Enerflex Ltd. (TSX:EFX) (“Enerflex” or “the Company” or “we” or

“our”), a leading supplier of products and services to the global

energy industry, today reported its financial and operating results

for the three months ended March 31, 2022.

Summary Table of First Quarter of 2022

Financial and Operating Results

|

(Unaudited)($ Canadian millions, except per share amounts,

horsepower, and percentages) |

Three months ended March 31, |

|

|

|

2022 |

|

|

2021(1) |

|

|

Change |

|

|

Revenue |

$ |

323.1 |

|

$ |

203.2 |

|

$ |

119.9 |

|

| Gross margin |

|

53.6 |

|

|

45.5 |

|

|

8.1 |

|

| Operating Income |

|

6.8 |

|

|

7.0 |

|

|

(0.2) |

|

| EBIT |

|

7.1 |

|

|

6.6 |

|

|

0.5 |

|

| EBITDA(2) |

|

29.0 |

|

|

27.7 |

|

|

1.3 |

|

| Adjusted EBITDA(3) |

|

38.7 |

|

|

29.6 |

|

|

9.1 |

|

| Net earnings |

|

(0.4) |

|

|

3.0 |

|

|

(3.4) |

|

| Earnings per share –

basic |

|

(0.00) |

|

|

0.03 |

|

|

(0.03) |

|

| Recurring revenue growth |

|

13.5% |

|

|

(6.7)% |

|

|

|

| Bookings(4) |

|

236.9 |

|

|

98.7 |

|

|

138.2 |

|

| Backlog(4) |

|

620.0 |

|

|

169.4 |

|

|

450.6 |

|

| Rental horsepower |

|

833,872 |

|

|

767,842 |

|

|

66,030 |

|

(1) Certain prior period amounts have

been reclassified between COGS and SG&A following management’s

continuing review of the function of expenditures incurred. Please

refer to Note 1 of the interim condensed consolidated financial

statements for additional details.(2) Earnings Before

Interest (Finance Costs), Income Taxes, Depreciation, and

Amortization (“EBITDA”) is considered a non-IFRS measure, which may

not be comparable with similar non-IFRS measures used by other

entities.(3) Adjusted EBITDA is a non-IFRS measure.

Please refer to the full reconciliation of these items in the

Adjusted EBITDA section.(4) Engineered Systems bookings and

backlog are considered non-IFRS measures that do not have

standardized meanings as prescribed by IFRS, and are therefore

unlikely to be comparable to similar measures used by other

entities.

“Enerflex is pleased to report a safe and

successful first quarter of 2022,” said Marc Rossiter, Enerflex’s

President and Chief Executive Officer. “Our revenue and Adjusted

EBITDA increased substantially compared to the prior year quarter

despite increased inflationary and competitive pressures. Our

global Energy Infrastructure business performed very well and our

Engineered Systems business had a very strong quarter on two

fronts. First, while we continue progressing some of the lower

margin projects that were booked in early 2021, we are starting to

see gradual margin improvement off the lows, having increased the

margin on Engineered Systems revenue by 200 basis points relative

to Q4 2021 while managing a turbulent supply chain. Second, we

recorded a high level of new bookings for compression, gas

processing and energy transition-related equipment.”

“We continue progressing several opportunities

in the energy transition space and expect that continued public

policy support for lower carbon energy solutions will benefit

Enerflex in the coming years. Finally, we are progressing towards

close of our transformational acquisition of Exterran that was

announced in January of 2022. We are increasingly excited about the

strategic fit of the two companies, the supportive macroeconomic

fundamentals for global natural gas production growth, and the

support received by the market.”

Quarterly Overview

- Bookings totaled $237 million, up

significantly from $99 million in the same period last year,

reflecting the increased activity in our Engineered Systems

business. Movement in foreign exchange rates resulted in a decrease

of $6 million on foreign currency denominated backlog during the

first quarter of 2022.

