Enerflex Ltd. (“Enerflex” or the “Company”) (TSX: EFX) and Exterran

Corporation (“Exterran”) (NYSE:EXTN) today announced a business

combination (the “Transaction”) to create a premier integrated

global provider of energy infrastructure. The company will operate

as Enerflex Ltd. and will remain headquartered in Calgary, Alberta,

Canada. Through greater scale and efficiencies, the transaction

will strengthen Enerflex’s ability to serve customers in key

natural gas, water, and energy transition markets, while enhancing

shareholder value through sustainable improvements in profitability

and cash flow generation.

The companies will combine in an all-share

transaction pursuant to which Enerflex will acquire all of the

outstanding common stock of Exterran on the basis of 1.021 Enerflex

common shares for each outstanding share of common stock of

Exterran, resulting in approximately 124 million Enerflex common

shares outstanding upon closing, representing an implied combined

enterprise value of approximately US$1.5 billion. The transaction

value for Exterran is approximately US$735 million, which

represents an 18% premium to Exterran’s enterprise value as at

January 21, 2022. The transaction value paid for Exterran implies

an EV/2022E Adjusted EBITDA of 3.6x and Price/2022E Cash Flow of

1.9x, including synergies, respectively. Upon closing of the

Transaction, Enerflex and Exterran shareholders will respectively

own approximately 72.5% and 27.5% of the total Enerflex common

shares outstanding. Enerflex will continue to trade on the Toronto

Stock Exchange (“TSX”) and intends to apply to either the New York

Stock Exchange (the “NYSE”) or the NASDAQ exchange (“NASDAQ”) for

the listing of Enerflex common shares to be effective upon

Transaction close.

“This is an exciting day in the history of our

companies. The Transaction is immediately accretive to

shareholders; enhances our presence, offerings, and scale across

our regions; and importantly, executes upon our years-long

strategic goal of increasing recurring revenues to improve the

profitability and resiliency of our platform,” said Marc Rossiter,

Enerflex’s President and Chief Executive Officer. “Enerflex and

Exterran each have a long history of global expertise in the

delivery of modular energy solutions. Together, we are more

efficient and better positioned in global capital markets. The

Transaction will improve our ability to partner with an expanded

set of customers to solve their growing energy infrastructure

challenges with integrity, creativity, commitment, and

success.”

“We are excited about the ability to create

shareholder value through this Transaction and improving our

product and service offering. The scale and efficiencies this

combination brings is the right path for Exterran and brings

significant opportunities for accelerated growth in produced water

treatment and energy transition products and services,” said Andrew

Way, President and Chief Executive Officer of Exterran.

Strategic Rationale

- Creates a Premier

Integrated Global Provider of Energy Infrastructure:

- Highly complementary product lines, geographies, and asset

bases provide enhanced scale, efficiencies, and expanded offerings

for customers.

- The pro forma geographic exposure will be well-balanced with

approximately 25-35% of revenues from each of North America, the

Middle East, and Latin America.

- Accelerates Growth of Gross

Margin from Recurring Segments:

- Combination significantly accelerates the generation of

predictable, recurring gross margin from energy infrastructure and

after-market services platforms.

- Over 70% of the combined entity’s gross margin will derive from

recurring sources, strengthening its margin profile and reducing

cyclicality.

- Improved Operational

Efficiencies:

- Expect to realize at least US$40 million of annual run-rate

synergies within 12 to 18 months after closing through overhead

savings and operating efficiencies.

- Accretive to

Shareholders:

- Expected to approximately double Adjusted EBITDA and be over

50% accretive to cash flow per share and approximately 50%

accretive to earnings per share (subject to purchase price

allocation to be determined upon closing), for Enerflex

shareholders.

- Enhanced scale with pro forma 2023E Adjusted EBITDA of US$360

million to 400 million, inclusive of synergies.

- Meaningful excess free cash flow beginning in 2023 that

supports debt reduction, shareholder returns, and continued

growth.

