Information Services Corporation (TSX:ISV) (“ISC” or the “Company”)

today reported on the Company’s financial results for the third

quarter ended September 30, 2023.

Capitalized terms that are used but not defined

in this news release have the meaning ascribed to those terms in

Management's Discussion & Analysis for the period ended

September 30, 2023

2023 Third Quarter

Highlights

- Revenue was $54.6

million for the quarter, an increase of 12 per cent compared to the

third quarter of 2022. The increase was due to continued customer

and transaction growth in Services combined with fee increases

implemented in Registry Operations in July 2023.

- Net income was

$4.2 million or $0.24 per basic share and $0.23 per diluted share

compared to $7.8 million or $0.44 per basic share and $0.43 per

diluted share in the third quarter of 2022. The reduction in net

income during the quarter resulted from increased net finance

expense due to increased interest rates, higher borrowings used to

fund the Upfront Payment, interest accrued on the vendor concession

liability to the Province of Saskatchewan and amortization related

to the intangible asset associated with the right to operate the

Saskatchewan Registries. This was partially offset by strong

adjusted EBITDA contributions from Registry Operations and

Services.

- Net cash flow provided by

operating activities was $14.6 million for the quarter, a

3 per cent reduction from $15.1 million in the prior year due to

non-cash working capital changes in accounts receivable (due to

higher revenue in the current year) and timing of income tax

payments, partially offset by the growth of adjusted EBITDA in

Registry Operations and Services.

- Adjusted net

income was $8.4 million or $0.47 per basic share and $0.46

per diluted share compared to $8.7 million or $0.49 per basic share

and $0.48 per diluted share in the third quarter of 2022. The

slight decrease for the quarter was driven by increased interest

expense on long-term debt, largely offset by the strong performance

of Registry Operations following fee adjustments introduced during

the quarter and continued customer and transaction growth in

Services.

- Adjusted EBITDA

was $19.2 million for the quarter compared to $17.0 million in 2022

primarily due to a higher contribution from Registry Operations

driven by fee adjustments implemented during the quarter and

continued customer and transaction growth in Services. This

increase was partially offset by lower adjusted EBITDA in

Technology Solutions and Corporate due to the timing of revenue

recognition and continued investments in people and technology.

Adjusted EBITDA margin was 35.2 per cent compared

to 34.9 per cent in the third quarter of 2022.

- Adjusted free cash

flow for the quarter was $14.4 million, up 27 per cent

compared to $11.4 million in the third quarter of 2022, primarily

related to stronger results from operations in Registry Operations

and Services during the quarter. This was partially offset by

increased capital expenditures related to technology systems in

Registry Operations and Services and increased interest expense due

to higher interest rates and higher principal balance outstanding

as a result of the borrowings to fund the Upfront Payment.

- On July 5, 2023, the Company

entered into an extension agreement (the extension agreement

together with certain related ancillary agreements are collectively

referred to as the “Extension Agreement”) with the Province of

Saskatchewan to extend the term of its exclusive MSA until 2053.

The Extension Agreement extends ISC’s exclusive right to manage and

operate the Saskatchewan Registries. Under the Extension Agreement,

ISC was granted the right to introduce and/or enhance fees on

certain transactions with applicable fee adjustments that went into

effect on July 29, 2023. The consideration to be paid includes the

Upfront Payment, which was paid during the quarter, five annual

cash payments of $30.0 million per year commencing in July 2024 and

annual contingent payments potentially payable after 2033 if

certain volume growth criteria are met.

- In addition to entering into the

Extension Agreement, the MSA was also amended and restated

(“Amended and Restated MSA”) to, among other things, implement

certain incremental terms and conditions, the objectives of which

are to enhance security features and protocols for the Saskatchewan

Registries, contemplate emerging and future technology enhancements

for the Saskatchewan Registries and the services provided pursuant

to the Amended and Restated MSA, refresh and clarify governance

practices and structure, adjust the registry fees chargeable by the

Company, and provide flexibility for change over the life of the

extended term.

