Eldorado Gold Corporation (“Eldorado” or the

“Company”) and its wholly-owned subsidiary, Hellas Gold Single

Member S.A. (“Hellas”), are pleased to announce that Hellas has

satisfied all necessary precedent conditions and has closed its

previously announced €680 million project financing facility (the

“Facility”) for the development of the Skouries Project in Northern

Greece (“Skouries” or the “Project”).

The Facility is structured to provide 80% of the

funding required to complete the Project, with the remaining 20% to

be funded by the Company. Hellas contributed €31.2 million

(approximately US$34.0 million) from January 2022 through to the

end of March 2023, on early works activities at Skouries, which

will be applied as a credit towards the Company’s equity commitment

per the terms of the Facility. The Company’s equity commitment for

the Project is backstopped by a letter of credit in the amount of

€190 million issued under the Company’s revolving credit facility.

The letter of credit will be reduced Euro for Euro as the Company

invests further in the Project.

As noted in the Company’s December 15, 2022,

news release, in accordance with the terms of the Facility, Hellas

has entered into a secured hedging program that covers gold and

copper prices, an interest rate swap and US dollar to Euro exchange

rate arrangements. The key terms of the hedging program are as

follows:

1. Limited

forward sales for delivery on June 30, 2026, as follows:

- Gold: 32,000 ounces of gold at a

forward price of US$2,160 per ounce; and

- Copper: 6,160 tonnes of copper at a

forward price of US$8,525 per tonne.

2. Hellas has

entered into an interest rate swap covering 70% of the variable

interest rate exposure, per the terms of the Facility. Details of

the interest rate swap are as follows:

|

Term |

Term Detail |

|

Interest Payment Frequency |

6 months |

|

Floating Index |

6-month Euribor |

|

Tenor |

9 years |

|

Effective Date |

April 6, 2023 |

|

Maturity Date |

December 31, 2032 |

|

Fixed Rate |

3.11% |

3. Hellas has

entered into foreign exchange hedging arrangements to fix the US

dollar to Euro exchange rate for a portion of the Facility

repayments:

|

Delivery Dates |

Euro Notional |

Forward Rate |

|

June 30, 2026 |

17,000,000 |

1.1362 |

|

December 31, 2026 |

17,000,000 |

1.1393 |

|

June 30, 2027 |

17,000,000 |

1.1423 |

|

December 31, 2027 |

17,000,000 |

1.1455 |

|

June 30, 2028 |

17,000,000 |

1.1487 |

|

December 29, 2028 |

17,000,000 |

1.1521 |

|

June 29, 2029 |

17,000,000 |

1.1554 |

|

December 31, 2029 |

17,000,000 |

1.1587 |

|

June 28, 2030 |

11,350,000 |

1.1619 |

|

December 31, 2030 |

11,350,000 |

1.1655 |

|

June 30, 2031 |

11,350,000 |

1.1688 |

|

December 31, 2031 |

11,350,000 |

1.1722 |

|

June 30, 2032 |

11,350,000 |

1.1755 |

|

December 30, 2032 |

11,350,000 |

1.1787 |

About Eldorado Gold

Eldorado is a gold and base metals producer with

mining, development and exploration operations in Turkiye, Canada

and Greece. The Company has a highly skilled and dedicated

workforce, safe and responsible operations, a portfolio of

high-quality assets, and long-term partnerships with local

communities. Eldorado's common shares trade on the Toronto Stock

Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Contact

Investor Relations

Philip Yee, EVP and Chief Financial

Officer604.687 4018 or 1.888.353.8166

philip.yee@eldoradogold.com

Media

Louise McMahon, Director Communications &

Public Affairs604.757 5573 or 1.888.353.8166

louise.mcmahon@eldoradogold.com

Cautionary Note about Forward-looking

Statements and Information

Certain of the statements made and information

provided in this press release are forward-looking statements or

information within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. Often, these forward-looking statements and

forward-looking information can be identified by the use of words

such as “believes”, “budgets”, “commitment”, “confident”,

“estimates”, “expects”, “forecasts”, “intends”, “plans”,

“potential”, “prospective”, or “schedule” or the negatives thereof

or variations of such words and phrases or statements that certain

actions, events or results “can”, “could”, “likely”, “may”,

“might”, “will” or “would” be taken, occur or be achieved.

Forward-looking statements or information

contained in this press release include, but are not limited to,

statements or information with respect to: the total funding

requirements for the Project, including the sources thereof; the

drawdown of the proceeds of the Facility, including the timing

thereof; the Company’s ability to fund the remaining 20% equity

funding commitment, the Company’s hedging strategy; risk factors

affecting our business; our expectations as to our future financial

and operating performance, including future cash flow, estimated

cash costs, expected metallurgical recoveries and gold and copper

price outlook; and our strategy, plans and goals, including our

proposed exploration, development, construction, permitting and

operating plans and priorities, related timelines and schedules.

