Cardinal Energy Ltd. ("

Cardinal" or the

"

Company") (TSX:CJ) is pleased to present the

results of its independent reserve report effective December 31,

2020. One hundred percent of Cardinal's year-end 2020 reserves were

evaluated by independent reserves evaluator GLJ Ltd. ("GLJ") as at

December 31, 2020 (the "2020 Reserve Report"). The 2020 financial

information in this press release is unaudited and accordingly,

such financial information is subject to change based on the

results of the Company's year-end audit.

SUSTAINABILITY AND

OPERATIONS

The resilience, quality and sustainability of

our low decline asset base was demonstrated through an extremely

challenging operational and financial period in 2020. The impacts

on our business due to COVID-19 and the associated volatility in

oil prices were profound and forced rapid decisions to reduce long

term negative consequences. Cardinal’s focus was to preserve

financial liquidity, capture cost savings while keeping our

operations safe and maintaining the long term value of our assets.

The year started off in a bullish fashion with

WTI oil prices over US$60 per bbl and Cardinal kicking off a

multi-well drilling program. This successful program consisted of

six horizontal Glauconitic wells and one multi-leg Ellerslie

horizontal well in our Bantry and Duchess fields in southern

Alberta.

Then the world changed due to the COVID-19

pandemic. We spent the balance of 2020 in a survival mode cutting

our capital budget by over 50% and significantly reducing our well

reactivation program. The low decline nature of our assets

performed exceptionally well as workover and reactivation costs

were cut, salaries and wages were significantly reduced and capital

spending halted, yet our production base was held relatively

flat. We did shut down higher operating cost properties, some

of which are still shut in, and we will continue to review these

properties to come up with long term solutions to fix their cost

structure. Production volumes averaged 17,169 boe/d in the second

quarter of 2020 and as prices recovered, reached an average of

18,625 boe/d in the fourth quarter of 2020 without the benefit of

drilling new wells as existing production was optimized and

selective shut-in barrels were brought back on stream.

Throughout the second half of the year,

commodity prices stabilized however there were ongoing restrictions

and uncertainty when a second wave of the COVID-19 pandemic hit

most countries. WTI oil prices averaged US$42.66 per bbl in

the fourth quarter and closed at approximately $48.50 per bbl, an

increase of 74% over the average price experienced in the second

quarter of 2020. Oil prices through Q1 2021 have continued to

strengthen to pre COVID-19 levels with recent spot WTI prices

around US$60 per bbl further improving the long term outlook for

Cardinal and the industry.

RESERVE REPORT HIGHLIGHTS

All reserves information contained in this press

release is based on the 2020 Reserve Report.

- The Net Present

Value ("NPV"), discounted at 10% ("NPV10") is $600 million, $712

million for our Proved Developed Producing ("PDP") and Proved Plus

Probable Producing ("P+PDP") reserves respectively.

- Cardinal

continues to maintain a long producing reserve life index(1)

("RLI") of 9.5 years PDP and 12 years P+PDP based on fourth quarter

2020 production which reflects the low decline, low risk

predictable nature of our asset base.

- Cardinal's light

and medium crude oil reserves, natural gas and associated liquids

saw positive technical revisions of 6.3 Mmboe and 6.7 Mmboe in the

Total Proved ("TP") and Total Proved plus Probable ("TPP") reserves

category, respectively. The Midale CO2 enhanced recovery project

continues to exhibit improved performance.

- Cardinal

maintained a high percentage of reserves as producing with the

P+PDP reserves accounting for 82% of the Company's total

reserves.

- Based on the

2020 Reserve Report, the debt adjusted, NPV10 (2) of the Company's

PDP reserves was $2.91 per basic share.

- 90% of

Cardinal's TPP reserves are associated with oil and natural gas

liquids.

- Future

Development Capital ("FDC") was reduced by $51 million (19%) in the

TPP reserves category as the Company has limited drilling plans in

2021.