- After close, Enerflex expects to maintain its quarterly

dividend of CAD$0.025 per common share.

- Transaction Benefits From a

Long-Term, Stable Capital Structure:

- The combined entity will benefit from a capital structure that

provides ample liquidity.

- In conjunction with the Transaction, Enerflex has entered into

a binding agreement with the Royal Bank of Canada to provide

Enerflex with a fully committed financing consisting of a US$600

million 3-year revolving credit facility and a US$925 million

5-year bridge loan facility. The bridge loan will provide financing

to backstop an anticipated issuance of new debt securities prior to

closing of the Transaction. The committed financing is sufficient

to fully repay existing Enerflex and Exterran notes and revolving

credit facilities and support putting in place a new capital

structure, provide for capital expenditures and other ordinary

course capital needs, and provide significant liquidity for the pro

forma business.

- The new revolving credit facility will be subject to a

bank-adjusted total net debt to EBITDA covenant of 4.5x, stepping

down to 4.0x by the fourth quarter of 2023.

- Enerflex targets a bank-adjusted net debt to EBITDA ratio of

2.5x - 3.0x within 12 to 18 months of closing.

- Following capital project commitments in 2022, the combined

entity’s capital allocation in 2023 onwards will prioritize: (i)

balance sheet strength; (ii) sustainable shareholder returns; and

(iii) disciplined growth focused on full-cycle earnings.

- Commitment to Sustainability:

- Aligns strong cultures emphasizing

the health and safety of our global workforce and corporate

citizenship.

- Global coverage enhances the

ability to deliver sustainable natural gas, water, and energy

transition solutions, including carbon capture utilization and

sequestration, biofuels (including renewable natural gas), produced

water reuse and recycling, and electrification.

Select Pro Forma Financial

Information

|

Market Capitalization (1) |

~US$800 Million |

|

Enterprise Value (1) |

~US$1.5 Billion |

|

2022E Adjusted EBITDA (including synergies) (2) (3) |

US$320 - $370 Million |

|

2023E Adjusted EBITDA (including synergies) (2) (3) |

US$360 - $400 Million |

|

Annual Synergies (2) |

US$40+ Million |

|

Annual Maintenance Capital Spending |

US$40 - $50 Million |

(1) Based on Enerflex’s closing share price on

the TSX and approximately 124 million Enerflex common shares

outstanding upon closing, as at January 21, 2022.(2) Annual

run-rate synergies are expected to be fully realized within 12 to

18 months after closing.(3) Adjusted EBITDA is a non-IFRS financial

measure. See “Non-IFRS Measures and Other Financial Information”

below.

Governance and Leadership

One Exterran director will be appointed to

Enerflex’s Board of Directors at closing. Mr. Marc Rossiter will

continue to serve as Enerflex’s President and Chief Executive

Officer and a member of the Board of Directors of Enerflex and will

oversee all aspects of integration. Mr. Sanjay Bishnoi will

continue to serve as Enerflex’s Chief Financial Officer. Enerflex’s

Executive Management Team will continue to serve in their current

roles.

Timing and Approvals

The Transaction is expected to close in the

second or third quarter of 2022, subject to, among other things:

the approval of the Transaction by Exterran stockholders; the

approval by Enerflex shareholders of the issuance of Enerflex

common shares pursuant to TSX requirements in connection with the

Transaction; regulatory approvals; and other customary closing

conditions, including those of the TSX and the NYSE or NASDAQ, as

applicable.

Copies of the Transaction agreement and related

materials will be filed by Enerflex with the Canadian securities

regulators and will be available for viewing under Enerflex’s

profile on www.sedar.com. Enerflex shareholders are urged to read

the information circular once available as it will contain

important information concerning the Transaction.

Support for the Transaction

The Boards of Directors of Enerflex and Exterran

have each unanimously approved the Transaction and recommend that

their respective shareholders vote in favour of the

Transaction.

