Fennec Pharmaceuticals Announces Third Quarter 2022 Financial Results and Provides Business Update

11 November 2022 - 1:10PM

Fennec Pharmaceuticals Inc. (NASDAQ:FENC; TSX: FRX), a commercial

stage specialty pharmaceutical company focused on the development

of PEDMARK® (sodium thiosulfate injection) to reduce the risk

of ototoxicity associated with cisplatin in pediatric patients one

month of age and older with localized, non-metastatic solid tumors

today reported its financial results for the fiscal quarter ended

September 30, 2022 and provided a business update.

“This was an important quarter for Fennec with

the FDA approval of PEDMARK® and the successful buildout of our

commercial infrastructure leading to the recent U.S. commercial

launch of PEDMARK. In addition, we successfully completed a $25

million financing, which we believe well positions the Company for

the launch of PEDMARK,” said Rosty Raykov, chief executive officer

of Fennec Pharmaceuticals. “PEDMARK provides the first and only

FDA-approved treatment specifically designed to help protect

hearing in children and young adults after receiving cisplatin. We

remain focused on continuing our engagement with healthcare

providers and supporting pediatric patient access to this

breakthrough therapy.”

Financial Results for the Third Quarter

2022

- Cash Position

– Cash and cash equivalents were $29.8 million at

September 30, 2022. The increase in cash and cash equivalents

between September 30, 2022, and December 31, 2021, is the result of

cash inflow from the Petrichor financing offset by cash to pay off

the Bridge Bank loan and expenditures related to the commercial

readiness activities for PEDMARK® and general and administrative

expenses.

- Research and Development

(R&D) Expenses – R&D expenses decreased

by $0.4 million for the three months ended September 30, 2022,

compared to the same period in 2021. The Company’s research and

development activities during the quarter decreased as the

Company’s efforts on a year-over-year basis were more focused on

commercial readiness.

- General and Administrative

(G&A) Expenses – General and administrative

expenses increased by $4.1 million over same period in 2021. The

increase in general and administrative expenses over the same

period in 2021 reflects increased expenses related to commercial

readiness activities, including increased headcount, non-cash

equity compensation for employees and increased legal

expenses.

- Net Loss

– Net loss for the three months ended September 30,

2022 was $8.1 million ($0.31 per share), compared to $4.2 million

($0.16 per share) for the same period in 2021.

Financial Update

The selected financial data presented below is

derived from our unaudited condensed consolidated financial

statements, which were prepared in accordance with U.S. generally

accepted accounting principles. The complete unaudited condensed

consolidated financial statements for the period ended September

30, 2022 and management's discussion and analysis of financial

condition and results of operations will be available via

www.sec.gov and www.sedar.com. All values are presented in

thousands unless otherwise noted.

Unaudited Condensed ConsolidatedStatements of

Operations:(U.S. Dollars in thousands except per share amounts)

| |

|

|

|

|

|

| |

Three Months Ended |

| |

September 30, |

|

September 30, |

| |

2022 |

|

2021 |

| |

|

|

|

|

|

|

Revenue |

$ |

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

Research and development |

|

846 |

|

|

|

1,242 |

|

|

General and administrative |

|

7,053 |

|

|

|

2,931 |

|

| Total operating

expenses |

|

7,899 |

|

|

|

4,173 |

|

| Loss from

operations |

|

(7,899 |

) |

|

|

(4,173 |

) |

| |

|

|

|

|

|

| Other

(expense)/income |

|

|

|

|

|

|

Foreign currency transaction (loss)/gain |

|

(4 |

) |

|

|

(1 |

) |

|

Amortization expense |

|

(64 |

) |

|

|

(8 |

) |

|

Unrealized (loss)/gain on securities |

|

(27 |

) |

|

|

39 |

|

|

Interest income |

|

24 |

|

|

|

13 |

|

|

Interest expense |

|

(119 |

) |

|

|

(55 |

) |

|

Total other (expense)/income |

|

(190 |

) |

|

|

(12 |

) |

| |

|

|

|

|

|

| Net loss |

$ |

(8,089 |

) |

|

$ |

(4,185 |

) |

| |

|

|

|

|

|

| Basic net loss per

common share |

$ |

(0.31 |

) |

|

$ |

(0.16 |

) |

| Diluted net loss per

common share |

$ |

(0.31 |

) |

|

$ |

(0.16 |

) |

| Weighted-average

number of common shares outstanding basic |

|

26,108 |

|

|

|

26,007 |

|

| Weighted-average

number of common shares outstanding diluted |

|

26,108 |

|

|

|

26,007 |

|

Fennec Pharmaceuticals Inc.Balance Sheets(U.S.

