Clairvest Sells Interest in DTG Enterprises Holdings, Inc.

01 Dezember 2022 - 3:15PM

Clairvest Group Inc. (TSX: CVG) (“CVG”), today announced that it, a

partnership managed by it, Clairvest Equity Partners V (“CEP V”,

collectively “Clairvest”) and the shareholders of DTG Enterprises

Holdings, Inc. (“DTG” or the “Company”) have completed a

recapitalization of DTG. As part of the transaction, Clairvest has

sold its equity interests in DTG to a fund managed by Macquarie

Asset Management (“MAM”).

DTG is Washington State’s leading independent

vertically integrated non-MSW recycling business providing

integrated recycling services for commercial, industrial, and

construction customers. Since its formation in 1999, DTG has grown

from a single truck to a regional leader with an impressive network

of collection assets, 12 materials recovery facilities (MRFs)

across the Puget Sound region and one construction & demolition

(C&D) landfill.

In January 2020, Clairvest partnered with

Founder & President Dan Guimont and CEO Tom Vaughn to embark on

an aggressive growth plan. Over the next 34 months, DTG

successfully completed 10 acquisitions and executed several

exciting greenfield growth projects.

Upon closing, CVG’s portion of sale proceeds was

approximately US$53.2 million. On a constant currency basis, the

sale proceeds for CVG represent a multiple of capital invested of

6.2x and an IRR of 88%.

“We are extremely proud of the results generated

by our management partners – Dan Guimont and Tom Vaughn – and the

entire DTG team. Our partners not only demonstrated sustainability

leadership in the Pacific Northwest, but fostered a culture of

safety first, operational excellence, growth and innovation. One of

DTG’s noteworthy differentiators in a period of a very tight labor

market was their commitment to DTG’s employees. We are honored to

have been partners in DTG’s success since 2020 and we are excited

for DTG to continue its growth in the evolving environmental

services landscape in the Pacific Northwest,” said Michael

Castellarin, Managing Director at Clairvest.

“Our initial vision in partnering with Clairvest

was to become the largest non-MSW waste and recycling company in

the greater Seattle region, and we have achieved what we set out to

do. Michael Castellarin and Davey Mishra have supported our plan

and encouraged us to pursue a wide range of initiatives, invest in

our people, and thus accelerate our growth significantly,” said Dan

Guimont, Founder & President of DTG.

“We partnered with Clairvest back in 2020

because of their strategy to help us build a strategically

significant company, their experience, their willingness to invest

and help and, most importantly, their focus on trusting and

allowing their operating partners to lead and execute. Over our

partnership, Clairvest has been value-add and ensured DTG was well

financed, which positively contributed to the deep and wide

defensive moat that we have today,” said Tom Vaughn, CEO of

DTG.

Stoel Rives LLP acted as legal advisor to

DTG.

About ClairvestClairvest’s

mission is to partner with entrepreneurs to help them build

strategically significant businesses. Founded in 1987 by a group of

successful Canadian entrepreneurs, Clairvest is a top performing

private equity management firm with over CAD $3.3 billion of

capital under management. Clairvest invests its own capital and

that of third parties through the Clairvest Equity Partners limited

partnerships in owner-led businesses. Under the current management

team, Clairvest has initiated investments in 59 different platform

companies and generated top quartile performance over an extended

period.

Contact InformationStephanie

LoManager, Investor Relations and MarketingClairvest Group Inc.Tel:

(416) 925-9270stephaniel@clairvest.com

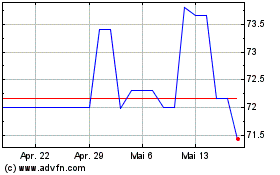

Clairvest (TSX:CVG)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

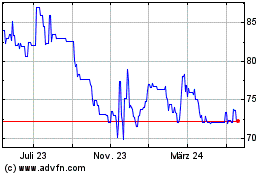

Clairvest (TSX:CVG)

Historical Stock Chart

Von Nov 2023 bis Nov 2024