Aberdeen Asia-Pacific Income Investment Company Limited (the

“Company”) (TSX: FAP), a closed-end investment company

trading on The Toronto Stock Exchange, today announced performance

data and portfolio composition details as of June 30, 2011.

The Company’s total returns for various periods through June 30,

2011 are provided below. (All figures are based on distributions

reinvested at the dividend reinvestment price and are stated

net-of-fees):

Period

NAV Total Return (%)

Market Price Total Return (%)

Cumulative Annualized

Cumulative Annualized Since inception (June

1986) 610.8 8.2 669.8 8.5 10-years

94.9 6.9 145.3 9.4 5-years 36.0

6.3 51.7 8.7 3-years 20.4 6.4

52.9 15.2 1-year 11.8 25.9

The Company’s returns, which are denominated in Canadian

dollars, are affected by the performance of the Canadian dollar

against the various currencies listed below.

As of June 30, 2011, the portfolio was invested as follows:

Currency

Exposure (%) Geographic Exposure (%) Australia

25.0 23.7 New Zealand 0.9 0.7

United States * 18.3 0.3

Canada - 0.1 Mexico 10.0 10.0 United

Kingdom - 0.4 Germany - 0.5 Norway

- 0.2 European Union - 0.1

Brazil 9.4 9.4 Turkey

3.6 3.6 South

Korea - 3.6 Singapore - 0.3 Thailand

- 0.9 Philippines 7.2 9.7 Malaysia

- 1.2 India 10.9 12.6 China -

2.6 Hong Kong - 3.0 Indonesia 14.7

17.1 *Of which 18.3% held in US$ denominated bonds issued by

foreign issuers.

As of June 30, 2011, the top ten holdings of the portfolio based

on total assets were as follows:

Holding

Coupon / Maturity (%)

Philippine Government 9.13%, 09/04/2016

3.5 Turkey Government Bond 16.00%, 03/07/2012

3.3 Philippine Government 7.00%, 01/27/2016

3.3 India Government 7.02%, 08/17/2016

3.1 Mexico Government 9.50%, 12/18/2014

2.9 Brazil Notas de Tesouro Nacional (Series F)

10.00%, 01/01/2021 2.8 Federal Republic

of Brazil 10.00%, 01/01/2012 2.8

Mexican Bonos 8.50%, 05/31/2029 2.7

Nota de Tesouro Nacional 10.00%, 01/01/2017

2.6 Mexico Government 8.50%, 12/13/2018

2.6

TOTAL

29.6

As of June 30, 2011 the holdings of the portfolio represented

approximately 70.9% sovereign and state government securities, 2.7%

supranationals, 25.3% corporates, 0.3% cash and 0.8% mortgage

backed securities.

As of June 30, 2011, the Company’s net assets, including C$139.9

million in bank borrowing, amounted to C$494.9 million. The net

asset value per ordinary share was C$6.85.

As of June 30, 2011, 40.7% of the portfolio was invested in

securities where either the issue or the issuer was rated “A” or

better, or judged by the Investment Manager to be of equivalent

quality.

The credit quality and maturity breakdown of

the portfolio was as follows:

Credit Quality (%) AAA/Aaa AA/Aa

A BBB/Baa BB/Ba B

17.8 5.0 17.9 23.5

35.6 0.2

Maturity (%) 10 Years 15.9 23.1

41.7 19.3

As of June 30, 2011, the average maturity of the portfolio was

7.6 years.

The Company has a Normal Course Issuer Bid (“NCIB”) in place

whereby shares of the Company may be purchased at times when the

market price per share trades at a discount in excess of 8% to the

Company’s net asset value per share. During the month of June there

were no shares purchased under the NCIB.

The Fund has in place leverage in the form of a loan facility

that renews annually. The outstanding balance on the loan as of

June 30, 2011 is US$145,000,000, which represents no change from

the previous month.

The leverage is used with the intent of enhancing returns by

borrowing at interest rates that are lower than the relatively

higher yields of the Asian-Pacific fixed income securities in which

the Company invests. The Company has entered into interest rate

swap agreements in order to fix the interest payable on a portion

of the credit facility. Details regarding the revolving credit loan

facility and the interest rate swap agreements are contained in the

Company’s annual and semi-annual reports to shareholders.

Important Information

Aberdeen Asset Management Inc., the Company’s Administrator, has

prepared this report based on information sources believed to be

accurate and reliable. However, the figures are unaudited and

neither the Company, the Administrator, Aberdeen Asset Management

Asia Limited (the Investment Manager), Aberdeen Asset Management

Limited (the Investment Advisor), Aberdeen Fund Management Limited

(the Sub-Adviser), nor any other person guarantees their accuracy.

Investors should seek their own professional advice and should

consider the investment objectives, risks, charges and expenses

before acting on this information.

Closed-end funds have a one-time initial public offering and

then are subsequently traded on the secondary market through one of

the stock exchanges. The investment return and principal value will

fluctuate so that an investor’s shares may be worth more or less

than the original cost. Shares of closed-end funds may trade above

(a premium) or below (a discount) the net asset value (NAV) of the

fund’s portfolio. There is no assurance that a fund will achieve

its investment objective. Past performance does not guarantee

future results.

Total return figures are stated net-of-fees, in C$ and represent

past performance. They assume reinvestment of dividends at the

dividend reinvestment price on the ex-dividend date and include

long-term capital gains. The returns are not adjusted for any

issuance of rights or warrants by the Company. Past performance is

not indicative of future results, current performance may be higher

or lower. Holdings are subject to change and are provided for

informational purposes only and should not be deemed as a

recommendation to buy or sell the securities shown. Inception date

June 13, 1986.

Information in this press release that is not current or

historical factual information may constitute forward-looking

information within the meaning of securities laws. Implicit in this

information, particularly in respect of future financial

performance and condition of the Company, are factors and

assumptions which, although considered reasonable by the Company at

the time of preparation, may prove to be incorrect. Shareholders

are cautioned that actual results are subject to a number of risks

and uncertainties, including general economic and market factors,

including credit, currency, political and interest-rate risks and

could differ materially from what is currently expected. The

Company has no specific intention of updating any forward-looking

information whether as a result of new information, future events

or otherwise, except as required by law.

If you wish to receive this information

electronically, please contact

InvestorRelations@aberdeen-asset.com

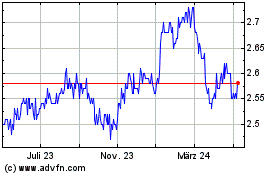

Abrdn Asia Pacific Incom... (TSX:FAP)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

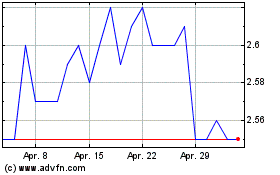

Abrdn Asia Pacific Incom... (TSX:FAP)

Historical Stock Chart

Von Jan 2024 bis Jan 2025