- In connection with the Extension

Agreement, ISC entered into an Amended and Restated Credit

Agreement with its syndicate of lenders in connection to its Credit

Facility. The aggregate amount available under the Credit Facility

has been increased from $150.0 million to $250.0 million and

consists of ISC’s existing $150.0 million revolving credit facility

together with a new $100.0 million revolving credit facility. In

addition, ISC maintains access to a $100.0 million accordion

option, providing the flexibility to upsize the aggregate revolving

credit facility up to $350.0 million. The Consolidated Net Funded

Debt to EBITDA financial covenant was increased to provide

additional balance sheet flexibility to ISC. The expiry date of the

Credit Facility of September 2026 remained unchanged. During the

quarter, the Company made total drawings of $150.7 million of which

$150.0 million was used to fund the Upfront Payment required on the

execution of the Extension Agreement while $0.7 million was used to

fund transaction costs.

- On July 27, 2023, ISC announced that it has expanded the

lenders under the Company’s Credit Facility to include the Bank of

Montreal. The syndicated Credit Facility now includes RBC, CIBC and

the BMO. The total amount available under the Credit Facility

remained unchanged.

Financial Position as at September 30,

2023

- Cash of $21.4 million compared to

$34.5 million as of December 31, 2022.

- Total debt of $187.2 million

compared to $66.0 million as of December 31, 2022. The Company is

focused on continuing sustainable growth and rapidly deleveraging

towards a long-term net leverage target of 2.0x – 2.5x.

Subsequent Event

- On October 31, 2023, ISC announced

a new US$3.2 million (approximately CA$4.5 million) contract with

the State of Michigan for a period of five years to be delivered

through its Technology Solutions segment. This contract includes

the delivery of a modern, online Uniform Commercial Code System

using the Company’s RegSys platform to support service improvement

and efficiencies for the State of Michigan.

Commenting on ISC’s results, Shawn Peters,

President and CEO stated, “The big news of the quarter and

year-to-date was our milestone announcement regarding the extension

of the term of ISC’s exclusive Master Service Agreement with the

Province of Saskatchewan to manage and operate the Saskatchewan

Registries until 2053. This Extension has been an important

priority for us and immediately enhanced the Company’s scale and

financial profile.” Peters continued, “With respect to our three

segments, both Registry Operations and Services performed well in

difficult economic conditions with Services proving once again to

be our driver of organic growth. ISC continues to prove that it can

produce sustained, positive performances regardless of economic

conditions and although not currently recognized by the market,

ISC’s fundamentals remain stronger than ever, especially with the

extension completed and a solid plan to de-lever the balance sheet

in the near-term.”

Management’s Discussion of ISC’s Summary

of 2023 Third Quarter Consolidated Financial Results

|

(thousands of CAD; except earnings per

share, adjusted earnings per shareand where

noted) |

Three MonthsEnded September 30,

2023 |

Three Months Ended September 30,

2022 |

|

Revenue |

|

|

|

Registry Operations |

$ |

27,419 |

|

$ |

25,025 |

|

|

Services |

|

25,551 |

|

|

22,248 |

|

|

Technology SolutionsCorporate and other |

|

1,6355 |

|

|

1,4923 |

|

|

Total Revenue |

$ |

54,610 |

|

$ |

48,768 |

|

|

Expenses |

$ |

43,334 |

|

$ |

36,922 |

|

|

Adjusted EBITDA1 |

$ |

19,209 |

|

$ |

17,037 |

|

|

Adjusted EBITDA margin1 |

|

35.2 |

% |

|

34.9 |

% |

|

Net income |

$ |

4,234 |

|

$ |

7,756 |

|

|

Adjusted net income1 |

$ |

8,357 |

|

$ |

8,625 |

|

|

Earnings per share (basic) |

$ |

0.24 |

|

$ |

0.44 |

|

|

Earnings per share (diluted) |

$ |

0.23 |

|

$ |

0.43 |

|

|

Adjusted earnings per share (basic)1 |

$ |

0.47 |

|

$ |

0.49 |

|

|

Adjusted earnings per share (diluted)1 |

$ |

0.46 |

|

$ |

0.48 |

|

|

Adjusted free cash flow1 |

$ |

14,444 |

|

$ |

11,357 |

|

1Adjusted net income, adjusted earnings per

share, basic, adjusted earnings per share, diluted, adjusted

EBITDA, adjusted EBITDA margin and adjusted free cash flow are not

recognized as measures under IFRS and do not have a standardized

meaning prescribed by IFRS and, therefore, they may not be

comparable to similar measures reported by other companies; refer

to section 8.8 “Non-IFRS financial measures” in the MD&A. Refer

to section 2 “Consolidated Financial Analysis” in the MD&A for

a reconciliation of adjusted net income and adjusted EBITDA to net

income. Refer to section 6.1 “Cash flow” in the MD&A for a

reconciliation of adjusted free cash flow to net cash flow provided

by operating activities. See also a description of these non-IFRS

measures and reconciliations of adjusted net income and adjusted

EBITDA to net income and adjusted free cash flow to net cash flow

provided by operating activities presented in the section of this

news release titled “Non-IFRS Performance Measures”.

