Eldorado Gold Corporation (“Eldorado” or the

“Company”) is pleased to announce that its wholly-owned subsidiary,

Hellas Gold Single Member S.A. (“Hellas”) has entered into a €680

million project financing facility (the “Term Facility”) for the

development of the Skouries Project in Northern Greece (“Skouries”

or the “Project”) with National Bank of Greece S.A. (“National Bank

of Greece”) and Piraeus Bank S.A. (“Piraeus Bank”) as lead

arrangers. Consistent with the Company’s previous disclosure, the

Term Facility will provide 80% of the expected future funding

required to complete the Project, which is approximately

half-built. The Term Facility is non-recourse to Eldorado and the

collateral securing the Term Facility covers the Skouries Project

and the Hellas operating assets. The remaining 20% of Project

funding is expected to be fully covered by Eldorado’s existing cash

and future cash flow from operations. Until such further equity is

fully invested, Eldorado’s investment undertaking for the Project

will be fully backstopped by a letter of credit from the Company’s

Revolving Credit Facility. Drawdown on the Term Facility is subject

to customary closing conditions. The Company expects such

conditions to be satisfied and the initial drawdown to occur in the

first quarter of 2023.

The Company is also pleased to announce that its

Board of Directors (the “Board”) has approved, conditional upon the

initial drawdown of the Term Facility, the investment decision and

full re-start of construction at Skouries. The Company will host a

conference call on Thursday, December 15, 2022, at 11:30 am ET

(8:30 am PT). The call details are at the end of this news

release.

“Skouries represents the next phase of growth at

Eldorado, generating significant value for all of our stakeholders

with robust project economics and providing many benefits to the

local communities and economy in Greece,” said Steve Reid, Chair of

the Board. “Having had the opportunity to tour Skouries recently,

Eldorado’s board and the leadership team are excited to be resuming

construction and bringing this world-class asset into production.

On behalf of the Board, I want to congratulate the team on this

important milestone.”

“We are proud to be announcing the signing of

this financing and the restart of construction at Skouries,” said

George Burns, President and CEO of Eldorado Gold. “The

participation of Greek lenders in the Project provides aligned

strategic partners as we advance Skouries towards commercial

production. The Term Facility covers 80% of the expected remaining

future funding required to complete the Project. The Company is

able to fund the remaining 20% from its current balance sheet,

future cash flow from existing operations and will receive a credit

for its actual expenditures during the pre-construction phase in

2022, all of which fully addresses the Project funding

requirement.”

“Our focus now shifts to project execution, with

first production expected in the second half of 2025, followed by a

ramp-up as we optimize facilities,” continued Burns. “Once in

production, Skouries will have a significant impact on Eldorado’s

total gold production and cash cost profile and will diversify our

business through revenue from copper. On behalf of the Eldorado and

Hellas teams, I want to thank our local partners and workforce, the

Aristotle Municipality, the Greek government, and National Bank of

Greece and Piraeus Bank, for their support of the Project. We look

forward to working with them and developing a world-class mine in

the region adhering to best-in-class sustainability standards.”

Highlights of the Term

Facility:

- Borrower: Hellas

Gold Single Member S.A., a 100%-owned subsidiary of Eldorado.

- Mandated Lead

Arrangers: National Bank of Greece and Piraeus Bank

(the “Lenders”)

- Term Facility

Amount: €680 million, consisting of:

- €480 million commercial loan;

- €100 million of initial funding

from the Greek Recovery and Resilience Facility (“RRF”);

- €100 million commercial bridge loan

that is expected to be replaced by an additional RRF loan in

2023.

- Interest Rate:

- Commercial loans: Variable interest

rate of 5.4% (comprised of six-months EURIBOR plus a fixed margin)

until Project completion, and then 5.2% (comprised of six-months

EURIBOR plus a fixed margin) following Project completion, with 70%

of the variable rate exposure to be hedged via an interest rate

swap for the term of the facility.

