Firm Capital Mortgage Investment Corporation (the

“

Corporation”) (TSX: FC, FC.DB.F, FC.DB.G,

FC.DB.H, FC.DB.I, FC.DB.J, FC.DB.K and FC.DB.L) announced today

that the Toronto Stock Exchange (the “

TSX”) has

accepted a notice filed by the Corporation of its intention to make

a normal course issuer bid (the “

NCIB”) with

respect to its outstanding common shares (the “

Common

Shares”), 5.30% convertible unsecured subordinated

debentures due August 31, 2024 (the “

2024

Debentures”), 5.40% convertible unsecured subordinated

debentures due June 30, 2025 (the “

2025

Debentures”), 5.50% convertible unsecured subordinated

debentures due January 31, 2026 (the “

2026

Debentures”), 5.00% convertible unsecured subordinated

debentures due September 30, 2028 (the “

2028

Debentures”) and 5.00% convertible unsecured subordinated

debentures due March 31, 2029 (the “

2029

Debentures”, and together with the 2024 Debentures, 2025

Debentures, 2026 Debentures and 2028 Debentures, the

“

Debentures”).

The notice provides that the Corporation may,

during the 12 month period commencing July 18, 2022 and ending no

later than July 17, 2023, purchase through the facilities of the

TSX and/or alternative Canadian Trading Systems up to: (i)

3,359,442 Common Shares in total, being 10% of the “public float”

of Common Shares as of July 5, 2022; (ii) $2,621,831 aggregate

principal amount of 2024 Debentures in total, being 10% of the

“public float” of 2024 Debentures as of July 5, 2022; (iii)

$2,478,894 aggregate principal amount of 2025 Debentures in total,

being 10% of the “public float” of 2025 Debentures as of July 5,

2022; (iv) $2,462,188 aggregate principal amount of 2026 Debentures

in total, being 10% of the “public float” of 2026 Debentures as of

July 5, 2022; (v) $4,600,000 aggregate principal amount of 2028

Debentures in total, being 10% of the “public float” of 2028

Debentures as of July 5, 2022; and (vi) $4,369,850 aggregate

principal amount of 2029 Debentures in total, being 10% of the

“public float” of 2029 Debentures as of July 5, 2022.

The price which the Corporation will pay for any

Common Shares or Debentures will be the market price at the time of

acquisition. During the period of this NCIB, the Corporation may

make purchases under the NCIB by means of open market transactions.

The actual number of Common Shares and Debentures which may be

purchased pursuant to the NCIB and the timing of any such purchases

will be determined by senior management of the Corporation. The

average daily trading volume from January 1 to June 30, 2022

(except for the 2029 Debentures, which is from January 27 to June

30, 2022) was 47,866 Common Shares, $16,480 aggregate principal

amount of 2024 Debentures, $8,536 aggregate principal amount of

2025 Debentures, $6,600 aggregate principal amount of 2026

Debentures, $25,536 aggregate principal amount of 2028 Debentures

and $97,175 aggregate principal amount of 2029 Debentures. Daily

purchases under the NCIB will be limited to 11,966 Common Shares,

$4,120 aggregate principal amount of 2024 Debentures, $2,134

aggregate principal amount of 2025 Debentures, $1,650 aggregate

principal amount of 2026 Debentures, $6,384 aggregate principal

amount of 2028 Debentures and $24,293 aggregate principal amount of

2029 Debentures, other than block purchases. All Common Share and

Debentures purchased by the Corporation under the NCIB will be

cancelled.

As of July 5, 2022, there were: (i) 34,483,717

Common Shares outstanding, and the public float was 33,594,424

Common Shares; (ii) $26,500,000 aggregate principal amount of 2024

Debentures outstanding, and the public float was $26,218,310

aggregate principal amount of 2024 Debentures; (iii) $25,000,000

aggregate principal amount of 2025 Debentures outstanding, and the

public float was $24,788,940 aggregate principal amount of 2025

Debentures; (iv) $24,983,000 aggregate principal amount of 2026

Debentures outstanding, and the public float was $24,621,884

aggregate principal amount of 2026 Debentures; (v) $46,000,000

aggregate principal amount of 2028 Debentures outstanding, and the

public float was $46,000,000 aggregate principal amount of 2028

Debentures; and (vi) $43,700,000 aggregate principal amount of 2029

Debentures outstanding, and the public float was $43,698,500

aggregate principal amount of 2029 Debentures.