2023 Third Quarter Results of

Operations

- Total revenue

was $54.6 million, up 12 per cent compared to Q3 2022.

- Registry

Operations segment revenue was $27.4 million, up compared to $25.0

million in Q3 2022:

- Land Registry

revenue was $17.8 million, up compared to $15.2 million in Q3

2022.

- Personal

Property Registry revenue was $3.0 million, flat compared to the

same prior year period.

- Corporate

Registry revenue was $2.8 million, up compared to $2.6 million in

Q3 2022.

- Property Tax

Assessment Services revenue in Registry Operations was $3.9

million, flat compared to the same prior year period.

- Services segment

revenue was $25.6 million, up compared to $22.2 million in Q3 2022:

- Regulatory

Solutions revenue was $19.4 million, up compared to $16.3 million

in Q3 2022.

- Recovery

Solutions revenue was $2.9 million, up compared to $2.4 million in

Q3 2022.

- Corporate

Solutions revenue was $3.3 million, down compared to $3.5 million

in Q3 2022.

- Technology

Solutions revenue from third parties was $1.6 million, up from $1.5

million in Q3 2022.

- Consolidated

expenses (all segments) were $43.3 million, up $6.4 million

compared to $36.9 million in Q3 2022.

- Net income was

$4.2 million or $0.24 per basic share and $0.23 per diluted share,

down $3.6 million compared to $7.8 million or $0.44 per basic and

$0.43 per diluted share for Q3 2022.

OutlookThe following section

includes forward-looking information, including statements related

to our strategy, future results, including revenue and adjusted

EBITDA, segment performance, the industries in which we operate,

economic activity, growth opportunities, investments, and business

development opportunities. Refer to “Caution Regarding

Forward-Looking Information” in Management’s Discussion &

Analysis for the three and nine months ended September 30,

2023.

For For the balance of 2023, we expect continued

organic growth in our Services segment, while the Registry

Operations segment will continue to be a strong contributor to

adjusted EBITDA and free cash flow generation. Our year-to-date

results continue our history of positive quarter-after-quarter

performance and stability; we expect that to continue.

We also expect to execute on our plan to

de-lever the balance sheet to realize a long-term net leverage

target of 2.0x – 2.5x; a plan which commenced immediately following

the announcement of the Extension in July, as evidenced by our

third quarter 2023 payment against our outstanding debt.

At the end of October, the Bank of Canada held

interest rates at 5 per cent, noting that it was prepared to raise

interest rates again if inflation remains high. We therefore expect

economic conditions in Canada to remain in line with our

expectations for the remainder of 2023. As a result, we expect

volumes in the Saskatchewan Land Registry within Registry

Operations to remain at current (seasonally adjusted) levels, as

well as a continuing positive impact in the Regulatory and Recovery

Solutions divisions in Services due to increased due diligence

searches and Asset Recovery revenue, respectively. Overall, we

believe our performance will remain strong for the balance of the

year, being steady in our core products and services, well

positioned with certain counter-cyclical businesses and ready to

benefit positively from any improvements to market conditions in

the future.

With the above factors in mind, we are pleased

to reiterate our updated annual guidance provided in August 2023

with revenue for 2023 expected to be between $207.0 million and

$212.0 million and adjusted EBITDA1 to be between $71.0 million and

$76.0 million. Given the strength of the business to date, we

expect revenue to be at the top end of our guidance range and

adjusted EBITDA to be towards the lower end of the guidance range,

as we continue to invest in people and technology to position

ourselves for the growth ahead.

In summary, we are proud of the year-to-date

work we have done in 2023 to realize our short-term objectives for

the year while pursuing our long-term goals for growth. Although

the capital markets are currently challenging, and are presently

not recognizing ISC’s extremely strong fundamentals, the Company is

stronger than ever, especially with the Extension completed, a

robust plan to de-lever in the near term and a management team

focused on long-term growth.

1 Adjusted EBITDA is not recognized as a measure

under IFRS and does not have a standardized meaning prescribed by

IFRS and, therefore, may not be comparable to similar measures

reported by other companies; refer to section 8.8 “Non-IFRS

financial measures” in the MD&A. Refer to section 2

“Consolidated Financial Analysis” in the MD&A for a

reconciliation of historical adjusted EBITDA to net income.

