Interfor to Acquire Chaleur Forest Products in New Brunswick, Canada

03 Oktober 2022 - 1:30PM

INTERFOR CORPORATION (“Interfor” or the “Company”)

(TSX: IFP) announced today that it has reached an agreement with an

affiliate of the Kilmer Group (“Kilmer”) to acquire 100% of the

equity interests in the entities comprising Chaleur Forest Products

(“Chaleur”).

Chaleur owns two modern and well-capitalized sawmill operations

located in Belledune and Bathurst, New Brunswick, with a combined

annual lumber production capacity of 350 million board feet.

Chaleur also operates a woodlands management division based out of

Miramichi that manages approximately 30% of the total Crown forest

in New Brunswick. This division provides a secure source of fibre

supply for the sawmill operations as well as a stable, long-term

stream of cash flow from third-party log sales, licence management

fees and silviculture activities.

The purchase price is C$325 million, on a cash and debt free

basis, which includes approximately C$31 million of net working

capital. In addition, Interfor will assume Chaleur’s countervailing

(“CV”) and anti-dumping (“AD”) duty deposits at closing, for

consideration equal to 55% of the total deposits on an after-tax

basis. As of August 31, 2022, Chaleur had paid cumulative CV and AD

duties of approximately US$82 million.

“This acquisition is consistent with Interfor’s growth-focused

strategy as a pure-play lumber producer and builds upon our recent

expansion into Eastern Canada with further geographic diversity,”

said Ian Fillinger, President & Chief Executive

Officer. “New Brunswick has a secure, high quality and

competitive log supply, a supportive investment environment and

proximity to key eastern markets. These are well-managed and

efficient mills with a desirable SPF product mix, which fit

extraordinarily well within our existing portfolio. Chaleur’s

strong management team further bolsters our core lumber strength

and we look forward to welcoming the team into our company.”

On a proforma basis, Interfor’s total annual lumber production

capacity will increase to 5.1 billion board feet, of which 44% will

be in the US South, 19% in Eastern Canada, 15% in the US Northwest,

15% in British Columbia and 7% in Atlantic Canada.

The acquisition will be immediately accretive to Interfor’s

earnings and is expected to provide attractive returns in both the

near-term and over the long-term. Interfor estimates Chaleur’s

mid-cycle EBITDA to be approximately C$50 million per year

pre-synergies, taking into account mid-cycle lumber prices and

current run-rate performance. Interfor expects to achieve synergies

of C$5 million per year from combined sales and marketing

opportunities, shared purchasing programs and general and

administrative expense reductions. These synergies are expected to

be fully achieved within twelve months of closing, with no capital

requirements.

Interfor intends to finance the acquisition with a combination

of cash on hand and its existing credit facilities. Following the

completion of this acquisition Interfor will continue to have

significant financial flexibility to execute its strategic capital

investment plans and consider additional value-creating capital

deployment options. As of August 31, 2022 Interfor had net debt of

approximately C$48 million and a Net Debt to Invested Capital ratio

of 2%. Proforma the Chaleur acquisition and proforma Interfor’s

C$100 million Substantial Issuer Bid completed on September 12,

2022, Interfor’s Net Debt to Invested Capital ratio as of August

31, 2022 would remain below 20%1. Similarly, proforma liquidity as

of August 31, 2022 would be approximately C$322 million, before

consideration of significant additional borrowing capacity

available under existing credit limits and continued near-term

operating cash flows.

The completion of the acquisition is subject to Canadian and

U.S. regulatory reviews and customary conditions for a transaction

of this kind and is expected to close in the fourth quarter of

2022.

Chaleur’s operations were not damaged or impacted by Hurricane

Fiona in any way.

This release, including a French language version of this

release, has been posted on www.interfor.com in the Investors

section under News.

FORWARD-LOOKING STATEMENTS

This release contains forward-looking information about the

Company’s and Chaleur’s business outlook, objectives, plans,

strategic priorities and other information that is not historical

fact. A statement contains forward-looking information when the

Company uses what it knows and expects today, to make a statement

about the future. Statements containing forward-looking information

in this release, include but are not limited to, statements

regarding production capacity, future growth, growing demand,

synergies, proforma capacity, expected earnings and returns,

proforma debt ratios, proforma liquidity, borrowing capacity,

regulatory reviews and approvals and the expected closing date, and

other relevant factors. Readers are cautioned that actual results

may vary from the forward-looking information in this release, and

undue reliance should not be placed on such forward-looking

information. Risk factors that could cause actual results to differ

materially from the forward-looking information in this release are

described in Interfor’s annual Management’s Discussion &

Analysis under the heading “Risks and Uncertainties”, which is

available on www.interfor.com and under Interfor’s profile on

www.sedar.com. Material factors and assumptions used to develop the

forward-looking information in this report include volatility in

the selling prices for lumber, logs and wood chips; the Company’s

ability to compete on a global basis; the availability and cost of

log supply; natural or man-made disasters; currency exchange rates;

changes in government regulations; Indigenous reconciliation; the

Company’s ability to export its products; the softwood lumber trade

dispute between Canada and the U.S.; environmental impacts of the

Company’s operations; labour disruptions; information systems

security; and the existence of a public health crisis. Unless

otherwise indicated, the forward-looking statements in this release

are based on the Company’s expectations at the date of this

release. Interfor undertakes no obligation to update such

forward-looking information or statements, except as required by

law. The Company’s independent auditor, KPMG LLP, has not audited,

reviewed or performed any procedures with respect to the interim

financial results and other data included in this release, and

accordingly does not express an opinion or any other form of

assurance with respect thereto.

ABOUT INTERFOR

Interfor is a growth-oriented forest products company with

operations in Canada and the United States. The Company has annual

lumber production capacity of approximately 4.7 billion board feet

and offers a diverse line of lumber products to customers around

the world. For more information about Interfor, visit our website

at www.interfor.com.

Investor Contacts:

Rick Pozzebon, Executive Vice President & Chief Financial

Officer(604) 689-6804

Mike Mackay, Vice President of Corporate Development &

Strategy (604) 689-6846

Media Contact:

Svetlana Kayumova, Senior Manager, Corporate Affairs &

Communications(604) 422-7329svetlana.kayumova@interfor.com

1 Proforma is based on C$325 million purchase price and 55% of

the tax-effected amount of Chaleur’s August 31, 2022 countervailing

(“CV”) and anti-dumping (“AD”) duties on deposit of US$82 million,

assuming an income tax rate of 29%.

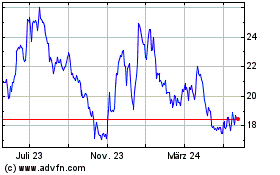

Interfor (TSX:IFP)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

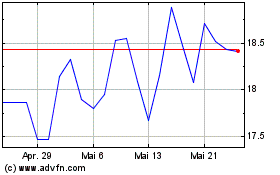

Interfor (TSX:IFP)

Historical Stock Chart

Von Dez 2023 bis Dez 2024