Enerflex Ltd. (TSX:EFX) (“Enerflex” or the “Company” or “we” or

“our”), a leading supplier of products and services to the global

energy industry, announced today that S&P Global Ratings

(“S&P”) and Fitch Ratings Ltd. (“Fitch”) have each provided an

initial credit rating for the pro forma combination of Enerflex and

Exterran Corporation (“Exterran”). S&P’s initial corporate

credit rating is BB- with a stable outlook and Fitch’s initial

long-term issuer rating is BB- with a stable outlook. The ratings

will be used to support our previously announced high yield debt

offering that we intend to pursue.

On January 24, 2022, Enerflex and Exterran

announced an intention to combine in an all-share transaction,

creating a premier integrated global provider of energy

infrastructure (the “Transaction”). Upon closing, Enerflex will

acquire all of the outstanding common stock of Exterran on the

basis of 1.021 Enerflex common shares for each outstanding share of

common stock of Exterran, resulting in approximately 124 million

Enerflex common shares outstanding, representing an implied

combined enterprise value of approximately US$1.5 billion. The

transaction value for Exterran is approximately US$735 million,

which represents an 18% premium to Exterran’s enterprise value as

of January 21, 2022, the last trading day before the Transaction

was announced. The combined company will operate as Enerflex and

will remain headquartered in Calgary, Alberta, Canada. Enerflex

will continue to trade on the Toronto Stock Exchange (“TSX”) under

the symbol “EFX” and intends to apply to either the New York Stock

Exchange or the NASDAQ exchange for the listing of Enerflex common

shares to be effective upon Transaction close.

The Transaction combines highly complementary

product lines, geographies, and asset bases, which are expected to

materially enhance scale and utilization and provide operating

efficiencies for the combined company’s customers.

Transaction and Financing

Update

The Company continues to progress all matters

that need to be addressed to close the Transaction, including the

filing of necessary regulatory approvals. Enerflex expects to file,

during the second quarter of 2022, an information circular (the

"Circular") with respect to the shareholder approvals that are

required for the Transaction. The Circular will contain a detailed

description of the Transaction and will be available under our

electronic profile on SEDAR at www.sedar.com as well as

Enerflex’s website. All Enerflex shareholders are urged to read the

Circular once available as it will contain important information

concerning the Transaction.

Enerflex recently completed the syndication of a

new senior secured revolving credit facility for a 3-year term

subject to annual extension. RBC Capital Markets, TD Securities,

and The Bank of Nova Scotia served as Joint Bookrunners and Co-Lead

Arrangers for the facility which was significantly oversubscribed.

With the support of the lenders, Enerflex elected to upsize the

facility size from US$600 million to US$700 million to provide

enhanced liquidity. The new credit facility is in addition to the

fully committed US$925 million 5-year bridge loan facility entered

into between Enerflex and Royal Bank of Canada as previously

announced. The bridge loan will provide financing to backstop an

anticipated issuance of new high yield debt securities prior to

closing of the Transaction. The committed financing is sufficient

to fully repay the existing Enerflex and Exterran notes as well as

amounts outstanding under the existing revolving credit facilities

and supports putting in place a new capital structure, provides for

capital expenditures and other ordinary course capital needs, and

provides significant liquidity for the pro forma business.

About EnerflexEnerflex is a

single-source supplier of natural gas compression, oil and gas

processing, refrigeration systems, energy transition solutions, and

electric power generation equipment – plus related in-house

engineering and mechanical services expertise. The Company’s broad

in-house resources provide the capability to engineer, design,

manufacture, construct, commission, service, and operate

hydrocarbon handling systems. Enerflex’s expertise encompasses

field production facilities, compression and natural gas processing

plants, gas lift compression, refrigeration systems, energy

transition solutions, and electric power solutions serving the

natural gas production industry.

