Argonaut Gold Reports Q3 2011 Revenue of $22.7 Million Net Income of $6.0 Million; Cash Flow from Operating Activities of $7....

14 November 2011 - 12:30PM

Marketwired Canada

Argonaut Gold Inc. (TSX:AR) ("Argonaut Gold", "Argonaut" or the "Company")

announces financial and operating results for the third quarter ended September

30, 2011. All dollar amounts are expressed in United States dollars unless

otherwise specified. All financial results are presented in accordance with

IFRS, unless otherwise noted.

THIRD QUARTER 2011 & RECENT HIGHLIGHTS

-- Q3 2011 revenue of $22.7 million

-- Q3 2011 net income of $6.0 million, $0.07 per basic share

-- Cash flows from operating activities before changes in non-cash

operating working capital and other items of $9.7 million

-- Cash on hand was $35 million at September 30, 2011

-- Gold production and cost:

-- 29,997 ounces of gold loaded to the pad (up 24% from Q3 2010)

-- Gold ounces produced in Q3 of 2011 were 16,884 ounces (up 33% from

Q3 2010)

-- Cash cost per ounce sold - $628

-- Q3 2011 El Castillo operating statistics:

-- Total tonnes mined - 4.8 million tonnes (up 2% from Q3 2010)

-- Record ore tonnes mined - 2.9 million tonnes (up 44% from Q3 2010)

-- Operational improvements:

-- Finalized agreement with the Company's mining contractor to expand

from 13 to 18 trucks with 100 tonne capacity and a fourth 992 loader

added to the mining fleet

-- West crusher relocated to east side for consolidated crushing

circuit with design capacity of 500,000 tonnes per month ("TPM");

operational in October

-- East side pad loading initiated and east carbon plant operational in

October with the ramp up to continue thru Q4 of 2011

-- Finalized an agreement expanding surface rights on the western side

of the property by 100 hectares, for an increase in overall surface

rights to 1385 hectares.

-- Exploration & resources:

-- La Colorada -Indicated resource increase to 1.06 mm oz. within an NI

43-101 compliant technical resource (up 76% Au and up 173% Ag over

previous NI 43-101)

-- Completed 36,234 metres of drilling in 245 holes total (39

pending release)

-- Three drill rigs continue on 52,000 metre drill program with a

fourth drill rig scheduled to arrive in early November

-- El Castillo - Sulphide metallurgical work pending completion

-- San Antonio - Two drill rigs continue on +10,000 metre drill program

-- Completed 10,242 metres for 71 holes pending release

This press release should be read in conjunction with the Company's unaudited

interim condensed consolidated financial statements for the three months ended

September 30, 2011 and associated Management's Discussion and Analysis ("MD&A")

which are available from the Company's website, www.argonautgoldinc.com, in the

"Investors" section under "Financial Filings", and under the Company's profile

on SEDAR at www.sedar.com.

Argonaut Gold Financial Statistics

3rd Quarter 9 Months Ended

9/30/2011 9/30/2010 9/30/2011 9/30/2010

Revenue $22,706,718 $9,813,684 $70,015,072 $31,676,481

Net income (loss) $6,039,747 $961,881 $17,148,761 ($341,623)

Income (loss) per share -

basic $0.07 $0.02 $0.20 ($0.03)

Income (loss) per share -

diluted $0.06 $0.02 $0.19 ($0.03)

Gold ounces sold 13,260 7,994 46,052 26,779

Cash cost per ounce for

units sold $628 $622 $597 $809

Financial Results - Third Quarter 2011

During the third quarter of 2011, revenue was $22.7 million from gold sales of

13,260 ounces compared to $9.8 million from sales of 7,994 ounces in the third

quarter of 2010. Cost of sales and depreciation, depletion and amortization

expenses were $10.8 million for the quarter. Cash cost per gold ounce for units

sold (see Non-IFRS measures section note below) was $628 compared to $622 in the

same period of 2010 principally because of an increase in longer ore hauls to

the east pad and cyanide costs. During the third quarter of 2011, operating

income from mining operations was $11.9 million compared to a $3.2 million

operating income in the third quarter of 2010. Net income for the quarter was

$6.0 million, or $0.07 per share.

Cash on hand increased from $32.3 million at June 30, 2011 to $35.0 million, as

a result of higher gold price realized sales and early exercise of $6.8 million

in broker compensation options issued in connection with the private placement

of shares of the Company in late 2009. Cash flow from operations before changes

in non-cash operating working capital and other items was $9.7 million during

the quarter. The cash flow provided by operating activities in the quarter was

$7.7 million. At September 30, 2011, approximately 6,300 gold ounces from Q3

were in finished goods inventory.

Summary of Production Results

Ore tonnes mined increased by 44% (total tonnes mined increased by 2%) for the

third quarter 2011 over the third quarter of 2010. Utilizing a larger, more

efficient truck fleet at El Castillo for the full quarter, the rate of mining

production exceeded 1.6 million tonnes per month. The strip ratio of waste to

ore declined in the third quarter of 2011 to 0.66 compared to the third quarter

of 2010 of 1.36. (The new NI 43-101 compliant technical report for El Castillo

indicates the anticipated strip ratio is approximately 0.88 for the life of

mine). Total ounces loaded to the pads also increased. In the third quarter of

2011, there were 29,997 ounces placed on the pad, representing a 24% increase

over the 24,202 ounces placed on the pad in the third quarter of 2010. Gold

production of 16,884 ounces in the third quarter of 2011 was a 33% increase

compared to the third quarter of 2010.

