Argonaut Gold Inc. (TSX:AR) (the "Company", "Argonaut Gold" or "Argonaut") is

pleased to announce its financial and operating results for the first quarter

ended March 31, 2013. All dollar amounts are expressed in United States dollars

unless otherwise specified.

----------------------------------------------------------------------------

1st Quarter

----------------------------

2013 2012 Change

----------------------------------------------------------------------------

Financials (000s)

----------------------------------------------------------------------------

Revenue $ 43,080 $ 24,353 up 77%

----------------------------------------------------------------------------

Net income $ 11,615 $ 7,260 up 60%

----------------------------------------------------------------------------

Income per share - basic $ 0.08 $ 0.08 N/A

----------------------------------------------------------------------------

Cash flow from operating activities

before changes in non-cash

operating working capital and other

items $ 19,351 $ 8,141 up 138%

----------------------------------------------------------------------------

Cash and cash equivalents $ 168,514 $ 17,779 up 848%

----------------------------------------------------------------------------

Gold production and cost:

----------------------------------------------------------------------------

Gold ounces loaded to pads 39,786 44,169 down 10%

----------------------------------------------------------------------------

Gold ounces produced 28,907 20,884 up 38%

----------------------------------------------------------------------------

Gold ounces sold 25,441 14,498 up 75%

----------------------------------------------------------------------------

Average realized sales price $ 1,622 $ 1,677 down 3%

----------------------------------------------------------------------------

Cash cost per gold ounce sold $ 594 $ 639 down 7%

----------------------------------------------------------------------------

FIRST QUARTER 2013 & RECENT HIGHLIGHTS

-- Capital expenditures of $18.8 million on mineral properties, plant and

equipment

-- El Castillo operations:

-- Pad 8 construction well under way with stacking of ore and leaching

-- Argonaut is now operating all mining internally, having assumed

prior contractor mining activities in March 2013

-- Over 360,000 gold ounces were added to the in-pit resources relating

to sulphide mineralization

-- La Colorada operations:

-- Pad construction initiated in 2012 continues to progress well and we

have now begun loading and leaching

-- Crushing circuit expansion continues and is scheduled to be

completed and operational in the third quarter of 2013

-- Updated resource for the Veta Madre deposit added 110,000 inferred

gold ounces, with potential for further expansion

-- San Antonio and Magino permitting process underway

CEO Commentary

Pete Dougherty, President and CEO of Argonaut Gold stated "2013 will see a

substantial investment in both the El Castillo and La Colorada operations as we

bring forward our capital expansion programs. At El Castillo, the addition of

the new heap leach pads and west side crusher/overland conveyor is aimed at

reducing operating costs and providing production growth; both should be fully

functional in the third quarter of this year. At La Colorada, the Company

continues to open the ore body and construct the new crusher; both are

anticipated to provide improved production in the second half of the year.

Overall operations are showing steady improvement toward our 2013 goals and

objectives and we are poised to make our guidance provided earlier."

Financial Results - First Quarter 2013

During the first quarter of 2013, revenue was $43.1 million from gold sales of

25,441 ounces, compared to $24.4 million from gold sales of 14,498 ounces in the

first quarter of 2012. Cash cost per gold ounce sold in the quarter was $594,

compared to $639 in the same period of the prior year (cash cost per gold ounce

sold is a non-IFRS measure, see note below).

During the first quarter of 2013, gross profit was $21.0 million, compared to

$12.3 million in the first quarter of 2012. During the quarter, profit from

operations was $17.2 million, compared to $9.7 million in the same period of the

prior year. Net income for the period was $11.6 million, or $0.08 per basic

share, versus $7.3 million, or $0.08 per basic share, in the first quarter of

2012.

Cash and cash equivalents was $168.5 million at March 31, 2013. Capital

expenditures in the first quarter were $18.8 million primarily as a result of

infrastructure improvements at the El Castillo and La Colorada mines.

This press release should be read in conjunction with the Company's unaudited

interim condensed consolidated financial statements for the quarter ended March

31, 2013 and associated management's discussion and analysis ("MD&A") which are

available from the Company's website, www.argonautgold.com, in the "Investors"

section under "Financial Filings", and under the Company's profile on SEDAR at

www.sedar.com.

El Castillo Operating Statistics

Q1 2013 Q1 2012 Change

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Tonnes ore 3,172,772 3,050,527 up 4%

Tonnes waste 3,013,605 2,914,397 up 3%

Tonnes mined 6,186,377 5,964,924 up 4%

Waste/ore ratio 0.95 0.96 down 1%

Tonnes ore direct to leach pad 1,729,396 2,183,893 down 21%

Tonnes crushed 1,431,686 838,378 up 71%

Average grams per tonne of gold to

leach pad 0.35 0.36 down 3%

Gold loaded to leach pad (oz) 36,023 35,283 up 2%

Gold produced (oz) 23,125 17,799 up 30%

Gold ounces sold 19,509 14,498 up 35%

Silver ounces sold 8,687 1,410 up 516%

Cash cost per gold ounce sold $ 702 $ 639 up 10%

Summary of Production Results at El Castillo

As of mid-March, we assumed the day to day mining operations at El Castillo from

the former mining contractor. We hope to bring further efficiencies to the

mining process through this investment. Total tonnes mined in the first quarter

2013 were up 4 percent, compared to the first quarter of 2012. Of note, the 1.4

million tonnes crushed in the first quarter was a new record for El Castillo and

represented a 71 percent increase in crushed tonnes, over the first quarter of

2012. The total ounces loaded to the leach pad were 36,023 in the first quarter

of 2013, a 2 percent increase over the first quarter of 2012. The stripping

ratio of waste to ore remained relatively consistent between periods.

