Argonaut Gold Inc. (TSX:AR) (the "Company", "Argonaut Gold" or "Argonaut") is

pleased to announce its financial and operating results for the second quarter

ended June 30, 2013. All dollar amounts are expressed in United States dollars

unless otherwise specified.

----------------------------------------------------------------------------

2nd Quarter 6 months

------------------ ------------------

2013 2012 Change 2013 2012 Change

----------------------------------------------------------------------------

Financials (000s)

----------------------------------------------------------------------------

Revenue $44,930 $37,544 up 20% $88,010 $61,897 up 42%

----------------------------------------------------------------------------

Net income $6,494 $11,314 down 43% $18,109 $18,574 down 3%

----------------------------------------------------------------------------

Income per share -

basic $0.04 $0.12 down 67% $0.12 $0.20 down 40%

----------------------------------------------------------------------------

Cash flow from

operating

activities before

changes in non-cash

operating working

capital and other

items $16,756 $16,406 up 2% $36,107 $24,547 up 47%

----------------------------------------------------------------------------

Cash and cash

equivalents $139,752 $21,443 up 552% $139,752 $21,443 up 552%

----------------------------------------------------------------------------

Gold production and cost:

----------------------------------------------------------------------------

Gold ozs. loaded to

the pad 42,965 45,393 down 5% 82,751 89,562 down 8%

----------------------------------------------------------------------------

Gold ozs. produced 33,586 24,123 up 39% 62,493 45,007 up 39%

----------------------------------------------------------------------------

Gold ozs. sold 31,756 23,247 up 37% 57,197 37,745 up 52%

----------------------------------------------------------------------------

Average realized

sales price $1,388 $1,600 down 13% $1,492 $1,630 down 8%

----------------------------------------------------------------------------

Cash cost per gold

oz sold $643 $620 up 4% $621 $627 down 1%

----------------------------------------------------------------------------

SECOND QUARTER 2013 & RECENT HIGHLIGHTS

-- Capital expenditures of $31.1 million on mineral properties, plant and

equipment

-- El Castillo operations:

-- Record tonnes crushed and loaded to the east pad

-- West Side Pad 8 loading continues with ongoing construction during

2013

-- Overland conveying construction initiated with completion and

operation expected in the third quarter

-- La Colorada operations:

-- Pre-stripping continues at the La Colorada pit

-- New crushing system has been installed and is expected to be

complete and operational in the third quarter of 2013

-- San Antonio and Magino permitting process continues

-- Subsequent to quarter-end, the Company acquired the rights to a 3% net

smelter royalty on certain La Colorada mining concessions for $3.6

million. This royalty was assessed at $10.3 million in the economic

analysis in the La Colorada Project National Instrument 43-101

Preliminary Economic Assessment dated December 30, 2011.

CEO Commentary

Pete Dougherty, President and CEO of Argonaut Gold, stated "This was a

tremendous quarter and first half of the year for the Company. New production

highs were achieved while implementing new capital expansion programs. The

majority of capital expenditures at El Castillo and La Colorada have been

incurred in the first half of the year. El Castillo pad construction will

continue through the year and construction of the overland conveyor is expected

to be completed and operational by the end of the third quarter. The La Colorada

crusher has been installed and is in the commissioning stages. Cash costs at El

Castillo have been relatively constant since inception in spite of inflationary

pressures. The 2013 capital expenditure projects is aimed at reducing operating

costs and providing production growth at both mines."

The Company is on track to meet production guidance established at the beginning

of the year. Company guidance is maintained for 120,000 to 140,000 ounces of

gold production at a cash cost per gold ounce sold of $630 to $660 (cash cost

per gold ounce sold is a non-IFRS measure, see note below).

Financial Results - Second Quarter 2013

During the second quarter of 2013, revenue was $44.9 million from gold sales of

31,756 ounces, compared to $37.5 million from gold sales of 23,247 ounces in the

second quarter of 2012. Cash cost per gold ounce sold in the quarter was $643,

compared to $620 in the same period of the prior year.