- Engineered Systems backlog at March

31, 2022 is $620 million compared to the backlog of $558 million at

December 31, 2021. This $62 million increase is due to the higher

Engineered Systems bookings outpacing revenue recognized in the

period, offset by unfavourable foreign exchange impacts of $6

million.

- The Company experienced a healthy

increase in revenue in the current quarter at $323 million compared

to $203 million in the comparable quarter, mainly due to a stronger

opening backlog, revenue recognition of the previously announced

10-year natural gas infrastructure project, higher rental

utilizations, and the increased volume of work in all segments.

Gross margin was $54 million or 17 percent for the first quarter of

2022 compared to $46 million or 22 percent for the comparable

period. The higher gross margin in the current quarter is primarily

due to the increased volume of work. However, the Company reported

a lower gross margin percent due to a shift in the product mix,

less government grants received, and competitive pricing pressures

on materials and labour.

- SG&A costs of $47 million in

the first quarter of 2022 were up from $38 million in the same

period last year. The increase is primarily due to the transaction

costs on the pending Exterran transaction and the reduced cost

recoveries from government subsidies. These increases are partially

offset by lower share-based compensation.

- Operating income was lower than the

prior period, primarily due to higher SG&A and competitive

margin pressures, partially offset by increased gross margin from

higher revenue. Excluding the transaction costs, the Company’s

operating income would have been higher than the prior period.

- The Company invested $29 million

towards construction of a natural gas infrastructure asset that was

awarded in the fourth quarter of 2021 and which will be accounted

for as a finance lease. The Company also invested $3 million in

rental assets; the majority used to fund the organic expansion of

the USA contract compression fleet. At March 31, 2022, the USA

contract compression fleet totaled approximately 405,000 horsepower

with an average fleet utilization of 91 percent for the

quarter.

- The Company continues to maintain a

strong balance sheet and our bank-adjusted net debt to EBITDA ratio

is 1.43:1, compared to a maximum ratio of 3:1. This leverage ratio

excludes the non-recourse debt. Enerflex has substantial undrawn

credit capacity and cash on hand.

- Subsequent to March 31, 2022,

Enerflex declared a quarterly dividend of $0.025 per share, payable

on July 7, 2022, to shareholders of record on May 19, 2022. The

Board will continue to evaluate dividend payments on a quarterly

basis, based on the availability of cash flow and anticipated

market conditions.

Exterran Transaction UpdateOn

January 24, 2022 the Company announced an all-share acquisition of

Exterran in which Enerflex would acquire all of the outstanding

shares of common stock of Exterran by issuing 1.021 common shares

of Enerflex in exchange for each share of Exterran. The closing of

the transaction is subject to obtaining regulatory approvals and

approval by shareholders of Exterran and Enerflex, and satisfying

other conditions that are customary for a transaction of this type,

which are fully described in the Merger Agreement which is

available under our electronic profile on SEDAR at

www.sedar.com as well as our website. The Company continues to

progress all matters that need to be addressed to close the

Transaction, including the submission of required notifications and

applications necessary to obtain the required regulatory approvals

and clearances, a number of which have already been obtained.

Pending satisfaction of the terms and conditions as set forth in

the Merger Agreement, Enerflex anticipates closing the Transaction

during the second half of 2022. For additional information on the

status of this transaction, please see Enerflex’s Management’s

Discussion and Analysis for the three months ended March 31, 2022,

which is available on the Enerflex website at www.enerflex.com

under the Investors section and on SEDAR at www.sedar.com.

OutlookThe outlook for

Exploration & Production (“E&P”) capital spending has been

steadily improving since mid-2020 when budgets were reset during

the COVID-19 pandemic. Commodity prices have risen on strengthening

supply/demand fundamentals and a renewed focus on energy security

in light of Russia’s invasion of Ukraine, and E&P and Midstream

balance sheets and free-cash-flow positions have been improving.

