided closer to the

date.

Our Sustainability Journey

As we advance our sustainability journey, we

will provide regular updates on our environmental, social and

governance efforts as part of our normal disclosure process. Recent

highlights include:

- Plan to publish our next Sustainability report in Q4 2021. This

disclosure will build upon our inaugural report and will contain an

overview of our enterprise-wide sustainability strategy, including

GHG emissions reduction targets.

- Continued to increase our renewable fuel manufacturing

capability at the Burnaby refinery, co-processing a record 25

million litres of bio-feedstocks during the quarter. We are on

track with our 2021 co-processing target of 100 million litres

(equivalent effect of taking over 80,000 passenger vehicles off the

road).

- On March 1, 2021, we launched a ‘carbon offset’ reward option

as part of our JOURNIE™ Rewards program to help our customers

offset their own emissions. In the first 30 days, over 23,000

Carbon offsets were selected by JOURNIE™ members with the value

directed toward a landfill gas capture and utilization project in

Niagara, Ontario, removing the equivalent of more than 3,000 tons

of CO2 from the atmosphere. This project helps create healthier

communities and promotes sustainable management of greenhouse

gases.

- Parkland is committed to diversity at all levels of the

organization. The Board of Directors has adopted a written

diversity policy which sets a target for women to occupy at least

30 percent of Board seats and executive officer positions by 2023,

and 2025, respectively. Women currently occupy 22 percent of Board

seats and 20 percent of executive officer positions.

Year-to-date acquisitions

- In January 2021, we completed the acquisition of two Midwest

U.S. LPG terminals to expand our integrated logistics business and

enhance our overall LPG supply optionality.

- In February 2021, we completed the acquisition of the assets of

Story Distributing Company and its affiliates (collectively

"Story"). Story is a retail and commercial fuel business based in

Bozeman, Montana, which expands our presence in the Montana and

Idaho-based markets.

- In March 2021, we completed the acquisition of a residential

and commercial LPG distributor in St. Maarten which further

supports our LPG growth strategy in the International segment.

- In April 2021, we completed the acquisition of Conrad &

Bischoff Inc. and its related companies (collectively, “C&B”).

This acquisition establishes our fourth U.S. ROC, strengthens our

supply advantage and adds a high-quality retail network to our

portfolio. Please see our press release dated February 26, 2021 for

more information regarding the acquisition.

- In April 2021, we signed an agreement for the purchase of an

aviation business and associated infrastructure with operations in

Puerto Rico. The acquisition includes operations at two

International airports in Puerto Rico, including the Luis Munoz

Marin International Airport, which is the busiest in the Caribbean

region. This acquisition expands our presence in the

well-diversified Puerto Rico market and unlocks positive network

effects for our regional aviation portfolio. The transaction is

expected to close by the end of the second quarter of 2021.

