Argonaut Gold Inc. (TSX:AR) (the "Company", "Argonaut Gold" or "Argonaut") is

pleased to announce its financial and operating results for the fourth quarter

and year ended December 31, 2011. All dollar amounts are expressed in United

States dollars unless otherwise specified.

2011 YEAR END HIGHLIGHTS:

----------------------------------------------------------------------------

4th Quarter

------------------------------

12/31/2011 12/31/2010 Change

----------------------------------------------------------------------------

Financials

----------------------------------------------------------------------------

Revenue $34,552,626 $19,885,954 +74%

----------------------------------------------------------------------------

Net income (loss) $9,123,486 $4,100,252 +122%

----------------------------------------------------------------------------

Income per share - basic $0.10 $0.07 +43%

----------------------------------------------------------------------------

Cash flow from operating

activities before changes in

non-cash operating working

capital and other items $15,333,075 $7,254,107 +111%

----------------------------------------------------------------------------

Gold production and cost:

----------------------------------------------------------------------------

Gold ounces loaded to the pad 30,162 31,095 -3%

----------------------------------------------------------------------------

Gold ounces produced 19,698 18,292 +8%

----------------------------------------------------------------------------

Cash cost per ounce for units

sold $679 $579 +17%

----------------------------------------------------------------------------

Cost per tonne $4.81 $4.06 +19%

----------------------------------------------------------------------------

El Castillo operating statistics

----------------------------------------------------------------------------

Total tonnes mined 2.9 million 2.6 million +14%

----------------------------------------------------------------------------

Ore tonnes mined 5.4 million 4.9 million +11%

----------------------------------------------------------------------------

2011 YEAR END HIGHLIGHTS:

----------------------------------------------------------------------------

Year End

------------------------------

12/31/2011 12/31/2010 Change

----------------------------------------------------------------------------

Financials

----------------------------------------------------------------------------

Revenue $104,567,698 $51,562,435 +103%

----------------------------------------------------------------------------

Net income (loss) $26,272,247 $3,758,629 +592%

----------------------------------------------------------------------------

Income per share - basic $0.30 $0.07 +328%

----------------------------------------------------------------------------

Cash flow from operating

activities before changes in

non-cash operating working

capital and other items $41,906,254 $8,709,324 +381%

----------------------------------------------------------------------------

Gold production and cost:

----------------------------------------------------------------------------

Gold ounces loaded to the pad 117,939 91,839 +28%

----------------------------------------------------------------------------

Gold ounces produced 72,049 51,324 +40%

----------------------------------------------------------------------------

Cash cost per ounce for units

sold $622 $728 -15%

----------------------------------------------------------------------------

Cost per tonne $4.34 $4.21 +3%

----------------------------------------------------------------------------

El Castillo operating statistics

----------------------------------------------------------------------------

Total tonnes mined 11.1 million 7.8 million +44%

----------------------------------------------------------------------------

Ore tonnes mined 20.0 million 16.0 million +25%

----------------------------------------------------------------------------

-- Operational Improvements:

-- Finalised agreement with the Company's El Castillo mining contractor

to expand mining fleet from 13 to 18 one hundred tonne trucks by end

of the first quarter of 2012

-- El Castillo west crusher relocated to east side for consolidated

crushing circuit

-- El Castillo east side pad loading initiated and east carbon plant

operational in October

-- Finalised an agreement expanding El Castillo surface rights on the

western side of the property by 100 hectares, overall surface rights

now at 1385 hectares

-- Constructed 30 million tonnes capacity of heap leach pad space at

the east pad

-- La Colorada announced February 27, 2012 that limited production has

begun via the reprocessing of material from existing leach pads

-- Exploration & Resources:

-- El Castillo - Column testing of core samples to define the leaching

characteristics of sulphide mineralisation is ongoing

-- La Colorada - Indicated resource increase to 1.06 mm ozs. Au and 14

mm ozs Ag within an NI 43-101 compliant technical resource

(+76% Au and +173% Ag over previous NI 43-101)

-- Completed approximately 44,000 metres of drilling in 299 holes

-- San Antonio

-- Completed 17,483 metres of drilling in 116 holes

This press release should be read in conjunction with the Company's audited

Consolidated Financial Statements for the year-ended December 31, 2011 and

associated Management's Discussion and Analysis ("MD&A") which are available

from the Company's website, www.argonautgoldinc.com, in the "Investors" section

under "Financial Filings", and under the Company's profile on SEDAR at

www.sedar.com.

