(TSX:CJ) Cardinal Energy Ltd. ("Cardinal" or the "Company") is

pleased to announce its operating and financial results for the

quarter ended June 30, 2017, as well as the appointment of a new

member to its Board of Directors.

The Company's unaudited financial statements and

management's discussion and analysis for the quarter ended June 30,

2017, will be available on the System for Electronic Document

Analysis and Retrieval ("Sedar") at www.sedar.com and on Cardinal's

website at www.cardinalenergy.ca.

Highlights from the 2nd Quarter of

2017

During the quarter we:

- Closed a strategic acquisition of light oil low decline

properties at House Mountain and Midale for an adjusted purchase

price of $297 million;

- Increased our light oil and NGL weighting to 45% of our total

oil and NGL production with the acquired assets;

- Raised new equity for gross proceeds of approximately $170

million;

- Increased our credit facilities to $325 million;

- Increased production for Q2 2017 versus Q2 2016 by 17% to

17,154 boe/d;

- Reduced operating costs on a unit basis by 10% from Q1 2017 to

$20.57 per boe; and

- Initiated a process to identify for sale certain royalty

interests and fee title lands to reduce our bank debt.

Subsequent to the quarter we added 27 net

sections of undeveloped lands in our core Bantry area which are

prospective for Mannville oil.

Acquisition

On June 30, 2017, Cardinal closed its previously

announced light oil acquisition for an adjusted purchase price of

$297 million. The adjusted purchase price further increases certain

of the previously announced positive metrics of the acquisition,

being: 5.5X (estimated 2017) adjusted funds flow (based on $55

million of annualized operating income from the assets) and a

recycle ratio of 2.1X.

Cardinal considers House Mountain and Midale to

be top quality light oil assets. These long life low decline light

oil assets also include significant light oil drilling inventory

and other potential optimization opportunities.

The higher netbacks associated with these assets

is expected to improve Cardinal's overall sustainability which will

be further enhanced with anticipated royalty sales.

We have begun the process of understanding and

integrating the newly acquired assets into Cardinal and welcome the

addition of 54 employees, both in the Midale and House Mountain

field offices and our Calgary office.

We feel confident in our ability to reduce

operating costs on the acquired assets. We also see areas for

field optimization and will continue to work on our plans to expand

our drilling inventory for 2018.

Operating Costs

Operating costs have begun the trend back to

normalized values in Q2, decreasing on a unit basis from $22.96/boe

in Q1 to $20.57/boe, a 10% decrease and trending towards our goal

of second half 2017, $20/boe operating costs. Reduced workover

frequency was the key driver behind operating cost per boe

reductions.

Cardinal will continue to focus on reducing

operating costs per boe in 2017. We expect to see operating

synergies and per boe cost reductions on the recently acquired

assets in the second half of 2017 and into 2018.

Credit Facility

Concurrent with the closing of the asset

acquisition, Cardinal increased its credit facilities to $325

million and as at June 30, 2017 we had bank debt of $233 million.

The increase funded the portion of the acquisition not funded by

equity until the proceeds on royalty sales can be realized.

On a run rate adjusted funds flow basis, we are currently at 2.1

net bank debt to adjusted funds flow ratio, above our targeted net

debt to adjusted funds flow ratio of less than 2.0 and our targeted

net bank debt to adjusted funds flow ratio of less than 1.0. We

expect to reduce the amount drawn on our credit facilities with

potential royalty sales and expected free cash flow in the second

half of 2017.

Appointment of New Director

We would like to announce the appointment of

Stephanie Sterling to the Board of Directors. She holds a Bachelor

of Science (Mechanical Engineering) degree and an MBA from the

University of Alberta. Ms. Sterling is a recently retired senior

executive with Shell Canada with over 25 years’ experience in

engineering, large project start-up and operations, governance,

joint venture negotiations and relationships, risk management,

business development and strategic planning. She has served as

General Manager for Non-Technical Risk Integration, Community and

Indigenous Relations for Shell in Canada, USA and Latin America

where she was responsible for integrating risk management into new

projects. She also served as the Vice President Business and

Joint Ventures for Shell’s Heavy Oil business, where she was

responsible for the joint venture governance, commercial

negotiations and relationships for two significant joint

ventures: the Athabasca Oil Sands Project among Shell,

Chevron and Marathon; and the AERA joint venture in California

between Shell and Exxon.

Guidance

Based on our expectation for continued lower

commodity prices (including the effect of recent increases in the

US/Cdn exchange rate) and lower realized prices in the first half

of 2017 compared to those used in our guidance for the House

Mountain and Midale Acquisition Cardinal is revising its second

half and annual 2017 guidance for adjusted funds flow and related

financial information. Due to the expected reduction in adjusted

funds flow we are also revising our annual guidance for development

capital expenditures to maintain a total payout ratio of less than

100% for the second half of 2017. We have adjusted our pricing to

$47.50 WTI for the second half of 2017 and reduced our capital

spending by $8 million for the same period. Refer to our

Management's Discussion and Analysis for a full description of the

revised guidance.