Note to ReadersThe Board of

Directors (“Board”) carries out its responsibility for review of

this disclosure primarily through the Audit Committee, which is

comprised exclusively of independent directors. The Audit Committee

reviews and approves the fiscal year-end Management’s Discussion

and Analysis (“MD&A”) and financial statements and recommends

both to the Board for approval. The interim financial statements

and MD&A are reviewed and approved by the Audit Committee.

This news release provides a general summary of

ISC’s results for the quarters ended September 30, 2023, and 2022.

Readers are encouraged to download the Company’s complete financial

disclosures. Links to ISC’s financial statements and related notes

and MD&A for the period are available on our website in the

Investor Relations section at company.isc.ca.

Copies can also be obtained SEDAR+ at www.sedarplus.ca by

searching Information Services Corporation’s profile or by

contacting Information Services Corporation at

investor.relations@isc.ca.

All figures are in Canadian dollars unless

otherwise noted.

Conference Call and WebcastWe

will hold an investor conference call on Wednesday, November 8,

2023 at 11:00 a.m. ET to discuss the results. Those joining the

call on a listen-only basis are encouraged to join the live audio

webcast which will be available on our website at

company.isc.ca/investor-relations/events. Participants who wish to

ask a question on the live call may do so through the ISC website

or by registering through the following live call URL:

https://register.vevent.com/register/BI4f3923462cbc454c9aa5458ff6b3a7eb

Once registered, participants will receive the

dial-in numbers and their unique PIN number. When dialing in,

participants will input their PIN and be placed into the call. The

audio file with a replay of the webcast will be available about 24

hours after the event on our website at the link above. We invite

media to attend on a listen-only basis.

About ISCHeadquartered in

Canada, ISC is a leading provider of registry and information

management services for public data and records. Throughout our

history, we have delivered value to our clients by providing

solutions to manage, secure and administer information through our

Registry Operations, Services and Technology Solutions segments.

ISC is focused on sustaining its core business while pursuing new

growth opportunities. The Class A Shares of ISC trade on the

Toronto Stock Exchange under the symbol ISV.

Cautionary Note Regarding

Forward-Looking InformationThis news release contains

forward-looking information within the meaning of applicable

Canadian securities laws including, without limitation, those

contained in the “Outlook” section hereof and statements related to

the industries in which we operate, growth opportunities and our

future financial position and results of operations.

Forward-looking information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those expressed or implied by such

forward-looking information. Important factors that could cause

actual results to differ materially from the Company's plans or

expectations include risks relating to changes in the condition of

the economy, including those arising from public health concerns,

reliance on key customers and licences, dependence on key projects

and clients, securing new business and fixed-price contracts,

identification of viable growth opportunities, implementation of

our growth strategy, competition and other risks detailed from time

to time in the filings made by the Company including those detailed

in ISC’s Annual Information Form for the year ended December 31,

2022 and ISC’s unaudited Condensed Consolidated Interim Financial

Statements and Notes and Management’s Discussion and Analysis for

the third quarter ended September 30, 2023, copies of which are

filed on SEDAR+ at www.sedarplus.ca.

The forward-looking information in this release

is made as of the date hereof and, except as required under

applicable securities laws, ISC assumes no obligation to update or

revise such information to reflect new events or circumstances.

Non-IFRS Performance

MeasuresIncluded within this news release are certain

measures that have not been prepared in accordance with IFRS, such

as adjusted net income, adjusted earnings per share, basic,

adjusted earnings per share, diluted, EBITDA, EBITDA margin,

adjusted EBITDA, adjusted EBITDA margin, free cash flow and

adjusted free cash flow. These measures are provided as additional

information to complement those IFRS measures by providing further

understanding of our financial performance from management’s

perspective, to provide investors with supplemental measures of our

operating performance and, thus, highlight trends in our core

business that may not otherwise be apparent when relying solely on

IFRS financial measures.

Management also uses non-IFRS measures to

facilitate operating performance comparisons from period to period,

prepare annual operating budgets and assess our ability to meet

future capital expenditure and working capital requirements.