Consolidated Financial

Overview

|

($ millions, unless otherwise noted) |

Three months ended March 31, |

|

Financial Summary |

2021 |

|

2020 |

|

2019 |

|

| Sales and operating

revenue(1) |

4,233 |

|

4,316 |

|

4,215 |

|

| Fuel and petroleum product volume (million litres)(1) |

5,536 |

|

5,908 |

|

5,336 |

|

| Adjusted gross profit(2) |

665 |

|

593 |

|

697 |

|

| Adjusted EBITDA including non-controlling interest ("NCI") |

337 |

|

214 |

|

339 |

|

| Adjusted EBITDA attributable to Parkland ("Adjusted

EBITDA")(2) |

314 |

|

191 |

|

315 |

|

|

Canada(3) |

116 |

|

102 |

|

117 |

|

|

International |

67 |

|

67 |

|

71 |

|

|

USA(4) |

20 |

|

16 |

|

11 |

|

|

Supply(4) |

136 |

|

42 |

|

143 |

|

|

Corporate |

(25 |

) |

(36 |

) |

(27 |

) |

| Net earnings (loss) |

38 |

|

(74 |

) |

91 |

|

| Net earnings (loss) attributable to Parkland |

31 |

|

(79 |

) |

77 |

|

|

Net earnings (loss) per share – basic ($ per share) |

0.21 |

|

(0.53 |

) |

0.53 |

|

|

Net earnings (loss) per share – diluted ($ per share) |

0.20 |

|

(0.53 |

) |

0.52 |

|

| Dividends |

47 |

|

45 |

|

43 |

|

|

Per share |

0.3053 |

|

0.3002 |

|

0.2951 |

|

| Weighted average number of common shares (million shares) |

150 |

|

148 |

|

145 |

|

| Total assets |

9,592 |

|

9,446 |

|

8,998 |

|

| Non-current financial

liabilities |

4,311 |

|

4,376 |

|

4,269 |

|

(1) Certain amounts within sales and

operating revenue and fuel and petroleum product volumes were

restated and reclassified to conform to the presentation used in

the current period. (2) Measure of segment profit and Non-GAAP

financial measures. See Section 14 of the MD&A.(3) For

comparative purposes, information for the year ended December 31,

2019 was restated due to a change in segment presentation. Canada

Retail and Canada Commercial, formerly presented separately as

individual segments, and the Canadian distribution business,

formerly presented in Supply, are now included in Canada,

reflecting a change in organizational structure in 2020.(4) For

comparative purposes, information for previous periods was restated

due to a change in segment presentation. The supply and trading

business in the United States, formerly presented in the Supply

segment, is now included in the USA segment, reflecting a change in

organizational structure in the first three months of 2021.

Conference Call and Webcast

Details

Parkland will host a webcast and conference call

on Tuesday, May 4, at 6:30am MDT (8:30am EDT) to discuss the

results. To listen to the live webcast and watch the presentation,

please use the following link:

https://produceredition.webcasts.com/starthere.jsp?ei=1450915&tp_key=c49f8f1250

Analysts and institutional investors interested

in participating in the question and answer session of the

conference call may do so by calling 1-888-390-0605 (toll-free)

(Conference ID: 83343797). International participants can call

1-587-880-2171 (toll) (Conference ID: 83343797).

Please connect and log in approximately 10

minutes before the beginning of the call.

The webcast will be available for replay two

hours after the conference call ends at the link above. It will

remain available for one year and will also be posted to

www.parkland.ca.

MD&A and Consolidated Financial

Statements

The Q1 2021 MD&A and Q1 2021 Financial

Statements provide a detailed explanation of Parkland's operating

results for the three months ended March 31, 2021. An English

version of these documents will be available online at

www.parkland.ca and SEDAR after the results are released by

newswire under Parkland's profile at www.sedar.com. The Q1 2021

French MD&A and Q1 2021 French Financial Statements will be

posted to www.parkland.ca and SEDAR as soon as they become

available.

Forward-Looking Statements

Certain statements contained in this news

release constitute forward-looking information and statements

(collectively, "forward-looking statements"). When used in this

news release the words "expect", "will", "could", "would",

"believe", "continue", "pursue" and similar expressions are

intended to identify forward-looking statements. In particular,

this news release contains forward-looking statements with respect

to, among other things, business objectives and strategies,

Parkland's ambition to generate run-rate Adjusted EBITDA of $2

billion by 2025 and the key strategic pillars underpinning such

ambition, Parkland's 2021 Adjusted EBITDA and maintenance and

capital expenditures guidance, expected benefits to be derived from

acquisitions, potential future acquisition opportunities, potential

growth in Parkland's renewable fuels business, Parkland's ability

to harness its existing retail network to meet our customer's

mobility needs, including with respect to electric vehicle charging

options, Parkland's robust pipeline of organic growth

opportunities, potential projects to extend Parkland's supply

advantage, expected Burnaby refinery utilization rates, and

Parkland's ability to advance its growth agenda.

These statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking statements. No assurance can be given that

these expectations will prove to be correct and such

forward-looking statements included in this news release should not

be unduly relied upon. These forward-looking statements speak only

as of the date of this news release. Parkland does not undertake

any obligations to publicly update or revise any forward-looking

statements except as required by securities law. Actual results

could differ materially from those anticipated in these

forward-looking statements as a result of numerous risks,

assumptions and uncertainties including, but not limited to,

general economic, market and business conditions, including the

duration and impact of the COVID-19 pandemic; Parkland's ability to

execute its business strategies, including without limitation,

Parkland's ability to consistently identify accretive acquisition

targets and successfully integrate them, successfully implement

organic growth initiatives and to finance such acquisitions and

initiatives on reasonable terms; Parkland's ability to grow its

supply advantage by leveraging its scale and infrastructure;