Outlook

The second quarter of 2017 was transformational

for Cardinal with the successful closing of the House Mountain and

Midale acquisition. A more balanced crude oil production mix of

approximately 45% light oil and liquids after the acquisition is

expected to improve our netback.

We remain focused on our goal to create long

term shareholder value through accretive growth and regular

dividends.

The low decline rate of our base assets

(including the recently acquired assets) require minimal capital to

maintain production. We have a large inventory of economic projects

including opportunities arising from the recent acquisition of

Midale and House Mountain and a recent large land acquisition in

the Bantry area. However, current commodity prices (including

the effect of the Canada-US exchange rate) has led the Board to

consider whether expending growth capital to bring on production is

the best use of available funds. Cardinal has opted to use a

conservative price forecast for budgeting purposes, to reduce

expenditures which would have resulted in growth and to apply free

cash flow to debt reduction.

Financial and Operating

Highlights

| ($ 000's

except shares, per share and operating amounts) |

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2017 |

|

2016 |

|

% Change |

|

2017 |

|

2016 |

|

% Change |

|

Financial |

|

|

|

|

|

|

|

|

|

Petroleum and natural gas revenue |

|

67,602 |

|

50,124 |

|

35 |

|

|

130,176 |

|

83,548 |

|

56 |

|

| Cash

flow from operating activities |

|

12,986 |

|

11,167 |

|

16 |

|

|

28,369 |

|

29,142 |

|

(3 |

) |

| Adjusted

funds flow(1) |

|

15,781 |

|

16,922 |

|

(7 |

) |

|

30,367 |

|

24,680 |

|

23 |

|

| basic and

diluted per share |

|

0.20 |

|

0.25 |

|

(20 |

) |

|

0.39 |

|

0.37 |

|

5 |

|

| Earnings

(loss) |

|

1,218 |

|

(35,317 |

) |

(103 |

) |

|

8,780 |

|

(50,961 |

) |

(117 |

) |

| basic and

diluted per share |

|

0.02 |

|

(0.52 |

) |

(104 |

) |

|

0.11 |

|

(0.77 |

) |

(114 |

) |

|

Dividends declared |

|

9,406 |

|

7,202 |

|

31 |

|

|

17,424 |

|

14,119 |

|

23 |

|

| per

share |

|

0.105 |

|

0.105 |

|

- |

|

|

0.21 |

|

0.21 |

|

- |

|

| Net bank

debt (1) |

|

238,652 |

|

31,908 |

|

n/m |

|

|

238,652 |

|

31,908 |

|

n/m |

|

|

Exploration and development capital |

|

15,285 |

|

12,077 |

|

27 |

|

|

36,504 |

|

14,154 |

|

158 |

|

|

Acquisitions, net |

|

297,114 |

|

160 |

|

n/m |

|

|

301,115 |

|

335 |

|

n/m |

|

| Total

capital expenditures |

|

313,004 |

|

12,395 |

|

n/m |

|

|

366,712 |

|

14,801 |

|

n/m |

|

| Weighted

average shares outstanding |

|

|

|

|

|

|

|

|

| basic

(000s) |

|

79,612 |

|

67,356 |

|

18 |

|

|

77,596 |

|

66,541 |

|

17 |

|

| diluted

(000s) |

|

80,511 |

|

67,356 |

|

20 |

|

|

78,782 |

|

66,541 |

|

18 |

|

| |

|

|

|

|

|

|

|

|

|

Operating |

|

|

|

|

|

|

|

|

| Average

daily production |

|

|

|

|

|

|

|

|

| Crude oil

and NGL (bbl/d) |

|

13,817 |

|

12,870 |

|

7 |

|

|

13,415 |

|

12,734 |

|

5 |

|

| Natural

gas (mcf/d) |

|

20,021 |

|

10,506 |

|

91 |

|

|

16,506 |

|

10,196 |

|

62 |

|

| Total

(boe/d) |

|

17,154 |

|

14,621 |

|

7 |

|

|

16,166 |

|

14,433 |

|

12 |

|

|

Netback(1) |

|

|

|

|

|

|

|

|

| Petroleum

and natural gas revenue |

|

43.31 |

|

37.67 |

|

15 |

|

|

44.49 |

|

31.81 |

|

40 |

|

|

Royalties |

|

6.01 |

|

4.26 |

|

41 |

|

|

6.19 |

|

3.92 |

|

58 |

|

| Operating

expenses |

|

20.57 |

|

20.23 |

|

2 |

|

|

21.69 |

|

20.86 |

|

4 |

|

|

Netback |

|

16.73 |

|

13.18 |

|

27 |

|

|

16.61 |

|

7.03 |

|

136 |

|

| Realized

gain (loss) |

|

(2.51 |

) |

2.29 |

|

(210 |

) |

|

(2.43 |

) |

5.29 |

|

(146 |

) |

| Netback

after risk management (1) |

|

14.22 |

|

15.47 |

|

(8 |

) |

|

14.18 |

|

12.32 |

|

15 |

|

| (1) See

non-GAAP measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note Regarding Forward Looking