The Corporation may purchase its Common Shares

and Debentures, from time to time, if it believes that the market

price of its Common Shares and/or Debentures is attractive and that

the purchase would be an appropriate use of corporate funds and in

the best interests of the Corporation.

ABOUT THE

CORPORATIONWhere Mortgage Deals Get

Done®

The Corporation, through its mortgage banker,

Firm Capital Corporation, is a non-bank lender providing

residential and commercial short-term bridge and conventional real

estate financing, including construction, mezzanine and equity

investments. The Corporation's investment objective is the

preservation of shareholders' equity, while providing shareholders

with a stable stream of monthly dividends from investments. The

Corporation achieves its investment objectives through investments

in selected niche markets that are under-serviced by large lending

institutions. Lending activities to date continue to develop a

diversified mortgage portfolio, producing a stable return to

shareholders. The Corporation is a Mortgage Investment Corporation

(MIC) as defined in the Income Tax Act (Canada). Accordingly, the

Corporation is not taxed on income provided that its taxable income

is paid to its shareholders in the form of dividends within 90 days

after December 31 each year. Such dividends are generally treated

by shareholders as interest income, so that each shareholder is in

the same position as if the mortgage investments made by the

Corporation had been made directly by the shareholder. Full reports

of the financial results of the Corporation are outlined in the

financial statements and the related management discussion and

analysis of the Corporation, available on the SEDAR website at

www.sedar.com. In addition, supplemental information is available

on the Corporation’s website at www.firmcapital.com.

FORWARD-LOOKING STATEMENTS

This press release contains statements that

constitute “forward-looking statements” within the meaning of

applicable securities legislation, including, but not limited to,

statements relating to future purchases of Common Shares and/or

Debentures under the NCIB. Much of this information can be

identified by words such as “expect to,” “expected,” “will,”

“estimated” or similar expressions suggesting future outcomes or

events. The Corporation believes the expectations reflected in such

forward-looking statements are reasonable but no assurance can be

given that these expectations will prove to be correct and such

forward-looking statements should not be unduly relied upon.

Forward-looking statements are based on current

information and expectations that involve a number of risks and

uncertainties, which could cause actual results or events to differ

materially from those anticipated. These risks include, but are not

limited to, risks associated with the Corporation’s financial

condition and prospects; the stability of general economic and

market conditions; interest rates; the underlying value of the

Corporation and its Common Shares and Debentures; the ability of

the Corporation to complete purchases under the NCIB; the

availability of cash for repurchases of outstanding Common Shares

and/or Debentures under the NCIB; the existence of alternative uses

for the Corporation’s cash resources which may be superior to

effecting repurchases under the NCIB; compliance by third parties

with their contractual obligations; compliance with applicable laws

and regulations pertaining to the NCIB; and other risks related to

the Corporation’s business, including those identified in the

Corporation’s most recent annual information form under the heading

“Risk Factors” (a copy of which may be obtained at www.sedar.com)

and subsequent filings. Forward-looking statements contained in

this press release are made as of the date hereof and are subject

to change. All forward-looking statements in this press release are

qualified by these cautionary statements. Unless otherwise required

by applicable securities laws, we do not intend, nor do we

undertake any obligation, to update or revise any forward-looking

statements contained in this press release to reflect subsequent

information, events, results or circumstances or otherwise.

| |

| For further

information, please contact: |

|

|

|

| Eli Dadouch |

Ryan Lim |

| President & Chief Executive

Officer |

Chief Financial Officer |

| (416) 635-0221 |

(416) 635-0221 |

| |

|

| For Investor

Relations information, please contact: |

| |

|

| Victoria Moayedi |

|

| Director, Investor Relations |

|

| (416) 635-0221 |

|

Boutique Mortgage Lenders®

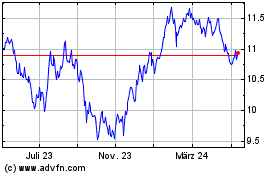

Firm Capital Mortgage In... (TSX:FC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Firm Capital Mortgage In... (TSX:FC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024