Original-Research: Westwing Group SE (von NuWays AG): Kaufen

08 Mai 2024 - 9:01AM

EQS Non-Regulatory

Original-Research: Westwing Group SE - von NuWays AG

Einstufung von NuWays AG zu Westwing Group SE

Unternehmen: Westwing Group SE

ISIN: DE000A2N4H07

Anlass der Studie: Update

Empfehlung: Kaufen

seit: 08.05.2024

Kursziel: EUR 18.00

Kursziel auf Sicht von: 12 Monaten

Letzte Ratingänderung:

Analyst: Mark Schüssler

Healthy Q1 results // FY24 guidance confirmed

Healthy Q1 results underpin that Westwing was able to continue

the trend of yoy GMV growth witnessed in recent quarters. Q1 sales

increased by 6% yoy to € 109m (eNuW: € 107.7m), showing an

acceleration of growth versus Q4 (+2% yoy), driven by growth in

active customers (+2% yoy to 1.28m) and basket size (+9% yoy to €

185). International and DACH grew 3% and 8% yoy, respectively,

implying continued market share gains amid ongoing challenges in

the German online Home & Living market (-4% yoy).

At the same time, efficiency measures are bearing fruit. Adj.

EBITDA arrived in line with expectations at € 6m in Q1 (eNuW: €

6.5m), representing a margin improvement of 0.8ppts yoy to 5.8%.

This was carried by a strong contribution margin expansion of

+4ppts yoy to 32%, a favorable product mix (i.e. higher private

label share, +5ppts yoy to 51% of GMV in Q1), reduced fulfilment

expenses (-2ppts yoy) as well as lower G&A costs (-1ppts yoy)

as a result of cost savings (i.e. consolidation of logistics and

warehouses and streamlining the organization). Notably, Westwing

was able to translate the favorable adj. EBITDA development into

healthy FCF of € 4m in Q1, supported by net working capital of €

-18m, likely concluding the reduction of excess inventory built up

during Covid.

Westwing confirmed its FY24 guidance and with sales expected to

develop within a range of -3% to 4% yoy to € 415445m (eNuW: €

442m). While the Q1 performance was overall satisfactory,

management continues to expect H2'24 sales to be weighed down by a

strategic adjustment of the product offering in Spain and Italy

(low to mid single-digit percentage impact) along with ongoing

challenges in the home & living market as consumers continue to

hold back on higher-value products such as furniture. The adj.

EBITDA outlook was reiterated at € 14m to € 24m implying a 3.1 to

5.8% margin (eNuW: € 23.7m with a 5.4% margin). Considering € 6m

adj. EBITDA in Q1, the bottom-line guidance looks achievable, in

our view, while FCF for the full year should likely be close to

break-even (eNuW: € 0.3m) due to one-off restructuring costs (i.e.

complexity reduction, SaaS transition) and normalizing inventory

patterns.

Overall, Westwing has adapted successfully to the current

transition period towards a leaner and more scalable organizational

setup. While visibility on a return of consumer confidence remains

low, Westwing’s mid-term prospects continue to look bright driven

by the structural shift towards e-commerce and its unique

positioning in the European home & living market. We reiterate

our BUY recommendationwith a PT of € 18.00, based on DCF, and keep

the stock on our Alpha List.

Die vollständige Analyse können Sie hier downloaden:

http://www.more-ir.de/d/29623.pdf

Die Analyse oder weiterführende Informationen zu dieser können Sie

hier downloaden www.nuways-ag.com/research.

Kontakt für Rückfragen

NuWays AG - Equity Research

Web: www.nuways-ag.com

Email: research@nuways-ag.com

LinkedIn: https://www.linkedin.com/company/nuwaysag Adresse:

Mittelweg 16-17, 20148 Hamburg, Germany ++++++++++

Diese Meldung ist keine Anlageberatung oder Aufforderung zum

Abschluss bestimmter Börsengeschäfte. Offenlegung möglicher

Interessenskonflikte nach § 85 WpHG beim oben analysierten

Unternehmen befinden sich in der vollständigen Analyse.

++++++++++

-------------------übermittelt durch die EQS Group

AG.-------------------

Für den Inhalt der Mitteilung bzw. Research ist alleine der

Herausgeber bzw. Ersteller der Studie verantwortlich. Diese Meldung

ist keine Anlageberatung oder Aufforderung zum Abschluss bestimmter

Börsengeschäfte.

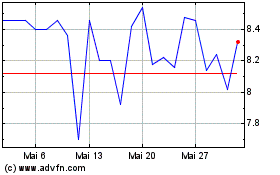

Westwing (TG:WEW)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

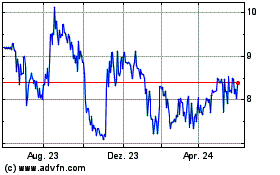

Westwing (TG:WEW)

Historical Stock Chart

Von Dez 2023 bis Dez 2024