Oil and gas demand has been recovering, despite some continued

effects of the COVID-19 pandemic and evolving regulatory risks

associated with continued focus on ESG factors. As a result,

Enerflex expects customer capex to increase modestly as

fundamentals improve. This trend can be seen in Enerflex’s bookings

which have been trending upward since the third quarter of 2020.

Although customers continue to show discipline in spending within

their cash flow and return money to shareholders, we are cautiously

optimistic that this trend should continue given the current

fundamentals outlook.

In addition, an “Energy Transition” towards less

carbon-intensive energy sources is presenting new opportunities for

the Company in several regions, leveraging the strength of Enerflex

in providing modularized engineer-to-order process solutions for

the energy industry. The Company is working with existing and new

customers to advance projects that: 1) decarbonize core operations;

2) providing a path for electrification; 3) capture carbon; 4)

build infrastructure for Renewable Natural Gas (RNG) and biofuels;

and 5) new hydrogen opportunities.

Enerflex remains focused on providing a safe

working environment for all employees, while positioning the

Company to capitalize on increased industry spending. Given the

current environment, the Company is carefully assessing project

spending, with a focus on ensuring future projects provide maximum

returns on invested capital. In the longer term, the Company

continues to balance the expected impacts of broader market

factors, such as volatility in realized commodity prices, political

and economic uncertainty, and consistent access to market, against

the projected increases in global demand for natural gas,

particularly as an energy transition fuel to support

decarbonization. Enerflex continues to assess the effects of these

contributing factors and the corresponding impact on customer

activity levels, which will drive the demand for the Company’s

products and services in future periods.

First Quarter Segmented

ResultsUSAUSA segment revenue was $147 million, an

increase of $66 million from the same period in 2021. Engineered

Systems revenue increased due to improved activity levels and

higher opening backlog; higher Service revenue due to increased

volume of work and the inclement weather that impacted the first

quarter of 2021; and higher Energy Infrastructure as a result of

larger rental fleet and higher utilizations. SG&A was higher in

the first quarter of 2022 compared to the same period last year as

a result of the allocated transaction costs related to the

previously announced Exterran transaction, and higher total

compensation due to increased headcount. EBIT was lower by less

than $1 million in the first quarter primarily due to higher

SG&A compared to the prior year, despite the higher gross

margins mainly due to the higher Engineered Systems revenue on

stronger opening backlog for 2022.

Rest of WorldRevenue in the Rest of World

segment was $109 million, an increase of $39 million from the same

period in 2021, with higher Engineered Systems and Energy

Infrastructure revenue, offset by lower Service revenue. Engineered

Systems revenue improved primarily from a previously announced

10-year natural gas infrastructure project in the Middle East that

began operations at the beginning of the year and accounted for as

a finance lease. Energy Infrastructure revenues slightly increased

during the first quarter helped by the finance lease income on the

aforementioned finance lease project, offset by lower Service

revenues. The slight increase in SG&A costs are primarily due

to the segment’s allocated share of transactions costs related to

the previously announced Exterran transaction and increased total

compensation expense, partially offset by lower share-based

compensation on mark-to-market movement and favourable foreign

exchange impacts. EBIT increased by $6 million due to higher gross

margins on higher Engineered Systems and Energy Infrastructure

revenue, partially offset by slightly higher SG&A.

CanadaCanadian revenue was $66 million, an

increase of $16 million, primarily due to higher Engineered Systems

revenue based on the strength of higher opening backlog. Service

revenues have increased due to a number of maintenance service

agreements and large parts sales. Energy Infrastructure revenue

decreased due to lower utilization of available rental units based

on lower demand. Canada did see a decrease in gross margins in the

first quarter of 2022 compared to the same period last year,

primarily driven by reduced government grants; continued lower

margin projects; and margin erosion from unanticipated cost

overruns. SG&A increased due to the segment’s allocated share

of transactions costs related to the previously announced Exterran

transaction and reduced government grants. EBIT is in a loss

position and the decrease is due to lower gross margins and higher

SG&A.

