Aberdeen Reports Shareholders' Equity of $0.54 Per Share and 2014 Year End Financial Results

02 Mai 2014 - 1:00PM

Marketwired Canada

ABERDEEN INTERNATIONAL INC. ("Aberdeen", or the "Company") (TSX: AAB) is pleased

to announce that it has released its financial results for the fourth quarter of

2014, ended January 31, 2014. For more information please see the Company's

Audited Condensed Annual Financial Statements and Management's Discussion and

Analysis ("MD&A") posted on SEDAR at www.sedar.com.

As at January 31, 2014, Aberdeen's Shareholders' Equity (or Net Asset Value,

"NAV") was $47.5 million, or $0.54 per share. Aberdeen's shareholders' equity

decreased by $2.0 million from $49.5 million at the end of Q3 2014. The decrease

in shareholders' equity was largely due to the performance of Aberdeen's equity

investment portfolio in the fourth quarter, which had a total investment loss of

$2.0 million for the quarter. On a year-over-year basis, Aberdeen's

shareholders' equity decreased by $17.9 million. Note that the reference to

shareholders' equity is similar to previous references to Net Asset Value or

"NAV" by Aberdeen.

January 31, 2014 January 31, 2013 October 31, 2013

Shares

outstanding 87,349,422 85,994,602 85,449,422

$/ $/ $/

$ Shares $ Shares $ Shares

-------------------------------------------------------------

Cash on hand 868,267 0.01 10,417,577(i) 0.12 1,176,224 0.01

Investments

Publicly

traded 17,216,988 0.197 29,844,393 0.347 17,661,275 0.207

Private 20,075,953 0.230 21,039,834 0.245 20,067,856 0.235

Non-trading

warrants

Intrinsic

value 25,000 0.000 1,032,114 0.012 - -

Option

value 545,909 0.006 1,415,665 0.016 323,105 0.004

-------------------------------------------------------------

570,909 0.007 2,447,779 0.028 323,105 0.004

-------------------------------------------------------------

Portfolio

Investments 37,863,850 0.433 53,332,006 0.620 38,052,236 0.445

Loans /

preferred

shares 6,902,617 0.079 6,116,040 0.071 8,421,625 0.099

-------------------------------------------------------------

Total 45,634,734 0.522 69,865,623 0.812 47,650,085 0.558

-------------------------------------------------------------

-------------------------------------------------------------

(i) Includes cash from trades made at the end of January 2013 but settled in

February 2013.

For the twelve months ended January 31, 2014, Aberdeen reported net earnings of

$(16.3) million or $(0.19) per basic share on total revenue of $(13.5) million.

Revenue was comprised of $(14.3) million from net investment losses and $0.8

million from interest income, dividends and advisory services fees. For the

twelve months ending January 31, 2013, Aberdeen reported net earnings of $(30.6)

million or $(0.35) per share on total revenue of $(20.5) million ($(22.4)

million from net investment losses, $0.6 million from royalties and $1.9 million

from interest and dividend income and advisory service fees).

Normal Course Issuer Bid ("NCIB")

During the twelve months ending January 31, 2014, 725,180 common shares were

purchased for cancellation under the Company's NCIB at an average cost of $0.17.

Aberdeen expects to continue to purchase shares over the remainder of its NCIB,

depending on market conditions and other investment opportunities that may be

available.

About Aberdeen International Inc:

Aberdeen is a publicly traded global investment and merchant banking company

focused on small cap companies in the resource sector. Aberdeen will seek to

acquire significant equity participation in pre-IPO and/or early stage public

resource companies with undeveloped or undervalued high-quality resources.

Aberdeen will focus on companies that: (i) are in need of managerial, technical

and financial resources to realize their full potential; (ii) are undervalued in

foreign capital markets; and/or (iii) operate in jurisdictions with moderate

local political risk. Aberdeen will seek to provide value-added managerial and

board advisory services to companies. The Corporation's intention will be to

optimize the return on its investment over a 24 to 36 month investment time

frame.

For additional information, please visit our website at

www.aberdeeninternational.ca.

Cautionary Note

Except for statements of historical fact contained herein, the information in

this press release constitutes "forward-looking information" within the meaning

of Canadian securities law. Such forward-looking information may be identified

by words such as "plans", "proposes", "estimates", "intends", "expects",

"believes", "may", "will" and include without limitation, statements regarding;

past success as an indicator of future success; net asset value of the Company;

the potential of investee companies and the appreciation of their share price;

the future intentions of the Company with regard to its shareholdings; the

Company's plan of business operations; and anticipated returns. There can be no

assurance that such statements will prove to be accurate; actual results and

future events could differ materially from such statements. Factors that could

cause actual results to differ materially include, among others, metal prices,

competition, financing risks, acquisition risks, risks inherent in the mining

industry, and regulatory risks. Most of these factors are outside the control of

the Company. Investors are cautioned not to put undue reliance on

forward-looking information. Except as otherwise required by applicable

securities statutes or regulation, the Company expressly disclaims any intent or

obligation to update publicly forward-looking information, whether as a result

of new information, future events or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Aberdeen International Inc.

Mike McAllister

Manager, Investor Relations

+1 416-309-2134

info@aberdeeninternational.ca

Aberdeen International Inc.

David Stein

President and CEO

+1 416-861-5812

dstein@aberdeeninternational.ca

www.aberdeeninternational.ca

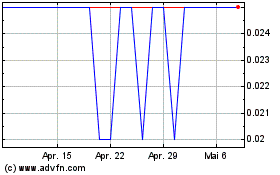

Aberdeen (TSX:AAB)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

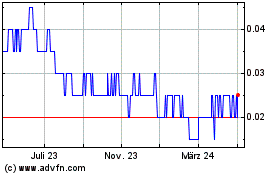

Aberdeen (TSX:AAB)

Historical Stock Chart

Von Mai 2023 bis Mai 2024