Notes: (1) RLI is calculated by

dividing the reserves by the annualized fourth quarter production

of 18,625 boe per day, consisting of 10,172 bbl/d of light and

medium crude oil, 4,977 bbl/d of heavy crude oil, 1,200 bbl/d of

natural gas liquids and 13.7 MMcf/d of conventional natural

gas.(2) PDP net asset value is based on the before

tax NPV10 of the PDP reserves less net debt of $247 million

(unaudited) divided by the Company's basic shares at December 31,

2020 of 121.3 million.

OIL AND GAS RESERVES

The 2020 Reserve Report encompasses 100% of

Cardinal's oil and gas properties and was prepared in accordance

with definitions, standards and procedures contained in the

Canadian Oil and Gas Evaluation Handbook("COGEH") and National

Instrument 51-101 - Standards of Disclosure for Oil and Gas

Activities ("NI 51-101").

Reserves Detail

Our 2020 Reserve Report reflects the impact of a

materially lower commodity price forecast of the three consultant's

average (GLJ, McDaniel & Associates Consultants Ltd. and

Sproule Associates Ltd.) used by GLJ. The forecast crude oil

reference prices are 25% lower in the first five years from the

2019 Reserve Report forecast. There were 2.9 million barrels

of TP and 2.3 million barrels of TPP heavy oil reserves removed due

to low oil pricing at year end. These revisions were offset by the

maintained low decline and improved performance in the Midale and

other light and medium crude oil properties with associated natural

gas and natural gas liquids.

The FDC was reduced by $47 million on a TP basis

and $51 million on a TPP basis year over year due to the removal of

some undeveloped locations primarily due to the change in

forecasted commodity prices and the Company's decision to have

minimal drilling activity in 2021. FDC was also reduced from

revisions to the CO2 purchase requirements and price. The FDC

includes costs to develop the undeveloped reserves as well as

maintenance capital and CO2 purchases.

In the 2020 Reserve Report, Cardinal has

included all abandonment, decommissioning and reclamation ("ADR")

costs for active and inactive wells, pipelines and facilities. The

ADR costs for the active assets are considered in the PDP reserves

category. Full inclusion of all ADR costs is recommended by COGEH.

Cardinal's full inclusion of costs exceeds the NI 51-101 minimum

requirement of ADR for active assets only. At year-end 2020, the

2020 Reserve Report included TPP ADR costs discounted at 10% of

$79.8 million.

Consistent with prior years and in accordance

with COGEH recommendations, Cardinal has included all operating

costs, for active and inactive assets. The Company also includes

the consideration of future maintenance costs which is included as

part of the operating costs or as FDC.

Summary of Oil and Gas Reserves

(1)

The following tables summarize certain

information contained in the 2020 Reserve Report. Reserves included

below are the Company's estimated gross reserves as at December 31,

2020, as evaluated in the 2020 Reserve Report.

|

Reserves Category |

Light andMedium Oil(Mbbl) |

Heavy Oil(Mbbl) |

Natural GasLiquids(Mbbl) |

ConventionalNatural

Gas(2)(MMcf) |

TotalBOE(Mboe) |

|

Proved Developed Producing |

36,186 |

18,934 |

2,984 |

37,531 |

64,359 |

|

Proved Developed Non-Producing |

1,371 |

1,011 |

179 |

6,901 |

3,711 |

|

Proved Undeveloped |

4,512 |

1,845 |

226 |

2,531 |

7,005 |

|

Total Proved |

42,069 |

21,790 |

3,389 |

46,963 |

75,074 |

|

Probable |

14,180 |

6,351 |

1,076 |

15,457 |

24,184 |

|

Total Proved Plus Probable |

56,249 |

28,141 |

4,465 |

62,420 |

99,258 |

Notes: (1) Total values may not

add due to rounding.(2) Includes non-associated

gas, associated gas and solution gas. (3) In addition to the

gross reserves indicated in the above table, the Company has 162

Mboe TPP royalty interest reserves comprised of 122 Mbbl light and

medium crude oil and 238 MMcf of conventional natural

gas.Summary of Net Present Values of Future Net Revenue

(Before Tax)(Based on forecast price and costs)