Dollars in thousands)

| |

|

|

|

|

|

| |

|

September 30, 2022 |

|

|

December 31, |

| |

|

(Unaudited) |

|

|

2021 |

| Assets |

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

29,752 |

|

|

$ |

21,100 |

|

| Prepaid expenses |

|

278 |

|

|

|

1,034 |

|

| Other current assets |

|

123 |

|

|

|

253 |

|

| Total current

assets |

|

30,153 |

|

|

|

22,387 |

|

| |

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

| Deferred issuance cost, net of

amortization |

|

264 |

|

|

|

27 |

|

| Total non-current

assets |

|

264 |

|

|

|

27 |

|

| Total

assets |

$ |

30,417 |

|

|

$ |

22,414 |

|

| |

|

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

| Accounts payable |

$ |

2,533 |

|

|

$ |

777 |

|

| Accrued liabilities |

|

394 |

|

|

|

877 |

|

| Total current

liabilities |

|

2,927 |

|

|

|

1,654 |

|

| |

|

|

|

|

|

| Long-term

liabilities |

|

|

|

|

|

| Term loan |

|

25,000 |

|

|

|

5,000 |

|

| Debt discount |

|

(312 |

) |

|

|

(12 |

) |

| Total long-term

liabilities |

|

24,688 |

|

|

|

4,988 |

|

| Total

liabilities |

|

27,615 |

|

|

|

6,642 |

|

| |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

| Common stock, no par value;

unlimited shares authorized; 26,238 shares issued |

|

141,309 |

|

|

|

140,801 |

|

| and outstanding (2021 -

26,014) |

|

|

|

|

|

| Additional paid-in

capital |

|

56,593 |

|

|

|

53,214 |

|

| Accumulated deficit |

|

(196,343 |

) |

|

|

(179,486 |

) |

| Accumulated other

comprehensive income |

|

1,243 |

|

|

|

1,243 |

|

| Total stockholders’

equity |

|

2,802 |

|

|

|

15,772 |

|

| Total liabilities and

stockholders’ equity |

$ |

30,417 |

|

|

$ |

22,414 |

|

Working Capital

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

As of |

|

|

As of |

| Selected Asset and Liability

Data (thousands): |

|

September 30, 2022 |

|

|

December 31, 2021 |

|

Cash and equivalents |

$ |

29,752 |

|

|

$ |

21,100 |

|

| Other current assets |

|

401 |

|

|

|

1,287 |

|

| Current liabilities |

|

2,927 |

|

|

|

1,654 |

|

| Working capital (1) |

$ |

27,226 |

|

|

$ |

20,733 |

|

| (1) [Current assets – current

liabilities] |

|

|

|

|

|

| |

|

|

|

|

|

| Selected Equity: |

|

|

|

|

|

| Common stock and additional

paid in capital |

|

197,902 |

|

|

|

194,015 |

|

| Accumulated deficit |

|

(196,343 |

) |

|

|

(179,486 |

) |

| Shareholders’ equity |

|

2,802 |

|

|

|

15,772 |

|

About Fennec

Pharmaceuticals

Fennec Pharmaceuticals Inc. is a specialty

pharmaceutical company focused on the development and

commercialization of PEDMARK® to reduce the risk of

platinum-induced ototoxicity in pediatric patients. Further,

PEDMARK received FDA approval in September 2022 and has received

Orphan Drug Designation in the U.S. Fennec has a license agreement

with Oregon Health and Science University (OHSU) for exclusive

worldwide license rights to intellectual property directed to

sodium thiosulfate and its use for chemoprotection, including the

reduction of risk of ototoxicity induced by platinum chemotherapy,

in humans. For more information, please

visit www.fennecpharma.com.

Forward Looking Statements

Except for historical information described in

this press release, all other statements are forward-looking. Words

such as “believe,” “anticipate,” “plan,” “expect,” “estimate,”

“intend,” “may,” “will,” or the negative of those terms, and

similar expressions, are intended to identify forward-looking

statements. These forward-looking statements include statements

about our business strategy, timeline, and other goals, plans and

prospects, including our commercialization plans respecting

PEDMARK®, the market opportunity for and market impact of PEDMARK®,

its potential impact on patients and anticipated benefits

associated with its use, and potential access to further funding

after the date of this release. Forward-looking statements are

subject to certain risks and uncertainties inherent in the

Company’s business that could cause actual results to vary,

including the risks and uncertainties that regulatory and guideline

developments may change, scientific data and/or manufacturing

capabilities may not be sufficient to meet regulatory standards or

receipt of required regulatory clearances or approvals, clinical

results may not be replicated in actual patient settings,

unforeseen global instability, including political instability, or

instability from an outbreak of pandemic or contagious disease,

such as the novel coronavirus (COVID-19), or surrounding the

duration and severity of an outbreak, protection offered by the

Company’s patents and patent applications may be challenged,

invalidated or circumvented by its competitors, the available

market for the Company’s products will not be as large as expected,

the Company’s products will not be able to penetrate one or more

targeted markets, revenues will not be sufficient to fund further

development and clinical studies, our ability to obtain necessary

capital when needed on acceptable terms or at all, the Company may

not meet its future capital requirements in different countries and

municipalities, and other risks detailed from time to time in the

Company’s filings with the Securities and Exchange Commission

including its Annual Report on Form 10-K for the year ended

December 31, 2021. Fennec disclaims any obligation to update these

forward-looking statements except as required by law.

For a more detailed discussion of related risk

factors, please refer to our public filings available at

www.sec.gov and www.sedar.com.

PEDMARK® and Fennec® are registered trademarks

of Fennec Pharmaceuticals Inc.

©2022 Fennec Pharmaceuticals Inc. All rights

reserved.

For further information, please contact:

Investors:Robert AndradeChief Financial

OfficerFennec Pharmaceuticals Inc.(919) 246-5299

Media:Elixir Health Public RelationsLindsay

Rocco(862) 596-1304lrocco@elixirhealthpr.com

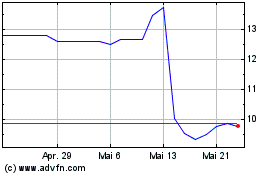

Fennec Pharmaceuticals (TSX:FRX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Fennec Pharmaceuticals (TSX:FRX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025