Conifex Timber Inc. (“Conifex”, “we” or “us”) (TSX: CFF) today

reported results for the second quarter ended June 30, 2022.

EBITDA* was $20.1 million for the quarter compared to EBITDA of

$37.8 million in the second quarter of 2021. Net income was $12.3

million or $0.31 per share for the year versus $26.1 million or

$0.56 per share in the year-earlier quarter.

Selected Financial

Highlights

The following table summarizes our selected

financial information for the comparative periods.

|

Selected Financial Information(1) |

|

|

|

|

|

|

|

(unaudited, in millions of dollars, except earnings per share and

share information) |

Q22022 |

Q12022 |

YTD2022 |

Q22021 |

YTD2021 |

|

Sales |

|

|

|

|

|

|

Lumber – Conifex produced |

66.4 |

52.6 |

119.0 |

80.1 |

120.0 |

|

Lumber – wholesale |

2.3 |

8.4 |

10.7 |

9.0 |

9.6 |

|

By-products and other |

11.6 |

2.8 |

14.4 |

2.7 |

5.1 |

|

Bioenergy |

4.8 |

8.0 |

12.8 |

4.7 |

8.4 |

|

|

85.1 |

71.8 |

156.9 |

96.5 |

143.1 |

| Operating income |

17.6 |

17.1 |

34.7 |

33.5 |

42.2 |

| EBITDA from

continuing operations(2) |

20.1 |

20.1 |

40.2 |

37.8 |

47.5 |

|

Net income from continuing operations |

12.3 |

11.4 |

23.7 |

26.1 |

30.6 |

| Basic

and diluted earnings per share |

|

|

|

|

|

| Continuing

operations |

0.31 |

0.28 |

0.59 |

0.56 |

0.66 |

| Shares

outstanding – weighted average (millions) |

40.2 |

40.1 |

40.2 |

46.3 |

46.2 |

| |

|

|

|

|

|

|

Reconciliation of EBITDA to net income |

|

|

|

|

|

| Net income from

continuing operations |

12.3 |

11.4 |

23.7 |

26.1 |

30.6 |

| Add: Finance

costs |

1.1 |

1.1 |

2.2 |

1.1 |

2.3 |

|

Amortization |

2.0 |

3.2 |

5.2 |

2.1 |

4.2 |

|

Income tax expense |

4.7 |

4.3 |

9.0 |

8.5 |

10.4 |

|

EBITDA from continuing operations(2) |

20.1 |

20.1 |

40.2 |

37.8 |

47.5 |

* Conifex's EBITDA calculation

represents earnings before finance costs, taxes, depreciation and

amortization. We disclose EBITDA as it is a measure used by

analysts and by our management to evaluate our performance. As

EBITDA is a non-GAAP measure that does not have any standardized

meaning prescribed by International Financial Reporting Standards,

it may not be comparable to EBITDA calculated by others and is not

a substitute for net earnings or cash flows, and therefore readers

should consider those measures in evaluating our performance.

Selected Operating

Information

|

|

Q22022 |

Q12022 |

YTD2022 |

Q22021 |

YTD2021 |

|

Production – WSPF lumber (MMfbm)(3) |

51.4 |

47.1 |

98.5 |

49.0 |

100.0 |

| Shipments – WSPF lumber (MMfbm)

(3) |

55.5 |

42.5 |

98.0 |

55.5 |

93.3 |

| Shipments – wholesale lumber

(MMfbm)(3) |

1.2 |

4.9 |

6.1 |

5.8 |

6.5 |

| Electricity production (GWh) |

54.6 |

53.9 |

108.5 |

50.9 |

75.9 |

| Average exchange rate –

$/US$(4) |

0.783 |

0.790 |

0.787 |

0.814 |

0.802 |

| Average WSPF 2x4 #2 & Btr

lumber price (US$)(5) |

$827 |

$1,288 |

$1,057 |

$1,290 |

$1,136 |

|

Average WSPF 2x4 #2 & Btr lumber price ($)(6) |

$1,056 |

$1,631 |

$1,343 |

$1,584 |

$1,414 |

(1) Reflects results of continuing operations,

except where otherwise noted.(2) Conifex's EBITDA calculation

represents earnings before finance costs, taxes, and depreciation

and amortization.(3) MMfbm represents million board feet.(4) Bank

of Canada, www.bankofcanada.ca.(5) Random Lengths Publications

Inc.(6) Average SPF 2x4 #2 & Btr lumber prices (US$) divided by

average exchange rate.