----------------------------------------------------------------------------

4th Quarter Year End

----------------------------------------------------------------------------

12/31/2011 12/31/2010 12/31/2011 12/31/2010

----------------------------------------------------------------------------

Revenue $34,552,626 $19,885,954 $104,567,698 $51,562,435

----------------------------------------------------------------------------

Net income (loss) $9,123,486 $4,100,252 $26,272,247 $3,758,629

----------------------------------------------------------------------------

Income (loss) per

share - basic $0.10 $0.07 $0.30 $0.07

----------------------------------------------------------------------------

Income (loss) per

share - diluted $0.09 $0.07 $0.28 $0.07

----------------------------------------------------------------------------

Gold ounces sold 20,468 14,414 66,521 41,193

----------------------------------------------------------------------------

Average realised

gold sales price $1,684 $1,377 $1,568 $1,249

----------------------------------------------------------------------------

Cash cost per ounce

for units sold $679 $579 $622 $728

----------------------------------------------------------------------------

Financial Results - Fourth Quarter 2011

During the fourth quarter of 2011, revenue was $34.6 million from gold sales of

20,468 ounces. Gross profit was $16.7 million for the quarter. Cash cost per

gold ounce for units sold was $679. (Cash cost per gold ounce for units sold is

a non-IFRS measure, see note below). During the quarter, profit from operations

was $15.0 million. Net income for the quarter was $9.1 million, or $0.10 per

basic share.

Financial Results - Year End 2011

For the year ended December 31, 2011, revenue was $104.6 million from gold sales

of 66,521 ounces. Gross profit was $50.3 million for the year. Cash cost per

gold ounce for units sold was $622 (compared to $728 for the same period in

2010). For the full year, profit from operations was $43.2 million. Net income

for the year was $26.3 million, or $0.30 per basic share.

CEO Commentary

Mr. Pete Dougherty, Argonaut's President and CEO states: "2011 was a milestone

year for Argonaut Gold. We achieved our stated production goal of 72,000 ounces

at the El Castillo mine. Our acquisition of Pediment Gold in January 2011 added

two significant properties to our portfolio, La Colorada and San Antonio. Our

overall gold resource has increased from 2.0 million to 6.5 million ounces

through the acquisition and through additional exploration results."

In discussing the outlook for 2012, Mr. Dougherty added; "Initiatives planned

for 2012 provide the framework for increasing future production. At El Castillo,

we will be adding to the mining fleet and adding a conveying and stacking system

to enhance production. We have announced La Colorada is in limited production,

reprocessing existing leach pad material. Once construction of the gold

processing plant and refinery are completed and the Phase II permits are

received, we will start to ramp up gold production further at La Colorada. The

new processing plant at La Colorada will have a designed capacity to handle gold

production from all three of the Company's Mexican projects."

Forecasted gold production for 2012 is 75-80,000 ounces at El Castillo and an

additional 13-17,000 ounces from La Colorada. In 2012, the Company has announced

exploration drill programs totaling 32,500 metres for El Castillo, La Colorada,

San Antonio and La Fortuna. "The lowest cost ounces we will ever find are the

ones that lie within the properties we already own", Mr. Dougherty added. "We

remain committed to exploration as we look to grow the Company"

El Castillo Operating Statistics

4th Quarter

12/31/2011 12/31/2010 Change

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total tonnes ore 2,912,526 2,560,093 14%