Headquartered in Calgary, Canada, Enerflex has

approximately 2,000 employees worldwide. Enerflex, its

subsidiaries, interests in associates, and joint operations operate

in Canada, the United States of America (“USA”), Argentina,

Bolivia, Brazil, Colombia, Mexico, the United Kingdom, Bahrain,

Kuwait, Oman, the United Arab Emirates, Australia, New Zealand,

Indonesia, Malaysia, and Thailand. Enerflex operates three business

segments: USA, Rest of World, and Canada. Enerflex’s shares trade

on the Toronto Stock Exchange under the symbol “EFX”. For more

information about Enerflex, go to www.enerflex.com.

Advisory Regarding Forward-Looking

InformationThis press release contains forward-looking

information within the meaning of applicable U.S. and Canadian

securities laws. All statements other than statements of historical

fact are forward-looking statements. The use of any of the words

“anticipate”, “plan”, “contemplate”, “continue”, “estimate”,

“expect”, “intend”, “propose”, “might”, “may”, “will”, “shall”,

“project”, “should”, “could”, “would”, “believe”, “predict”,

“forecast”, “pursue”, “potential”, “objective” and “capable” and

similar expressions are intended to identify forward-looking

information. In particular, this press release includes (without

limitation) forward-looking information pertaining to: the closing

of the Transaction and the timing associated therewith, if at all;

the number of Enerflex common shares to be outstanding following

closing of the Transaction and the corresponding implied combined

enterprise value; the Transaction value for Exterran shareholders;

the receipt of required regulatory approvals and the timing

associated therewith, if at all; the application for listing of the

Enerflex common shares on the NYSE or NASDAQ and the timing

associated therewith; the expectations pertaining to the enhanced

scale, utilization and operating efficiencies of the combined

company; and the filing of the Circular, the timing associated

therewith, and the expected disclosures to be provided therein.

This forward-looking information is based on assumptions, estimates

and analysis made in the light of the Company's experience and its

perception of trends, current conditions and expected developments,

as well as other factors that are believed by the Company to be

reasonable and relevant in the circumstances. Forward-looking

information involves known and unknown risks and uncertainties and

other factors, which are difficult to predict, including but not

limited to: the impact of economic conditions including volatility

in the price of oil, gas, and gas liquids, interest rates and

foreign exchange rates; industry conditions including supply and

demand fundamentals for oil and gas, and the related

infrastructure; changes to environmental, taxation and other laws

and regulations and the enforcement of laws and regulations by

Courts in the relevant jurisdictions; disruptions to business

operations, including the disruptions resulting from the COVID-19

pandemic and the responses of government and the public to the

pandemic; changes in economic conditions that restrict Enerflex’s

cash flow; the ability to continue to build and improve on proven

manufacturing capabilities and innovate into new product lines and

markets; increased competition; insufficient funds to support

capital investments required to grow the business; the lack of

availability of qualified personnel or management; political

unrest; and other factors, many of which are beyond the Company's

control. For an augmented discussion of the risk factors and

uncertainties that affect or may affect Enerflex, the reader is

directed to the section entitled “Risk Factors” in Enerflex’s most

recently filed Annual Information Form, as well as Enerflex’s other

publicly filed disclosure documents, available under our electronic

profile on SEDAR at www.sedar.com. While the Company believes that

there is a reasonable basis for the forward-looking information and

statements included in this press release, as a result of such

known and unknown risks, uncertainties and other factors, actual

results, performance, or achievements could differ materially from

those expressed in, or implied by, these statements, and readers

are cautioned not to unduly rely on forward-looking statements. The

forward-looking information contained herein is expressly qualified

in its entirety by the above cautionary statement. The

forward-looking information included in this press release is made

as of the date hereof and, other than as required by law, the

Company disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise.

Advisory Regarding Credit

Ratings

Credit ratings are intended to provide investors

with an independent assessment of the credit quality of an issue or

issuer of securities. Credit ratings are not recommendations to

purchase, hold, or sell securities and do not speak to the

suitability of particular securities for any particular investor.

There is no assurance that any credit rating will remain in effect

for any given period of time or that any credit rating will not be

revised or withdrawn entirely by the rating agency in the future

if, in its judgment, circumstances so warrant.