- Initial RRF loan: Fixed interest

rate of 3.04% for the term of the facility.

- Additional RRF loan: Fixed interest

rate to be set at issuance on replacement of bridge facility.

- Term: 3 years

availability, 7 years repayment.

- Cost Overrun

Facility: Although not expected to be necessary, the

project financing includes, in addition to the Term Facility, a

Contingent Overrun Facility for an additional 10% of capital costs,

funded by the Lenders and Hellas in the same proportion as the Term

Facility.

- Hedging: Hellas

will hedge limited volumes of gold and copper production to manage

downside commodity price exposure and support minimum debt service

coverage ratios. It is expected that hedging will be limited to not

more than 50% of the first year of commercial production and this

will be reviewed at least annually. In addition, Hellas will hedge

a portion of its foreign exchange exposure (Euro/US dollar). Terms

of the hedging program will be confirmed at initial drawdown.

- Repayment:

Semi-annual instalments over seven years, commencing on June 30,

2026, with a weighted average life to maturity of approximately

eight years.

Focused on Execution

Eldorado remains confident in the capital cost

estimate of $845 million(1) to bring the Skouries project into

commercial production, which is derived from the “Technical Report,

Skouries Project, Greece” prepared for Eldorado with an effective

date of January 22, 2022 (the “Feasibility Study” or “FS”), and

believes it is well-positioned to execute. The Project is

approximately half built, with most major processing equipment

already purchased and installed or in storage.

(1) All

financial figures are in U.S. dollars unless otherwise stated.

In 2022, Project activity was focused on steel

erection and enclosure of the processing facilities, which is now

largely complete, as well as execution readiness and critical path

activities. In 2023, Project activities will focus on

finalizing detailed engineering, which is 42% complete and

forecasted to be 70-75% complete for full construction mobilization

in the second half of 2023, release of remaining procurement

packages, and community engagement. Additionally, Eldorado has

built a highly capable owners’ team that is based at Skouries, and

the Engineering, Procurement and Construction Management contractor

has been progressively mobilizing.

The Company has confidence in the level of

expertise and availability of the construction workforce in the

Halkidiki region and Greece. Since the Project was placed on care

& maintenance in November 2017, the Company has continued to

engage with local communities and key stakeholders and is committed

to continuing this open dialogue for the life of the mine.

Project Capital Cost and

Schedule

Eldorado remains confident in the project

schedule and capital cost estimate, based on several factors:

- The filter press, a long-lead item

for tailings dewatering, was ordered in the second quarter of 2022,

with cost and delivery schedules in line with the FS assumptions;

and the labour productivity for the steel erection and enclosure of

the processing facility has been consistent with the FS

assumptions.

- Labour accounts for approximately

half of the capital cost estimate. A readily available Greek

workforce and stable labour rates remain consistent with the FS

capital cost assumptions.

- In 2022, construction activities at

the nearby Olympias dry-stack tailings management facility, which

is of a similar design in similar topography, support the FS

assumptions made for the Skouries dry-stack tailings facility

construction.

- Overall, commodity price

assumptions, including copper, steel, and cement, remain in line

with the FS.

- Approximately 80% of the capital

cost estimate is in Euros, which has weakened since the FS

assumptions.

- The Project will benefit from

early-works activities completed throughout 2022, and is on track

to deliver in line with the three-year construction and

commissioning schedule.

Project

Economics(1)

The Skouries Project has robust economics, with

a 19% after-tax Internal Rate of Return (“IRR”) and $1.3

billion after-tax Net Present Value

(“NPV5%”) (5%), based on

long-term prices of $1,500 per ounce (“oz”) gold and $3.85 per

pound copper. The Project is expected to produce 2.9

million ounces of gold over the 20-year life of mine, with average

annual production of 140,000 oz of gold and 67 million pounds of

copper (approximately 312,000 oz gold equivalent), with exploration

potentially extending mine life. The Project is expected to

generate, on average, $215 million of free cash

flow(2) per year

for the first five years. Overall, the Skouries Project has the

potential to increase Eldorado’s production profile and lower

Eldorado’s cash cost per ounce.

