MCI Onehealth Technologies Inc. (“MCI” or the “Company”) (TSX:

DRDR), a clinician-led healthcare technology company focused on

increasing access to and quality of healthcare, has released its

financial results for the three months ended March 31, 2023.

A summary of MCI’s financial and operational

results is set out below, and more detailed information is

contained in the condensed interim consolidated financial

statements and related management discussion and analysis, which

are available on MCI’s SEDAR page at www.sedar.com. Financial

measures described as “Adjusted” in this news release are non-IFRS

financial measures and may not be comparable to other similar

measures disclosed by other companies. Please see Non-IFRS

Financial Measures below for more information.

Cash and Liquidity Update

For the three months ended March 31, 2023, the

Company experienced operating losses of $7.4 million and negative

cash flows from operations of $1.11 million, and as at the end of

that period had a cash balance of approximately $1.4 million and

accounts payable and other current liabilities of approximately

$20.7 million. The Company will need to obtain additional financing

by the end of May to fund ongoing operations in the ordinary

course, and may be required to obtain additional financing in

future periods.

To address its immediate liquidity constraints,

the Company announced on April 27, 2023 that it is seeking approval

for an additional $1.5 million debt financing facility from a

related party to fund its ongoing operations and for general and

administrative expenses. That facility remains subject to the

approval of the Toronto Stock Exchange and has not yet closed. Even

if the facility is implemented, it is likely that the Company will

need to obtain additional sources of liquidity by the end of May to

continue to fund its ongoing operations.

The Company’s special committee (the

“Special Committee”), comprised of two of its

independent directors, remains engaged in a process to evaluate and

consider the Company's current financial and liquidity position,

operational challenges and possible financing, reorganization or

restructuring alternatives that may be available to the Company.

The Company is also continually evaluating other alternatives for

generating cash in the short term, including the potential sale of

certain assets identified by the Company, and is continuing to

responsibly reduce costs while it evaluates the potential options.

The Company provided an update on these efforts, which are ongoing,

in a press release on April 20, 2023.

Other than as described in this news release,

the Company has not made any decisions related to strategic

alternatives at this time. The Company cautions that there are no

assurances that the evaluation of strategic alternatives will

result in the approval or completion of any specific transaction or

outcome and there is no certainty that the Company will be able to

secure additional financing or sell assets to generate liquidity,

or on what terms it will be able to do so, or that its revenue

growth and expense reduction strategies will be successful.

First Quarter 2023 Financial and

Operational Highlights

Significant financial and operational highlights

for MCI during the three months ended March 31, 2023 included:

- Operational

Challenges: As described above, the Company faced, and is

continuing to face, liquidity and operational challenges, and has

taken, and is continuing to take, steps to reduce costs while

considering all available options.

- Revenue: Revenue

for 1Q23 declined 11% in the Reporting Period as compared to the

Prior Period, due in large part to lower patient volumes in the

Company’s clinics, telehealth services and virtual healthcare

services. Lower patient volumes in the Company’s clinics relate in

part to the consolidation of five of the Company’s clinics in

Ontario into its remaining fourteen clinics in that Province. Total

revenue for 1Q23 was $11.5 million, compared to $13.0 million in

1Q22.

- Financing: On

January 4, 2023, MCI announced an amendment of its existing credit

facility with The First Canadian Wellness Co. Inc., a related party

to the Company, increasing the amount of debt financing available

to the Company from $5 million to $7 million. The details of the

loan amendment are set out in the Company’s press release on

January 4, 2023.

- Information and

Data Analytics: The Company continues to make progress in

standing-up its data lake, comprised of an ever-increasing volume

of health records currently numbering in excess of 3.3 million. The

Company anticipates that it will begin servicing customers looking

for data insights from these records later in 2023.

-

Smart Referral System: The Company continues to make progress in

rolling out its smart referral system, the first application to

leverage the data backbone which the Company is developing with a

leading data analytics partner. The smart referral system

streamlines the flow of patient referrals from general

practitioners to specialists within the Company’s network,

optimizing patient care pathways and increasing revenue from

existing customers.

- Corporate Health

Services: The Company began offering corporate health services from

its five Calgary clinics and continued to roll out services to

national customers. Overall revenue from corporate health services

declined during the quarter due to decreased demand for COVID-19

testing but is expected to recover as more customers are onboarded

and new service offerings are made available.

- Personnel: The

Company hired 8 new physicians during the three months ended March

31, 2023, who will begin delivering health services to patients in

2023.

