Cardinal Energy Ltd. ("

Cardinal" or the

"

Company") (TSX: CJ) is pleased to announce that

with improved commodity pricing and the security of its oil hedging

position that it is increasing its 2019 budget guidance and

dividend rate.

Budget Update:

- Using an average oil price of

$57.50 WTI and a WCS differential of US $15.50 for the balance of

2019 we are now forecasting an increase of approximately 20% in

adjusted funds flow to $110 to $120 million for 2019.

- Increase in adjusted funds flow

expected to be utilized for the following:º $5 to $10 million of

additional debt repayment resulting in a $30 to $35 million net

debt reduction in 2019, andº A $5 million increase in capital

expenditures for drilling and power generation initiatives,

andº $3.6 million to fund an increase in dividends in

2019.

- Increase our monthly dividend by 50% to $0.015 per month ($0.18

per year) effective for the July dividend payable in August.

- One-time costs associated with reactivating production shut in

during Q4 2018 are expected to increase operating costs to

approximately $23 per boe in Q1 with Q2 reverting to budgeted

levels.

We will continue to take a conservative approach

to operating our business and manage our debt levels and expect to

assess our dividend rate again in 2020. Any further adjustments to

our dividend level are dependent on numerous factors including oil

egress options and pricing in 2020.

At our budgeted simple dividend payout ratio of

approximately 16%, we are in a position where the dividend level

allows us to strengthen the Company with projects that improve both

the short-term and long-term adjusted funds flow as well as

improving the long-term viability of the business.

Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements and forward-looking information (collectively

"forward-looking information") within the meaning of applicable

securities laws relating to Cardinal's plans and other aspects of

Cardinal's anticipated future operations, management focus,

objectives, strategies, financial, operating and production

results. Forward-looking information typically uses words such as

"anticipate", "believe", "project", "expect", "goal", "plan",

"intend", "may", "would", "could" or "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to 2019 adjusted funds flow,

2019 net debt, plans to reduce net debt, anticipated increase in

adjusted funds flow and the use of such increase, our increased

2019 capital expenditures and allocation, our revised dividend

policy, dividend increase and timing thereof, our budgeted dividend

payout ratio, production reactivation costs and future operating

costs and our plans to improve cash flow and the long-term

viability of the business.

Forward-looking statements regarding Cardinal

are based on certain key expectations and assumptions of Cardinal

concerning anticipated financial performance, business prospects,

strategies, regulatory developments, including production and

production curtailments, current and future commodity prices,

differentials and exchange rates, applicable royalty rates, tax

laws, future well production rates and reserve volumes, future

operating costs, the performance of existing and future wells, the

success of its exploration and development activities, the

sufficiency and timing of budgeted capital expenditures in carrying

out planned activities, the availability and cost of labor and

services, the impact of increasing competition, conditions in

general economic and financial markets, availability of drilling

and related equipment, effects of regulation by governmental

agencies, the ability to obtain financing on acceptable terms which

are subject to change based on commodity prices, market conditions,

drilling success and potential timing delays.

These forward-looking statements are subject to

numerous risks and uncertainties, certain of which are beyond

Cardinal's control. Such risks and uncertainties include, without

limitation: the impact of general economic conditions; volatility

in market prices for crude oil and natural gas; industry

conditions; currency fluctuations; imprecision of reserve

estimates; liabilities inherent in crude oil and natural gas

operations; environmental risks; incorrect assessments of the value

of acquisitions including the Acquisition and exploration and

development programs; competition from other producers; the lack of

availability of qualified personnel, drilling rigs or other

services; changes in income tax laws or changes in royalty rates

and incentive programs relating to the oil and gas industry;

hazards such as fire, explosion, blowouts, and spills, each of

which could result in substantial damage to wells, production

facilities, other property and the environment or in personal

injury; and ability to access sufficient capital from internal and

external sources.

Management has included the forward-looking

statements above and a summary of assumptions and risks related to

forward-looking statements provided in this press release in order

to provide readers with a more complete perspective on Cardinal's

future operations and such information may not be appropriate for

other purposes. Cardinal's actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that Cardinal will derive there

from. Readers are cautioned that the foregoing lists of

factors are not exhaustive. These forward-looking statements

are made as of the date of this press release and Cardinal

disclaims any intent or obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or results or otherwise, other than as required by

applicable securities laws.

Non-GAAP measures

This press release contains the terms "adjusted

funds flow", "simple dividend payout ratio" and "net debt" which do

not have a standardized meaning prescribed by International

Financial Reporting Standards ("IFRS" or, alternatively, "GAAP")

and therefore may not be comparable with the calculation of similar

measures by other companies. Cardinal uses adjusted funds flow and

simple dividend payout ratio to analyze operating performance and

assess leverage. Cardinal feels these benchmarks are key measures

of profitability and overall sustainability for the Company.

Adjusted funds flow and simple dividend payout ratio are not

intended to represent operating profits nor should they be viewed

as an alternative to cash flow provided by operating activities,

net earnings or other measures of performance calculated in

accordance with GAAP. Adjusted funds flow is calculated as cash

flows from operating activities adjusted for changes in non-cash

working capital and decommissioning expenditures. Simple dividend

payout ratio represents the ratio of the sum of dividends declared

plus development capital expenditures divided by adjusted funds

flow.

Oil and Gas Metrics The term

"boe" or barrels of oil equivalent may be misleading, particularly

if used in isolation. A boe conversion ratio of six thousand cubic

feet of natural gas to one barrel of oil equivalent (6 Mcf: 1 bbl)

is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value

equivalency at the wellhead. Additionally, given that the value

ratio based on the current price of crude oil, as compared to

natural gas, is significantly different from the energy equivalency

of 6:1; utilizing a conversion ratio of 6:1 may be misleading as an

indication of value.

About Cardinal Energy Ltd.

Cardinal is a junior Canadian oil focused

company built to provide investors with a stable platform for

dividend income and growth. Cardinal's operations are focused in

low decline light and medium quality oil in Alberta and

Saskatchewan.

For further information: M.

Scott Ratushny, CEO or Shawn Van Spankeren, CFO or Laurence Broos,

VP Finance Email: info@cardinalenergy.caPhone: (403) 234-8681

Website: www.cardinalenergy.ca Address: 600, 400 – 3rd Avenue SW,

Calgary, AB T2P 4H2

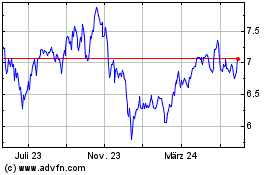

Cardinal Energy (TSX:CJ)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

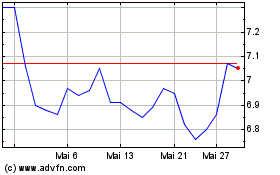

Cardinal Energy (TSX:CJ)

Historical Stock Chart

Von Feb 2024 bis Feb 2025