All of the funds managed by Chai Trust Company,

LLC that own common stock of Exterran and all of Exterran’s

directors and officers have entered into voting agreements with

Enerflex pursuant to which they have agreed to vote their

respective shares in favour of the Transaction at the meeting of

Exterran shareholders.

All of the directors and officers of Enerflex

have entered into voting agreements with Exterran pursuant to which

they have agreed to vote their respective Enerflex common shares in

favour of the issuance of Enerflex common shares pursuant to the

Transaction at the meeting of Enerflex shareholders.

Operational Update –

Enerflex

“The timing is right for this Transaction as it

strengthens our positioning while global energy markets recover

from the pandemic-induced lows. Natural gas is a transition fuel

that, together with renewables, will lead the world toward a lower

carbon future. The world’s continued reliance on natural gas is

evidenced by strong fourth quarter 2021 Engineered Systems bookings

of over CAD$300 million, our highest bookings quarter since 2018,”

said Rossiter. “This month, we also successfully commissioned a gas

infrastructure facility in the Middle East that will further

strengthen our asset ownership portfolio. The recovery remains

widespread, and we are optimistic that overall market strength will

continue in 2022.”

Operational Update –

Exterran

“We expect fourth quarter results to be in-line

with our guidance provided on our third quarter call. Net debt and

cash flow for the fourth quarter were favorable to our forecast,

putting us in a good position as we enter the new year. The macro

environment continues to be supportive of strong bookings in the

first half of 2022,” said Way. “We continue to execute well on our

two water ECO projects along with the large processing facility in

the Middle East, all of which are expected to commence operations

on time.”

Conference Call Conference Call

Details

Enerflex will host a conference call today,

January 24, 2022 starting at 6:30 am MST (8:30 am EST). To

participate, please call toll free 1.844.231.9067 or

1.703.639.1277. Please dial in 10 minutes prior to the start of the

call. No passcode is required. The live audio webcast of the

teleconference will be available via www.enerflex.com. The webcast

will be archived for approximately 90 days.

An investor presentation has been posted and is

available on Enerflex’s website under the Investors section.

Advisors

RBC Capital Markets is acting as exclusive

financial advisor to Enerflex and has provided an opinion to

Enerflex’s Board of Directors to the effect that the consideration

to be paid under the Transaction is fair, from a financial point of

view, to Enerflex and is subject to the assumptions made as well as

the limitations and qualifications, which will be included in the

written opinion of RBC Capital Markets.

Norton Rose Fulbright US LLP and Norton Rose

Fulbright Canada LLP (transaction counsel) and Davies Ward Phillips

& Vineberg LLP and Cravath, Swaine & Moore LLP (financing

counsel) are acting as Enerflex’s legal advisors.

TD Securities and Scotia Capital acted as

strategic advisors to Enerflex.

Wells Fargo Securities, LLC is acting as

exclusive financial advisor to Exterran.

King & Spalding LLP and McCarthy Tétrault

LLP are acting as Exterran’s legal advisor.

About Enerflex

Enerflex Ltd. is a single source supplier of

natural gas compression, oil and gas processing, refrigeration

systems, and electric power generation equipment – plus related

engineering and mechanical service expertise. The Company’s broad

in-house resources provide the capability to engineer, design,

manufacture, construct, commission, operate, and service

hydrocarbon handling systems. Enerflex’s expertise encompasses

field production facilities, compression and natural gas processing

plants, gas lift compression, refrigeration systems, and electric

power equipment servicing the natural gas production industry.

Headquartered in Calgary, Canada, Enerflex has

approximately 2,000 employees worldwide. Enerflex, its

subsidiaries, interests in associates and joint ventures operate in

Canada, the United States, Argentina, Bolivia, Brazil, Colombia,

Mexico, the United Kingdom, the United Arab Emirates, Oman,

Bahrain, Kuwait, Australia, New Zealand, Indonesia, Malaysia, and

Thailand. Enerflex’s shares trade on the Toronto Stock Exchange

under the symbol “EFX”. For more information about Enerflex, go to

www.enerflex.com.