Statements

This press release contains forward-looking

statements and forward-looking information (collectively

"forward-looking information") within the meaning of applicable

securities laws relating to Cardinal's plans and other aspects of

Cardinal's anticipated future operations, management focus,

objectives, strategies, financial, operating and production

results. Forward-looking information typically uses words such as

"anticipate", "believe", "project", "expect", "goal", "plan",

"intend", "may", "would", "could" or "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to the anticipated achievements

of the Company's' 2017 second half budget and the funding of the

same, our dividend policy, payout ratios, capital expenditure plans

including the 2017 capital expenditure budget, potential for the

sale of royalty interests, the use of proceeds therefrom and the

anticipated benefits therefrom, expected development capital,

anticipated cost reductions, adjusted funds flow, net bank debt,

net bank debt to adjusted funds flow, future drilling, completion

and optimization results and opportunities, operating costs,

targeted corporate decline rates, the matters set forth under

"Guidance" and "Outlook", Cardinal’s asset base and future

prospects for development and growth therefrom.

Forward-looking statements regarding Cardinal

are based on certain key expectations and assumptions of Cardinal

concerning anticipated financial performance, business prospects,

strategies, regulatory developments, current and future commodity

prices and exchange rates, applicable royalty rates, tax laws,

future well production rates and reserve volumes, future operating

costs, the performance of existing and future wells, the success of

its exploration and development activities, the ability to market

and monetize the Company's royalty interests in a manner, and for

proceeds, acceptable to the Company, the sufficiency and timing of

budgeted capital expenditures in carrying out planned activities,

the availability and cost of labor and services, the impact of

increasing competition, conditions in general economic and

financial markets, availability of drilling and related equipment,

effects of regulation by governmental agencies, the ability to

obtain financing on acceptable terms which are subject to change

based on commodity prices, market conditions, drilling success and

potential timing delays.

These forward-looking statements are subject to

numerous risks and uncertainties, certain of which are beyond

Cardinal's control. Such risks and uncertainties include, without

limitation: the impact of general economic conditions; volatility

in market prices for crude oil and natural gas; industry

conditions; currency fluctuations; imprecision of reserve

estimates; liabilities inherent in crude oil and natural gas

operations; the royalty interests may not be monetized in the

manner, timing or for proceeds expected by the Company,

environmental risks; incorrect assessments of the value of

acquisitions and exploration and development programs; competition

from other producers; the lack of availability of qualified

personnel, drilling rigs or other services; changes in income tax

laws or changes in royalty rates and incentive programs relating to

the oil and gas industry; hazards such as fire, explosion,

blowouts, and spills, each of which could result in substantial

damage to wells, production facilities, other property and the

environment or in personal injury; and ability to access sufficient

capital from internal and external sources.

Management has included the forward-looking

statements above and a summary of assumptions and risks related to

forward-looking statements provided in this press release in order

to provide readers with a more complete perspective on Cardinal's

future operations and such information may not be appropriate for

other purposes. Cardinal's actual results, performance or

achievement could differ materially from those expressed in, or

implied by, these forward-looking statements and, accordingly, no

assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that Cardinal will derive there

from. Readers are cautioned that the foregoing lists of

factors are not exhaustive. These forward-looking statements

are made as of the date of this press release and Cardinal

disclaims any intent or obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or results or otherwise, other than as required by

applicable securities laws.

This press release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about our prospective results of operations,

cash flows, payout ratios and components thereof, all of which are

subject to the same assumptions, risk factors, limitations, and

qualifications as set forth in the above paragraphs. FOFI contained

in this press release were made as of the date hereof and is

provided for the purpose of describing our anticipated future

business operations. We disclaim any intention or obligation to

update or revise any FOFI contained in this press release, whether

as a result of new information, future events or otherwise, unless

required pursuant to applicable law. Readers are cautioned that the

FOFI contained in this press release should not be used for

purposes other than for which it is disclosed herein.