Summary of Second Quarter 2022

Results

Consolidated Net EarningsDuring the second

quarter of 2022, we generated net income of $12.3 million or $0.31

per share compared to net income of $11.4 million or $0.28 per

share in the previous quarter and $26.1 million or $0.56 per share

in the second quarter of 2021.

Lumber Operations

North American lumber market prices declined in

the second quarter of 2022 following the elevated lumber prices

seen in the first quarter of the year. Canadian dollar-denominated

benchmark Western Spruce / Pine / Fir (“WSPF”)

prices 1, which averaged $1,056 in the second quarter of 2022,

decreased by 35% or $575 from the previous quarter and by 33% or

$528 from the second quarter of 2021. Market prices experienced a

slide from the record-high levels driven largely by a slowdown in

new home construction demand in the U.S. due to higher mortgage

rates and reduced affordability. U.S. housing starts on a

seasonally adjusted annual basis remained steady, averaging

1,677,000 in the second quarter of 2022, down 4% from the previous

quarter and up 6% from the second quarter of 2021 2.

Our lumber production in the second quarter of

2022 totalled approximately 51.4 million board feet, representing

operating rates of approximately 86% of annualized capacity. In the

previous quarter, 47.1 million board feet of lumber was produced.

The increase in lumber production for the second quarter was

largely due to operations not being affected by the COVID-19 shift

reductions and operational impacts of severe winter weather

experienced during the previous quarter. While lumber production in

the current quarter was higher, production was negatively impacted

by multiple power outages in June 2022. In the second quarter of

2021, 49.0 million board feet was produced, representing operating

rates of approximately 82% of annualized capacity.

Shipments of Conifex produced lumber totaled

55.5 million board feet in the second quarter of 2022, representing

an increase of 31% from the 42.5 million board feet shipped in the

previous quarter and consistent with the 55.5 million board feet of

lumber shipped in the second quarter of 2021. Shipments of Conifex

produced lumber in the second quarter of 2022 benefited from a

modest improvement of railcar supply. Our wholesale lumber program

shipped 1.2 million board feet in the second quarter of 2022,

representing a decrease of 76% from the 4.9 million board feet

shipped in the first quarter of 2022 and 79% from the 5.8 million

board feet shipped in the second quarter of 2021 as a global

shortage of wood experienced in 2021 eased.

Revenues from lumber products were $68.7 million

in the second quarter of 2022 representing an increase of 13% from

the previous quarter and a decrease of 23% from the second quarter

of 2021. Compared to the previous quarter, the higher revenues in

the current quarter were driven by increased shipment volumes,

partially offset by reduced realized lumber prices. The revenue

decrease in the current quarter over the same period in the prior

year is largely the result of lower benchmark lumber prices.

Cost of goods sold in the second quarter of 2022

increased by 21% from the previous quarter and by 4% from the

second quarter of 2021. The increase in cost of goods sold from the

prior quarter is mainly due to higher overall shipments in the

current quarter. Unit manufacturing costs decreased in comparison

to the previous quarter as a result of increased lumber production

and reduced fixed costs.

We expensed countervailing

(“CV”) and anti-dumping (“AD”)

duty deposits of $7.2 million in the second quarter of 2022, $5.0

million in the previous quarter and $5.3 million in the second

quarter of 2021. The duty deposits were based on a combined rate of

8.99% until December 1, 2021 and 17.91% thereafter. The export

taxes during the second quarter of 2022 were higher than the

previous quarter due to increased lumber shipment volumes in the

current quarter and were higher than the second quarter of 2021

largely due to the higher cash deposit rate in effect on lumber

shipment volumes made to the U.S. market.

Bioenergy Operations

Our Mackenzie power plant sold 54.6 gigawatt

hours of electricity under our Electricity Purchase Agreement

(“EPA”) with BC Hydro in the second quarter of

2022 representing approximately 96% of targeted operating rates.

Our Mackenzie power plant sold 53.9 and 50.9 gigawatt hours of

electricity in the previous quarter and second quarter of 2021,

respectively.