- Net Losses: Net

losses for 1Q23 were $7.4 million, as compared to losses of $4.2

million in 1Q22. The Company’s revenue declined over the same

period last year, driven by lower patient volumes. The Company’s

general and administrative expenses declined in 1Q23 due to cost

reduction measures and focus on operational efficiency, but

research and development spending increased to support projects

relating to the Company’s data-insights-as-a-service

initiatives.

- Adjusted EBITDA:

Adjusted EBITDA(1) for 1Q23 remained steady at negative $2.4

million, as compared to an Adjusted EBITDA of negative $2.4 million

in 1Q22.

Selected Financial

Information(in thousands of dollars, except percentages

and per share amounts)

| |

|

Quarter ended |

Period over |

| |

|

March 31 |

period Change |

|

|

|

2023 |

|

2022 |

|

$ |

|

% |

|

| |

|

($ in thousands except percentages) |

|

Revenues |

|

$11,534 |

|

$13,020 |

|

$(1,486) |

|

(11) |

|

|

Cost of sales |

|

8,155 |

|

8,926 |

|

(771) |

|

(9) |

|

|

Gross profit |

|

3,379 |

|

4,094 |

|

(715) |

|

(17) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

1,851 |

|

1,830 |

|

21 |

|

1 |

|

|

Sales and marketing |

|

336 |

|

412 |

|

(76) |

|

(18) |

|

|

General and administrative |

|

5,487 |

|

6,615 |

|

(1,128) |

|

(17) |

|

|

|

|

7,674 |

|

8,857 |

|

(1,183) |

|

(13) |

|

|

|

|

|

|

|

|

|

Net finance costs |

|

355 |

|

132 |

|

223 |

|

NM |

|

|

FV changes-contingent liabilities |

|

(7) |

|

- |

|

(7) |

|

NM |

|

|

Loss on settlement of shares-contingent consideration |

|

677 |

|

- |

|

677 |

|

NM |

|

|

Impairment on investments |

|

2,303 |

|

- |

|

2,303 |

|

NM |

|

|

Share of net loss of associate |

|

26 |

|

142 |

|

(116) |

|

(82) |

|

|

|

|

3,354 |

|

274 |

|

3,080 |

|

NM |

|

|

|

|

|

|

|

|

|

Loss before taxes |

|

(7,649) |

|

(5,037) |

|

(2,612) |

|

(52) |

|

|

Income taxes recoveries |

|

(201) |

|

(814) |

|

613 |

|

75 |

|

|

|

|

|

|

|

|

|

Net loss |

|

(7,448) |

|

(4,223) |

|

(3,225) |

|

(76) |

|

|

|

|

|

|

|

|

|

Adjusted gross profit (1) |

|

3,537 |

|

4,252 |

|

(715) |

|

(17) |

|

|

Adjusted gross margin (1) |

|

30.7% |

|

32.7% |

|

|

|

|

Adjusted EBITDA (2) |

|

(2,396) |

|

(2,421) |

|

25 |

|

1 |

|

|

Adjusted EBITDA margin (2) |

|

(20.8%) |

|

(18.6%) |

|

|

|

|

Weighted average number |

|

|

|

|

|

| Of Share outstanding: Basic and

diluted |

|

51,930,326 |

|

50,075,202 |

|

|

|

| Net loss per share -Basic and

diluted |

|

$(0.15) |

|

$(0.09) |

|

|

|

(1), (2) Adjusted Gross Profit, Adjusted Gross

Margin, Adjusted EBITDA and Adjusted EBITDA Margin are non-IFRS

measures. Please see “Non-IFRS Financial Measures” below for more

information and a reconciliation of these amounts to the IFRS

measures found in the Company’s condensed interim consolidated

financial statements.

Selected Statement of Financial Position

Data

|

|

|

|

|

March 31, 2023 |

December 31, 2022 |

|

|

$ in thousands |

|

|

|

|

|

Cash |

1,403 |

1,411 |

|

Accounts receivable |

4,535 |

5,627 |

|

Other assets |

1,078 |

1,493 |

|

Accounts payable and accrued liabilities |

(8,957) |

(9,227) |

|

Bank loan |

(1,695) |

(1,685) |

|

Related party loan |

(7,169) |

(5,315) |

|

Lease liabilities |

(9,833) |

(10,420) |

|

Other liabilities |

(130) |

(130) |

|

Non-controlling interest redeemable liability |

(1,305) |

(1,305) |

|

Liability for contingent consideration |

(30) |

(1,637) |

Non-IFRS Financial Measures

The terms Adjusted EBITDA, Adjusted EBITDA

Margin, Adjusted Gross Profit and Adjusted Gross Margin used in

this document do not have any standardized meaning under IFRS, may

not be comparable to similar financial measures disclosed by other

companies and should not be considered a substitute for, or

superior to, IFRS financial measures. Readers are advised to review

the section entitled “Non-IFRS Financial Measures” in the Company’s

management discussion and analysis for the quarter ended March 31,

2023, available on MCI’s SEDAR page at www.sedar.com, for a

detailed explanation of the composition of these measures and their

uses.

