Sartorius (FWB:SRT), a leading international laboratory and

process equipment provider, increased its operating profit in 2009

despite the difficult macroeconomic climate and achieved operating

earnings of 60.9 million euros, up from 56.8 million euros a year

earlier. “As a result, we are among the companies that were able to

close the 2009 year of crisis with a positive development of

operating earnings,” commented CEO Dr. Joachim Kreuzburg on the

company’s full-year results at the annual press conference in

Goettingen, Germany.

Both divisions of the Group contributed very differently to

consolidated earnings. The Biotechnology Division, which

predominantly manufactures consumables for the biopharmaceutical

industry and contributes approximately two thirds to consolidated

sales, reported dynamic growth and attained a new level in

operating profit. By contrast, the Mechatronics Division, which

manufactures primarily weighing and control equipment, i.e.,

capital goods and is thus much more dependent on economic cycles,

saw its development of business and earnings severely impacted by

the global downturn. Nevertheless, this division achieved a

turnaround as a result of extensive restructuring measures during

the course of the year and closed 2009 with positive operating

earnings.

For 2010, Dr. Kreuzburg expects growth in sales revenue and

profit for both divisions. “I assume that the Biotechnology

Division can maintain its strong growth. Production technology in

our key customer segment, the biopharmaceutical industry, is

undergoing rapid change. Pharmaceutical manufacturers are

increasingly switching from stationarily installed stainless steel

equipment to flexibly deployable single-use products made of

plastic. This is exactly the direction in which we have been

strategically heading and propelling developments in the

Biotechnology Division right from a very early stage. Meanwhile, we

offer the widest and best integrated portfolio in the industry for

the manufacture of pharmaceuticals using single-use systems. We

will be launching highly attractive new products in this market

segment in 2010 as well."Referring to the Mechatronics Division,

Dr. Kreuzburg mentioned the considerable unknowns still surrounding

the current business cycle, but for the division expects the

economy to recover slightly. “On the cost side, we are in a

substantially improved position thanks to our extensive

restructuring program. Moreover, in 2009 we initiated a strategic

realignment of the Mechatronics Division. Building on our strong

market position in weighing equipment, we will transform our

company from being a technology specialist into an applications

expert. Through strategic alliances and our own developments, we

will be adding new technologies to our array of products,

technologies that help our customers enhance their production

processes in terms of cost, quality, safety and reliability. In the

process, we are focusing even more strongly on the food and the

pharmaceutical industries, both of which are sectors with excellent

mid- and long-term growth prospects."

In view of strong consolidated cash flow and highly robust key

balance sheet ratios and financials, Dr. Kreuzburg sees the

Sartorius Group in a capable position to take further growth steps.

“In addition to our strong focus on our operating results,

strategic acquisitions will again be an issue as of 2010, but we

are in no hurry in this regard.”

Essential Figures on the Business Development of the

Divisions and of the Group

Sartorius Stedim Biotech

The Biotechnology Division, which operates under the name of

Sartorius Stedim Biotech (SSB), looks back upon a successful fiscal

2009 and increased its sales revenue 9.4% from 366.0 million euros

to 400.4 million euros (currency-adjusted: 8.3%). Order intake also

considerably jumped 11.5% from 367.1 million euros to 409.2 million

euros (currency-adjusted: 10.3%). Again, double-digit growth rates

generated by the company’s business with single-use products for

the biopharmaceutical industry substantially fueled this growth. In

addition, SSB benefited in the reporting year from the high demand

driven by vaccine manufacturers who required considerable

quantities of single-use bags and filters used in the production of

the vaccine against the H1N1 virus. This effect contributed around

two percentage points to growth. As expected, business with

large-scale bioreactor systems slightly declined, by contrast, but

saw positive momentum as of the second half of the year.

Regarding regional distribution of sales revenue, all business

regions with their significantly positive growth rates contributed

to the successful development of sales. North America achieved the

highest growth, where sales were up 18.1% (currency-adjusted:

11.6%), followed by Asia|Pacific, with sales up 7.8%

(currency-adjusted: 4.7%), and Europe, up 5.1% (currency-adjusted:

6.5%).