Adjusted EBITDAThe Company’s

results include items that are unique and items that management and

users of the financial statements adjust for when evaluating the

Company’s results. The presentation of Adjusted EBITDA should not

be considered in isolation from EBIT or EBITDA as determined under

IFRS. Adjusted EBITDA may not be comparable to similar measures

presented by other companies and should not be considered in

isolation or as a replacement for measures prepared as determined

under IFRS.

The items that have historically been adjusted

for presentation purposes relate generally to five categories: 1)

impairment or gains on idle facilities (not including rental asset

impairments); 2) severance costs associated with restructuring

activities and cost reduction activities undertaken in response to

the COVID-19 pandemic; 3) grants received from Federal governments

in response to the COVID-19 pandemic; 4) transaction costs related

to M&A activity; and 5) share-based compensation. Enerflex has

presented the impact of share-based compensation as it is an item

that can fluctuate significantly with share price changes during a

period based on factors that are not specific to the long-term

performance of the Company. The disposal of idle facilities is

isolated within Adjusted EBITDA as they are not reflective of the

ongoing operations of the Company and are idled as a result of

restructuring activities.

Management believes that identification of these

items allows for a better understanding of the underlying

operations of the Company based on the current assets and

structure.

| ($ Canadian millions) |

|

|

| Three

months ended March 31, 2022 |

|

Total |

|

USA |

|

ROW |

|

Canada |

|

Reported EBIT |

$ |

7.1 |

$ |

0.3 |

$ |

10.3 |

$ |

(3.5) |

|

| Transaction costs |

|

5.7 |

|

2.6 |

|

1.9 |

|

1.2 |

|

| Share-based compensation |

|

4.0 |

|

1.8 |

|

1.5 |

|

0.7 |

|

|

Depreciation and amortization |

|

21.9 |

|

11.7 |

|

8.3 |

|

1.9 |

|

|

Adjusted EBITDA |

$ |

38.7 |

$ |

16.4 |

$ |

22.0 |

$ |

0.3 |

|

| ($ Canadian millions) |

|

|

| Three

months ended March 31, 2021 |

|

Total |

|

USA |

|

ROW |

|

Canada |

|

Reported EBIT |

$ |

6.6 |

|

$ |

0.4 |

|

$ |

4.7 |

$ |

1.5 |

|

| Severance costs in COGS and

SG&A |

|

0.7 |

|

|

0.1 |

|

|

0.2 |

|

0.4 |

|

| Government grants in COGS and

SG&A |

|

(4.1) |

|

|

(0.5) |

|

|

- |

|

(3.6) |

|

| Share-based compensation |

|

5.3 |

|

|

2.2 |

|

|

2.1 |

|

1.0 |

|

|

Depreciation and amortization |

|

21.1 |

|

|

10.2 |

|

|

8.9 |

|

2.0 |

|

|

Adjusted EBITDA |

$ |

29.6 |

|

$ |

12.4 |

|

$ |

15.9 |

$ |

1.3 |

|

DividendSubsequent to the end

of the quarter, Enerflex declared a quarterly dividend of $0.025

per share, payable on July 7, 2022, to shareholders of record on

May 19, 2022. Enerflex’s Board of Directors will continue to

evaluate dividend payments on a quarterly basis, based on the

availability of cash flow and anticipated market conditions.

Board RetirementsAs previously

disclosed, Mr. Stephen Savidant and Mr. Robert Boswell, each of

whom has served as a director since 2011, did not stand for

re-election pursuant to the Board Retirement Policy having attained

the age of 72. In addition, Ms. Helen Wesley, having recently been

appointed as President of a Florida-based utility company, decided

to not stand for re-election after serving as a director since

2013. Enerflex would like to thank Mr. Savidant, Mr. Boswell, and

Ms. Wesley for their long-standing dedication, guidance and

leadership over the past several years.

