|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| |

WASHINGTON,

DC 20549 |

|

SCHEDULE TO

(RULE 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR

13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

Zhihu

Inc.

(Name of Subject Company (Issuer)) |

| |

Zhihu Inc.

(Name of Filing Person (Issuer)) |

Class A

ordinary shares, par value US$0.000125 per share

(Title of Class of Securities)

98955N 207*

(CUSIP Number of Class of Securities) |

Han Wang

Chief Financial Officer

Zhihu Inc.

18 Xueqing Road

Haidian District, Beijing 100083

People’s Republic of China

+86 (10) 8271-6605

with copy to:

|

Shu Du, Esq.

Skadden, Arps, Slate, Meagher &

Flom LLP

c/o 42/F, Edinburgh Tower

The Landmark

15 Queen’s Road Central

Hong Kong

+852 3740-4700

|

(Name, address, and telephone number of person

authorized to receive notices and communications on behalf of the filing person)

* CUSIP number 98955N 207 has been assigned to the American depositary

shares (“ADSs”) of the issuer, which are quoted on the New York Stock Exchange under the symbol “ZH.” One

ADS represents three Class A ordinary shares.

|

x Check

the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions

to which the statement relates:

¨ third-party

tender offer subject to Rule 14d-1.

x issuer

tender offer subject to Rule 13e-4.

¨ going-private

transaction subject to Rule 13e-3.

¨ amendment

to Schedule 13D under Rule 13d-2.

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below to designate

the appropriate rule provision(s) relied upon:

¨ Rule 13e-4(i) (Cross-Border

Issuer Tender Offer)

¨ Rule 14d-1(d) (Cross-Border

Third-Party Tender Offer) |

On

July 19, 2024, Zhihu Inc. (the “Company”) announced a proposed share buy-back of up to HK$427.5 million (US$54.8

million) by way of a tender offer. Subject to independent shareholder approval, the tender offer will commence on the date when

an offer document setting forth the full terms of the tender offer and an expected timetable is published.

The tender offer has not yet commenced and has

not yet been approved by the Company’s shareholders. This communication (including the exhibits hereto) is provided for informational

purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any securities of the Company pursuant to the

tender offer or otherwise. As soon as practicable on the date of commencement of the tender offer, the Company intends to file a tender

offer statement on Schedule TO and related materials, including the offer document, with the SEC in respect of such tender offer pursuant

to Rule 13e-4 under the U.S. Securities Exchange Act of 1934, as amended. The shareholders and ADS holders are advised to carefully

read these documents if and when they become available, and any amendments to these documents, in their entirety before making any decision

with respect to the tender offer, because these documents will contain important information. If and when filed, the shareholders and

ADS holders may obtain copies of these documents and other documents filed with the SEC for free at the SEC’s website at https://www.sec.gov.

In addition, if and when filed, the Company will provide copies of such documents free of charge to the shareholders and ADS holders.

ITEM 12. EXHIBITS.

EXHIBIT INDEX

Exhibit 99.1

Hong Kong Exchanges and Clearing Limited and

The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its

accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole

or any part of the contents of this announcement.

This announcement has been prepared pursuant

to, and in order to comply with, the Listing Rules and the Codes, and does not constitute an invitation or offer to acquire, purchase

or subscribe for securities of the Company nor shall there be any sale, purchase or subscription for securities of the Company in any

jurisdiction in which such offer, solicitation or sale would be unlawful absent the filing of a registration statement or the availability

of an applicable exemption from registration or other waiver.

Zhihu Inc.

