Emera (TSX: EMA) today reported results for the second

quarter of 2017.

Q2 2017 Highlights:

Reported Net Income:

- Reported Q2 2017 net income of $101

million, compared with net income of $208 million in Q2 2016.

- Reported earnings per common share in

Q2 2017 were $0.47, compared with $1.39 per common share in Q2

2016.

Adjusted Net Income (excluding after-tax mark-to-market

impacts):

- Adjusted net income (1) was $117

million, or $0.55 per common share, in Q2 2017, compared with $238

million or $1.59 per common share in Q2 2016. Excluding the Q2 2016

gains, acquisition costs and tax adjustment Q2 2016 adjusted

earnings would have been $50 million, or $0.34 on a per share

basis.

- After-tax mark-to-market losses

decreased $14 million to $16 million in Q2 2017 compared to $30

million in Q2 2016 mainly due to changes in existing positions on

long-term natural gas contracts at Emera Energy.

- Q2 2017 adjusted net income (1)

included a contribution of $58 million from Emera Florida and New

Mexico, net of the $45 million of permanent financing cost.

Net income Earnings per share Three

months ended June 30 Three months ended June 30 In

millions of $CAD, except per share amounts 2017

2016 2017 2016 Adjusted $ 117 $

238 $ 0.55 $ 1.59 Gain on Algonquin Power

& Utilities Corp (APUC) shares -- (146) -- (0.97) Gain on

conversion of APUC subscription receipts -- (53) -- (0.35)

Barbados Light & Power Company Self

Insurance Fund(SIF) liability reduction

-- (43) -- (0.29) TECO acquisition costs -- 42 -- 0.28 Emera Energy

prior period fuel tax recognition -- 12 --

0.08 Adjusted excluding one-time items $ 117 $ 50 $ 0.55 $

0.34

Cash Flow (1)

- In 2017, year-to-date operating cash

flow (before changes in working capital) increased $378 million, or

116 percent, to $703 million from $325 million in the 2016

period.

"Our second quarter results reflect Emera’s enhanced earning

power and less seasonality from the combined businesses, as well as

strong earnings across our regulated businesses,” said Emera’s

President and CEO Chris Huskilson. “Our earnings and cash flow,

combined with the steady progress on our capital plans, support

Emera’s long-term prospects and dividend growth target.”

“Our financial success this quarter is overshadowed by the

accident at TECO’s Big Bend facility and our deepest condolences

are with the families of those who passed and were injured. This

tragic incident has impacted all of us across Emera deeply and we

are more focused than ever before on having world class safety

programs, where all of our employees go home safely every day.”

Huskilson added.

2017 Year-to-Date Highlights

Reported Net Income:

- Reported net income of $413 million,

compared with $252 million in the 2016 period.

- Reported earnings per share of $1.95,

compared with $1.69 in the 2016 period

Adjusted Net Income (1)

- Adjusted net income was $269 million,

or $1.27 per common share, compared with $358 million or $2.40 per

common share, in the 2016 period. Adjusted net income in the 2016

period, excluding the Q2 2016 items noted above and the $18 million

Q1 2016 TECO Energy acquisition costs was $188 million, or $1.26 on

a per common share basis.

- Earnings per share increased only

slightly in 2017 despite the 43 percent increase in adjusted net

income, excluding 2Q 2016 one-time items, due to the new shares

issued in August 2016 in conjunction with the TECO acquisition and

the December 2016 equity issue.

- Year-to-date, after-tax mark-to-market

increased $250 million to a $144 million gain in 2017 compared to a

$106 million loss for the same period in 2016. 2016 included a $117

million loss resulting from the reversal of 2015 gains on

USD-denominated currency and forward contracts related to the

financing of the TECO Energy acquisition. In addition, losses have

decreased due to changes in existing positions on long-term

contracts at Emera Energy, and the reversal of 2016 mark-to-market

losses at Emera Energy.

- Adjusted net income included a

contribution of $92 million from Emera Florida and New Mexico, net

of the $90 million of permanent financing costs.

Net income Earnings per share Six

months ended June 30 Six months ended June 30 In

millions of $CAD, except per share amounts 2017

2016 2017 2016 Adjusted $ 269 $ 358 $

1.27 $ 2.40 Gain on Algonquin Power & Utilities Corp (APUC)

shares -- (146) -- (0.98) Gain on conversion of APUC subscription

receipts -- (53) -- (0.36)

Barbados Light & Power Company Self

Insurance Fund(SIF) liability reduction

-- (43) -- (0.29) TECO acquisition costs -- 60 -- 0.40 Emera Energy

fuel tax recognition -- 12 -- 0.08

Adjusted excluding one-time items $ 269 $ 188 $ 1.27 $ 1.26

Financial Highlights (in millions of

$CAD, except per share amounts)

Three months ended June 30

Six months ended

June 30

2017 2016 2017 2016

Net income attributable to common shareholders $ 101 $ 208 $

413

$ 252

After-tax mark-to-market gain (loss) $ (16)

$ (30) $ 144 $ (106)

Adjusted net income attributable to common

shareholders (1)(2) $ 117 $ 238 $ 269 $ 358

Earnings

per common share - basic $ 0.47 $ 1.39 $ $1.95 $ 1.69

Adjusted earnings per common share - basic (1)(2) $ 0.55 $

1.59 $ $1.27 $ 2.40

Weighted average shares of common stock

outstanding - basic(millions of shares for the three months

ended June 30)

213

150

212

149

(1) See “Non-GAAP Measures” noted below.(2) Adjusted net income

(1) and Adjusted earnings per common share (1) exclude the effect

of mark-to-market adjustments.

