Black Iron Inc. (“Black Iron” or the “Company”) (TSX:BKI)

(OTC:BKIRF) (FRANKFURT:BIN) continues to advance the Shymanivske

Iron Ore Project (“Shymanivske” or the “Project”) towards

construction. The Company has made significant progress

towards acquiring the surface rights for the land required for

construction and is working on securing financing for the

Project. The Company has received significant interest from

potential off-take partners as a result of the strengthening of the

iron ore price, which has increased by more than 25% since the

re-scoped Preliminary Economic Assessment (“PEA”) was released on

November 21, 2017. Land acquisition and the securing of

future financing are two of the critical path activities required

to advance Shymanivske to construction.

IRON ORE PRICES CONTINUE TO STRENGTHEN

IMPROVING PROJECT IRR TO OVER 50%

Since publishing the re-scoped Preliminary

Economic Assessment, benchmark iron ore prices have rallied from

US$62 per tonne (“T”) to US$70/T as of March 9, 2018, an increase

of close to 13% resulting in stronger economic returns and

significant interest in the Project. Figure 1 provides the

Project’s projected Net Present Value (“NPV”) and Internal Rate of

Return (“IRR”) based on the current iron ore (“Fe”) price and

quality adjustments using a 10% discount rate.

A photo accompanying this announcement is

available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/a539abc3-ddb6-4ed2-9fe7-48ee876a637b

Based on prevailing iron ore prices and

adjustments for product quality mainly related to iron content,

Black Iron’s construction capital is estimated to have an estimated

51% after tax IRR and US$1.4 billion NPV, assuming 60% debt

financing, 10% discount rate and an initial capital cost of US$436

million. Even under highly pessimistic long-term iron ore

prices of US$50/T, the Project generates IRR’s in excess of

20%.

LAND ACQUISITION ADVANCING

Since releasing the revised Project economics,

the Company has accelerated its efforts to secure the necessary

land surface rights for the mine and plant.

The leases related to three parcels of land that

are required to begin construction are currently held within two

Ukrainian Government groups. The first parcel of land is held

by the Kryviy Rih City Council who have been very supportive. In

December 2016, they arranged public hearings on behalf of the

Company which were very positive and led to the required permission

to conduct a land allotment study on the property. The land

allotment study is a detailed report which shows the Kryviy Rih

City Council how the Company proposes to use the leased land.

Black Iron’s team and specialist consultants have completed more

than 50% of the land allotment study to date. The second

parcel of land is held by Ukraine’s Central Government and is

currently being used by the Ministry of Defence for training

purposes. Multiple discussions have been held, year to date,

with high ranking Ukrainian Government officials including the

First Deputy Prime Minister and Deputy Minister of Defence of

Ukraine, both of whom are supportive of the Project and are now

reviewing options for the land transfer. The final parcel of

land is held by Ukraine’s State Forestry, who have submitted the

required documents for this land to be re-zoned and transferred to

the Kryviy Rih City Council, who will in turn, lease the property

to the Company.

The acquisition of these land packages will

represent a significant milestone in beginning construction of the

Project and the Company expects this process to be completed prior

to year end.

CONSTRUCTION FUNDING AND OFF-TAKE

AGREEMENTS ADVANCING

The Company continues to pursue various

financing options for construction of the Project and has received

significant interest from multiple groups which are currently

conducting due diligence. Interest is driven by the prolific

economics of the Project, supported by the low initial capital

costs, and the opportunity for financiers to secure access to the

ultra high-grade premium iron product that Shymanivske is expected

to produce. The ultra high-grade premium 68% Fe product is in

the top 4% of the world’s current production, is rare and commands

a very significant premium. The potential financiers include

several multi billion-dollar steel mills, global trading houses and

other mining companies. Due diligence is well advanced, in

most cases, with on-site visits by these prospective financiers

being the next step. In addition, CRU has been commissioned

to conduct a detailed marketing study on behalf of Black Iron to

identify additional buyers of the ultra premium product who will

also be targeted for financing and to potentially secure other

off-take agreements.

Obtaining financing for the Project will

represent another significant milestone toward the construction of

Shymanivske and the Company is pleased with the level of interest

it is receiving from potential financiers.

Over the coming months, the Company expects to

secure the land leases and formalize financing while also renewing

its major infrastructure contracts. Once these milestones

have been achieved, the Company will be well positioned to initiate

construction.

About Black IronBlack Iron is

an iron ore exploration and development company, advancing its 100%

owned Shymanivske project located in Kryviy Rih, Ukraine. The

Shymanivske project contains a NI 43-101 compliant resource

estimated to be 646 Mt Measured and Indicated mineral resources,

consisting of 355 Mt Measured mineral resources grading 31.6% total

iron and 18.8% magnetic iron, and Indicated mineral resources of

290 Mt grading 31.1% total iron and 17.9% magnetic iron, using a

cut-off grade of 10% magnetic iron. Additionally, the Shymanivske

project contains 188 Mt of Inferred mineral resources grading 30.1%

total iron and 18.4% magnetic iron. Full mineral resource details

can be found in the NI 43-101 compliant technical report entitled

“Preliminary Economic Assessment of the Re-scoped Shymanivske Iron

Ore Deposit” effective November 21, 2017 under the Company's

profile on SEDAR at www.sedar.com. The Shymanivske project is

surrounded by five other operating mines, including ArcelorMittal's

iron ore complex. Please visit the Company's website at

www.blackiron.com for more information.

The technical and scientific contents of this

press release have been prepared under the supervision of and have

been reviewed and approved by Matt Simpson, P.Eng., CEO of Black

Iron, who is a Qualified Person as defined by NI 43-101.

Cautionary Statement

The PEA is preliminary in nature, and it

includes inferred mineral resources that are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral

reserves. There is no certainty that the PEA will be realized.

| For

more information, please contact: |

| |

|

Lisa Doddridge |

Matt Simpson |

| Vice

President, Strategic Communications

|

Chief

Executive Officer |

| Tel:

+1 (416) 309-2698 |

Tel:

+1 (416) 309-2138 |

|

info@blackiron.com |

|

Forward-Looking Information

This press release contains forward-looking

information. Forward-looking information is based on what

management believes to be reasonable assumptions, opinions and

estimates of the date such statements are made based on information

available to them at that time, including those factors discussed

in the section entitled ‘‘Risk Factors’’ in the Company’s annual

information form for the year ended December 31, 2016 or as may be

identified in the Company’s public disclosure from time to time, as

filed under the Company’s profile on SEDAR at www.sedar.com.

Forward-looking information may include, but is not limited to,

statements with respect to the Project, the mineralization of the

Project, the results of the PEA, the realization of the PEA, the

expectations of future cash flows, the expected economics forecast,

the geo-political climate in Ukraine, the Company’s ability to

obtain the requisite land rights for the Project and other

requisite permits or approvals, the Company’s ability to secure

financing for the Project and future plans for the Company’s

development. Generally, forward looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: general business, economic, competitive, geopolitical

and social uncertainties; the actual results of current exploration

activities; other risks of the mining industry and the risks

described in the annual information form of the Company. Although

the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward looking information. The Company

does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

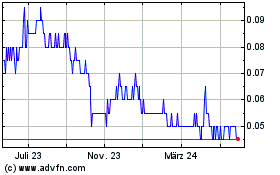

Black Iron (TSX:BKI)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

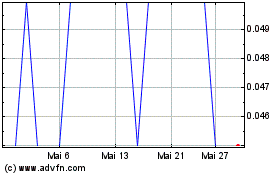

Black Iron (TSX:BKI)

Historical Stock Chart

Von Feb 2024 bis Feb 2025