As at December 31, 2020

(1)(2)(3)

|

|

Discounted at: |

|

Reserves Category |

0.0%(M$) |

5.0%(M$) |

10.0%(M$) |

15.0%(M$) |

20.0%(M$) |

|

Proved Developed Producing |

950,174 |

770,949 |

600,164 |

488,401 |

412,823 |

|

Proved Developed Non-Producing(4) |

(129,617) |

(44,145) |

(21,819) |

(13,519) |

(9,735) |

|

Proved Undeveloped |

142,042 |

78,913 |

49,693 |

32,440 |

21,164 |

|

Total Proved |

962,599 |

805,717 |

628,037 |

507,322 |

424,252 |

|

Probable |

692,446 |

312,338 |

183,298 |

123,502 |

90,055 |

|

Total Proved Plus Probable |

1,655,045 |

1,118,055 |

811,335 |

630,824 |

514,306 |

Notes:(1) Total values may not

add due to rounding.(2) Based on three

consultant's average, as defined below, December 31, 2020 forecast

prices and costs. See below for "Price

Forecast".(3) Future net revenue has been reduced

for future abandonment costs and estimated capital for future

development associated with the reserves. (4) The

Proved Developed Non-Producing NPV includes the consideration of

the inactive ADR costs of the Company. Excluding these costs the

NPV10 of these reserves would be $32.9 million.

Reconciliations of Changes in

Reserves

The following table sets out a reconciliation of

the changes in the Corporation's reserves as at December 31, 2020

against such reserves at December 31, 2019 based on forecast prices

and cost assumptions in effect at the applicable reserve evaluation

date:

|

|

Total Proved |

|

|

Light andMediumCrude

Oil(Mbbl) |

HeavyCrude Oil(Mbbl) |

Conventional Natural

Gas(MMcf) |

NaturalGasLiquids(Mbbl) |

MBOE(Mboe) |

|

December 31, 2019 |

43,962 |

26,864 |

46,704 |

3,276 |

81,886 |

|

Technical Revisions (1) |

4,792 |

(772) |

5,629 |

616 |

5,575 |

|

Improved Recovery |

(7) |

- |

1 |

(1) |

(8) |

|

Extensions and Infill Drilling |

628 |

346 |

3,098 |

25 |

1,515 |

|

Dispositions (2) |

(113) |

- |

(7) |

(2) |

(116) |

|

Economic Factors (1)(3) |

(3,387) |

(2,882) |

(3,452) |

(211) |

(7,055) |

|

Production |

(3,805) |

(1,766) |

(5,009) |

(315) |

(6,722) |

|

December 31, 2020 |

42,069 |

21,790 |

46,963 |

3,389 |

75,074 |

|

|

Total Proved Plus Probable |

|

|

Light andMediumCrude

Oil(Mbbl) |

Heavy Crude Oil(Mbbl) |

Conventional Natural

Gas(MMcf) |

NaturalGasLiquids(Mbbl) |

MBOE(Mboe) |

|

December 31, 2019 |

58,279 |

34,887 |

63,016 |

4,355 |

108,024 |

|

Technical Revisions (1) |

5,199 |

(2,693) |

5,174 |

673 |

4,040 |

|

Improved Recovery |

(15) |

- |

(10) |

(1) |

(17) |

|

Extensions and Infill Drilling |

722 |

- |

3,555 |

28 |

1,342 |

|

Dispositions (2) |

(143) |

- |

(9) |

(2) |

(147) |

|

Economic Factors (1)(3) |

(3,987) |

(2,286) |

(4,297) |

(273) |

(7,262) |

|

Production |

(3,805) |

(1,766) |

(5,009) |

(315) |

(6,722) |

|

December 31, 2020 |

56,249 |

28,141 |

62,420 |

4,465 |

99,258 |

Notes:

(1) Heavy oil reserves were revised downward due

to truncation or uneconomic with this oil price forecast. Other

positive or negative revisions are due to variations in performance

versus previous forecasts.(2) There were no reserve acquisitions in

2020.(3) Economic factors have been calculated as the difference in

reserves using the 2020 Reserve Report price forecast with the 2019

Reserve Report reserve forecasts. There is no consideration of

changes in operating costs or price offset changes that occurred in

2020.