This strong sales development is also reflected by the

Biotechnology Division’s earnings. Its earnings before interest,

taxes and amortization, which were adjusted for special items

(underlying EBITA or operating earnings), grew overproportionately

by 51.5% to 60.2 million euros from 39.7 euros a year earlier. The

corresponding EBITA margin rose from 10.9% to 15.0% and thus marks

a new level. Besides the uplift in sales volume, the division’s

enhanced product mix and stringent cost management were decisive

for this boost in profitability.

Sartorius Mechatronics

Amid a climate of pronounced reluctance to invest shared by

nearly all customer sectors, the Mechatronics Division reported a

steep decline in demand for its products in the reporting year.

This impacted its business with industrial weighing and control

equipment slightly more than its business with laboratory

instruments. By contrast, service business proved to be robust.

Compared with a year ago, the division’s sales revenue dropped

17.9% from 245.6 million euros to 201.7 million euros

(currency-adjusted: -19.3%). At 205.9 million euros, order intake

was also down 15.2% from 242.7 million euros a year earlier

(currency-adjusted: -16.6%). Following an especially steep plunge

in first-half demand, business indicated initial signs of recovery

at year-end.

The regional pattern shows that the division’s decline in

revenue was somewhat less pronounced in Asia|Pacific at a minus of

8.2% (currency-adjusted: -12.7%) than in the regions of North

America (-14.4%; currency-adjusted: -19.1%) and Europe (-22.4%;

currency-adjusted -21.7%).

Despite the drop in sales, the Mechatronics Division posted

slightly positive operating earnings of 0.7 million euros, up from

17.1 million euros a year ago. This increase was due to an

extensive restructuring program, which was implemented in the

reporting year to adapt the division’s structures to the changed

market conditions and which reduced its annual cost base by a good

30 million euros. The division’s underlying EBITA margin was 0.4%

compared with 7.0% for the year-earlier period.

Business Development of the Sartorius Group

At Group level, the excellent development of the Biotechnology

Division's business compensated for the recession-induced losses in

the Mechatronics Division for the most part. Consolidated sales

revenue in 2009 was 602.1 million euros compared with 611.6 million

euros a year ago, and therefore eased only slightly by 1.6%

(currency-adjusted: -2.7%) relative to the previous reporting

period. At 615.1 million euros, order intake was slightly above the

year-earlier figure of 609.8 million euros (0.9%;

currency-adjusted: -0.4%).

On account of the Biotechnology Division’s significant rise in

profitability, consolidated operating earnings rose 7.2% from 56.8

million euros to 60.9 million euros. The corresponding earnings

margin climbed from 9.3% to 10.1%. Extraordinary expenses, which

are predominantly comprised of provisions for the restructuring

program in the Mechatronics Division, totaled 30.0 million euros.

Unadjusted consolidated EBITA was 30.9 million euros (previous

year: 56.8 million euros).

The Group’s relevant net profit – underlying consolidated net

profit after minority interest without the two non-cash items of

amortization and interest for share price warrants – was also

slightly up from 18.2 million euros a year ago, at 20.8

million euros; this equates to earnings per share of 1.22 euros, up

from 1.07 euros in the previous year. In particular, due to the

significant restructuring charges in the Mechatronics Division, the

unadjusted consolidated net profit after minority interest amounts

to -7.3 million euros (12.4 million euros).

Key Balance Sheet Ratios and Financials at an Improved, Solid

Level

A particular focus of the reporting year was on strengthening

cash flow. Because of strong operating profit, stringent management

of working capital and the factoring program implemented in middle

of the reporting year, operating cash flow surged from 53.0 million

euros to 143.4 million euros. Accordingly, the key balance sheet

ratios and financials were at an overall improved, solid level: the

equity ratio was 38.9% (Dec. 31, 2008: 38.5%) and the ratio of net

debt to EBITDA was 2.6 (previous year: 2.7).

Research and Development Adapted to Accommodate Market

Conditions

In fiscal 2009, Sartorius spent 40.2 million euros on research

and development, down from 43.9 million euros a year ago; at 6.7%,

its ratio of R&D costs to sales revenue eased slightly from a

year earlier. While R&D costs in the Biotechnology Division

remained at a constantly high level, R&D spending in the

Mechatronics Division was adapted to accommodate the changed market

conditions. As in the Biotechnology Division, Sartorius plans to

extend its product portfolio in the Mechatronics Division through

targeted alliances with external partners from science and

industry.

Workforce Reduced by Restructuring in the Mechatronics

Division

As of December 31, 2009, the Sartorius Group employed 4,323

people, 337 persons, or -7.2%, fewer than in the previous year.