Consolidated Financial

Review:

Below is a table highlighting significant changes between

adjusted net income from 2016 to 2017 in the second quarter and

year-to-date periods.

For the Three months ended Six months ended millions

of Canadian dollars June 30 June 30

Adjusted net income –

2016 $ 238 $ 358 Emera Florida and

New Mexico 103 182 2016 Acquisition and financing

costs related to the acquisition of TECO Energy 42 60

Emera Energy (1) 6 (32) 2016 Emera Energy's

recognition of fuel taxes for 2013 through March 2016 12

12 NSPML and LIL AFUDC earnings 8 15 NSPI

1 18 2016 gain on BLPC SIF regulatory liability

(43) (43) TECO Energy post-acquisition financing

costs (45) (90)

2016 gain on conversion of APUC

subscription receipts and dividend equivalents tocommon shares of

APUC

(53)

(53)

2016 gain on sale of APUC common shares (146) (146)

Other (6) (12)

Adjusted net income – 2017

$ 117 $ 269

(1) Excludes the effect of mark-to-market adjustments.

Segment Results

Emera reports its results in six operating segments: Emera

Florida and New Mexico, Nova Scotia Power Inc., Emera Maine, Emera

Caribbean, Emera Energy, and Corporate & Other.

Segmented Results (in millions of $CAD,

except per share amounts)

Three months ended June 30

Six months ended June 30 2017

2016 2017

2016 Emera Florida and New Mexico $ 103 $ -- $ 182 $

--

Nova Scotia Power Inc. 29 28 99 81

Emera Maine 12

10 25 19

Emera Caribbean 11 58 18 68

Emera Energy

(2) (11) (29) (1) 19

Corporate & Other (2)

(27) 171 (54) 171

Adjusted net

income $ 117 $ 238 $

269 $ 358 Adjusted EPS (basic)(1)

$ 0.55 $ 1.59 $ 1.27

$ 2.40

(1)See “Non-GAAP Measures” noted below.(2)Adjusted net income(1)

excludes after-tax mark-to-market loss in Pipelines, Emera Energy,

and Corporate and Other

Emera Florida and New Mexico’s net income was $103

million in Q2 2017, compared with $82 million in Q2 2016.

Comparative information is presented for information only as Emera

did not own the Emera Florida and New Mexico operations in the Q2

or year-to-date periods in 2016. Q2 2017 results were driven

primarily by higher base revenues effective January 2017 when the

Polk Power Station expansion entered service; higher electricity

sales resulting from strong customer growth; and warmer than normal

spring weather at Tampa Electric. The net contribution to adjusted

net income was $58 million or $0.27 per common share net of the $45

million in after-tax permanent financing cost of the TECO Energy

acquisition. Year-to-date 2017 net income was $182 million,

essentially unchanged from the 2016 period, which reflects mild

winter weather in Florida and New Mexico offset by customer growth,

favorable second quarter weather and higher base revenues. Net of

the $90 million of permanent financing cost, Emera Florida and New

Mexico contributed $92 million, or $0.43 per common share, in the

year-to-date 2017 period.

Nova Scotia Power Inc.’s net income was consistent for

the quarter at $29 million in Q2 2017, compared with $28 million in

Q2 2016. NSPI’s net income year-to-date was $99 million compared to

$81 million for the same period last year driven by lower OM&G

and lower provision for income taxes partially offset by higher

depreciation.

Emera Maine’s net income was $12 million Q2 2017,

compared to Q2 2016 net income of $10 million. Emera Maine’s net

income year-to-date was $25 million compared to $19 million for the

same period last year. Year-to-date 2017 results were driven by

lower OM&G and higher electric revenues as a result of

transmission and distribution rate changes

Emera Caribbean’s net income of $11 million in Q2 2017

compared with $58 million in Q2 2016. Results in 2016 reflect the

$43 million after-tax gain from the BLPC SIF as a result of the

reduction in the regulatory liability. Excluding the 2016 gain,

results reflect lower energy sales volumes at GBPC due to the

continued effects of Hurricane Matthew, which struck Grand Bahama

in October 2016 and higher interest charges on new debt issued in

Q4 2016. Emera Caribbean’s net income year-to-date was $18 million

compared to $68 million for the same period last year, driven by

the same factors as Q2.