Price Forecast

The following table summarizes Consultant's

average (an arithmetic average of the price forecasts of GLJ,

McDaniel & Associates Consultants Ltd. and Sproule Associates

Ltd.) commodity price forecast and foreign exchange rate

assumptions as at December 31, 2020, as applied in the 2020 Reserve

Report, for the next five years.

|

Consultants Average Price

Forecast(1) |

|

|

ExchangeRate |

WTI @Cushing |

CanadianLight Sweet40° API |

WesternCanada Select20.5° API |

Mediumat Cromer29° API |

Natural gasAECO – Cspot |

|

Year |

($US/$C) |

($US/bbl) |

($C/bbl) |

$C/bbl) |

($C/bbl) |

($C/MMbtu) |

|

2021 |

0.768 |

47.17 |

55.76 |

44.63 |

53.89 |

2.78 |

|

2022 |

0.765 |

50.17 |

59.89 |

48.18 |

57.58 |

2.70 |

|

2023 |

0.763 |

53.17 |

63.48 |

52.10 |

61.05 |

2.61 |

|

2024 |

0.763 |

54.97 |

65.76 |

54.10 |

63.25 |

2.65 |

|

2025 |

0.763 |

56.07 |

67.13 |

55.19 |

64.57 |

2.70 |

Note:(1) Inflation is accounted

for at 0% for 2021, 1.3% for 2022, and 2% thereafter.Future

Development Costs

FDC reflects the best estimate of the capital

cost required to produce the reserves. The FDC

associated with the TPP reserves at yearend 2020 is $219 million

undiscounted ($152 million discounted at 10%).

|

|

millions $ |

PDP |

Total Proved |

Total Provedplus Probable |

|

|

Total FDC, Undiscounted |

61.4 |

172.6 |

219.3 |

|

|

Total FDC, Discounted at 10% |

34.2 |

119.9 |

151.8 |

FDC included at year-end 2020 for CO2 purchases,

maintenance and facility capital in PDP, TP and TPP were $61

million, $69 million and $80 million, respectively. This represents

37% of Cardinal's TPP FDC of $219 million. There are 76 net future

locations included in the 2020 Reserve Report (including future CO2

injectors).

Note Regarding Forward Looking

Statements

This press release contains forward-looking

statements and forward-looking information (collectively

"forward-looking information") within the meaning of applicable

securities laws relating to the Cardinal's plans and other aspects

of Cardinal's anticipated future operations, management focus,

objectives, strategies, financial, operating and production

results. Forward-looking information typically uses words such as

"anticipate", "believe", "project", "expect", "goal", "plan",

"intend", " may", "would", "could" or "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.Specifically, this press release contains

forward-looking statements relating to: our business strategies,

plans and objectives, future drilling plans and locations, plans to

improve the cost structure of some of our properties; plans to

maintain our production and improve our future Environment, Social

and Governance ("ESG") plans, Cardinal's asset base and its future

potential and opportunities. In addition, information and

statements relating to reserves are deemed to be forward-looking

statements, as they involve implied assessment, based on certain

estimates and assumptions, that the reserves described exist in

quantities predicted or estimated, and that the reserves can be

profitably produced in the future.

Forward-looking statements regarding Cardinal

are based on certain key expectations and assumptions of Cardinal

concerning anticipated financial performance, business prospects,

strategies, regulatory developments, current and future commodity

prices and exchange rates, applicable royalty rates, tax laws,

future well production rates and reserve volumes, future operating

costs, the performance of existing and future wells, the success of

its exploration and development activities, the sufficiency and

timing of budgeted capital expenditures in carrying out planned

activities, the availability and cost of labor and services, the

impact of competition, conditions in general economic and financial

markets, access to markets, availability of drilling and related

equipment, effects of regulation by governmental agencies,

including curtailments, the ability to obtain financing on

acceptable terms which are subject to change based on commodity

prices, market conditions and potential timing delays.