(1) The following table reconciles Adjusted

EBITDA and Adjusted EBITDA Margin to net income (loss) for the

three-months ended March 31, 2023 and March 31, 2022:

|

|

Three months ended |

|

|

March 31 |

|

|

2023 |

|

2022 |

|

|

|

$ in thousands |

|

|

|

|

|

Total Revenue |

$11,534 |

|

$13,020 |

|

|

|

|

|

|

Net loss |

(7,448) |

|

(4,223) |

|

|

Add back (deduct) |

|

|

|

Depreciation and amortization |

1,261 |

|

1,221 |

|

|

Net finance charges |

355 |

|

132 |

|

|

Expected credit recovery |

(76) |

|

- |

|

|

Loss on settlement of shares-contingent consideration |

677 |

|

- |

|

|

Share of loss of associate |

26 |

|

142 |

|

|

Impairment on investments |

2,303 |

|

- |

|

|

FV changes-contingent liabilities |

(7) |

|

- |

|

|

Income taxes recoveries |

(201) |

|

(814) |

|

|

Share-based payment expense |

714 |

|

1,121 |

|

|

Adjusted EBITDA |

$(2,396) |

|

$(2,421) |

|

|

Adjusted EBITDA Margin |

(20.8%) |

|

(18.6%) |

|

(2) The following table reconciles Adjusted

Gross Profit and Adjusted Gross Margin to revenue and cost of sales

for the three-months ended March 31, 2023 and March 31, 2022:

|

|

|

Three months ended |

Period over |

| |

|

March 31 |

period Change |

| |

|

2023 |

|

2022 |

|

$ |

|

% |

|

| |

|

($ in thousands except percentages) |

|

|

|

|

|

|

|

|

Revenue |

|

$11,534 |

|

$13,020 |

|

$(1,486) |

|

(11%) |

|

|

|

|

|

|

|

|

|

Cost of sales |

|

8,155 |

|

8,926 |

|

(771) |

|

(9%) |

|

|

Less: |

|

|

|

|

|

| Depreciation and

amortization |

|

(158) |

|

(158) |

|

- |

|

NM |

|

|

|

|

7,997 |

|

8,768 |

|

(771) |

|

(9%) |

|

|

|

|

|

|

|

|

|

Adjusted gross profit |

|

$3,537 |

|

$4,252 |

|

|

|

|

Adjusted gross margin |

|

30.7% |

|

32.7% |

|

|

|

About MCIMCI is a healthcare

technology company focused on empowering patients and doctors with

advanced technologies to increase access, improve quality, and

reduce healthcare costs. As part of the healthcare community for

over 30 years, MCI operates one of Canada’s leading primary care

networks with approximately 280 physicians and specialists, serves

more than one million patients annually and had nearly 300,000

telehealth visits last year, including online visits via

mciconnect.ca. MCI additionally offers an expanding suite of

occupational health service offerings that support a growing list

of more than 650 corporate customers. Led by a proven management

team of doctors and experienced executives, MCI remains focused on

executing a strategy centered around acquiring technology and

health services that complement the company’s current roadmap. For

more information, visit mcionehealth.com.