Accordingly, these non-IFRS measures should not

be considered in isolation or as a substitute for analysis of our

financial information reported under IFRS. Such measures do not

have any standardized meaning prescribed by IFRS and therefore may

not be comparable to similar measures presented by other

companies.

|

Non-IFRS Performance Measure |

Why we use it |

How we calculate it |

Most comparable IFRS financial measure |

|

Adjusted net incomeAdjusted earnings per share, basicAdjusted

earnings per share, diluted |

- To evaluate performance and profitability while excluding

non-operational and share-based volatility.

- We believe that certain investors and analysts will use

adjusted net income and adjusted earnings per share to evaluate

performance while excluding items that management believes do not

contribute to our ongoing operations.

|

Adjusted net income;Net income AddShare-based compensation expense,

acquisitions, integration and other costs, effective interest

component of interest expense, debt finance costs expensed to

professional and consulting, amortization of the intangible asset

related to extension of the MSA with the Province of Saskatchewan,

amortization of registry enhancements, interest on the vendor

concession liability and the tax effect of these adjustments at

ISC’s statutory tax rate.Adjusted earnings per share,

basic;Adjusted net income divided by weighted average number of

common shares outstandingAdjusted earnings per share,

diluted;Adjusted net income divided by diluted weighted average

number of common shares outstanding |

Net incomeEarnings per share, basicEarnings per share, diluted |

|

EBITDAEBITDA Margin |

- To evaluate performance and profitability of segments and

subsidiaries as well as the conversion of revenue.

- We believe that certain investors and analysts use EBITDA to

measure our ability to service debt and meet other performance

obligations.

|

EBITDA: Net income add (remove)Depreciation and amortization, net

finance expense, income tax expenseEBITDA Margin:EBITDA divided

byTotal revenue |

Net income |

|

Adjusted EBITDAAdjusted EBITDA Margin |

- To evaluate performance and profitability of segments and

subsidiaries as well as the conversion of revenue while excluding

non-operational and share-based volatility.

- We believe that certain investors and analysts use Adjusted

EBITDA to measure our ability to service debt and meet other

performance obligations.

- Adjusted EBITDA is also used as a component of determining

short-term incentive compensation for employees.

|

Adjusted EBITDA:EBITDA add (remove)share-based compensation

expense, acquisition, integration and other costs, gain/loss on

disposal of assets if significantAdjusted EBITDA Margin:Adjusted

EBITDA divided byTotal revenue |

Net income |

|

Free Cash Flow |

- To show cash available for debt repayment and reinvestment into

the Company on a levered basis.

- We believe that certain investors and analysts use this measure

to value a business and its underlying assets.

- Free cash flow is also used as a component of determining

short-term incentive compensation for employees.

|

Net cash flow provided by operating activities deduct (add)Net

change in non-cash working capital, cash additions to property,

plant and equipment, cash additions to intangible assets, interest

received and paid as well as interest paid on lease obligations and

principal repayments on lease obligations |

Net cash flow provided by operating activities |

|

Adjusted Free Cash Flow |

- To show cash available for debt repayment and reinvestment into

the Company on a levered basis from continuing operations while

excluding non-operational and share-based volatility.

- We believe that certain investors and analysts use this measure

to value a business and its underlying assets based on continuing

operations while excluding short term non-operational items.

|

Free Cash Flow deduct (add)Share-based compensation expense,

acquisition, integration and other costs and registry enhancement

capital expenditures |

Net cash flow provided by operating activities |

The following presents a reconciliation of

adjusted net income to net income, a reconciliation of adjusted

EBITDA to EBITDA to net income and a reconciliation of adjusted

free cash flow to free cash flow to net cash flow from operating

activities:

Reconciliation of Adjusted Net Income to Net

Income

| |

|

Three Months EndedSeptember 30, |

|

(thousands of CAD) |

|

|

|

2023 |

|

|

2022 |

|

|

Adjusted net income |

|

|

$ |

8,357 |

|

$ |

8,652 |

|

| Add (subtract): |

|

|

|

|

|

Share-based compensation expense |

|

|

|

(1,513 |

) |

|

(1,081 |

) |

|

Acquisition, integration and other costs |

|

|

|

(796 |

) |

|

(127 |

) |

|

Effective interest component of interest expense |

|

|

|

(64 |

) |

|

(18 |

) |

|

Interest on vendor concession liability |

|

|

|

(1,733 |

) |

|

- |

|

|

Amortization of right to operate the Saskatchewan Registries |

|

|

|

(1,543 |

) |

|

- |

|

|

Tax effect on above adjustments1 |

|

|

|

1,526 |

|

|

330 |

|

|

Net income |

|

|

$ |

4,234 |

|

$ |

7,756 |

|

1Calculated at ISC’s statutory tax rate of 27.0 per cent.