Our EPA with BC Hydro, similar to other

electricity purchase agreements, provides BC Hydro with the option

to “turn down” electricity purchased from us during periods of low

demand by issuing a “dispatch order”. In April 2022, BC Hydro

issued a dispatch order for 61 days, from May 5 to July 4, 2022. In

2021, our power plant was dispatched for 61 days, from May 1 to

June 30, 2021. We continue to be paid revenues under the EPA based

upon a reduced rate and on volumes that are generally reflective of

contracted amounts. During any dispatch period, we continue to

produce electricity to fulfill volume commitments under our Load

Displacement Agreement (“LDA”) with BC Hydro and

Power Authority (“BC Hydro”).

Electricity production contributed revenues of

$4.8 million in the second quarter of 2022, a decrease of 40% from

the previous quarter and an increase of 2% from the second quarter

of 2021. In comparison to the previous quarter, revenues were lower

due to a “time of delivery factor” that adds a seasonal effect to

quarterly revenues. In comparison to the second quarter of 2021,

revenues were higher due to higher billable gigawatt hours

generated.

Following the end of the dispatch period in July

2022, our Mackenzie power plant had a scheduled outage to perform

annual major maintenance work. During the course of maintenance

work, damage to the power plant’s turbine was discovered and

delayed the restart of the plant. We continue to work with the

original equipment manufacturer to assess the required work plan.

While we do not anticipate the power plant to be operational during

the third quarter of 2022, until the assessment and work plan are

completed, no definitive timeline may be provided as to when the

power plant will recommence operations. We expect the property

damage and business interruption will be covered by our insurance,

subject to customary deductibles and limits.

An insurance claim was submitted for physical

damage to our equipment and for loss of revenues from the

interruption of operations from December 2020 to February 2021

arising from the previous failure of the power plant’s generator.

We recognized $3.5 million as other income on our statement of net

income and comprehensive income in 2021 to reflect the settlement

for lost income under our business interruption policy. Final

settlement of the physical damage and business interruption claim

was received in July 2022.

Selling, General and Administrative Costs

Selling, general and administrative

(“SG&A”) costs were $3.1 million in the second

quarter of 2022, $3.3 million in the previous quarter and $3.0

million in the second quarter of 2021. The reduced SG&A costs

were primarily attributable to lower selling costs associated with

wholesale lumber shipments as shipment volumes declined relative to

the previous quarter and comparative quarter in the preceding

year.

Finance Costs and Accretion

Finance costs and accretion totaled $1.1 million

in the second quarter of 2022 and in each comparative quarter.

Finance costs and accretion relate primarily to our term loan

supporting our bioenergy operations (the “Power Term

Loan”).

Gain or Loss on Derivative Financial

Instruments

We enter into lumber future contracts at times

to manage our commodity lumber price exposures. Gains or losses on

lumber derivative instruments are recognized as they are settled or

as they are marked to market for each reporting period.

We had no outstanding futures contracts in place

as at June 30, 2022.

Foreign Exchange Translation Gain or Loss

The foreign exchange translation gain or loss

recorded for each period on our statement of net income results

from the revaluation of U.S. dollar-denominated cash and working

capital balances to reflect the change in the value of the Canadian

dollar relative to the value of the US dollar. U.S.

dollar-denominated monetary assets and liabilities are translated

using the period end rate.

The U.S. dollar averaged US$0.783 for each

Canadian dollar during the second quarter of 2022, a level which

represented a weakening of the Canadian dollar over the previous

quarter 3.

The foreign exchange translation impacts arising

from the variability in exchange rates at each measurement period

on cash and working capital balances resulted in a foreign exchange

translation gain of $0.5 million in the second quarter of 2022,

compared to foreign exchange translation loss of $0.2 million in

the previous quarter and a gain of $0.1 million in the second

quarter of 2021.

Income Tax

The current quarter results include a current

income tax expense of $1.5 million, compared to nil in each of the

comparative quarters.

Deferred income taxes reflect the net tax

effects of temporary differences between the carrying amounts of

assets and liabilities on our balance sheet and the amounts used

for income tax purposes. We recorded a deferred income tax expense

of $3.3 million in the second quarter of 2022, $4.3 million in the

previous quarter and $8.5 million in the second quarter of 2021. As

at June 30, 2022, we have recognized a deferred income tax

liability of $6.9 million.