For media enquiries please contact:Nolan Reeds

| nolan@mcionehealth.com

Forward Looking

StatementsCertain statements in this press release,

constitute “forward-looking information” and "forward looking

statements" (collectively, "forward looking statements") within the

meaning of applicable Canadian securities laws and are based on

assumptions, expectations, estimates and projections as of the date

of this press release. Forward-looking statements include

statements with respect to projected cash and liquidity, the

Company’s need for financing, the anticipated completion of the

Company’s additional debt financing, the Company’s ongoing review

of strategic alternatives and the work of its Special Committee,

the possibility of disposing of certain of the Company’s assets and

plans for future cost reduction. The words “engaged in”,

“evaluating”, “continuing to”, “potential”, “future”, “seeking”,

“remains”, “implement”, “consider”, “possible”, “continually”,

“ongoing”, “result in”, “able to”, “successful”, “progress”,

“increasing”, “anticipates”, “begin”, “delivering” or variations of

such words and phrases or statements that certain future

conditions, actions, events or results “will”, “may”, “could”,

“would”, “should”, “might” or “can”, or negative versions thereof,

“occur”, “continue” or “be achieved”, and other similar

expressions, identify forward-looking statements. Forward-looking

statements are necessarily based upon management’s perceptions of

historical trends, current conditions and expected future

developments, as well as a number of specific factors and

assumptions that, while considered reasonable by MCI as of the date

of such statements, are outside of MCI's control and are inherently

subject to significant business, economic and competitive

uncertainties and contingencies which could result in the

forward-looking statements ultimately being entirely or partially

incorrect or untrue. Forward looking statements contained in this

press release are based on various assumptions, including, but not

limited to, the following: MCI's short- and medium-term liquidity

and working capital needs, the availability of working capital and

sources of short-term liquidity; the Company’s ability to continue

to operate as a going concern; the Company’s ability to secure

additional debt or equity financing and the terms on which that

financing may be secured; MCI’s ability to close the transaction

with a related party to gain access to the additional debt

financing facility and the granting of approval of the debt

facility by the Toronto Stock Exchange; MCI’s ability to find

potential transaction partners to acquire the business or certain

of its assets, the price which those transaction partners may be

willing to pay and the timelines required to complete any potential

transactions; MCI’s ability to achieve its growth and revenue

strategies; the demand for MCI's products and fluctuations in

future revenues; the availability of future business ventures,

commercial arrangements and acquisition targets or opportunities

and MCI’s ability to consummate them and to effectively integrate

future acquisition targets into its platform; MCI’s ability to

effectively roll out its smart referral system and monetize its

data lake; MCI’s ability to grow its customer base in its corporate

health services; the effects of competition in the industry; the

requirement for increasingly innovative product solutions and

service offerings; trends in customer growth; the stability of

general economic and market conditions; currency exchange rates and

interest rates; MCI's ability to comply with applicable laws and

regulations; MCI's continued compliance with third party

intellectual property rights; the anticipated effects of COVID-19;

and that the risk factors noted below, collectively, do not have a

material impact on MCI's business, operations, revenues and/or

results. By their nature, forward-looking statements are subject to

inherent risks and uncertainties that may be general or specific

and which give rise to the possibility that expectations,

forecasts, predictions, projections or conclusions will not prove

to be accurate, that assumptions may not be correct, and that

objectives, strategic goals and priorities will not be

achieved.

Readers are encouraged to review the “Liquidity

and Capital Resources” section of the Company’s MD&A, together

with Note 2(c) of the Company’s condensed interim consolidated

financial statements, for the period ended March 31, 2023, which

indicate the existence of material uncertainties that cast

significant doubt on the Company’s ability to continue as a going

concern. The Company’s ability to continue as a going concern is

dependent on, among other things, its ability to meet its financing

requirements on a continuing basis, to sell certain assets to

generate short-term liquidity, to have access to financing and to

generate positive operating results. The Company’s ability to

satisfy its financing requirements and ultimately achieve necessary

levels of profitability and positive cash flows from operations, to

raise additional funds, to sell assets and to improve operating

results are dependent on a number of factors outside the Company’s

control and there can be no assurance that the Company will be able

to do so in the future.

Known and unknown risk factors, many of which

are beyond the control of MCI, could cause the actual results of

MCI to differ materially from the results, performance,

achievements or developments expressed or implied by such

forward-looking statements. Such risk factors include but are not

limited to those factors which are discussed under the section

entitled “Risk Factors” in MCI's annual information form dated

March 31, 2023, which is available under MCI's SEDAR profile at

www.sedar.com. The risk factors are not intended to represent a

complete list of the factors that could affect MCI and the reader

is cautioned to consider these and other factors, uncertainties and

potential events carefully and not to put undue reliance on

forward-looking statements. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Forward-looking statements are

provided for the purpose of providing information about

management’s expectations and plans relating to the future. MCI

disclaims any intention or obligation to update or revise any

forward-looking statements whether as a result of new information,

future events or otherwise, or to explain any material difference

between subsequent actual events and such forward-looking

statements, except to the extent required by applicable law. All of

the forward-looking statements contained in this press release are

qualified by these cautionary statements.

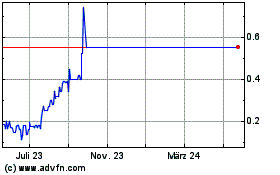

MCI Onehealth Technologies (TSX:DRDR)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

MCI Onehealth Technologies (TSX:DRDR)

Historical Stock Chart

Von Jan 2024 bis Jan 2025