During the second quarter of 2013, gross profit was $16.9 million, compared to

$18.2 million in the second quarter of 2012. During the quarter, profit from

operations was $12.8 million, compared to $15.9 million in the same period of

the prior year. Net income for the period was $6.5 million, or $0.04 per basic

share, versus $11.3 million, or $0.12 per basic share, in the second quarter of

2012.

Cash and cash equivalents was $139.8 million at June 30, 2013. Capital

expenditures in the second quarter were $31.1 million, primarily as a result of

infrastructure improvements at the El Castillo and La Colorada mines.

Financial Results - Six months ended June 30, 2013

During the six months ended June 30, 2013, revenue was $88.0 million from gold

sales of 57,197 ounces, compared to $61.9 million from gold sales of 37,745

ounces in the first half of 2012. Cash cost per gold ounce sold in the six

months ended June 30, 2013 was $621, compared to $627 in the same period of the

prior year.

During the first half of 2013, gross profit was $37.8 million, compared to $30.5

million in the first half of 2012. During the six months ended June 30, 2013,

profit from operations was $30.0 million, compared to $25.6 million in the same

period of the prior year. Net income for the period was $18.1 million, or $0.12

per basic share, versus $18.6 million, or $0.20 per basic share, in the six

months ended June 30, 2012.

This press release should be read in conjunction with the Company's unaudited

interim condensed consolidated financial statements for the three and six months

ended June 30, 2013 and associated management's discussion and analysis

("MD&A"), which are available from the Company's website, www.argonautgold.com,

in the "Investors" section under "Financial Filings", and under the Company's

profile on SEDAR at www.sedar.com.

El CASTILLO OPERATING STATISTICS

3 Months Ended June 30 6 Months Ended June 30

% %

2013 2012 Change 2013 2012 Change

----------------------------------------------------------------------------

Mining (Tonnes)

Tonnes ore 3,277,688 2,506,756 up 31% 6,450,460 5,557,283 up 16%

Tonnes waste 3,417,585 2,530,645 up 35% 6,431,190 5,445,042 up 18%

Tonnes mined 6,695,273 5,037,401 up 33% 12,881,650 11,002,325 up 17%

Waste / Ore

ratio 1.04 1.01 up 3% 1.00 0.98 up 2%

Heap Leach Pad

(Tonnes)

Tonnes ore

direct to

leach pad 1,710,134 1,533,188 up 12% 3,439,530 3,717,080 down 7%

Tonnes crushed 1,564,681 1,164,340 up 34% 2,996,367 2,002,718 up 50%

Production

Gold grade

(g/t) 0.38 0.41 down 7% 0.37 0.38 down 3%

Gold loaded to

leach pad (oz) 40,169 35,220 up 14% 76,192 70,503 up 8%

Gold produced

(oz) 28,075 19,533 up 44% 51,200 37,332 up 37%

Gold ounces

sold 26,705 17,949 up 49% 46,214 32,447 up 42%

Silver ounces

sold 8,940 2,410 up 271% 17,627 3,820 up 361%

Cash cost per

gold ounce

sold $691 $632 up 9% $695 $635 up 9%

(1) "g/t" is grams per tonne

(2) "oz" means troy ounce

Summary of Production Results at El Castillo

Total tonnes mined in the second quarter 2013 were up 33 percent, compared to

the second quarter of 2012. Record crushed tonnes were achieved again with 1.6

million tonnes during the second quarter, representing a 34 percent increase

over the second quarter of 2012. The total ounces loaded to the leach pad were

40,169 in the second quarter of 2013, a 14 percent increase over the second

quarter of 2012. The stripping ratio of waste to ore remained relatively

consistent between periods.

The 2013 production guidance is expected to be between 90,000-100,000 ounces

with a cash cost between $700 and $725 per gold ounce sold.