(1) Project

economics are based on the “Technical Report, Skouries Project,

Greece” prepared for Eldorado with an effective date of January 22,

2022.(2) These financial measures or ratios are non-IFRS

financial measures or ratios. See the section “Non-IFRS Measures”

below.

Project Sensitivities

(1)

|

|

Base Case Assumptions(2) |

Spot Price(as of December 13,

2022) |

|

Gold Price ($/oz) |

1,500 |

1,800 |

|

Copper Price ($/lb) |

3.85 |

3.80 |

|

After-Tax IRR |

19.0% |

21.9% |

|

Payback (years) |

3.7 |

3.5 |

|

NPV5% |

$1.3 billion |

$1.6 billion |

|

Cash Operating Costs ($/oz)(3) |

(365) |

(341) |

|

All-in Sustaining Costs ($/oz)(3) |

(6) |

65 |

(1) Economics are

shown on an unlevered basis and do not include the impact of the

Term Facility.(2) Base case development assumptions are based on

the “Technical Report, Skouries Project, Greece” prepared for

Eldorado with an effective date of January 22, 2022.(3) These

financial measures or ratios are non-IFRS financial measures or

ratios. See the section “Non-IFRS Measures” below.

Social Benefit

The development of the Project, part of the

Kassandra Mines Complex in the Halkidiki region will provide

long-term value for both the national and local economies.

Where possible, Hellas prioritizes hiring local

employees and working with local suppliers. During peak

construction, the Project is expected to employ an additional 800

people and, once in production, Skouries will create over 25 years

of steady and well-paid employment with 1,400 long-term jobs

expected to be filled by members of the local community.

Over the life of the Kassandra Mines, it is

estimated that 5,000 direct and indirect jobs will be created and

more than $2 billion in revenue will be contributed to the Greek

State from income taxes, social contributions and royalties over

the life of mine. Eldorado expects to provide employees with

enhanced skills through the development of an innovative Technical

Training Center. In addition, $80 million will be committed to

Corporate Social Responsibility programs, including community,

cultural, social, and environmental investments.

About Skouries

Skouries is located within the Halkidiki

Peninsula of Northern Greece. It is a gold-copper porphyry deposit

to be mined using a combination of conventional open pit and

underground mining techniques. Based on the Feasibility Study,

Skouries is expected to produce, on average, 140,000 ounces of gold

and 67 million pounds of copper annually over its initial 20-year

mine life. For more information about the Project, and details of

the Feasibility Study, please refer to the news release dated

December 15, 2021 or the Technical Report dated January 22, 2022,

both of which are available on the Eldorado Gold website or under

the Company’s name on SEDAR at www.sedar.com.

Conference Call Details

Eldorado will host a conference call to discuss

the Skouries project financing and re-start of construction on

Thursday, December 15 at 11:30 am ET (8:30 am PT). A video will be

played during the webcast therefore we encourage participants to

join via the webcast. The video and a replay of the webcast will be

available on Eldorado’s website following the event.

The call will be webcast and can be accessed at

Eldorado’s website: www.eldoradogold.com, or via:

https://services.choruscall.ca/links/eldoradogold202212.html

|

Conference Call Details |

Replay (available until January 19, 2023) |

| Date: December 15, 2022 |

Vancouver:

+1 604 638 9010 |

| Time: 11:30 am ET (8:30 am

PT) |

Toll Free:

1 800 319 6413 |

| Dial in: +1 604 638 5340 |

Access code:

9684 |

| Toll free:1 800 319 4610 |

|

| |

|

About Eldorado Gold

Eldorado is a gold and base metals producer with

mining, development and exploration operations in Turkiye, Canada

and Greece. The Company has a highly skilled and dedicated

workforce, safe and responsible operations, a portfolio of

high-quality assets, and long-term partnerships with local

communities. Eldorado's common shares trade on the Toronto Stock

Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Qualified Person

Except as otherwise noted, Simon Hille, FAusIMM,

Senior Vice President, Technical Services, is the Qualified Person

under NI 43-101 responsible for preparing and supervising the

preparation of the scientific or technical information contained in

this press release and verifying the technical data disclosed in

this document relating to our operating mines and development

projects.