Tonnes waste 2,524,616 2,337,404 8%

Tonnes mined 5,437,142 4,897,497 11%

Waste/ore ratio 0.87 0.91 -5%

ROM tonnes ore

(direct to leach pad) 2,097,980 2,052,752 2%

Tonnes crushed 839,112 510,791 64%

Gold grade (g/t) 0.32 0.38 -16%

Gold loaded to pad (oz) 30,162 31,095 -3%

Gold produced (oz) 19,698 18,292 8%

El Castillo Operating Statistics

Year End

12/31/2011 12/31/2010 Change

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total tonnes ore 11,145,289 7,757,499 44%

Tonnes waste 8,863,766 8,233,514 8%

Tonnes mined 20,009,055 15,991,013 25%

Waste/ore ratio 0.80 1.06 -25%

ROM tonnes ore

(direct to leach pad) 8,114,249 6,290,284 29%

Tonnes crushed 3,041,053 1,465,350 108%

Gold grade (g/t) 0.33 0.37 -11%

Gold loaded to pad (oz) 117,939 91,839 28%

Gold produced (oz) 72,049 51,324 40%

Summary of Production Results:

Total tonnes mined increased by 14% for the fourth quarter 2011 over fourth

quarter 2010 and 44% year over year. The total of ounces loaded to the pads

decreased slightly in the fourth quarter of 2011 due to mining of lower grade

material. There were 30,162 ounces placed on the pad in the fourth quarter of

2011, representing a 3% decrease from the fourth quarter of 2010. Year over

year, there was a 28% increase in ounces of gold loaded to the pad.

Gold production of 19,698 ounces in the fourth quarter of 2011 was an 8%

increase compared to the fourth quarter of 2010. Production in 2011 of 72,049

ounces was a 40% increase over 2010 full year production.

The strip ratio of waste to ore dropped in the fourth quarter to 0.87 compared

to the fourth quarter of 2010 of 0.91. The strip ratio for the year ended

December 31, 2011 was 0.80 compared to 2010 of 1.06.

Looking Forward - 2012:

El Castillo Objectives $8-10 million capex program

-- New conveying, stacking system to be implemented on the east side during

third quarter.

-- Heap leach pad construction for the west side.

-- 2012 production of 75,000 - 80,000 ounces at cash cost between $625 and

$650 per ounce. (Q1 production of 17-18 k ozs @ $625-$650/oz estimate).

-- 1,000 metre core drill program to provide sampling of sulphides for

further metallurgical test work to assess recoveries.

La Colorada Objectives $15-20 million capex program

-- Completion of desorption plant and refinery in the second quarter.

-- Permit response anticipated on phase 2 expansion in the second quarter.

-- 2012 production of 13,500- 17,000 ounces at a cash cost between $625 and

$650 per ounce. (Q1 production of 2-3 k ozs at $625-$650/oz estimate).

-- 20,000 metre drill program at La Colorada targeted the Eastern side of

the property.

San Antonio Objectives $3-4 million capex program

-- 10,500 metres drill program.

-- $3-$4 million in development costs based on permitting timeline.

La Fortuna Objectives

-- 1,000 metre drill program at La Fortuna to follow up on drill targets.

Non-IFRS Measures

The Company included the non-IFRS measure "Cash cost per gold ounce for units

sold" in this press release to supplement its financial statements which are

presented in accordance with International Financial Reporting Standards

("IFRS"). Cash cost per gold ounce for units sold is equal to cost of sales less

silver sales divided by gold ounces sold. The Company believes that this measure

provides investors with an improved ability to evaluate the performance of the

Company. Non-IFRS measures do not have any standardised meaning prescribed under

IFRS. Therefore they may not be comparable to similar measures employed by other

companies. The data is intended to provide additional information and should not

be considered in isolation or as a substitute for measures of performance

prepared in accordance with IFRS. Please see the MD&A for full disclosure on

non-IFRS measures.

Technical Information and Mineral Properties Reports

The technical information contained in this document has been prepared under

supervision of, and reviewed and approved by Mr. Thomas H. Burkhart, Argonaut's

Vice President of Exploration, and a qualified person as defined by NI 43-101.

For further information on the Company's properties please see the reports as

listed below on the Company's website or on www.sedar.com.