The effective tax rate was 28% in the current

quarter, compared to 27% in the previous quarter and 25% in the

second quarter of 2021.

Financial Position and

Liquidity

Overall debt was $57.5 million at June 30, 2022

compared to $59.4 million at December 31, 2021. The reduction of

$1.9 million in debt comprised net lease repayments of $0.3 million

and Power Term Loan payments of $1.6 million. Our Power Term Loan,

which is largely non-recourse to our lumber operations, represents

substantially all of our outstanding long-term debt. At June 30,

2022, we had $55.7 million outstanding on our Power Term Loan,

while our remaining long-term debt, consisting of leases, was $1.8

million.

At June 30, 2022, we had total liquidity of

$55.4 million, compared to $16.4 million at December 31, 2021 and

$45.8 million at June 30, 2021. Liquidity at June 30, 2022 was

comprised of unrestricted cash of $40.4 million and unused

availability of $15.0 million under the $15.0 million secured

revolving credit facility with Wells Fargo Capital Finance

Corporation Canada (the “Revolving Credit

Facility”).

Like other Canadian lumber producers, we began

depositing cash on account of softwood lumber duties imposed by the

United States government in April 2017. Cumulative duties of

US$29.1 million paid by us, net of our sales of certain refunds,

since the inception of the current trade dispute remain held in

trust by the U.S. pending administrative reviews and the conclusion

of all appeals of U.S. decisions. We expect future cash flow will

continue to be adversely impacted by the CV and AD duty deposits to

the extent additional costs on US destined shipments are not

mitigated by higher lumber prices.

Outlook

We expect lumber prices in the remainder of 2022

to be elevated from the lows seen in June 2022. While demand for

new home construction may be reduced in the near-term as a result

of recent mortgage rate hikes, we anticipate repair and remodelling

activities will continue to support demand for lumber products. We

anticipate lumber shipments in the second half of 2022 to continue

to be challenged by transportation issues as rail supply shortages

continue to persist.

At our Mackenzie sawmill, we expect to see a

gradual increase in lumber production compared to the first half of

2022, with the expectation of achieving annualized operating rates

in excess of 90% in the second half of the year. Our Mackenzie

power plant is forecasted to resume operations at full capacity in

the fourth quarter and to generate a steady and diversified source

of cash flow, with seasonally stronger EBITDA contributions

expected upon resumption. We expect our third quarter results to be

shaped by lower lumber prices, the reduction in duty deposit rates

from 17.91% to 8.59% following publication in the U.S. Federal

Register and the delayed restart of our power plant which could

result in consolidated EBITDA that is materially lower than the

first half of the year, but to remain positive.

Our liquidity and financial position are

forecasted to continue to remain strong through the second half of

2022. We continue to prioritize funding quick payback sawmill

upgrades and exploring potential allocations of capital to enhance

shareholder value as we believe that the market price of our common

shares does not reflect the underlying value of our business and

future prospects. We believe that our strong liquidity position

will allow us to manage the delayed resumption of power plant

operations and market volatility, if any, that may arise in the

latter half of 2022.

Normal Course Issuer Bid

On August 9, 2022, our board of directors

approved a normal course issuer bid (the "NCIB")

for the purchase of up to such number of our common shares (the

"Common Shares") equal to 10% of the public float.

Subject to approval from the Toronto Stock Exchange, we expect to

be permitted to make purchases under the NCIB commencing September

1, 2022.

Public Discussion Paper

Released

On July 15, 2022, the British Columbia Ministry

of Forests (the “MOF”) released its Public

Discussion Paper (the “PDP”) which provides a

summary of the results of the timber supply review for the

Mackenzie Timber Supply Area (“TSA”) initiated in

the spring of 2019. Although further analysis will be completed

prior to the chief forester’s allowable annual cut

(“AAC”) determination and provided the chief

forester will consider a wide range of information prior to

determining a new AAC, the PDP provides up-to-date information

about fibre availability and quality in the Mackenzie TSA. The AAC

is the maximum volume of timber available for harvesting each year,

usually expressed as cubic metres of wood.