Non-IFRS Measures

Certain non-IFRS measures, including cash costs

and all-in sustaining cost ("AISC") are included in this press

release. The Company believes that these measures, in addition to

conventional measures prepared in accordance with International

Financial Reporting Standards (“IFRS”), provide investors an

improved ability to evaluate the underlying performance of the

Company. Please see the September 30, 2022 MD&A for

explanations and discussion of these non-IFRS measures. The

non-IFRS measures are intended to provide additional information

and should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with IFRS. These

measures do not have any standardized meaning prescribed under

IFRS, and therefore may not be comparable to other issuers.

Cash Costs

Cash operating costs and cash operating costs

per ounce sold are non-IFRS financial measures and ratios. In the

gold mining industry, these metrics are common performance measures

but do not have any standardized meaning under IFRS. We follow the

recommendations of the Gold Institute Production Cost Standard. The

Gold Institute, which ceased operations in 2002, was a

non-regulatory body and represented a global group of producers of

gold and gold products. The production cost standard developed by

the Gold Institute remains the generally accepted standard of

reporting cash operating costs of production by gold mining

companies. Cash operating costs include mine site operating costs

such as mining, processing and administration, but exclude royalty

expenses, depreciation and depletion, share based payment expenses

and reclamation costs. Revenue from sales of by-products including

silver, lead and zinc reduce cash operating costs. Cash operating

costs per ounce sold is based on ounces sold and is calculated by

dividing cash operating costs by volume of gold ounces sold. We

disclose cash operating costs and cash operating costs per ounce

sold as we believe the measures provide valuable assistance to

investors and analysts in evaluating the Company's operational

performance and ability to generate cash flow. The most directly

comparable measure prepared in accordance with IFRS is production

costs. Cash operating costs and cash operating costs per ounce of

gold sold should not be considered in isolation or as a substitute

for measures prepared in accordance with IFRS.

AISC

AISC and AISC per ounce sold are non-IFRS

financial measures and ratios. These financial measures and ratios

are intended to assist readers in evaluating the total costs of

producing gold from current operations. While there is no

standardized meaning across the industry for this measure, our

definition conforms to the definition of AISC set out by the World

Gold Council and the updated guidance note dated November 14, 2018.

We define AISC as the sum of total cash costs (as defined and

calculated above), sustaining capital expenditure relating to

current operations (including capitalized stripping and underground

mine development), sustaining leases (cash basis), sustaining

exploration and evaluation cost related to current operations

(including sustaining capitalized evaluation costs), reclamation

cost accretion and amortization related to current gold operations

and corporate and allocated general and administrative expenses.

Corporate and allocated general and administrative expenses include

general and administrative expenses, share-based payments and

defined benefit pension plan expense. Corporate and allocated

general and administrative expenses do not include non-cash

depreciation. As this measure seeks to reflect the full cost of

gold production from current operations, growth capital and

reclamation cost accretion not related to operating gold mines are

excluded. Certain other cash expenditures, including tax payments,

financing charges (including capitalized interest), except for

financing charges related to leasing arrangements, and costs

related to business combinations, asset acquisitions and asset

disposals are also excluded. AISC per ounce sold is based on ounces

sold and is calculated by dividing AISC by volume of gold ounces

sold.

Free Cash Flow

Free cash flow is a non-IFRS financial measure.

Free cash flow is a useful indicator of our ability to operate

without reliance on additional borrowing or usage of existing cash.