This decrease essentially resulted from the adjustment of personnel

capacity in the Mechatronics Division in line with its lower

business volume. Together with employee representatives, the

company agreed on socially responsible arrangements as far as

possible in making the unavoidable cuts in staff costs. The number

of employees in the Mechatronics Division dropped from 2,298 to

1,942. In contrast, the Biotechnology Division slightly increased

its number of staff 0.8% from 2,362 to 2,381 by the end of

2009.

Dividends Proposed at the Year-Earlier Level

The Supervisory Board and the Executive Board of Sartorius AG

will submit a proposal to the Annual General Shareholders’ Meeting

on April 21, 2010, to pay the dividends in the same amounts as in

the previous year: 0.42 euro per preference share and 0.40 euro per

ordinary share. As a result, the total profit distributed would be

7.0 million euros as in 2008. This dividend proposal mirrors the

operating profitability of the past fiscal year and the positive

future prospects of the company.

Positive Outlook for Both Group Divisions

For the Biotechnology Division, management expects

currency-adjusted sales growth in the upper single-digit range for

2010. This increase is forecasted to comprise strong gains for

single-use products and moderate gains for its equipment business.

As in 2010 extra business with the vaccine industry is not

anticipated and equipment business is likely to contribute a

relatively high percentage to sales growth, the division’s

operating EBITA margin is expected to rise rather slightly.

For the Mechatronics Division, which is more strongly dependent

upon business cycles, management assumes that despite the

persistent uncertainty about economic development, there will be a

slight upturn. Against this backdrop, currency-adjusted sales

growth is expected in the lower single-digit percentage range.

Given the division’s significantly reduced cost base as a result of

extensive restructuring measures, its operating EBITA margin should

attain around 5%.

For the entire Group, management accordingly expects sales

growth in constant currencies to be slightly above 5% and its

operating EBITA margin to continue to improve by one to two

percentage points. Furthermore, management anticipates a

significantly positive operating cash flow.

Current Image Files:

Dr. Joachim Kreuzburg, CEO and Executive Board Chairman of

Sartorius:

http://www.sartorius.com/media/content/press/support/Dr_Kreuzburg_4.jpg

Sartorius Stedim Biotech delivers innovative systems and

solutions for the manufacture of biopharmaceutical medications:

http://www.sartorius.com/media/content/press/support/SSB_Integrated_Solutions.jpg

Sartorius Mechatronics produces weighing and control equipment

for laboratory and industrial applications in the food and

pharmaceutical industries:

http://www.sartorius.com/media/content/press/support/Sartorius_Kontrolltechnik.jpg

Upcoming Financial Dates:

April 21, 2010 Annual General Shareholders’ Meeting in

Goettingen, Germany

April 2010 Publication of first-quarter figures (Jan. – March

2010)

This press release contains statements about the future

development of the Sartorius Group. The content of these statements

cannot be guaranteed as they are based on assumptions and estimates

that harbor certain risks and uncertainties.

A Profile of Sartorius

The Sartorius Group is a leading international laboratory and

process technology provider covering the segments of biotechnology

and mechatronics. In 2009, the technology group earned sales

revenue of 602.1 million euros. Founded in 1870, the

Goettingen-based company currently employs approximately 4,350

persons. The major areas of activity in its biotechnology segment

focus on fermentation, filtration, purification, fluid management

and laboratory applications. In the mechatronics segment, the

company primarily manufactures equipment and systems featuring

weighing, measurement and automation technology for laboratory and

industrial applications. Key Sartorius customers are from the

pharmaceutical, chemical and food and beverage industries and from

numerous research and educational institutes of the public sector.

Sartorius has its own production facilities in Europe, Asia and

America as well as sales subsidiaries and local commercial agencies

in more than 110 countries.

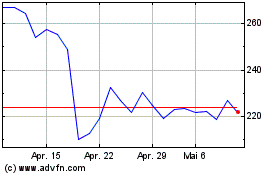

Sartorius (TG:SRT)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

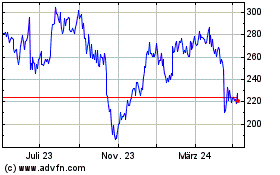

Sartorius (TG:SRT)

Historical Stock Chart

Von Jan 2024 bis Jan 2025