Enerflex Files Amended and Restated Financial Statements

11 Juli 2022 - 1:00PM

Enerflex Ltd. (TSX:EFX) (

Enerflex or the

Company), announced today that it has identified

matters which require the Company to make a restatement to

reclassify certain amounts within the Statement of Cash Flows.

Users of the Company’s financial statements

should note that the Adjustments, as described below, do

not change the Company’s overall cash position, and do not impact

the Company’s Statement of Financial Position, the Company’s

Statement of Earnings, or earnings before finance costs, income

taxes, depreciation and amortization (EBITDA)

calculations.

The restatement includes (1) the removal of

certain offsetting entries for non-cash items on the Statement of

Cash Flows and (2) the reclassification of certain items between

categories within the Statement of Cash Flows (collectively, the

Adjustments). All changes are contained within the

Statement of Cash Flows and related notes / exhibits and the net

cash position of the Company is unchanged. The Company has filed

amended and restated financial statements for the financial years

ended December 31, 2021, 2020, and the 2019 comparative period (the

Amended Annual Statements), the unaudited interim

financial statements for the three months ended March 31, 2022 (the

Amended Quarterly Statement and together with the

Amended Annual Statements, the Amended

Statements), and related amended and restated management’s

discussion and analysis (MD&A) for each

period.

A summary of the Adjustments is described below

and further details can be found in the Amended Statements and

related MD&A which are available under the Company’s electronic

profile on SEDAR at www.sedar.com.

| $ Canadian thousands |

|

|

|

| Three Months Ended March 31,

2022 |

As Previously Reported |

Amendment |

As Restated |

|

Cash provided by/(used in) operating activities |

2,625 |

|

(25,337 |

) |

(22,712 |

) |

|

Cash used in investing activities |

(36,954 |

) |

20,069 |

|

(16,885 |

) |

|

Cash provided by/(used in) financing activities |

(5,242 |

) |

6,627 |

|

1,385 |

|

|

Effect of exchange rate changes on cash denominated in foreign

currencies |

27 |

|

(1,359 |

) |

(1,332 |

) |

|

Change in cash and cash equivalents over the quarter |

(39,544 |

) |

- |

|

(39,544 |

) |

| |

|

|

|

| Three Months Ended March 31,

2021 |

|

|

|

|

Cash provided by/(used in) operating activities |

59,951 |

|

(1,374 |

) |

58,577 |

|

|

Cash used in investing activities |

(10,679 |

) |

(1,891 |

) |

(12,570 |

) |

|

Cash used in financing activities |

(33,745 |

) |

3,702 |

|

(30,043 |

) |

|

Effect of exchange rate changes on cash denominated in foreign

currencies |

(561 |

) |

(437 |

) |

(998 |

) |

|

Change in cash and cash equivalents over the quarter |

14,966 |

|

- |

|

14,966 |

|

| |

|

|

|

| |

|

|

|

| $ Canadian thousands |

|

|

|

| Year Ended December 31,

2021 |

As Previously Reported |

Amendment |

As Restated |

|

Cash provided by/(used in) operating activities |

225,155 |

|

(16,961 |

) |

208,194 |

|

|

Cash used in investing activities |

(63,530 |

) |

14,669 |

|

(48,861 |

) |

|

Cash used in financing activities |

(83,891 |

) |

3,435 |

|

(80,456 |

) |

|

Effect of exchange rate changes on cash denominated in foreign

currencies |

(652 |

) |

(1,143 |

) |

(1,795 |

) |

|

Change in cash and cash equivalents over the year |

77,082 |

|

- |

|

77,082 |

|

| |

|

|

|

| |

|

|

|

| Year Ended December 31,

2020 |

As Previously Reported |

Amendment |

As Restated |

|

Cash provided by/(used in) operating activities |

220,248 |

|

27,061 |

|

247,309 |

|

|

Cash used in investing activities |

(137,759 |

) |

(32,738 |

) |

(170,497 |

) |

|

Cash used in financing activities |

(82,050 |

) |

4,729 |

|

(77,321 |

) |

|

Effect of exchange rate changes on cash denominated in foreign

currencies |

(1,018 |

) |

948 |

|

(70 |

) |

|

Change in cash and cash equivalents over the year |

(579 |

) |

- |

|

(579 |

) |

| |

|

|

|

| Year Ended December 31,

2019 |

|

|

|

|

Cash provided by/(used in) operating activities |

54,169 |

|

12,752 |

|

66,921 |

|

|

Cash used in investing activities |

(222,820 |

) |

(27,011 |

) |

(249,831 |

) |

|

Cash used in financing activities |

(60,980 |

) |

16,742 |

|

(44,238 |

) |

|

Effect of exchange rate changes on cash denominated in foreign

currencies |

(978 |

) |

(2,483 |

) |

(3,461 |

) |

|

Change in cash and cash equivalents over the year |

(230,609 |

) |

- |

|

(230,609 |

) |

The Company has prepared a Note to the Amended

Statements detailing the impact of the Adjustments and has revised

the Supplemental Cash Flow Information Notes to the Amended

Statements. Additionally, the MD&A has been amended to reflect

the restated amounts for the categories of cash flow

activities.

In connection with the filing of the Amended

Statements, the Company is also filing CEO and CFO certifications

in compliance with National Instrument 52-109 Certification of

Disclosure in Issuers’ Annual and Interim Filings.

About Enerflex Enerflex is a

single source supplier of natural gas compression, oil and gas

processing, refrigeration systems, and electric power generation

equipment – plus related engineering and mechanical service

expertise. The Company’s broad in-house resources provide the

capability to engineer, design, manufacture, construct, commission,

operate, and service hydrocarbon handling systems. Enerflex’s

expertise encompasses field production facilities, compression and

natural gas processing plants, gas lift compression, refrigeration

systems, and electric power equipment servicing the natural gas

production industry.

Headquartered in Calgary, Canada, Enerflex has

approximately 2,100 employees worldwide. Enerflex, its

subsidiaries, interests in associates and joint-ventures operate in

Canada, the United States, Argentina, Bolivia, Brazil, Colombia,

Mexico, the United Kingdom, the United Arab Emirates, Oman,

Bahrain, Kuwait, Australia, New Zealand, Indonesia, Malaysia, and

Thailand. Enerflex’s shares trade on the Toronto Stock Exchange

under the symbol “EFX”. For more information about Enerflex, go to

www.enerflex.com.

For investor and media inquiries, please

contact:

| Marc

Rossiter |

Sanjay

Bishnoi |

Stefan

Ali |

| President & Chief

Executive Officer |

Senior Vice President &

Chief Financial Officer |

Vice President, Strategy and

Investor Relations |

| Tel: 403.387.6325 |

Tel: 403.236.6857 |

Tel: 403.717.4953 |

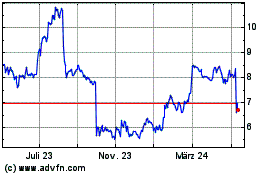

Enerflex (TSX:EFX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

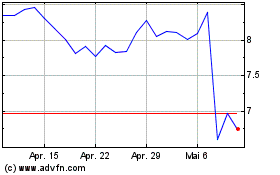

Enerflex (TSX:EFX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025