The Company anticipates operating costs to rise in the near term from longer ore

haul distances to the east pad and increased reagent costs as we begin

operations at the eastern side of the property. We believe this is a short term

issue as the mine expands. The Company is estimating a cash cost for ounces to

be sold in 2011 to be $600 to $625 per gold ounce.

Capital & Exploration Expenditures:

The Company recently increased its capital and exploration expenditure budget

for the year to $36 million. Additional commitments for development of La

Colorada are being allocated for construction of heap leach pads, an absorption

plant and a crushing circuit; this is anticipated to be completed during early

2012. Key operational metrics and production statistics for the third quarter of

2011 compared to the respective period in 2010 are presented below:

El Castillo Operating Statistics

3rd Quarter 9 Months

Percent Percent

9/30/2011 9/30/2010 Change 9/30/2011 9/30/2010 Change

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Tonnes ore 2,908,150 2,013,668 44% 8,232,763 5,197,406 58%

Tonnes waste 1,933,470 2,735,942 -29% 6,339,150 5,896,110 8%

Tonnes mined 4,841,620 4,749,610 2% 14,571,913 11,093,516 31%

Waste/ore ratio 0.66 1.36 -51% 0.77 1.13 -31%

Tonnes direct to

leach pad 2,282,601 1,675,504 +36% 6,016,269 4,237,532 +42%

Tonnes crushed 612,548 369,275 +66% 2,201,941 954,559 +131%

Average grams

per tonne of

gold to leach

pad 0.32 0.37 -14% 0.33 0.37 -11%

Gold ounces to

leach pad 29,997 24,202 +24% 87,777 60,744 +45%

Gold ounces

produced 16,884 12,724 +33% 52,351 33,032 +59%

Cash cost per

gold ounce sold $628 $622 10% $597 $809 -26%

CEO Commentary

Pete Dougherty, Argonaut's President and CEO states: "Argonaut continued to

deliver strong production in Q3, moving towards meeting 2011 guidance of 70,000

ounces of gold produced during the year. We are very pleased with the progress

made during the first nine months of 2011, expanding operations at El Castillo

was a key objective in future development of the property. In October, the

Company released a 76% gold increase and 173% silver increase in resources at

the La Colorada project. A total of 6 drill rigs are continuing programs at both

the La Colorada and San Antonio projects." Mr. Dougherty added "Argonaut

continues to see strong progress being made at all three projects."

Non-IFRS Measures

The Company included the non-IFRS measure "Cash cost per gold ounce for units

sold" in this press release to supplement its financial statements which are

presented in accordance with International Financial Reporting Standards

("IFRS"). Cash cost per gold ounce for units sold is equal to cost of sales less

silver sales divided by gold ounces sold. The Company believes that this measure

provides investors with an improved ability to evaluate the performance of the

Company. Non-IFRS measures do not have any standardized meaning prescribed under

IFRS. Therefore they may not be comparable to similar measures employed by other

companies. The data is intended to provide additional information and should not

be considered in isolation or as a substitute for measures of performance

prepared in accordance with IFRS. Please see the MD&A for full disclosure on

non-IFRS measures.

Technical Information and Mineral Properties Reports

The technical information contained in this document has been prepared under

supervision of, and reviewed and approved by Mr. Thomas H. Burkhart, Argonaut's

Vice President of Exploration, and a qualified person as defined by NI 43-101.

Information on the Company's properties please see the reports as listed below

on the Company's website or on www.sedar.com:

----------------------------------------------------------------------------

El Castillo Mine NI 43-101 Technical Report on Resources and

Reserves, Argonaut Gold Inc., El Castillo Mine,

Durango State, Mexico dated November 6, 2010

----------------------------------------------------------------------------

La Fortuna Property La Fortuna, Durango, Mexico, Technical Report

dated October 21, 2008

----------------------------------------------------------------------------

San Antonio Gold Project Technical Report and Mineral Resource Estimate on

the San Antonio Gold Project, Baja California Sur,

Mexico dated June 30, 2011

----------------------------------------------------------------------------

La Colorada Property Geological Report on the La Colorada Property with

a Resource Estimate on La Colorada and El Creston

Mineralized Zones - Sonora, Mexico dated November

30, 2009

----------------------------------------------------------------------------

About Argonaut Gold

Argonaut is a Canadian gold company engaged in exploration, mine development and

production activities. Its primary assets are the production-stage El Castillo

Mine in the State of Durango, Mexico, the development stage and past producing

La Colorada project, the advanced exploration San Antonio project, and several

exploration stage projects, all of which are located in Mexico.

Creating Value Beyond Gold

Cautionary Note Regarding Forward-looking Statements

This news release contains forward-looking statements that involve risks and

uncertainties that could cause results to differ materially from management's

current expectations. Actual results may differ materially due to a number of

factors. Except as required by law, Argonaut Gold Inc. assumes no obligation to

update the forward-looking information contained in this news release.

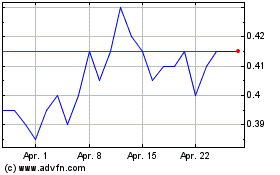

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

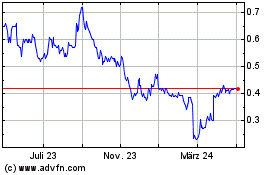

Argonaut Gold (TSX:AR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024