LA COLORADA OPERATING STATISTICS

3 Months Ended June 30 6 Months Ended June 30

2013 2012 % Change 2013 2012 % Change

----------------------------------------------------------------------------

Mining (Tonnes)

Tonnes ore 341,782 - up 100% 898,419 - up 100%

Tonnes waste 3,801,660 - up 100% 7,600,285 - up 100%

Tonnes mined 4,143,442 - up 100% 8,498,704 - up 100%

Waste / ore ratio 11.12 - up 100% 8.46 - up 100%

Tonnes moved 4,143,442 840,241 up 393% 8,498,704 1,518,551 up 460%

Heap Leach Pad

(Tonnes)

Crushed ore

tonnes to pad 312,466 743,533 down 58% 715,014 1,423,929 down 50%

Production

Gold grade (g/t) 0.28 0.43 down 35% 0.29 0.42 down 31%

Gold loaded to

leach pad (oz) 2,796 10,173 down 73% 6,559 19,059 down 66%

Gold produced

(oz) 5,511 4,590 up 20% 11,293 7,675 up 47%

Gold ounces sold 5,051 5,298 down 5% 10,983 5,298 up 107%

Silver produced

(oz) 45,318 25,796 up 76% 90,197 42,978 up 110%

Silver ounces

sold 27,801 9,748 up 185% 82,070 9,748 up 742%

Cash Cost per

ounce sold $391 $578 down 32% $309 $578 down 47%

(1) "g/t" is grams per tonne

(2) "oz" means troy ounce

Summary of Production Results at La Colorada

2013 production to date has exceeded initial forecasts as re-leaching of the old

heap leach material pad has continued. Ore tonnes processed and grades are

expected to increase in the second half of the year as the pit is opened to

higher grade ore during the third quarter. During the third quarter we also

anticipate the crusher to be completed and operational.

The 2013 production guidance is between 30,000-40,000 ounces, back loaded to the

second half of the year, with a cash cost, net of by-product credits, between

$450 and $475 per gold ounce sold.

Expansion Projects for 2013

The Company plans on investing $80 million on capital expenditures and

exploration initiatives in 2013. Major capital expenditures in 2013 are expected

to include approximately $30 million at El Castillo, $22 million at La Colorada,

$10 million at Magino (excluding exploration) and $4 million at San Antonio.

Exploration expenditures in 2013 are expected to amount to $10 million.

Additionally, the Company will incur $4 million for the purchased rights to a

royalty on certain La Colorada mining concessions.

The Company will be hosting a conference call and webcast to discuss the second

quarter financial results on August 13, 2013 at 8:30 a.m. ET (5:30 a.m. PT).

Q2 Conference Call Information:

Toll Free (North America): 1-866-223-7781

International: 1-416-340-8018

Webcast: http://www.argonautgold.com/

Q2 Conference Call Replay:

The conference call replay will be available from 10:30 a.m. ET on August

13, 2013 until August 20, 2013.

Toll Free Replay Call (North America): 1-800-408-3053

International Replay Call: 1-905-694-9451

Passcode: 7979249

Non-IFRS Measures

The Company included the non-IFRS measure "Cash cost per gold ounce sold" in

this press release to supplement its financial statements which are presented in

accordance with International Financial Reporting Standards ("IFRS"). Cash cost

per gold ounce sold is equal to production costs less silver sales divided by

gold ounces sold. The Company believes that this measure provides investors with

an improved ability to evaluate the performance of the Company. Non-IFRS

measures do not have any standardized meaning prescribed under IFRS. Therefore

they may not be comparable to similar measures employed by other companies. The

data is intended to provide additional information and should not be considered

in isolation or as a substitute for measures of performance prepared in

accordance with IFRS. Please see the MD&A for full disclosure on non-IFRS

measures.