Oil and Gas Advisories

Where applicable, oil equivalent amounts have

been calculated using a conversion rate of six thousand cubic feet

of natural gas to one barrel of oil. Boes may be misleading,

particularly if used in isolation. A boe conversion ratio of

six thousand cubic feet of natural gas to one barrel of oil is

based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value

equivalency at the wellhead. Utilizing a conversion ratio at

6 Mcf: 1Bbl may be misleading as an indication of value.

Certain oil and gas metrics such as "recycle

ratio" do not have standardized meanings or standard methods of

calculation and therefore such measures may not be comparable to

similar measures used by other companies and should not be used to

make comparisons. Such metric has been prepared by management and

is included in this press release to provide readers with

additional measures to evaluate our assets (including the acquired

assets) and our performance however, such measures are not reliable

indicators of our future performance and future performance may not

compare to our performance in previous periods and therefore such

metric should not be unduly relied upon.

"Recycle ratio" is calculated by dividing

netback per Boe by the finding, development and acquisition costs

for the relevant reserve category. Finding development and

acquisition costs are calculated per Boe, by dividing the aggregate

of the future development capital for the acquired assets and the

purchase price for the acquired assets by the reserves

acquired.

Non-GAAP measures

This press release contains the terms

"development capital expenditures", "adjusted funds flow" "run rate

adjusted funds flow", "adjusted funds flow per share", "total

payout ratio", "free cash flow", "net bank debt", "net bank

debt to adjusted funds flow", "netback" and "netback after risk

management" which do not have a standardized meaning prescribed by

International Financial Reporting Standards ("IFRS" or,

alternatively, "GAAP") and therefore may not be comparable with the

calculation of similar measures by other companies. Cardinal uses

adjusted funds flow and total payout ratio to analyze operating

performance. Cardinal feels these benchmarks are key measures of

profitability and overall sustainability for the Company. Adjusted

funds flow is not intended to represent operating profits nor

should it be viewed as an alternative to cash flow provided by

operating activities, net earnings or other measures of performance

calculated in accordance with GAAP. Adjusted funds flow is

calculated as cash flows from operating activities adjusted for

changes in non-cash working capital and decommissioning

expenditures. "Run rate adjusted funds flow" is adjusted funds

flow, presented on an annualized basis. "Development capital

expenditures" represent expenditures on property, plant and

equipment (excluding corporate and other assets and acquisitions)

to maintain and grow the Company's base production. "Total payout

ratio" represents the ratio of the sum of dividends declared (net

of participation in the DRIP and SDP) plus development capital

expenditures divided by adjusted funds flow. Total payout ratio is

a key measure to assess our ability to finance operating

activities, capital expenditures and dividends. The term

"free cash flow" represents adjusted funds flow less dividends

declared (net of participation in the DRIP and SDP) and less

development capital expenditures. The term "net bank debt" is not

recognized under GAAP and is calculated as bank debt plus working

capital deficiency or minus working capital surplus (adjusted for

the fair value of financial instruments and the current portion of

the decommissioning obligation). "Net bank debt" is used by

management to analyze the financial position, liquidity and

leverage of Cardinal. "Net bank debt to adjusted funds flow" is

calculated as net bank debt divided by adjusted funds flow for the

most recent quarter, annualized. The ratio of net bank debt

to adjusted funds flow is used to measure the Company’s overall

debt position and to measure the strength of the Company’s balance

sheet. Cardinal monitors this ratio and uses this as a key measure

in making decisions regarding financing, capital expenditures and

dividend levels. "Netback" is calculated on a boe basis and is

determined by deducting royalties and operating expenses from

petroleum and natural gas revenue in accordance with the COGE

Handbook. "Netback after risk management" includes realized gains

or losses in the period on a boe basis. Netback is utilized by

Cardinal to better analyze the operating performance of its

petroleum and natural gas assets against prior periods.

About Cardinal Energy Ltd.

Cardinal is a junior Canadian oil focused

company built to provide investors with a stable platform for

dividend income and growth. Cardinal's operations are focused in

low decline light and medium quality oil in Alberta and

Saskatchewan.

For further information: M. Scott Ratushny, CEO

or Laurence Broos, VP Finance, Cardinal Energy Ltd., 600, 400 – 3rd

Avenue SW, Calgary, AB T2P 4H2, Main Phone: (403) 234-8681

Website: www.cardinalenergy.ca

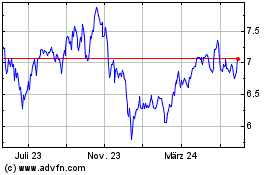

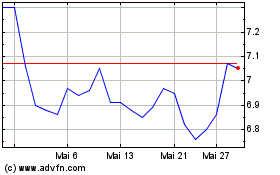

Cardinal Energy (TSX:CJ)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Cardinal Energy (TSX:CJ)

Historical Stock Chart

Von Feb 2024 bis Feb 2025