Black Iron Closes First Funding

27 September 2019 - 3:27PM

Black Iron Inc. (“Black Iron” or the “Company”) (TSX: BKI) has

closed on the first funding amount of CAD$2,250,000 pursuant to its

previously announced convertible security funding agreement (the

“Agreement”) with Lind Global Macro Fund LP (“Lind”). Pursuant to

the Agreement, Black Iron may issue to Lind convertible securities

in the principal amount of up to CAD$11 million (see the Company’s

press release dated September 18, 2019 for further details).

Pursuant to the Agreement the Company has issued

to Lind (i) a convertible security with a principal amount of

CAD$2.7 million representing a principal amount of CAD$2.25 million

and a pre-paid interest amount of CAD$450,000 (the “Convertible

Security”); and (ii) 13,081,395 warrants exercisable for a term of

48 months at an exercise price of CAD$0.11 per share. The

Company has paid Lind a commitment fee of CAD$78,750.

The Convertible Security will be repaid by Black

Iron through the issuance of common shares at pre-agreed conversion

limits to Lind over a 24-month period. Lind will have the option to

convert up to 1/20th of the face value of the Convertible

Security per month at a price equal to 85% of Black Iron's five-day

volume weighted average share price ("VWAP") immediately prior to

each time Lind notifies Black Iron of its intent to convert. Lind

will be restricted from selling any Black Iron shares it receives

in connection with the Convertible Security for a period of four

months and a day from the date of issuance of the Convertible

Security and is prohibited from short selling Black Iron's shares

during the term of the Agreement.

The Company shall use the net proceeds of the

Convertible Security for working capital purposes. The Agreement

and the issuance of securities thereunder has been conditionally

approved by the Toronto Stock Exchange and is subject to

satisfaction of customary closing conditions. Any additional

issuances of securities under the Agreement will be subject to

shareholder approval.

Project Update

Black Iron’s senior management recently met with

Ukraine’s newly elected Prime Minister and Minister of Economy to

discuss the importance of Black Iron’s project to Ukraine given the

high level of interest from foreign investors to fund construction,

large number of new highly skilled jobs that will be created and

the substantial investment planned. Both Ministers came to the

meeting well briefed on Black Iron, were very pragmatic and stated

their strong support plus alignment with other key ministries,

including the Ministry of Defence, to implement Black Iron’s

project. A single point of contact was assigned by the Prime

Minister to coordinate Black Iron’s Ukraine government support

needs including land transfer with all other agencies.

Black Iron’s management team also met with

Ukraine’s new Minister of Defence to firm up support to expedite

the transfer of essential land for project construction. The

Minister stated he agrees to transfer the needed land by Black Iron

in exchange for fair compensation that will primarily be used to

purchase needed apartments for military personnel. He agreed

to sign a Memorandum of Understanding formalizing this commitment

prior to October month end that will be followed by binding

contracts at year end.

Productive site visits were completed this week

with two multibillion Asian construction firms as part of their due

diligence to consider investing ~US$50M of equity in kind during

project construction. Equity in kind means the construction

company will receive shares of Black Iron on a monthly basis over

the planned twenty-four-month construction period as partial

payment for equipment and services invoiced instead of the full

payment being made in cash. This is beneficial to Black Iron

shareholders as these shares will only be issued once the balance

of construction funding is secured, announced and construction has

commenced at which time Black Iron management expects the Company’s

share price to be materially higher. Black Iron continues to

receive expressions of interest to provide debt for project

construction and a more detailed announcement outlining the

Company’s plan to fund project construction with potentially only a

small amount of equity from the public markets will soon be

provided to investors.

About Black Iron

Black Iron is an iron ore exploration and

development company, advancing its 100% owned Shymanivske project

located in Kryviy Rih, Ukraine. The Shymanivske project contains a

NI 43-101 compliant mineral resource estimated to be 646 Mt

Measured and Indicated mineral resources, consisting of 355 Mt

Measured mineral resources grading 32.0% total iron and 19.5%

magnetic iron, and Indicated mineral resources of 290 Mt grading

31.1% total iron and 17.9% magnetic iron, using a cut-off grade of

10% magnetic iron. Additionally, the Shymanivske project contains

188 Mt of Inferred mineral resources grading 30.1% total iron and

18.4% magnetic iron. Full mineral resource details can be found in

the NI 43-101 compliant technical report entitled “Preliminary

Economic Assessment of the Re-scoped Shymanivske Iron Ore Deposit”

effective November 21, 2017 (the “PEA”) under the Company’s profile

on SEDAR at www.sedar.com. The Shymanivske project is surrounded by

five other operating mines, including ArcelorMittal's iron ore

complex. Please visit the Company's website at www.blackiron.com

for more information.

The technical and scientific contents of this

press release have been prepared under the supervision of and have

been reviewed and approved by Matt Simpson, P.Eng, CEO of Black

Iron, who is a Qualified Person as defined by NI 43-101.

For more information, please

contact:

| Matt

SimpsonChief Executive OfficerBlack Iron Inc.Tel: +1 (416)

309-2138 |

|

|

Forward-Looking Information

This press release contains forward-looking

information. Forward-looking information is based on what

management believes to be reasonable assumptions, opinions and

estimates of the date such statements are made based on information

available to them at that time. Forward-looking information

may include, but is not limited to, statements with respect to the

Company’s ability to develop the Shymanivske project, the repayment

of the Convertible Security, the mineralization of the Shymanivske

project, the Company’s ability to raise adequate capital, the

Company’s ability to secure the requisite land rights and the

Company’s future plans. Generally, forward looking information can

be identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: general business, economic, competitive, geopolitical

and social uncertainties; the actual results of current exploration

activities; other risks of the mining industry and the risks

described in the annual information form of the Company. Although

the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward looking information. The Company

does not undertake to update any forward-looking information,

except in accordance with applicable securities laws. The Company

notes that mineral resources that are not mineral reserves do not

have demonstrated economic viability.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act") or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.

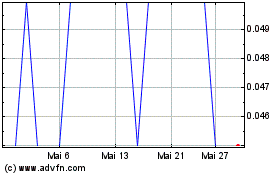

Black Iron (TSX:BKI)

Historical Stock Chart

Von Feb 2025 bis Mär 2025

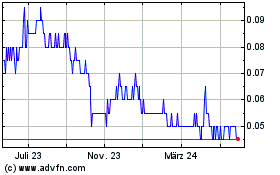

Black Iron (TSX:BKI)

Historical Stock Chart

Von Mär 2024 bis Mär 2025