Defined as net cash generated from (used in) operating activities

of continuing operations, less net cash used in investing

activities of continuing operations before increases or decreases

in cash from the following items that are not considered

representative of our ability to generate cash: term deposits,

restricted cash, cash used for acquisitions or disposals of mineral

properties, marketable securities and non-recurring asset

sales.

Contacts

Investor Relations

Lisa Wilkinson, VP, Investor Relations604 757

2237 or 1 888 353 8166 lisa.wilkinson@eldoradogold.com

Media

Louise McMahon, Director Communications &

Public Affairs604 757 5573 or 1 888 353 8166

louise.mcmahon@eldoradogold.com

Forward-looking Statements and Information

Certain of the statements made and information

provided in this press release are forward-looking statements or

information within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. Often, these forward-looking statements and

forward-looking information can be identified by the use of words

such as “believes”, “budgets”, “commitment”, “confident”,

“estimates”, “expects”, “forecasts”, “intends”, “plans”,

“potential”, “prospective”, or “schedule” or the negatives thereof

or variations of such words and phrases or statements that certain

actions, events or results “can”, “could”, “likely”, “may”,

“might”, “will” or “would” be taken, occur or be achieved.

Forward-looking statements or information

contained in this press release include, but are not limited to,

statements or information with respect to: the total funding

requirements for the Skouries Project; the Company’s ability to

participate in the RRF and the extent and timing of proceeds

received therefrom; the drawdown of the proceeds of the Term

Facility, including the timing thereof; the impact of the Term

Facility and funding of Skouries on the Company’s operations,

infrastructure, opportunities, financial condition, access to

capital and overall strategy; the Company’s ability to fund the

remaining 20% funding commitment; the Company’s ability to

successfully advance Skouries and achieve the results provided for

in the Feasibility Study; the results of the Feasibility Study,

including the forecasts for the economics, life of mine, required

capital, costs, and cash flow at Skouries; expectations regarding

advancement and development of Skouries, including the ability to

meet expectations and the timing thereof; expectations regarding

full mobilization; expectations regarding finalization of detailed

engineering; expectations on mining operations and water

management; the social and economic impacts and benefits of the

Skouries Project on the Company’s stakeholders, including in

respect of local employment and procurement and in local

communities; the development of a technical training center; the

timing of production; the use and benefits of dry stack tailings;

undertested exploration targets surrounding Skouries and

prospective satellite ore bodies; the Company’s conference call to

be held on December 15, 2022; non-IFRS financial measures and

ratios; risk factors affecting our business; our expectation as to

our future financial and operating performance, including future

cash flow, estimated cash costs, expected metallurgical recoveries

and gold price outlook; and our strategy, plans and goals,

including our proposed exploration, development, construction,

permitting and operating plans and priorities, related timelines

and schedules. Forward-looking statements and forward-looking

information by their nature are based on assumptions and involve

known and unknown risks, uncertainties and other factors, which may

cause the actual results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements or information.

We have made certain assumptions about the

forward-looking statements and information, including assumptions

about: the total funding required to complete the Skouries Project;

our ability to satisfy the conditions precedent to advances under

the Term Facility (including eligibility for, and the allocation of

funding from, the RRF); our ability to meet our timing objectives

for first drawdown of funds; our ability to execute our plans

relating to Skouries as set out in the Feasibility Study, including

the timing thereof; our ability to obtain all required approvals

and permits; the assumptions provided for in the Feasibility Study

will be accurate, including cost estimates; no changes in input

costs, exchange rates, development and gold; the geopolitical,

economic, permitting and legal climate that we operate in,

including at Skouries; how the world-wide economic and social

impact of COVID-19 is managed and the duration and extent of the

COVID-19 pandemic; timing, cost and results of our construction and

exploration; the geopolitical, economic, permitting and legal

climate that we operate in; the future price of gold and other

commodities; the global concentrate market; exchange rates;

anticipated values, costs, expenses and working capital

requirements; production and metallurgical recoveries; mineral

reserves and resources; and the impact of acquisitions,

dispositions, suspensions or delays on our business and the ability

to achieve our goals. In addition, except where otherwise stated,

we have assumed a continuation of existing business operations on

substantially the same basis as exists at the time of this press

release.