Technical Information and Mineral Properties Reports

For further information on the Company's properties please see the reports as

listed below on the Company's website or on www.sedar.com:

----------------------------------------------------------------------------

El Castillo Mine NI 43-101 Technical Report on Resources and

Reserves, Argonaut Gold Inc., El Castillo Mine,

Durango State, Mexico dated November 6, 2010

----------------------------------------------------------------------------

La Colorada Mine NI 43-101 Preliminary Economic Assessment La

Colorada Project, Sonora, Mexico dated December

30, 2011

----------------------------------------------------------------------------

Magino Gold Project NI 43-101 Technical Report and Mineral Resource

Estimate on the Magino Gold Project, Ontario,

Toronto, Canada dated October 4, 2012

----------------------------------------------------------------------------

San Antonio Gold Project NI 43-101 Technical Report and Mineral Resource

Estimate on the San Antonio Gold Project, Baja

California Sur, Mexico dated October 10, 2012

----------------------------------------------------------------------------

About Argonaut Gold

Argonaut Gold is a Canadian gold company engaged in exploration, mine

development and production activities. Its primary assets are the production

stage El Castillo Mine in Durango, Mexico and the La Colorada Mine in Sonora,

Mexico, the advanced exploration stage San Antonio project in Baja California

Sur, Mexico, the advanced exploration stage Magino project in Ontario, Canada

and several exploration stage projects, all of which are located in North

America.

Creating Value Beyond Gold

Cautionary Note Regarding Forward-looking Statements

This press release contains certain "forward-looking statements" and

"forward-looking information" under applicable Canadian securities laws

concerning the proposed transaction and the business, operations and financial

performance and condition of Argonaut Gold Inc. ("Argonaut"). Forward-looking

statements and forward-looking information include, but are not limited to,

statements with respect to estimated production and mine life of the various

mineral projects of Argonaut; synergies and financial impact of completed

acquisitions; the benefits of the development potential of the properties of

Argonaut; the future price of gold, copper, and silver; the estimation of

mineral reserves and resources; the realization of mineral reserve estimates;

the timing and amount of estimated future production; costs of production;

success of exploration activities; and currency exchange rate fluctuations.

Except for statements of historical fact relating to Argonaut, certain

information contained herein constitutes forward-looking statements.

Forward-looking statements are frequently characterized by words such as "plan,"

"expect," "project," "intend," "believe," "anticipate", "estimate" and other

similar words, or statements that certain events or conditions "may" or "will"

occur. Forward-looking statements are based on the opinions and estimates of

management at the date the statements are made, and are based on a number of

assumptions and subject to a variety of risks and uncertainties and other

factors that could cause actual events or results to differ materially from

those projected in the forward-looking statements. Many of these assumptions are

based on factors and events that are not within the control of Argonaut and

there is no assurance they will prove to be correct.

Factors that could cause actual results to vary materially from results

anticipated by such forward-looking statements include changes in market

conditions, variations in ore grade or recovery rates, risks relating to

international operations, fluctuating metal prices and currency exchange rates,

changes in project parameters, the possibility of project cost overruns or

unanticipated costs and expenses, labour disputes and other risks of the mining

industry, failure of plant, equipment or processes to operate as anticipated.

Although Argonaut has attempted to identify important factors that could cause

actual actions, events or results to differ materially from those described in

forward-looking statements, there may be other factors that cause actions,

events or results not to be anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those anticipated in such

statements. Argonaut undertakes no obligation to update forward-looking

statements if circumstances or management's estimates or opinions should change

except as required by applicable securities laws. The reader is cautioned not to

place undue reliance on forward-looking statements. Statements concerning

mineral reserve and resource estimates may also be deemed to constitute

forward-looking statements to the extent they involve estimates of the

mineralization that will be encountered if the property is developed.

Comparative market information is as of a date prior to the date of this

document.

FOR FURTHER INFORMATION PLEASE CONTACT:

Argonaut Gold Inc.

Nichole Cowles

Investor Relations Manager

(775) 284-4422 x 101

nichole.cowles@argonautgold.com

www.argonautgold.com

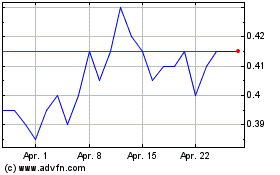

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

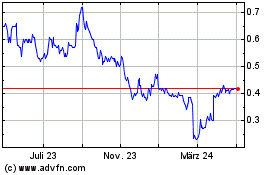

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024