The PDP discloses that its base case and

alternative harvest projections are not AAC recommendations, but

rather some of the many sources of information the chief forester

will consider when setting the new AAC. The starting level harvest

in the base case for the Mackenzie TSA was defined as the maximum

achievable for a live harvest projection. An initial harvest level

was established in the base case at 2.97 million cubic metres per

year to be maintained for 10 years before stepping down annually to

2.47 million cubic metres by the end of the third decade.

Approximately 860,000 cubic metres of sawlog consumption is

necessary to support two-shift capacity operations at our Mackenzie

sawmill complex, the sole sawmill complex presently operating in

the Mackenzie TSA. The harvest level projections in the base and

alternative cases indicate that sawlog surpluses are likely to

persist even after providing for the sawlog consumption required to

sustain capacity operations at our Mackenzie sawmill complex.

Our Annual Information Form for the year ended

December 31, 2021, available on SEDAR, disclosed that licensees in

the Mackenzie TSA are presently required to source a majority of

the annual AAC from dead stands while reserving green timber for

harvesting after the salvage process ended. We also disclosed that

accessing higher quality, green fibre would contribute to lower

harvesting and manufacturing costs, produce higher lumber grade

outturns, and enhance lumber selling price realizations. We

anticipate that when the revised AAC determination scheduled for

release later this year takes effect, the competitiveness of our

Mackenzie sawmill complex will improve, and the facility will

migrate to a lower position on the global lumber industry cost

curve.

Investigating Diversification

Opportunities

Our board of directors and leadership team

remain committed to pursuing affordable investment opportunities

with attractive potential returns on investment to stabilize and

enhance cash flow generation while concurrently maintaining strong

ESG credentials. In furtherance of these objectives, we are

examining the feasibility of developing data center hosting

operations in northern BC to consume surplus power supply that BC

Hydro expects to have available in our operating region through

2030 and beyond. This potential opportunity to develop an

additional complimentary revenue and cash flow stream leverages the

knowledge and expertise we possess as a result of developing our

power generation operations in Mackenzie, BC and operating the

plant on a continuous twenty-four hours a day, seven days a week

basis.

In November 2021, we advised BC Hydro that

Conifex and Tsay Keh Dene First Nations entered into a milestone

partnership agreement (the “Partnership”) to

develop a new business hosting data center or other

high-performance computing (“HPC”) customers such

as digital assets miners. The Partnership commenced hosting an

initial 1.5 megawatts of capacity in December 2021 on a trial basis

and an additional 1.5 megawatts of capacity in early March 2022.

The results from the 3 megawatt trial have been encouraging and the

Partnership gained valuable experience hosting HPC operations under

a variety of weather and operating conditions.

Besides validating our belief that the Conifex

power and corporate service teams have the expertise required to

successfully develop and operate sites serving HPC customers, the

trial enabled the Partnership to gain experience and input

necessary to evaluate the merits of significantly scaling HPC

hosting operations.

The Partnership is now investigating the

feasibility of building a hosting service business at other

potential sites in northern BC. The Partnership has an opportunity

to develop a hosting business in phases, utilizing cash flow

generated from the initial phases to fund the development of

subsequent phases.

We look forward to providing further details

about our progress on this potential initiative in our third

quarter 2022 earnings release. There is no assurance that the

Partnership will establish a data center hosting business.

Conference Call

We have scheduled a conference call on Tuesday,

August 9 at 2:00 PM Pacific time / 5:00 PM Eastern time to discuss

the second quarter 2022 financial and operating results. To

participate in the call, please dial 416-340-2217 or toll free

1-800-806-5484 and entering participant passcode 6816136#. The call

will also be available on instant replay access until September 9,

2022 by dialling 905-694-9451 or 1-800-408-3053 and entering

participant passcode 9702453#.

Our management's discussion and analysis and

financial statements for the quarter ended June 30, 2022 are

available under our profile on SEDAR.

For further information, please contact:

Winny TangChief Financial Officer(604)

216-2949

About Conifex Timber Inc.

Conifex and its subsidiaries' primary business

currently includes timber harvesting, reforestation, forest

management, sawmilling logs into lumber and wood chips, and value

added lumber finishing and distribution. Conifex's lumber products

are sold in the United States, Canadian and Japanese markets.