About Exterran

Exterran Corporation (NYSE: EXTN) is a global

systems and process company offering solutions in the oil, gas,

water and power markets. Exterran is a leader in natural gas

processing and treatment and compression products and services,

providing critical midstream infrastructure solutions to customers

throughout the world. Exterran Corporation is headquartered in

Houston, Texas and operates in approximately 25 countries.

Advisory Regarding Forward-Looking

Information

This press release contains forward-looking

information within the meaning of applicable Canadian securities

laws and within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995. These

statements relate to the respective management expectations about

future events, results of operations and the future performance

(both operational and financial) and business prospects of Enerflex

Ltd., Exterran Corp., or the combined entity. All statements other

than statements of historical fact are forward-looking statements.

The use of any of the words “anticipate”, “future”, “plan”,

“contemplate”, “continue”, “estimate”, “expect”, “intend”,

“propose”, “might”, “may”, “will”, “shall”, “project”, “should”,

“could”, “would”, “believe”, “predict”, “forecast”, “pursue”,

“potential”, “objective” and “capable” and similar expressions are

intended to identify forward-looking information. In particular,

this press release includes (without limitation) forward-looking

information pertaining to: the expectation that the Transaction

will strengthen Enerflex’s ability to serve customers and enhance

shareholder value; the anticipated financial performance of the

combined entity, including its expected gross margin and the

acceleration of its generation of recurring gross margins; the

expected run rate synergies and efficiencies to be achieved as a

result of the Transaction and the quantum and timing associated

therewith; the listing of Enerflex shares on the NYSE or NASDAQ, as

applicable, to be effective upon Transaction close; the listing of

the Enerflex common shares being issued in connection with the

Transaction on the TSX; anticipated shareholder value; expected

accretion to Adjusted EBITDA, cash flow per share, and earnings per

share for shareholders of Enerflex; excess free cash flow beginning

in 2023; pro forma geographic exposure and the expected revenues

associated therewith; future capital expenditures, including the

amount and nature thereof; product bookings and backlog; oil and

gas prices and the impact of such prices on demand for the combined

entity’s products and services; development trends in the oil and

gas industry; seasonal variations in the activity levels of certain

oil and gas markets; expectation in respect of excess free cash

flow following closing of the Transaction; business prospects and

strategy; expansion and growth of the business and operations,

including position in the energy service markets; expectations

regarding future dividends; the 3-year revolving credit facility

and 5-year bridge loan facility and the combined entity’s related

targets of bank-adjusted net debt to EBITDA and the timing thereof;

the bridge loan facility providing financing to backstop an

anticipated issuance of new debt securities and the timing thereof;

the committed financing being sufficient to fully repay existing

Enerflex and Exterran notes and revolving credit facilities,

provide for capital expenditures and other ordinary course capital

needs, and provide significant liquidity for the pro forma

business; the priorities of the combined entity in 2023 following

capital commitments in 2022; expectations and implications of

changes in government regulation, laws and income taxes;

environmental, social, and governance matters; the combined

entity’s ability to deliver sustainable solutions; the constitution

of the Board of Directors of the combined entity as at closing of

the Transaction; the receipt of all necessary approvals including

the approval of the Enerflex shareholders and Exterran shareholders

and the timing associated therewith; the disclosures provided under

the heading “Select Pro Forma Financial Information”; Exterran’s

expectations regarding its fourth quarter 2021 results; and the

successful completion of the Transaction and the anticipated

closing date. This forward-looking information is based on

assumptions, estimates and analysis made by Enerflex and its

perception of trends, current conditions and expected developments,

as well as other factors that are believed by Enerflex to be

reasonable and relevant in the circumstances and in light of the

Transaction.