No Offer or SolicitationThis

announcement is for informational purposes only and is neither an

offer to purchase, nor a solicitation of an offer to sell, any

securities or the solicitation of any vote in any jurisdiction

pursuant to the proposed Transaction or otherwise, nor shall there

be any sale, issuance or transfer of securities in any jurisdiction

in contravention of applicable law. No offer of securities shall be

made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act of 1933, as amended.

Additional Information and Where to Find

ItIn connection with the Transaction, Enerflex and

Exterran have filed, on March 18, 2022, relevant materials with the

Securities and Exchange Commission (“SEC”), including a

Registration Statement containing a proxy statement/prospectus on

appropriate form of registration statement regarding each of

Enerflex and Exterran, respectively. After the Registration

Statement has become effective, the definitive proxy

statement/prospectus will be mailed to Exterran stockholders. The

definitive proxy statement/prospectus will contain important

information about the proposed Transaction and related matters.

Enerflex expects to file the Circular with respect to the

shareholder approval that is required for the issuance of Enerflex

common shares pursuant to the Transaction during the second quarter

of 2022. The Circular will contain a detailed description of the

Transaction and will be available on SEDAR at www.sedar.com as

well as on Enerflex’s website. INVESTORS AND SHAREHOLDERS ARE URGED

AND ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS AND/OR THE

CIRCULAR CAREFULLY WHEN IT BECOMES AVAILABLE BECAUSE IT WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES

TO THE TRANSACTION. The definitive proxy statement, the preliminary

proxy statement, and other relevant materials in connection with

the transaction (when they become available) and any other

documents filed by Enerflex with the SEC, may be obtained free of

charge at the SEC's website, at www.sec.gov and the Circular

and other documents filed by Enerflex on SEDAR may be obtained free

of charge at www.sedar.com. The documents filed by Enerflex with

the SEC and on SEDAR may also be obtained free of charge at

Enerflex’s investor relations website at

https://www.enerflex.com/investors/index.php. Alternatively, these

documents, when available, can be obtained free of charge from

Enerflex upon written request to Enerflex Ltd., Attn: Investor

Relations, Suite 904, 1331 Macleod Trail SE, Calgary, Alberta,

Canada T2G 0K3 or by calling +1 403 387.6377.

Participants in the

SolicitationEnerflex, Exterran, and their respective

directors and executive officers may be deemed, under SEC rules, to

be participants in the solicitation of proxies from the Exterran’s

stockholders and Enerflex’s shareholders in connection with the

transaction. Information about Exterran’s directors and executive

officers and their ownership of Exterran’s securities is set forth

in Exterran’s definitive proxy statement on Schedule 14A filed with

the SEC on March 17, 2021. You may obtain information about

Enerflex’s executive officers and directors in Enerflex’s annual

information form, which was filed on SEDAR on February 23, 2022.

These documents may be obtained free of charge at

www.sedar.com and may also be obtained free of charge at

Enerflex’s investor relations website at

https://www.enerflex.com/investors/index.php. Alternatively, these

documents can be obtained free of charge from Enerflex upon written

request to Enerflex Ltd., Attn: Investor Relations, Suite 904, 1331

Macleod Trail SE, Calgary, Alberta, Canada T2G 0K3 or by calling

+1 403 387 6377. Additional information regarding the

interests of all such individuals in the proposed Transaction was

included in the proxy statement relating to such transaction as

filed with the SEC on March 18, 2022.

For investor and media inquiries, please

contact:

| Marc Rossiter |

Sanjay Bishnoi |

Stefan Ali |

| President & Chief Executive

Officer |

Senior Vice President & Chief

Financial Officer |

Vice President, Strategy &

Investor Relations |

| Tel: 403.387.6325 |

Tel: 403.236.6857 |

Tel: 403.717.4953 |

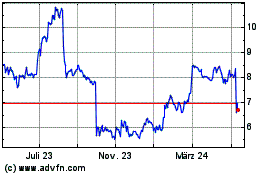

Enerflex (TSX:EFX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

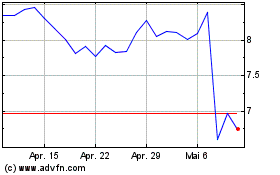

Enerflex (TSX:EFX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025