Reconciliation of Adjusted EBITDA to EBITDA to Net

Income

|

|

|

|

Three Months EndedSeptember 30, |

|

(thousands of CAD) |

|

|

|

2023 |

|

|

2022 |

|

|

Adjusted EBITDA |

|

|

$ |

19,209 |

|

$ |

17,037 |

|

| Add (subtract): |

|

|

|

|

|

Share-based compensation expense |

|

|

|

(1,513 |

) |

|

(1,081 |

) |

|

Acquisition, integration and other costs |

|

|

|

(796 |

) |

|

(127 |

) |

|

EBITDA |

|

|

$ |

16,900 |

|

$ |

15,829 |

|

| Add (subtract): |

|

|

|

|

|

Depreciation and amortization |

|

|

|

(5,624 |

) |

|

(3,983 |

) |

|

Net finance expense |

|

|

|

(5,171 |

) |

|

(1,038 |

) |

|

Income tax expense |

|

|

|

(1,871 |

) |

|

(3,052 |

) |

|

Net income |

|

|

$ |

4,234 |

|

$ |

7,756 |

|

Reconciliation of Adjusted Free Cash Flow to Free Cash

Flow to Net Cash Flow Provided by Operating Activities

| |

|

Three Months EndedSeptember 30, |

|

(thousands of CAD) |

|

|

|

2023 |

|

|

20222 |

|

| Adjusted Free Cash Flow |

|

|

$ |

14,444 |

|

$ |

11,357 |

|

| Add (subtract): |

|

|

|

|

|

Share-based compensation expense |

|

|

|

(1,513 |

) |

|

(1,081 |

) |

|

Acquisition, integration, and other costs |

|

|

|

(796 |

) |

|

(127 |

) |

|

Registry enhancement capital expenditures |

|

|

|

(157 |

) |

|

- |

|

|

Free cash flow2 |

|

|

$ |

11,978 |

|

$ |

10,149 |

|

| Add (subtract): |

|

|

|

|

|

Cash additions to property, plant and equipment |

|

|

|

71 |

|

|

183 |

|

|

Cash additions to intangible assets3 |

|

|

|

382 |

|

|

122 |

|

|

Interest received |

|

|

|

(347 |

) |

|

(130 |

) |

|

Interest paid |

|

|

|

2,498 |

|

|

949 |

|

|

Interest paid on lease obligations |

|

|

|

88 |

|

|

107 |

|

|

Principal repayment on lease obligations |

|

|

|

579 |

|

|

516 |

|

|

Net change in non-cash working capital1 |

|

|

|

(676 |

) |

|

3,162 |

|

|

Net cash flow provided by operating activities |

|

|

$ |

14,573 |

|

$ |

15,058 |

|

1 Refer to Note 16 of ISC’s Consolidated Financial Statements

for the three and nine months ended September 30, 2023 for

reconciliation.2 Commencing on January 1, 2023, ISC revised the

definition of free cash flow which is a non-IFRS measure to include

interest received and paid as well as principal repayments on lease

obligations. This is further defined in the MD&A section 8.8

“Non-IFRS financial measures”, and has been reflected in the

comparative period. The impact of the change to free cash flow to

include interest received and paid, interest paid on lease

obligations and principal repayments on lease obligations on the

previously stated prior year results was a $1.4 million decrease

for the three months ended September 30, 2022.3 During the third

quarter of 2023, ISC entered into the Extension Agreement which

resulted in the acquisition of an intangible asset related to the

right to manage and operate the Saskatchewan Registries. While this

material transaction has been excluded from the above free cash

flow calculation, the asset has been presented in Section 6.2

“Capital expenditures” of the MD&A.

Investor ContactJonathan HackshawSenior

Director, Investor Relations & Capital MarketsToll Free:

1-855-341-8363 in North America or

1-306-798-1137investor.relations@isc.ca

Media ContactJodi BosnjakExternal

Communications SpecialistToll Free: 1-855-341-8363 in North America

or 1-306-798-1137corp.communications@isc.ca

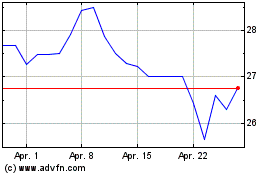

Information Services (TSX:ISV)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Information Services (TSX:ISV)

Historical Stock Chart

Von Feb 2024 bis Feb 2025