D-BOX Technologies Increases its Annual Sales and its Adjusted EBITDA by 23% and 64% Respectively

11 Juni 2014 - 1:30PM

Marketwired Canada

D-BOX Technologies Inc. (TSX:DBO), a leader in innovative motion technology

announced today revenues of $17.6 million for the 2014 fiscal year ended March

31, 2014 which represents a 23% increase in comparison to revenues of $14.3

million for the fiscal year ended March 31, 2013.

Financial Highlights

-- Growth in revenues and available funds:

-- Annual revenues up by 23% to $17,593 k including $3,654 k of

recurring revenues from utilization rights, rental and maintenance

fees.

-- Quarterly revenues up by 39% to $4,980 k, including $815 k of

recurring revenues also from utilization rights, rental and

maintenance fees.

-- Available funds of $6,717 k as at March 31, 2014.

-- Net loss of $1,589 k for the fiscal year and of $43 k for the quarter

representing respectively 38% and 92% decreases in comparison to last

year.

-- Positive adjusted EBITDA(i) and cash flow relating to operating

activities for the fiscal year ended March 31, 2014:

-- Adjusted EBITDA(i) of $957 k for the fiscal year and of $382 k for

the quarter.

-- Cash flow relating to operating activities of $2,165 k for the

fiscal year.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Fourth quarter and fiscal year ended March 31

(in thousands of $CA, except per share amounts)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Fourth Quarter Fiscal Year

----------------------------------------

2014 2013 2014 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Revenues 4,980 3,585 17,593 14,253

Net loss (43) (508) (1,589) (2,575)

Basic and diluted net loss per

share (0.0003) (0.0031) (0.0097) (0.0157)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Information from the consolidated Balance Sheet

----------------------------------------------------------------------------

----------------------------------------------------------------------------

March 31, 2014 March 31, 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash and cash equivalents 6,717 5,708

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(i) See the reconciliation table of adjusted EBITDA to the net loss on the next

page of this press release.

------------------------------------------------------------------------

------------------------------------------------------------------------

Adjusted EBITDA (in thousands of $CA)

------------------------------------------------------------------------

Quarters of 2014

------------------------------------------------------------------------

Q1 Q2 Q3 Q4 Fiscal Year

June 30, September 30, December 31, March 31, March 31,

2013 2013 2013 2014 2014

------------------------------------------------------------------------

13 229 333 382 957

------------------------------------------------------------------------

------------------------------------------------------------------------

Operational Highlights

-- Continuous and strategic deployment with large theatre chains: 45

screens added since April 1, 2013, including a significant breakthrough

in South America with Cinemark, in France and Switzerland with Gaumont

Pathe and in Russia with Luxor, Barguzin and Kinomax.

-- 39 films from Hollywood's main studios were coded by D-BOX to be

presented in commercial theatres of which 15 ranked number one at the

box-office on opening weekend. This compares to 28 titles obtained in

the fiscal year ended March 31, 2013.

-- Recent commercialization of new longer-stroke actuators targeting the

industrial market. These new applications make it possible to accelerate

the development of existing markets while providing the opportunity to

enter new business activities. At the same time, additional resources

were added to the sales team to address this potential.

Commenting the year's realizations, Mr. Claude Mc Master, President and CEO of

D-BOX declared: Our financial results are constantly improving while we keep

growing in the entertainment and industrial markets, invest more in our R&D and

strengthen our sales team. Considering these results and our advantageous

positioning, I anticipate enthusiastically the upcoming fiscal year."

Additional information with respect to the fiscal year and fourth quarter ended

March 31, 2014

The financial information relating to the fourth quarter and fiscal year ended

March 31, 2014 should be read in conjunction with the Corporation's consolidated

financial statements and Management's Discussion and Analysis dated June 10,

2014. These documents are available at www.sedar.com

Outlook

D-BOX focuses on two major development areas: the entertainment market and the

industrial market which have their respective sub-markets. In light of the

business development activities in each of these two markets, D-BOX anticipates

that the upward trend in revenues should be maintained.

In combination with this expected growth of revenues, D-BOX also expects to

gradually increase the level of its operating expenses including fees related to

sales, marketing, research and development that will support the

commercialization of new applications for its technology for new industrial

sub-markets. Generally speaking, the Corporation aims, however, to maintain a

positive adjusted EBITDA and intends to manage its operations based on attaining

this objective.

Reconciliation of the adjusted EBITDA to the net loss

The adjusted EBITDA allows evaluating profitability and the Corporation's

ability to generate cash flows from its operations. It designates the net loss

before items not affecting cash, the foreign exchange gain or loss, financial

expenses, interest income and income taxes.

The following table explains the reconciliation of the adjusted EBITDA to the

net loss.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Fiscal Year Fourth Quarter

ended ended

March 31 March 31

------------------------------------

2014 2013 2014 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net loss (1,589) (2,575) (43) (508)

Amortization of property, plant and

equipment 2,018 2,005 489 507

Amortization of intangible assets 290 259 75 68

Amortization of other assets 180 85 112 44

Write-off of property, plant and

equipment 78 - (45) (5)

Write-off of other assets - 5 - 5

Write-off of intangible assets - 4 - 4

Share-based payment expense 617 883 183 223

Foreign exchange gain (667) (74) (391) (156)

Financial results (financial expenses

and interest income) 21 (14) 3 (1)

Income taxes 9 6 (1) 2

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Adjusted EBITDA(i) 957 584 382 183

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(i) See the "non-IFRS" measures section in the Management Discussion and

Analysis dated June 10, 2014.

About D-BOX

D-BOX Technologies Inc. designs, manufactures and commercialize cutting-edge

motion systems intended for the entertainment and industrial markets. This

unique and patented technology uses motion effects specifically programmed for

each visual content which are sent to a motion system integrated into either a

platform, a seat or any other product. The resulting motion is perfectly

synchronized with the on-screen action, thus creating an unparalleled realistic

immersive experience.

D-BOX(R), D-BOX Motion Code(R), Motion Architects(TM) and Architectes du

Mouvement(TM) are trademarks of D-BOX Technologies Inc. Other names are for

informational purposes only and may be trademarks of their respective owners.

Disclaimer in regards to forward-looking statements

Certain statements included herein, including those that express management's

expectations or estimates of our future performance, constitute "forward-looking

statements" within the meaning of applicable securities laws. Forward-looking

statements are necessarily based upon a number of estimates and assumptions

that, while considered reasonable by management at this time, are inherently

subject to significant business, economic and competitive uncertainties and

contingencies. Investors are cautioned not to put undue reliance on

forward-looking statements. The Corporation disclaims any intent or obligation

to update publicly these forward looking statements, whether as a result of new

information, future events or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Luc Audet

Vice-President and Chief Financial Officer

D-BOX Technologies Inc.

450-442-3003 ext 296

laudet@d-box.com

Investor Relations

Marc Jasmin CPA, CMA, President

Jasmin Financial Communications

514-231-2360

marc@comjasmin.com

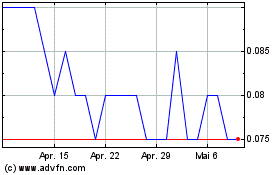

D Box Technologies (TSX:DBO)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

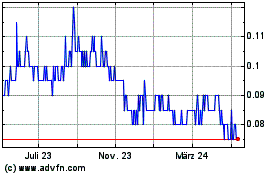

D Box Technologies (TSX:DBO)

Historical Stock Chart

Von Mai 2023 bis Mai 2024