----------------------------------------------------------------------------

El Castillo Mine NI 43-101 Technical Report on Resources and

Reserves, Argonaut Gold Inc., El Castillo Mine,

Durango State, Mexico dated November 6, 2010

----------------------------------------------------------------------------

La Colorada Property NI 43-101 Preliminary Economic Assessment La

Colorada Project, Sonora, Mexico dated December

30, 2011

----------------------------------------------------------------------------

San Antonio Gold Project Technical Report and Mineral Resource Estimate

on the San Antonio Gold Project, Baja California

Sur, Mexico dated June 30, 2011

----------------------------------------------------------------------------

La Fortuna Property La Fortuna, Durango, Mexico, Technical Report

dated October 21, 2008

----------------------------------------------------------------------------

About Argonaut Gold

Argonaut is a Canadian gold company engaged in exploration, mine development and

production activities. Its primary assets are the production-stage El Castillo

Mine in the State of Durango, Mexico, the La Colorada Mine in the State of

Sonora, Mexico, the advanced exploration stage San Antonio project in the State

of Baja California Sur, Mexico, and several exploration stage projects, all of

which are located in Mexico.

Creating Value Beyond Gold

Cautionary Note Regarding Forward-looking Statements

This press release contains certain "forward-looking statements" and

"forward-looking information" under applicable Canadian securities laws

concerning the proposed transaction and the business, operations and financial

performance and condition of Argonaut Gold Inc. ("Argonaut"). Forward-looking

statements and forward-looking information include, but are not limited to,

statements with respect to estimated production and mine life of the various

mineral projects of Argonaut; synergies and financial impact of completed

acquisitions; the benefits of the development potential of the properties of

Argonaut; the future price of gold, copper, silver; the estimation of mineral

reserves and resources; the realization of mineral reserve estimates; the timing

and amount of estimated future production; costs of production; success of

exploration activities; and currency exchange rate fluctuations. Except for

statements of historical fact relating to Argonaut, certain information

contained herein constitutes forward-looking statements. Forward-looking

statements are frequently characterized by words such as "plan," "expect,"

"project," "intend," "believe," "anticipate", "estimate" and other similar

words, or statements that certain events or conditions "may" or "will" occur.

Forward-looking statements are based on the opinions and estimates of management

at the date the statements are made, and are based on a number of assumptions

and subject to a variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those projected in the

forward-looking statements. Many of these assumptions are based on factors and

events that are not within the control of Argonaut and there is no assurance

they will prove to be correct.

Factors that could cause actual results to vary materially from results

anticipated by such forward-looking statements include changes in market

conditions, variations in ore grade or recovery rates, risks relating to

international operations, fluctuating metal prices and currency exchange rates,

changes in project parameters, the possibility of project cost overruns or

unanticipated costs and expenses, labour disputes and other risks of the mining

industry, failure of plant, equipment or processes to operate as anticipated.

Although Argonaut has attempted to identify important factors that could cause

actual actions, events or results to differ materially from those described in

forward-looking statements, there may be other factors that cause actions,

events or results not to be anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those anticipated in such

statements. Argonaut undertakes no obligation to update forward-looking

statements if circumstances or management's estimates or opinions should change

except as required by applicable securities laws. The reader is cautioned not to

place undue reliance on forward-looking statements. Statements concerning

mineral reserve and resource estimates may also be deemed to constitute

forward-looking statements to the extent they involve estimates of the

mineralization that will be encountered if the property is developed.

Comparative market information is as of a date prior to the date of this

presentation.

Argonaut Gold (TSX:AR)

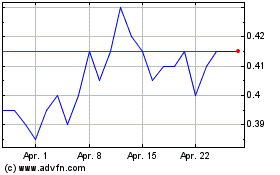

Historical Stock Chart

Von Jun 2024 bis Jul 2024

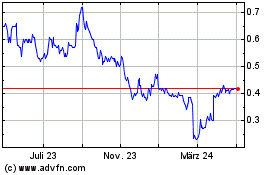

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024