All forward-looking information in this press

release is subject to important risks, uncertainties, and

assumptions, which are difficult to predict and which may affect

Enerflex’s operations, including, without limitation: the

satisfaction of closing conditions to the Transaction in a timely

manner, if at all; receipt of all necessary regulatory and/or

competition approvals on terms acceptable to Enerflex and Exterran;

the impact of economic conditions including volatility in the price

of oil, gas, and gas liquids, interest rates and foreign exchange

rates; industry conditions including supply and demand fundamentals

for oil and gas, and the related infrastructure including new

environmental, taxation and other laws and regulations; business

disruptions resulting from the ongoing COVID-19 pandemic; the

ability to continue to build and improve on proven manufacturing

capabilities and innovate into new product lines and markets;

increased competition; insufficient funds to support capital

investments required to grow the business; the lack of availability

of qualified personnel or management; political unrest; and other

factors, many of which are beyond the control of Enerflex. Readers

are cautioned that the foregoing list of assumptions and risk

factors should not be construed as exhaustive. While Enerflex

believes that there is a reasonable basis for the forward-looking

information and statements included in this press release, as a

result of such known and unknown risks, uncertainties and other

factors, actual results, performance, or achievements could differ

and such differences could be material from those expressed in, or

implied by, these statements. The forward-looking information

included in this press release should not be unduly relied upon as

a number of factors could cause actual results to differ materially

from the results discussed in these forward-looking statements,

including but not limited to: the completion and related timing for

completion of the Transaction; the ability of Enerflex and Exterran

to timely receive any necessary regulatory, shareholder, stock

exchange, lender, or other third-party approvals to satisfy the

closing conditions of the Transaction; interloper risk; the ability

to complete the Transaction on the terms contemplated by Enerflex

and Exterran or at all; the ability of the combined entity to

realize the anticipated benefits of, and synergies from, the

Transaction and the timing and quantum thereof; consequences of not

completing the Transaction, including the volatility of the share

prices of Enerflex and Exterran, negative reactions from the

investment community and the required payment of certain costs

related to the Transaction; actions taken by government entities or

others seeking to prevent or alter the terms of the Transaction;

potential undisclosed liabilities unidentified during the due

diligence process; the accuracy of the pro forma financial

information of the combined entity; the interpretation of the

Transaction by tax authorities; the success of business integration

and the time required to successfully integrate; the focus of

management's time and attention on the Transaction and other

disruptions arising from the Transaction; the ability to maintain

desirable financial ratios; the ability to access various sources

of debt and equity capital, generally, and on acceptable terms, if

at all; the ability to utilize tax losses in the future; the

ability to maintain relationships with partners and to successfully

manage and operate integrated businesses; risks associated with

technology and equipment, including potential cyberattacks; the

occurrence of unexpected events such as pandemics, war, terrorist

threats and the instability resulting therefrom; risks associated

with existing and potential future lawsuits, shareholder proposals

and regulatory actions; and those factors referred to under the

heading "Risk Factors" in Enerflex's Annual Information Form and

Exterran’s Form 10-K, each for the year ended December 31, 2020,

and in Enerflex’s Management’s Discussion and Analysis and

Exterran’s Form 10-Q, each for the three and nine months ended

September 30, 2021, located on SEDAR and EDGAR respectively. In

addition, the effects and impacts of the ongoing COVID-19 pandemic,

the rapid decline in global energy prices and the length of time to

significantly reduce the global threat of COVID-19 on Enerflex’s,

Exterran’s, and the combined entity’s respective businesses, the

global economy and markets are unknown and cannot be reasonably

estimated at this time and could cause actual results to differ

materially from the forward-looking statements contained in this

press release.

The forward-looking information contained herein

is expressly qualified in its entirety by the above cautionary

statement. The forward-looking information included in this press

release is made as of the date of this press release and, other

than as required by law, Enerflex disclaims any intention or

obligation to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise.

This press release and its contents should not be construed, under

any circumstances, as investment, tax or legal advice.

All figures in US dollars unless otherwise

indicated.

Future-Oriented Financial

Information

This press release contains information that may

constitute future-oriented financial information or financial

outlook information (“FOFI”) about Enerflex, Exterran and the

combined entity’s prospective financial performance, financial

position or cash flows, all of which is subject to the same

assumptions, risk factors, limitations and qualifications as set

forth above. Readers are cautioned that the assumptions used in the

preparation of such information, although considered reasonable at

the time of preparation, may provide to be imprecise or inaccurate

and, as such, undue reliance should not be placed on FOFI.