These forward-looking statements are subject to

numerous risks and uncertainties, certain of which are beyond

Cardinal's control. Such risks and uncertainties include, without

limitation: the impact of general economic conditions; volatility

in market prices for crude oil and natural gas; industry

conditions; currency fluctuations; imprecision of reserve

estimates; liabilities inherent in crude oil and natural gas

operations; environmental risks; incorrect assessments of the value

of acquisitions and exploration and development programs;

competition from other producers; the lack of availability of

qualified personnel, drilling rigs or other services; changes in

income tax laws or changes in royalty rates and incentive programs

relating to the oil and gas industry; hazards such as fire,

explosion, blowouts, and spills, each of which could result in

substantial damage to wells, production facilities, other property

and the environment or in personal injury; and ability to access

sufficient capital from internal and external sources.

Management has included the forward-looking

statements above and a summary of assumptions and risks related to

forward-looking statements provided in this press release in order

to provide readers with a more complete perspective on Cardinal's

future operations and such information may not be appropriate for

other purposes. Cardinal's actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that Cardinal will derive there from.

Readers are cautioned that the foregoing lists of factors are not

exhaustive. These forward-looking statements are made as of the

date of this press release and Cardinal disclaims any intent or

obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

Oil and Gas Metrics The term

"boe" or barrels of oil equivalent may be misleading, particularly

if used in isolation. A boe conversion ratio of six thousand cubic

feet of natural gas to one barrel of oil equivalent (6 Mcf: 1 bbl)

is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value

equivalency at the wellhead. Additionally, given that the value

ratio based on the current price of crude oil, as compared to

natural gas, is significantly different from the energy equivalency

of 6:1; utilizing a conversion ratio of 6:1 may be misleading as an

indication of value.

This press release contains a number of

additional oil and gas metrics, net asset value and reserve life

index, which do not have standardized meanings or standard methods

of calculation and therefore such measures may not be comparable to

similar measures used by other companies. Such metrics have been

calculated by management and included herein to provide readers

with additional measures to evaluate Cardinal's performance;

however, such measures are not reliable indicators of the future

performance of Cardinal and future performance may not compare to

the performance in previous periods.

Development costs include costs of land and

seismic, but exclude capitalized general and administration costs.

The aggregate of the development costs incurred in the most recent

financial year and the change during that year in estimated future

development costs generally will not reflect total finding and

development costs related to reserves additions for that year.

Operating netback is equal to production revenues, less royalties,

operating and transportation expenses. Operating netback per boe is

calculated by dividing operating netback by total production

volumes sold in the period. Reserve life index is calculated based

on the amount for the relevant reserve category divided by fourth

quarter average daily company interest production.

Net asset value is based on the NPV at varying

discount rates before tax for the respective reserve category less

net debt.

Certain financial and operating information

included in this press release for the year ended December 31, 2020

are based on estimated unaudited financial results for the year

then ended, and are subject to the same limitations as discussed

under Forward Looking Statements set out above. These

estimated amounts may change upon the completion of audited

financial statements for the year ended December 31,

2020 and changes could be material.

Supplemental Information Regarding

Product Types

This press release includes references 2020

production. The following table is intended to provide the product

type composition as defined by NI 51-101.

|

|

LIGHT/MEDIUMCRUDE OIL |

HEAVY OIL |

NGL |

CONVENTIONALNATURAL GAS |

TOTAL (BOE/D) |

|

|

|

|

|

|

|

|

Q4/20 |

55% |

27% |

6% |

12% |

18,625 |

|

Q2/20 |

57% |

27% |

4% |

12% |

17,169 |

Reserves Advisories

Unless otherwise indicated, all reserves

reported in this press release are Company share gross reserves

which represent Cardinal's total working interest reserves prior to

the deduction of royalties payable.