Forward-looking statements and forward-looking information by their

nature are based on assumptions and involve known and unknown

risks, uncertainties and other factors, which may cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements or information.

We have made certain assumptions about the

forward-looking statements and information, including assumptions

about: the total funding required to complete the Project; our

ability to meet our timing objectives for drawdown of funds under

the Facility and to provide our equity commitment; our ability to

execute our plans relating to Skouries, including the timing

thereof; our ability to obtain all required approvals and permits;

cost estimates in respect of Skouries; no changes in input costs,

exchange rates, development and gold; the geopolitical, economic,

permitting and legal climate that we operate in, including at

Skouries; how the worldwide economic and social impact of COVID-19

is managed and the duration and extent of the COVID-19 pandemic;

timing, cost and results of our construction and exploration; the

future price of gold and other commodities; the global concentrate

market; exchange rates; anticipated values, costs, expenses and

working capital requirements; production and metallurgical

recoveries; mineral reserves and resources; and the impact of

acquisitions, dispositions, suspensions or delays on our business

and the ability to achieve our goals. In addition, except where

otherwise stated, we have assumed a continuation of existing

business operations on substantially the same basis as exists at

the time of this press release.

Even though our management believes that the

assumptions made and the expectations represented by such

statements or information are reasonable, there can be no assurance

that the forward-looking statement or information will prove to be

accurate. Many assumptions may be difficult to predict and are

beyond our control.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in forward-looking statements or information.

These risks, uncertainties and other factors include, among others,

the following: increases in financing costs or adverse changes to

the Facility and our revolving credit facility; failure or delays

to receive necessary approvals or otherwise satisfy the conditions

to the drawdown of the Facility; the proceeds of the Facility not

being available to the Company or Hellas; ability to execute on

plans relating to Skouries, including the timing thereof, ability

to achieve the social impacts and benefits contemplated; inability

to meet production guidance; risks relating to the ongoing COVID-19

pandemic and any future pandemic, epidemic, endemic or similar

public health threats; risks relating to our operations being

located in foreign jurisdictions; community relations and social

license; climate change; liquidity and financing risks, including

our ability to further draw under our revolving credit facility;

development risks; indebtedness, including current and future

operating restrictions, implications of a change of control,

ability to meet debt service obligations, the implications of

defaulting on obligations and change in credit ratings;

environmental matters; waste disposal; the global economic

environment; government regulation; reliance on a limited number of

smelters and off-takers; commodity price risk; mineral tenure;

permits; risks relating to environmental sustainability and

governance practices and performance; non-governmental

organizations; corruption, bribery and sanctions; litigation and

contracts; information technology systems; estimation of mineral

reserves and mineral resources; production and processing

estimates; credit risk; actions of activist shareholders; price

volatility, volume fluctuations and dilution risk in respect of our

shares; reliance on infrastructure, commodities and consumables;

currency risk; inflation risk; interest rate risk; tax matters;

dividends; financial reporting, including relating to the carrying

value of our assets and changes in reporting standards; labour,

including relating to employee/union relations, employee

misconduct, key personnel, skilled workforce, expatriates and

contractors; reclamation and long-term obligations; regulated

substances; necessary equipment; co-ownership of our properties;

acquisitions, including integration risks, and dispositions; the

unavailability of insurance; conflicts of interest; compliance with

privacy legislation; reputational issues; competition, as well as

those risk factors discussed in the sections titled

“Forward-looking information and risks” and “Risk factors in our

business” in our most recent Annual Information Form & Form

40-F. The reader is directed to carefully review the detailed risk

discussion in our most recent Annual Information Form & Form

40-F filed on SEDAR and EDGAR under our Company name, which

discussion is incorporated by reference in this release, for a

fuller understanding of the risks and uncertainties that affect our

business and operations.

The inclusion of forward-looking statements and

information is designed to help you understand management’s current

views of our near- and longer-term prospects, and it may not be

appropriate for other purposes.

There can be no assurance that forward-looking

statements or information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, you should not place

undue reliance on the forward-looking statements or information

contained herein. Except as required by law, we do not expect to

update forward-looking statements and information continually as

conditions change and you are referred to the full discussion of

the Company’s business contained in the Company’s reports filed

with the securities regulatory authorities in Canada and the United

States.

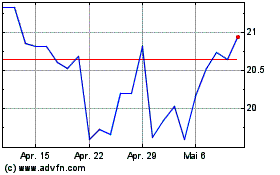

Eldorado Gold (TSX:ELD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Eldorado Gold (TSX:ELD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025