Enerflex, Exterran or the combined entity’s actual results,

performance and achievements could differ materially from those

expressed in, or implied by, FOFI. Enerflex and Exterran have

included FOFI in this press release in order to provide readers

with a more complete perspective on the combined entity’s future

operations and management’s current expectations regarding the

combined entity’s future performance. Readers are cautioned that

such information may not be appropriate for other purposes. FOFI

contained herein was made as of the date of this press release.

Unless required by application laws, Enerflex and Exterran do not

undertake any obligation to publicly update or revise any FOFI

statements, whether as a result of new information, future events,

or otherwise.

No Offer or Solicitation

This announcement is for informational purposes

only and is neither an offer to purchase, nor a solicitation of an

offer to sell, any securities or the solicitation of any vote in

any jurisdiction pursuant to the proposed transactions or

otherwise, nor shall there be any sale, issuance or transfer of

securities in any jurisdiction in contravention of applicable law.

No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

Additional Information and Where to Find

It

In connection with the proposed Transaction,

Enerflex and Exterran will file relevant materials with the

Securities and Exchange Commission (“SEC”). The definitive proxy

statement/prospectus will contain important information about the

proposed Transaction and related matters. INVESTORS AND

SHAREHOLDERS ARE URGED AND ADVISED TO READ THE PROXY

STATEMENT/PROSPECTUS CAREFULLY WHEN IT BECOMES AVAILABLE BECAUSE IT

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE

PARTIES TO THE TRANSACTION. The definitive proxy statement, the

preliminary proxy statement, and other relevant materials in

connection with the Transaction (when they become available) and

any other documents filed by the Company with the SEC, may be

obtained free of charge at the SEC's website, at www.sec.gov and

with SEDAR may be obtained free of charge from the SEDAR website at

www.sedar.com. The documents filed by Enerflex with the SEC and

SEDAR may also be obtained free of charge at Enerflex’s investor

relations website at https://www.enerflex.com/investors/index.php.

Alternatively, these documents, when available, can be obtained

free of charge from Enerflex upon written request to Enerflex Ltd.,

Attn: Investor Relations, Suite 904, 1331 Macleod Trail SE,

Calgary, Alberta, Canada T2G 0K3 or by calling +1.403.387.6377. The

documents filed by Exterran with the SEC may also be obtained free

of charge at Exterran’s investor relations website at

https://www.exterran.com/EXTN. Alternatively, these documents, when

available, can be obtained free of charge from Exterran upon

written request to investor.relations@exterran.com or by calling

+1.281.836.7000.

Participants in the

Solicitation

Enerflex, Exterran and their respective

directors and executive officers may be deemed, under SEC rules, to

be participants in the solicitation of proxies from Exterran’s

shareholders in connection with the Transaction. Information about

Exterran’s directors and executive officers and their ownership of

Exterran’s ’s securities is set forth in Exterran’s definitive

proxy statement on Schedule 14A filed with the SEC on March 17,

2021 and may also be obtained free of charge at Enerflex’s investor

relations website at https://www.enerflex.com/investors/index.php.

Alternatively, these documents can be obtained free of charge from

Exterran upon written request to investor.relations@exterran.com or

by calling +1.281.836.7000. You may obtain information about

Enerflex’s executive officers and directors in Enerflex's Annual

Information Form, which was filed with SEDAR on February 24, 2021.

These documents may be obtained free of charge from the SEDAR

website at www.sedar.com and may also be obtained free of charge at

Enerflex’s investor relations website at

https://www.enerflex.com/investors/index.php. Alternatively, these

documents can be obtained free of charge from Enerflex upon written

request to Enerflex Ltd., Attn: Investor Relations, Suite 904, 1331

Macleod Trail SE, Calgary, Alberta, Canada T2G 0K3 or by calling

+1.403.387.6377. Additional information regarding the interests of

all such individuals in the proposed transaction will be included

in the proxy statement relating to the Transaction when it is filed

with the SEC.