Even though our management believes that the

assumptions made and the expectations represented by such

statements or information are reasonable, there can be no assurance

that the forward-looking statement or information will prove to be

accurate. Many assumptions may be difficult to predict and are

beyond our control.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should

underlying assumptions prove incorrect, actual results may

vary materially from those described in forward-looking statements

or information. These risks, uncertainties and other factors

include, among others, the following: increases in financing costs

or adverse changes to the Term Facility; ability to satisfy the

conditions precedent to advances under the Term Facility (including

eligibility for, and the allocation of funding from, the RRF);

failure or delays to receive necessary approvals or otherwise

satisfy the conditions to the drawdown of the Term Facility; the

proceeds of the Term Facility not being available to the Company or

Hellas Gold S.A.; ability to execute on plans relating to Skouries,

including the timing thereof, ability to achieve the social impacts

and benefits contemplated; inability to meet production guidance;

risks relating to the ongoing COVID-19 pandemic and any future

pandemic, epidemic, endemic or similar public health threats; risks

relating to our operations being located in foreign jurisdictions;

community relations and social license; climate change; liquidity

and financing risks; development risks; indebtedness, including

current and future operating restrictions, implications of a change

of control, ability to meet debt service obligations, the

implications of defaulting on obligations and change in credit

ratings; environmental matters; waste disposal; the global economic

environment; government regulation; reliance on a limited number of

smelters and off-takers; commodity price risk; mineral tenure;

permits; risks relating to environmental sustainability and

governance practices and performance; non-governmental

organizations; corruption, bribery and sanctions; litigation and

contracts; information technology systems; estimation of mineral

reserves and mineral resources; production and processing

estimates; credit risk; actions of activist shareholders; price

volatility, volume fluctuations and dilution risk in respect of our

shares; reliance on infrastructure, commodities and consumables;

currency risk; inflation risk; interest rate risk; tax matters;

dividends; financial reporting, including relating to the carrying

value of our assets and changes in reporting standards; labour,

including relating to employee/union relations, employee

misconduct, key personnel, skilled workforce, expatriates and

contractors; reclamation and long-term obligations; regulated

substances; necessary equipment; co-ownership of our properties;

acquisitions, including integration risks, and dispositions; the

unavailability of insurance; conflicts of interest; compliance with

privacy legislation; reputational issues; competition, as well as

those risk factors discussed in the sections titled

“Forward-looking information and risks” and “Risk factors in our

business” in our most recent Annual Information Form & Form

40-F. The reader is directed to carefully review the detailed risk

discussion in our most recent Annual Information Form & Form

40-F filed on SEDAR and EDGAR under our Company name, which

discussion is incorporated by reference in this release, for a

fuller understanding of the risks and uncertainties that affect our

business and operations.

The inclusion of forward-looking statements and

information is designed to help you understand management’s current

views of our near- and longer-term prospects, and it may not be

appropriate for other purposes.

There can be no assurance that forward-looking

statements or information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, you should not place

undue reliance on the forward-looking statements or information

contained herein. Except as required by law, we do not expect to

update forward-looking statements and information continually as

conditions change and you are referred to the full discussion of

the Company’s business contained in the Company’s reports filed

with the securities regulatory authorities in Canada and the United

States.

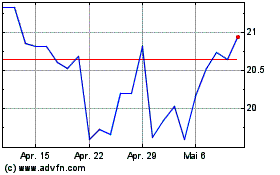

Eldorado Gold (TSX:ELD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Eldorado Gold (TSX:ELD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025