The 2013 production guidance at El Castillo is expected to be between

90,000-100,000 ounces with a cash cost between $700 and $725 per gold ounce

sold.

La Colorada Operating Statistics

Q1 2013 Q1 2012 Change

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Tonnes ore 556,637 - N/A

Tonnes waste 3,798,625 - N/A

Tonnes mined 4,355,262 - N/A

Waste/ore ratio 6.82 - N/A

Tonnes moved 4,355,262 678,310 up 542%

Tonnes ore direct to leach pad - - N/A

Tonnes crushed 402,548 680,396 down 41%

Average grams per tonne of gold to

leach pad 0.27 0.41 down 34%

Gold loaded to leach pad (oz) 3,763 8,886 down 58%

Gold produced (oz) 5,782 3,085 up 87%

Gold ounces sold 5,932 - N/A

Silver produced (oz) 44,879 17,182 up 161%

Silver ounces sold 54,269 - N/A

Cash cost per gold ounce sold $ 240 $ - N/A

Summary of Production Results at La Colorada

Overburden removal began in the fourth quarter of 2012; we have now increased

the daily mining rate to roughly 50,000 tonnes per day. During removal of the

overburden we have encountered some marginally mineralized material at 0.27 g/t

for the first quarter. We are on schedule to have the pit opened to ore in the

third quarter. As a result, we anticipate mineralization to increase during the

second half of the year.

The 2013 production guidance at La Colorada is between 30,000-40,000 ounces,

back loaded to the second half of the year, with a cash cost between $450 and

$475 per gold ounce sold.

Expansion Projects for 2013

The Company plans on investing a total of between $64 million to $74 million on

capital expenditures and exploration initiatives in 2013. Major capital

expenditures in 2013 are expected to include approximately $25 million at El

Castillo, $19 million at La Colorada, $6 million at Magino, between $5 million

and $11 million at San Antonio and between $2 million and $3 million for other

capital expenditures. Exploration expenditures in 2013 are expected to amount to

between $7 million and $10 million.

Non-IFRS Measures

The Company included the non-IFRS measure "Cash cost per gold ounce sold" in

this press release to supplement its financial statements which are presented in

accordance with International Financial Reporting Standards ("IFRS"). Cash cost

per gold ounce sold is equal to production costs less silver sales divided by

gold ounces sold. The Company believes that this measure provides investors with

an improved ability to evaluate the performance of the Company. Non-IFRS

measures do not have any standardized meaning prescribed under IFRS. Therefore

they may not be comparable to similar measures employed by other companies. The

data is intended to provide additional information and should not be considered

in isolation or as a substitute for measures of performance prepared in

accordance with IFRS. Please see the MD&A for full disclosure on non-IFRS

measures.

Qualified Person, Technical Information and Mineral Properties Reports

The technical information contained in this document has been prepared under

supervision of, and reviewed and approved by Mr. Thomas H. Burkhart, Argonaut's

Vice President of Exploration, a qualified person as defined by National

Instrument 43-101. Mr. Alberto Orozco, Argonaut's Mexico Exploration Manager

also supervised the drill programs and on-site sample preparation procedures at

La Colorada. Bret Swanson of SRK of Denver, CO, who is an "Independent Qualified

Person" as defined by NI 43-101 and the lead person responsible for completing

the updated Veta Madre resource has reviewed this press release as it relates to

Veta Madre.

For further information on the Company's properties please see the reports as

listed below on the Company's website or on www.sedar.com:

----------------------------------------------------------------------------

El Castillo NI 43-101 Technical Report on Resources and Reserves, Argonaut

Mine Gold Inc., El Castillo Mine, Durango State, Mexico dated

November 6, 2010

----------------------------------------------------------------------------

La Colorada NI 43-101 Preliminary Economic Assessment La Colorada Project,

Mine Sonora, Mexico dated December 8, 2011

----------------------------------------------------------------------------

Magino Gold NI 43-101 Technical Report and Mineral Resource Estimate on

Project the Magino Gold Project, Ontario, Toronto, Canada dated

October 4, 2012

----------------------------------------------------------------------------

San Antonio NI 43-101 Technical Report and Mineral Resource Estimate on

Gold Project the San Antonio Gold Project, Baja California Sur, Mexico

dated October 10, 2012

----------------------------------------------------------------------------

About Argonaut Gold

Argonaut Gold is a Canadian gold company engaged in exploration, mine

development and production activities. Its primary assets are the production

stage El Castillo Mine in Durango, Mexico and the La Colorada Mine in Sonora,

Mexico, the advanced exploration stage San Antonio project in Baja California

Sur, Mexico, the recently acquired advanced exploration stage Magino project in

Ontario, Canada and several exploration stage projects, all of which are located

in North America.

Creating Value Beyond Gold

Cautionary Note Regarding Forward-looking Statements

This news release contains forward-looking statements that involve risks and

uncertainties that could cause results to differ materially from management's

current expectations. Actual results may differ materially due to a number of

factors. Except as required by law, Argonaut Gold Inc. assumes no obligation to

update the forward-looking information contained in this news release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Argonaut Gold Inc.

Nichole Cowles

Investor Relations Manager

(775) 284-4422 x 101

nichole.cowles@argonautgold.com

www.argonautgold.com

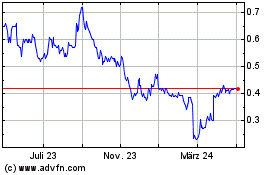

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

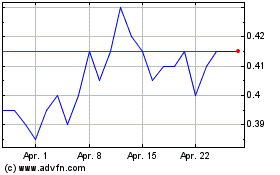

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024