Non-IFRS Measures and Other Financial

Information:

Financial measures in this press release do not

have a standardized meaning as prescribed by generally accepted

accounting principles in Canada, which are International Financial

Reporting Standards (IFRS) as issued by the International

Accounting Standards Board. These non-IFRS measures include

Adjusted EBITDA, net debt and free cash flow. These non-IFRS

measures may not be comparable to similar measures presented by

other issuers. These measures have been described and presented in

order to provide shareholders, potential investors and analysts

with additional measures for assessing the performance of Enerflex,

Exterran and, where applicable, the pro forma expectations of the

combined entity, as applicable, and should not be considered in

isolation or as a substitute for measures prepared in accordance

with IFRS. Adjusted EBITDA is a non-IFRS measure defined as

net earnings or loss before finance costs, taxes, depreciation,

depletion, amortization, non‐cash impairments or impairment

reversals on non‐current assets, unrealized gains or losses on mark

to market commodity transactions, equity-settled share‐based

compensation, and certain items that are considered unique in

nature, including restructuring costs and Transaction costs.

Management of Enerflex and Exterran believe that Adjusted EBITDA is

a useful supplemental measure to evaluate the results of each

issuer’s principal business activities prior to consideration of

how those activities are financed and the impacts of foreign

exchange, taxation, depreciation, depletion and amortization, and

other non-cash charges that add volatility to financial results

(such as impairment expenses, share-based compensation, and other

transactions that are unique in nature). A quantitative

reconciliation of this non-IFRS measure is incorporated by

reference herein and can be found on page 3 under the heading

“Adjusted EBITDA” of Enerflex’s Management’s Discussion and

Analysis for the three and nine months ended September 30, 2021 and

2020, which is available under Enerflex’s profile at

www.sedar.com.

Net debt is a non-IFRS measure defined as short-

and long-term debt less cash and cash equivalents. Net debt is a

commonly used non-IFRS measures to assess overall indebtedness and

capital structure. Net debt is a non-IFRS measure to assess overall

indebtedness and capital structure. See page 15 under the heading

“Non-IFRS Measures” of Enerflex’s Management’s Discussion and

Analysis for the three and nine months ended September 30, 2021 and

2020, which is available under Enerflex’s profile at

www.sedar.com.

Free cash flow is a non-IFRS measure defined as

cash from operating activities in a period adjusted for changes in

non-cash working capital, non-cash items (including interest

expense and current tax expense), and non-normal course inflows

(including proceeds on the disposition of property, plant and

equipment (“PP&E”) and rental equipment), less cash items

(interest paid, cash taxes paid, work-in-progress related to

finance leases, additions to PP&E, maintenance capital

expenditures, growth capital expenditures, and dividends) and

non-normal course outflows. Free cash flow is a non-IFRS measure

used in to assist in measuring a company’s ability to finance its

capital programs and meet its financial obligations. A quantitative

reconciliation of this non-IFRS measure is incorporated by

reference herein and can be found on page 16 under the heading

“Free Cash Flow” of Enerflex’s Management’s Discussion and Analysis

for the three and nine months ended September 30, 2021 and 2020,

which is available under Enerflex’s profile at www.sedar.com.

Exterran Contact:

| Blake

Hancock |

| Vice President of Finance –

FP&A, Investor Relations, and Corporate Development |

| Tel: 1.281.854.3043 |

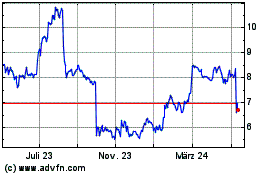

Enerflex (TSX:EFX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

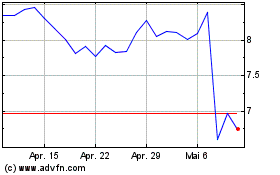

Enerflex (TSX:EFX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025