Emera Energy’s net loss, adjusted to exclude

mark-to-market changes, was $11 million in Q2 2017 compared to a

loss of $29 million in Q2 2016. Overall market conditions were

comparable quarter over quarter. The increase is mainly due to the

recognition in Q2 2016 of $12 million after tax of prior period

state fuel taxes, lower short-term fixed cost commitments for

transportation and more valuable transportation positions in Q2

2017; partially offset by the impact of an unplanned outage at

Bridgeport Energy which extended from mid-March 2017 to mid-June

2017. Emera Energy’s adjusted net loss year-to-date was $1 million

compared to adjusted net income of $19 million for the same period

last year. Year-to-date 2017 results were driven by lower realized

energy margins in the New England generating fleet in Q1,

reflecting more favorable short-term economic hedges in 2016

compared to 2017; and less favorable transportation capacity hedges

in Q1 2017 coupled with increased gas transportation infrastructure

in the northeast United States which reduced volatility; partially

offset by the Q2 2017 factors noted above.

Corporate & Other’s net loss, adjusted to exclude

mark-to-market changes, was $27 million in Q2 2017 compared to

adjusted net income of $171 million in Q2 2016. This was primarily

due to interest expense as a result of interest on the permanent

financing of the TECO acquisition partially offset by a combined $8

million higher AFUDC earnings on the NSPML and LIL transmission

projects. Results in Q2 2016 included the $199 million of after-tax

gains on the sale of the APUC shares and the conversion of the APUC

subscription receipts in the second quarter of 2016, and $42

million of acquisition costs. Corporate & Other’s adjusted loss

was $54 million for the year-to-date 2017 period compared to

adjusted net income of $171 million for the same period last year.

Year-to-date 2016 results include $60 million of after-tax TECO

acquisition costs.

(1) Non-GAAP MeasuresEmera uses financial measures that

do not have standardized meaning under USGAAP and may not be

comparable to similar measures presented by other entities. Emera

calculates the non-GAAP measures by adjusting certain GAAP and

non-GAAP measures for specific items the Company believes are

significant, but not reflective of underlying operations in the

period. Refer to the Non-GAAP Financial Measures section of our

Management's Discussion and Analysis ("MD&A") for further

discussion of these items.

Forward Looking InformationThis news release contains

forward-looking information within the meaning of applicable

securities laws. By its nature, forward-looking information

requires Emera to make assumptions and is subject to inherent risks

and uncertainties. These statements reflect Emera management’s

current beliefs and are based on information currently available to

Emera management. There is a risk that predictions, forecasts,

conclusions and projections that constitute forward-looking

information will not prove to be accurate, that Emera’s assumptions

may not be correct and that actual results may differ materially

from such forward-looking information. Additional detailed

information about these assumptions, risks and uncertainties is

included in Emera’s securities regulatory filings, including under

the heading “Business Risks and Risk Management” in Emera’s annual

Management’s Discussion and Analysis, and under the heading

“Principal Risks and Uncertainties” in the notes to Emera’s annual

and interim financial statements, which can be found on SEDAR at

www.sedar.com.

Teleconference CallThe company will be hosting a

teleconference Friday, August 11, 2017 at 11:00am Atlantic time

(10:00am Toronto/Montreal/New York; 9:00am Winnipeg; 8:00am

Calgary; 7:00am Vancouver) to discuss the Q2 2017 financial

results.

Analysts and other interested parties in North America wanting

to participate in the call should dial 1-866-521-4909 at least 10

minutes prior to the start of the call. International participants

wanting to participate should dial 1-647-427-2311. No pass code is

required. The teleconference will be recorded. If you are unable to

join the teleconference live, you can dial for playback, toll-free

at 1-800-585-8367. The Conference ID is 53138266 (available until

midnight, September 1, 2017).

The teleconference will also be web cast live at emera.com and

available for playback for one year.

About EmeraEmera Inc. is a geographically diverse energy

and services company headquartered in Halifax, Nova Scotia with

approximately $29 billion in assets and 2016 revenues of more than

$4 billion. The company invests in electricity generation,

transmission and distribution, gas transmission and distribution,

and utility energy services with a strategic focus on

transformation from high carbon to low carbon energy sources. Emera

has investments throughout North America, and in four Caribbean

countries. Emera continues to target having 75-85% of its adjusted

earnings come from rate-regulated businesses. Emera’s common and

preferred shares are listed on the Toronto Stock Exchange and trade

respectively under the symbol EMA, EMA.PR.A, EMA.PR.B, EMA.PR.C,

EMA.PR.E, and EMA.PR.F. Depositary receipts representing common

shares of Emera are listed on the Barbados Stock Exchange under the

symbol EMABDR. Additional Information can be accessed

at www.emera.com or at www.sedar.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170810006201/en/

For more information, please contact:

Mark Kane, (813) 228-1772

Vice President, Investor Relations

or

Neera Ritcey, (902) 428-6059

Manager, Investor Relations

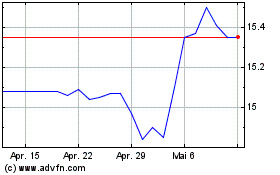

Emera (TSX:EMA.PR.A)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Emera (TSX:EMA.PR.A)

Historical Stock Chart

Von Nov 2023 bis Nov 2024