Conifex also produces bioenergy at its power generation facility at

Mackenzie, BC.

Forward-Looking Statements

Certain statements in this news release may

constitute “forward-looking statements”. Forward-looking statements

are statements that address or discuss activities, events or

developments that Conifex expects or anticipates may occur in the

future. When used in this news release, words such as “estimates”,

“expects”, “plans”, “anticipates”, “projects”, “will”, “believes”,

“intends” “should”, “could”, “may” and other similar terminology

are intended to identify such forward-looking statements.

Forward-looking statements reflect the current expectations and

beliefs of Conifex’s management. Because forward-looking statements

involve known and unknown risks, uncertainties and other factors,

actual results, performance or achievements of Conifex or the

industry may be materially different from those implied by such

forward-looking statements. Examples of such forward-looking

information that may be contained in this news release include

statements regarding: our expectations with respect to the matters

discussed in the PDP released by the MOF on July 15, 2022,

including the chief forester’s determination of the AAC in the

Mackenzie TSA; the realization of expected benefits of completed,

current and any contemplated capital projects and the expected

timing and budgets for such projects, including the build-out of

any HPC or data center operations; the growth and future prospects

of our business, including the impact of COVID-19 thereon; our

planned operating format and expected operating rates; our

perceptions of the industry and markets in which we operate and

anticipated trends in such markets and in the countries in which we

do business; our ability to supply our manufacturing operations

with wood fibre and our expected cost for wood fibre; our

expectation for market volatility associated with, among other

things, the softwood lumber dispute with the U.S.; that we could be

negatively impacted by the duties or other protective measures on

our products, such as AD or CV on softwood lumber; continued

positive relations with Indigenous groups; expectations regarding

the operation of the Mackenzie power plant; our ability to receive

full reimbursement of losses suffered from the disruption at our

Mackenzie power plant; expectations regarding our liquidity levels;

and our expectations for U.S. dollar benchmark prices. Material

factors or assumptions that were applied in drawing a conclusion or

making an estimate set out in the forward-looking statements may

include, but are not limited to, our future debt levels; that we

will complete our projects in the expected timeframes and as

budgeted; that we will effectively market our products; that

capital expenditure levels will be consistent with those estimated

by our management that the US housing market will improve; our

ability to ship products in a timely manner; that there will be no

unforeseen disruptions affecting the operation of our power

generation plant and that we will be able to continue to deliver

power therefrom; our ability to obtain financing on acceptable

terms, or at all; that interest and foreign exchange rates will not

vary materially from current levels; the general health of the

capital markets and the lumber industry; and the general stability

of the economic environments within the countries in which we

operate or do business. Forward-looking statements involve

significant uncertainties, should not be read as a guarantee of

future performance or results, and will not necessarily be an

accurate indication of whether or not such results will be

achieved. A number of factors could cause actual results to differ

materially from the results discussed in the forward-looking

statements, including, without limitation: those relating to

potential disruptions to production and delivery, including as a

result of equipment failures, labour issues, the complex

integration of processes and equipment and other factors; labour

relations; failure to meet regulatory requirements; changes in the

market; potential downturns in economic conditions; fluctuations in

the price and supply of required materials, including log costs;

fluctuations in the market price for products sold; foreign

exchange fluctuations; trade restrictions or import duties imposed

by foreign governments; availability of financing (as necessary);

shipping or logging disruptions; and other risk factors described

in Conifex’s management's discussion and analysis for the year

ended December 31, 2021 and the quarter ended June 30, 2022, which

is available on SEDAR at www.sedar.com. These risks, as well as

others, could cause actual results and events to vary

significantly. Accordingly, readers should exercise caution in

relying upon forward-looking statements and Conifex undertakes no

obligation to publicly revise them to reflect subsequent events or

circumstances, except as required by law.

1 Source: Random Lengths Publications Inc.2 Source: Forest

Economic Advisors, LLC3 Source: Bank of Canada,

www.bankofcanada.ca

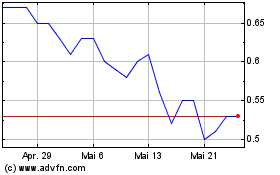

Conifex Timber (TSX:CFF)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Conifex Timber (TSX:CFF)

Historical Stock Chart

Von Dez 2023 bis Dez 2024