Quarterly Results MaterialThis

press release should be read in conjunction with Enerflex’s

unaudited interim condensed consolidated financial statements for

the three months ended March 31, 2022 and 2021, and the

accompanying Management’s Discussion and Analysis, both of which

are available on the Enerflex website at www.enerflex.com under the

Investors section and on SEDAR at www.sedar.com.

Conference Call and Webcast

DetailsEnerflex will host a conference call for analysts,

investors, members of the media, and other interested parties on

Thursday, May 5, 2022 at 8:00 a.m. MDT to discuss the first quarter

2022 financial results and operating highlights. The call will be

hosted by Mr. Marc Rossiter, President and Chief Executive Officer;

Mr. Sanjay Bishnoi, Senior Vice President and Chief Financial

Officer; and Mr. Stefan Ali, Vice President, Strategy and Investor

Relations.

If you wish to participate in this conference

call, please call 1.844.231.9067 or 1.703.639.1277. Please dial in

10 minutes prior to the start of the call. No passcode is required.

The live audio webcast of the conference call will be available on

the Enerflex website at www.enerflex.com under the Investors

section on May 5, 2022 at 8:00 a.m. MDT. A replay of the

teleconference will be available on May 5, 2022 at 11:00 a.m. MDT

until May 12, 2022 at 11:00 a.m. MDT. Please call 1.855.859.2056 or

1.404.537.3406 and enter conference ID 1855316.

About EnerflexEnerflex is a

single-source supplier of natural gas compression, oil and gas

processing, refrigeration systems, and electric power generation

equipment – plus related in-house engineering and mechanical

services expertise. The Company’s broad in-house resources provide

the capability to engineer, design, manufacture, construct,

commission, service, and operate hydrocarbon handling systems.

Enerflex’s expertise encompasses field production facilities,

compression and natural gas processing plants, gas lift

compression, refrigeration systems, and electric power solutions

serving the natural gas production industry.

Headquartered in Calgary, Canada, Enerflex has

approximately 2,100 employees worldwide. Enerflex, its

subsidiaries, interests in associates, and joint operations operate

in Canada, the United States of America (“USA”), Argentina,

Bolivia, Brazil, Colombia, Mexico, the United Kingdom (“UK”),

Bahrain, Kuwait, Oman, the United Arab Emirates (“UAE”), Australia,

New Zealand, Indonesia, Malaysia, and Thailand. Enerflex operates

three business segments: USA, Rest of World, and Canada. Enerflex’s

shares trade on the Toronto Stock Exchange under the symbol “EFX”.

For more information about Enerflex, go to www.enerflex.com.

Advisory Regarding Forward-Looking

InformationThis press release contains forward-looking

information within the meaning of applicable Canadian securities

laws. All statements other than statements of historical fact are

forward-looking statements. The use of any of the words

“anticipate”, “plan”, “contemplate”, “continue”, “estimate”,

“expect”, “intend”, “propose”, “might”, “may”, “will”, “shall”,

“project”, “should”, “could”, “would”, “believe”, “predict”,

“forecast”, “pursue”, “potential”, “objective” and “capable” and

similar expressions are intended to identify forward-looking

information. In particular, this press release includes (without

limitation) forward-looking information pertaining to: anticipated

financial performance; the Company’s growth capital expenditure

plans and maintenance capital spending; anticipated market

conditions and impacts on the Company’s operations; development

trends in the oil and gas industry; business prospects and

strategy; the ability to raise capital; the ability of existing and

expected cash flows and other cash resources to fund investments in

working capital and capital assets; the impact of economic

conditions on accounts receivable; expectations regarding future

dividends; implications of changes in government regulation, laws

and income taxes; and the anticipated outcomes of Enerflex’s

proposed combination with Exterran Corporation, including the

combined entity’s accelerated generation of recurring gross margins

to approximately 70 percent of total, approximate doubling of

EBITDA, and capital allocation priorities following the completion

of in-flight projects in 2022 and 2023. This forward-looking

information is based on assumptions, estimates and analysis made in

the light of the Company's experience and its perception of trends,

current conditions and expected developments, as well as other

factors that are believed by the Company to be reasonable and

relevant in the circumstances. Forward-looking information involves

known and unknown risks and uncertainties and other factors, which

are difficult to predict, including but not limited to: the impact

of economic conditions including volatility in the price of oil,

gas, and gas liquids, interest rates and foreign exchange rates;

