Allied Properties Real Estate Investment Trust Announces Acquisition of Strategic Infill Properties in Toronto

24 März 2014 - 3:01PM

Marketwired Canada

Allied Properties REIT (TSX:AP.UN) announced today that it has entered into

agreements to purchase the following properties for $32.5 million:

Address Total Office Retail Parking

GLA GLA GLA Spaces

----------------------------------------------------------------------------

241 Spadina Avenue, Toronto 31,197 24,611 6,586 -

32 Atlantic Avenue & 47 Jefferson 57,277 57,277 - 7

Avenue, Toronto

----------------------------------------------------------------------------

88,465 81,879 6,589 7

----------------------------------------------------------------------------

"In addition to being immediately accretive, each of these properties is close

to one or more of our existing properties," said Michael Emory, President & CEO.

"The property in Liberty Village affords a small value-creation opportunity that

we expect to execute on rapidly, given the ongoing demand for office space in

our Toronto target market."

The Spadina Property

Located on the east side of Spadina Avenue, south of Dundas Street, this

property is comprised of 31,197 square feet of GLA, all of which is leased to

tenants consistent in character and quality with our tenant base. Built in 1910

for the Consolidated Plate Glass Company, the building was renovated in 2012.

Designated under the Ontario Heritage Act, it is a good example of the Edwardian

classical style favoured in the early 1900s.

The Liberty Village Property

Located between Atlantic and Jefferson Avenues, south of Liberty Street, this

property is comprised of 50,434 square feet of leased GLA, 6,834 square feet of

un-leased GLA and seven surface parking spaces. Built in the early 1900s, the

buildings were renovated in 2012.

Closing and Financing

The acquisitions are expected to close in April of 2014, subject to customary

conditions. The purchase price for the completed properties represents a

capitalization rate of approximately 6.5% applied to the current annual net

operating income ("NOI"). The properties will be free and clear of mortgage

financing immediately prior closing. Allied plans to place mortgage financing on

the properties on or soon after closing and will fund the equity component of

the acquisitions with cash-on-hand.

Cautionary Statements

This press release may contain forward-looking statements with respect to

Allied, its operations, strategy, financial performance and condition. These

statements generally can be identified by use of forward looking words such as

"may", "will", "expect", "estimate", "anticipate", "intends", "believe" or

"continue" or the negative thereof or similar variations. The actual results and

performance of Allied discussed herein could differ materially from those

expressed or implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations, including that the transactions contemplated herein are completed.

Important factors that could cause actual results to differ materially from

expectations include, among other things, general economic and market factors,

competition, changes in government regulations and the factors described under

"Risk Factors" in Allied's Annual Information Form, which is available at

www.sedar.com. These cautionary statements qualify all forward-looking

statements attributable to Allied and persons acting on Allied's behalf. Unless

otherwise stated, all forward-looking statements speak only as of the date of

this press release and the parties have no obligation to update such statements.

"Capitalization rate" is not a measure recognized under International Financial

Reporting Standards ("IFRS") and does not have any standardized meaning

prescribed by IFRS. Capitalization rate is presented in this press release

because management of Allied believes that this non-IFRS measure is relevant in

interpreting the purchase price of the properties being acquired. Capitalization

rate, as computed by Allied, may differ from similar computations as reported by

other similar organizations and, accordingly, may not be comparable to

capitalization rate reported by such organizations.

NOI is not a measure recognized under IFRS and does not have any standardized

meaning prescribed by IFRS. NOI is presented in this press release because

management of Allied believes that this non-IFRS measure is relevant in

interpreting the purchase price of the property being acquired. NOI, as computed

by Allied, may differ from similar computations as reported by other similar

organizations and, accordingly, may not be comparable to NOI reported by such

organizations.

Allied Properties REIT is a leading owner, manager and developer of urban office

environments that enrich experience and enhance profitability for business

tenants operating in Canada's major cities. Its objectives are to provide stable

and growing cash distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth.

FOR FURTHER INFORMATION PLEASE CONTACT:

Allied Properties REIT

Michael R. Emory

President and Chief Executive Officer

(416) 977-0643

memory@alliedreit.com

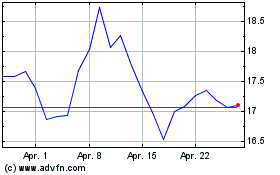

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

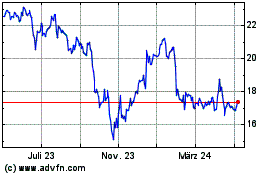

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024