Future net revenue is a forecast of revenue,

estimated using forecast prices and costs arising from the

anticipated development and production of resources, net of

associated royalties, operating costs, development costs and all

corporate abandonment and reclamation costs for all active and

inactive wells, pipelines and facilities. It should not be assumed

that the future net revenues undiscounted and discounted at 10%

included in this press release represent the fair market value of

the reserves.

Reserve Definitions:

"Proved" reserves are those reserves that can be

estimated with a high degree of certainty to be recoverable. It is

likely that the actual remaining quantities recovered will exceed

the estimated proved reserves.

"Probable" reserves are those additional

reserves that are less certain to be recovered than proved

reserves. It is equally likely that the actual remaining quantities

recovered will be greater or less than the sum of the estimated

proved plus probable reserves.

"Developed" reserves are those reserves that are

expected to be recovered from existing wells and installed

facilities or, if facilities have not been installed, that would

involve a low expenditure (e.g. when compared to the cost of

drilling a well) to put the reserves on production.

"Developed Producing" reserves are those

reserves that are expected to be recovered from completion

intervals open at the time of the estimate. These reserves may be

currently producing or, if shut-in, they must have previously been

on production, and the date of resumption of production must be

known with reasonable certainty.

"Developed Non-Producing" reserves are those

reserves that either have not been on production, or have

previously been on production, but are shut in, and the date of

resumption of production is unknown.

"Undeveloped" reserves are those reserves

expected to be recovered from known accumulations where a

significant expenditure (for example, when compared to the cost of

drilling a well) is required to render them capable of production.

They must fully meet the requirements of the reserves

classification (proved, probable, possible) to which they are

assigned.

Drilling Locations

This news release discloses Cardinal's 76 net

booked drilling (54 proved and 22 probable locations) locations

which are included in the 2020 Reserve Report. There is no

certainty that we will drill all drilling locations and if drilled

there is no certainty that such locations will result in additional

oil and gas production. The drilling locations on which we actually

drill wells will ultimately depend upon the availability of

capital, regulatory approvals, seasonal restrictions, oil and

natural gas prices, costs, actual drilling results, additional

reservoir information that is obtained and other factors.

Non-GAAP measures

This press release contains the term "net debt"

which does not have a standardized meaning prescribed by

International Financial Reporting Standards ("IFRS" or,

alternatively, "GAAP") and therefore may not be comparable with the

calculation of similar measures by other companies. The term "net

debt" is not recognized under GAAP and is calculated as bank debt

plus the principal amount of convertible unsecured subordinated

debentures ("convertible debentures"), secured notes and current

liabilities less current assets (adjusted for the fair value of

financial instruments, the current portion of lease liabilities and

the current portion of the decommissioning obligation). Net debt is

used by management to analyze the financial position, liquidity and

leverage of Cardinal.

About Cardinal Energy Ltd.

One of Cardinal's goals is to continually

improve our Environmental, Safety and Governance mandate and

operate our assets in a responsible and environmentally sensitive

manner. As part of this mandate, Cardinal injects and

conserves more carbon than it emits making us one of the few

Canadian energy companies to have a negative carbon footprint.

Cardinal is a Canadian oil focused company built

to provide investors with a stable platform for dividend income.

Cardinal's operations are focused in low decline light and medium

quality oil in Western Canada.

For further information: M.

Scott Ratushny, CEO or Shawn Van Spankeren, CFO or Laurence Broos,

VP Finance Email: info@cardinalenergy.caPhone: (403) 234-8681

Website: www.cardinalenergy.ca

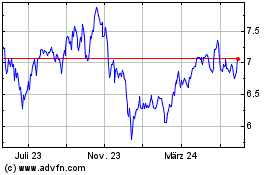

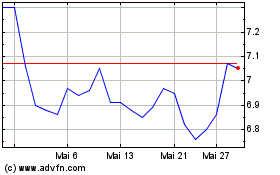

Cardinal Energy (TSX:CJ)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Cardinal Energy (TSX:CJ)

Historical Stock Chart

Von Nov 2023 bis Nov 2024