industry conditions including supply and demand fundamentals for

oil and gas, and the related infrastructure including new

environmental, taxation and other laws and regulations; disruptions

to business operations resulting from the COVID-19 pandemic and the

responses of government and the public to the pandemic; changes in

economic conditions that restrict Enerflex’s cash flow and impact

its ability to declare and pay dividends; the ability to continue

to build and improve on proven manufacturing capabilities and

innovate into new product lines and markets; increased competition;

insufficient funds to support capital investments required to grow

the business; the lack of availability of qualified personnel or

management; political unrest; and other factors, many of which are

beyond the Company's control. For an augmented discussion of the

risk factors and uncertainties that affect or may affect Enerflex,

the reader is directed to the section entitled “Risk Factors” in

Enerflex’s most recently filed Annual Information Form, as well as

Enerflex’s other publicly filed disclosure documents, available on

www.sedar.com. While the Company believes that there is a

reasonable basis for the forward-looking information and statements

included in this press release, as a result of such known and

unknown risks, uncertainties and other factors, actual results,

performance, or achievements could differ materially from those

expressed in, or implied by, these statements, and readers are

cautioned not to unduly rely on forward-looking statements. The

forward-looking information contained herein is expressly qualified

in its entirety by the above cautionary statement. The

forward-looking information included in this press release is made

as of the date hereof and, other than as required by law, the

Company disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise.

Future-Oriented Financial

InformationThis press release contains information that

may constitute future-oriented financial information or financial

outlook information (“FOFI”) about Enerflex and the entity

resulting from its combination with Exterran, including with

respect to the combined entity’s prospective financial performance,

financial position or cash flows, all of which is subject to the

same assumptions, risk factors, limitations and qualifications as

set forth above. Readers are cautioned that the assumptions used in

the preparation of such information, although considered reasonable

at the time of preparation, may provide to be imprecise or

inaccurate and, as such, undue reliance should not be placed on

FOFI. Enerflex, Exterran or the combined entity’s actual results,

performance and achievements could differ materially from those

expressed in, or implied by, FOFI. Enerflex has included FOFI in

this press release in order to provide readers with a more complete

perspective on the combined entity’s future operations and

management’s current expectations regarding the combined entity’s

future performance. Readers are cautioned that such information may

not be appropriate for other purposes. FOFI contained herein was

made as of the date of this press release. Unless required by

applicable laws, Enerflex does not undertake any obligation to

publicly update or revise any FOFI statements, whether as a result

of new information, future events, or otherwise.

For investor and media inquiries, please

contact:

|

Marc Rossiter |

Sanjay Bishnoi |

Stefan Ali |

| President & Chief Executive

Officer |

Senior Vice President & Chief

Financial Officer |

Vice President, Strategy &

Investor Relations |

| Tel: 403.387.6325 |

Tel: 403.236.6857 |

Tel: 403.717.4953 |

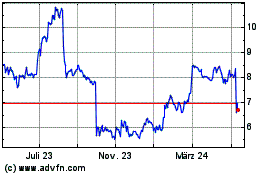

Enerflex (TSX:EFX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

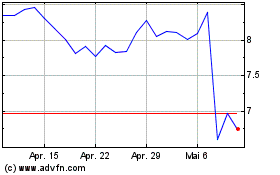

Enerflex (TSX:EFX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025