Alaris Equity Partners Income Trust ("

Alaris" or

the "

Trust") (TSX: AD.UN) is announcing that it

has received approval from the Toronto Stock Exchange

("

TSX") to proceed with a normal course issuer bid

("

NCIB"). Under the NCIB, the Trust may purchase

for cancellation up to 1,000,000 trust units of the Trust

("

Units"). As at May 23, 2023, Alaris had

45,479,179 Units outstanding. As a result, the NCIB represents

approximately 2% of Alaris’ issued and outstanding Units as at May

23, 2023. The actual number of Units that may be purchased for

cancellation under the NCIB and the timing of any such purchases

will be determined by Alaris, subject to a maximum daily purchase

limitation of 16,037 Units, which equals 25% of Alaris’ average

daily trading volume on the TSX of 64,150 Units for the six months

ended April 30, 2023. The Trust may also make one block purchase

per calendar week which exceeds the daily repurchase restrictions.

The NCIB will commence on May 25, 2023, and may continue to May

24, 2024, unless Alaris terminates the NCIB or the NCIB is

completed earlier. A registered broker will purchase Units under

the NCIB on behalf of the Trust only through the facilities of the

TSX and other alternative exchanges as are permitted under

applicable securities laws.

In connection with the NCIB, Alaris has entered into an

automatic securities purchase plan ("ASPP") with

its designated broker to allow for the purchase of Units under the

NCIB at times when Alaris normally would not be active in the

market due to internal trading black-out periods or for other

periods as the Trust may determine. Before the commencement of any

particular internal trading black-out period or other period as the

Trust may determine appropriate (each, an "Automatic

Purchase Period"), Alaris may, but is not required to,

instruct its designated broker to purchase Units under the NCIB

during the ensuing Automatic Purchase Period in accordance with the

ASPP. The broker will make purchases during an Automatic Purchase

Period in its sole discretion based on parameters established by

Alaris before commencement of the Automatic Purchase Period in

accordance with the ASPP and applicable TSX rules. Outside of these

Automatic Purchase Periods, Alaris will purchase Units at its

discretion under the NCIB.

Alaris believes that, from time to time, the market price of the

Units may not fully reflect the underlying value of the Units and

that at such times the purchase of Units would be in the best

interests of Alaris. As a result of such purchases, the number of

issued Units will be decreased and, consequently, the proportionate

Unit interest of all remaining Unitholders will be increased on a

pro rata basis. In addition, as the Trust is a distribution paying

Trust, purchases under the proposed issuer bid will reduce the

Trust’s ongoing distribution obligations and, consequently, reduce

its Run Rate Payout Ratio.

About Alaris

The Trust, through its subsidiaries, indirectly provides

alternative financing to private companies

("Partners") in exchange for distributions with

the principal objective of generating stable and predictable cash

flows for payment of distributions to unitholders of the Trust.

Distributions from the Partners are adjusted each year based on the

percentage change of a "top line" financial performance measure

such as gross margin and same-store sales and rank in priority to

the owners' common equity position.

NON-IFRS MEASURES:

"Run Rate Payout Ratio" refers to Alaris’ total

distribution per Unit expected to be paid over the next twelve

months divided by the estimated net cash from operating activities

per Unit that Alaris expects to generate over the same twelve-month

period (after giving effect to the impact of all information

disclosed as of the date of this report).

The term Run Rate Payout Ratio is not a standard measure under

IFRS. Alaris' calculation of the Run Rate Payout Ratio may differ

from those of other issuers and, therefore, should be used only in

conjunction with the Trust’s annual audited and unaudited interim

financial statements, which are available under the Trust's (and

its predecessor's) profile on SEDAR at www.sedar.com.

CONTACT:

ir@alarisequity.comP: (403) 260-1457Alaris Equity

Partners Income TrustSuite 250, 333 24th Avenue

S.W.Calgary, Alberta T2S 3E6www.alarisequitypartners.com

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements, including

forward-looking statements within the meaning of "safe harbor"

provisions under applicable securities laws

("forward-looking statements"). Statements other

than statements of historical fact contained in this news release

may be forward-looking statements. Many of these statements can be

identified by words such as "believe", "expects", "will",

"intends", "projects", "anticipates", "estimates", "continues" or

similar words or the negative thereof. Any forward-looking

statements which constitute a financial outlook or future-oriented

financial information (including the impact the Run Rate Payout

Ratio) were approved by management as of the date hereof and have

been included to explain Alaris' financial performance and are

subject to the same risks and assumptions disclosed above. There

can be no assurance that the plans, intentions or expectations on

which these forward-looking statements are based will occur.

By their nature, forward-looking statements require Alaris to

make assumptions and are subject to inherent risks and

uncertainties. Forward-looking statements are subject to risks,

uncertainties and assumptions and should not be read as guarantees

or assurances of future performance. The actual results of the

Trust could materially differ from those anticipated in the

forward-looking statements contained herein. Additional risks that

may cause actual results to vary from those stated are discussed

under the heading "Risk Factors" and "Forward Looking Statements"

in the Trust’s Management Discussion and Analysis for the year

ended December 31, 2022, which is filed under the Trust’s profile

at www.sedar.com and on its website at

www.alarisequitypartners.com.

Readers are cautioned not to place undue reliance on any

forward-looking information contained in this news release as

several factors could cause actual future results, conditions,

actions or events to differ materially from the targets,

expectations, estimates or intentions expressed in the

forward-looking statements. Statements containing forward-looking

information reflect management’s current beliefs and assumptions

based on information in its possession on the date of this news

release. Although management believes that the assumptions

reflected in the forward-looking statements contained herein are

reasonable, there can be no assurance that such expectations will

prove to be correct.

The forward-looking statements contained herein are expressly

qualified in their entirety by this cautionary statement. The

forward-looking statements included in this news release are made

as of the date of this news release and Alaris does not undertake

or assume any obligation to update or revise such statements to

reflect new events or circumstances except as expressly required by

applicable securities legislation.

Neither the TSX nor its Regulation Services Provider (as that

term is defined in the policies of the TSX) accepts responsibility

for the adequacy or accuracy of this release.

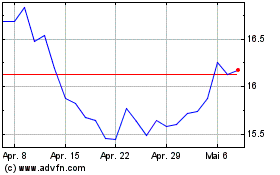

Alaris Equity Partners I... (TSX:AD.UN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Alaris Equity Partners I... (TSX:AD.UN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024