industry capacity; competitive action by other companies; refining

and marketing margins; the ability of suppliers to meet

commitments; actions by governmental authorities and other

regulators including but not limited to increases in taxes or

restricted access to markets; changes and developments in

environmental and other regulations; and other factors, many of

which are beyond the control of Parkland. See also the risks and

uncertainties described in "Forward-Looking Information" and "Risk

Factors" included in Parkland's Annual Information Form dated March

30, 2020, and "Forward-Looking Information" and "Risk Factors"

included in the Q1 2021 MD&A dated May 3, 2021 and the Q4

2020 MD&A dated March 4, 2021, each filed on SEDAR and

available on the Parkland website at www.parkland.ca. The

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Non-GAAP Financial Measures

This news release refers to certain non-GAAP

financial measures that are not determined in accordance with

International Financial Reporting Standards ("IFRS"). Distributable

cash flow, distributable cash flow per share, adjusted

distributable cash flow, adjusted distributable cash flow per

share, total funded debt to credit facility EBITDA ratio, dividend

payout ratio, adjusted dividend payout ratio and growth and

maintenance capital expenditures attributable to Parkland are not

measures recognized under IFRS and do not have standardized

meanings prescribed by IFRS. Management considers these to be

important supplemental measures of Parkland's performance and

believes these measures are frequently used by securities analysts,

investors and other interested parties in the evaluation of

companies in our industry. See Section 14 of the Q1 2021 MD&A

for a discussion of non-GAAP measures and their reconciliations to

the nearest applicable IFRS measure.

Adjusted EBITDA and adjusted gross profit are

measures of segment profit. See Section 9 and Section 14 of the Q1

2021 MD&A and Note 13 of the Q1 2021 FS for a reconciliation of

these measures of segment profit. Investors are encouraged to

evaluate each measure and the reasons Parkland considers it

appropriate for supplemental analysis.

In addition to non-GAAP financial measures,

Parkland uses a number of operational KPIs, such as SSSG and

refinery utilization, to measure the success of our strategic

objectives and to set variable compensation targets for employees.

These KPIs are not accounting measures, do not have comparable IFRS

measures, and may not be comparable to similar measures presented

by other issuers, as other issuers may calculate these metrics

differently. See Section 14 of the Q1 2021 MD&A for further

details.

Tons of CO2 equivalent removed from the

atmosphere resulting from the JOURNIE™ Rewards ‘carbon offset’

reward option is based on 23,000 carbon offset selections at a

price of $3.50 per ton of CO2.

Investors are cautioned that these measures

should not be construed as an alternative to net earnings

determined in accordance with IFRS as an indication of Parkland's

performance.

About Parkland Corporation

Parkland is an independent supplier and marketer

of fuel and petroleum products and a leading convenience store

operator. Parkland services customers across Canada, the United

States, the Caribbean region and the Americas through three

channels: Retail, Commercial and Wholesale. Parkland optimizes its

fuel supply across these three channels by operating and leveraging

a growing portfolio of supply relationships and storage

infrastructure. Parkland provides trusted and locally relevant fuel

brands and convenience store offerings in the communities it

serves.

Parkland creates value for shareholders by

focusing on its proven strategy of growing organically, realizing a

supply advantage and acquiring prudently and integrating

successfully. At the core of our strategy are our people, as well

as our values of safety, integrity, community and respect, which

are embraced across our organization.

For Further Information

Investor Inquiries

Brad Monaco

Director, Capital Markets

587-997-1447

Brad.Monaco@parkland.ca

Media Inquiries

Simon Scott

Director, Corporate Communications

403-956-9272

Simon.Scott@parkland.ca

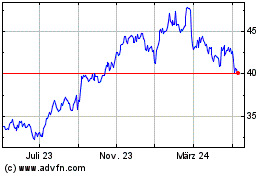

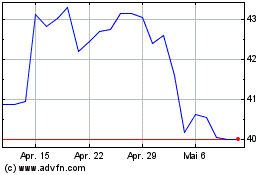

Parkland (TSX:PKI)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Parkland (TSX:PKI)

Historical Stock Chart

Von Feb 2024 bis Feb 2025