(A company controlled through weighted voting

rights and incorporated in the Cayman Islands with limited liability)

(NYSE: ZH; HKEX: 2390)

CONDITIONAL VOLUNTARY CASH OFFER BY DEUTSCHE

BANK AG HONG KONG BRANCH ON BEHALF OF THE COMPANY TO BUY BACK UP TO 46,921,448 CLASS A ORDINARY SHARES (INCLUDING IN THE FORM OF

AMERICAN DEPOSITARY SHARES) AT A PRICE OF HK$9.11 PER CLASS A ORDINARY SHARE (EQUIVALENT OF US$3.50 PER ADS)

Financial Adviser to the Company

Independent Financial Adviser to the Independent

Board Committee

|

THE OFFER

The Board announces that a conditional voluntary

cash offer will be made by Deutsche Bank on behalf of the Company to buy back, subject to fulfilment of the Condition, up to the Maximum

Number, being 46,921,448 Class A Ordinary Shares (including in the form of ADSs), representing approximately 15.9% of the total Shares

(on a one share one vote basis) in issue and outstanding as at the date of this announcement at a cash consideration of HK$9.11 per Class A

Ordinary Share (equivalent of US$3.50 per ADS).

The Offer will be made in full compliance with

the Codes and laws, regulations, and rules of the United States. The consideration for the Offer, being approximately HK$427,454,392

if the Offer is accepted in full, will be paid in cash and will be funded fully by internal resources of the Group.

The Offer Price of HK$9.11 values the entire issued

and outstanding share capital of the Company as at the date of this announcement (being 294,632,386 Shares) at approximately HK$2,684,101,036.

The Offer Price of HK$9.11 in cash per Class A

Ordinary Share represents:

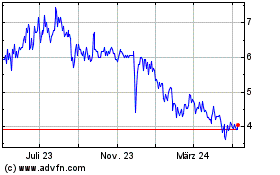

(i) a

premium of approximately 7.2% over the closing price of HK$8.50 per Class A Ordinary Share as quoted on the Stock Exchange

on July 19, 2024 (being the Last Trading Day);

(ii) a

premium of approximately 10.0% over HK$8.28 which is the average closing price per Class A Ordinary Share as quoted on the Stock

Exchange for the five consecutive trading days up to and including the Last Trading Day;

(iii) a

premium of approximately 9.6% over HK$8.31 which is the average closing price per Class A Ordinary Share as quoted on the

Stock Exchange for the ten consecutive trading days up to and including the Last Trading Day;

(iv) a

premium of approximately 14.9% over HK$7.93 which is the average closing price per Class A Ordinary Share as quoted on the

Stock Exchange for the thirty consecutive trading days up to and including the Last Trading Day; and

(v) a

discount of approximately 47.1% to the consolidated net asset value of the Company as at December 31, 2023 of approximately RMB15.61

per Share (equivalent to approximately HK$17.23 per Share) pursuant to the latest audited consolidated financial statements of the Company,

calculated based on the audited consolidated net asset value attributable to the Shareholders of RMB4,599.81 million as at December 31,

2023 and the total Shares in issue and outstanding as at the date of this announcement.

|

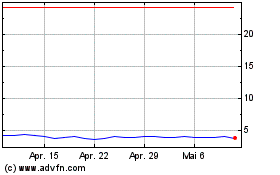

The Offer Price of US$3.50 in cash per ADS represents:

(i) a

premium of approximately 14.4% over the closing price of US$3.06 per ADS as quoted on the NYSE on July 18, 2024 (U.S. Eastern Time)

(being the NYSE trading day prior to the Last Trading Day);

(ii) a

premium of approximately 11.5% over US$3.14 which is the average closing price per ADS as quoted on the NYSE for the five consecutive

trading days up to and including the NYSE trading day prior to the Last Trading Day;

(iii) a

premium of approximately 10.8% over US$3.16 which is the average closing price per ADS as quoted on the NYSE for the ten consecutive trading

days up to and including the NYSE trading day prior to the Last Trading Day; and

(iv) a

premium of approximately 14.8% over US$3.05 which is the average closing price per ADS as quoted on the NYSE for the thirty consecutive

trading days up to and including the NYSE trading day prior to the Last Trading Day.

THE IRREVOCABLE UNDERTAKINGS

Each of Innovation Works Shareholders, Qiming

Shareholders and SAIF Shareholder has irrevocably undertaken to the Company that (i) it will, and will procure the holders of Shares

and/or ADSs whose Shares and/or ADSs it is deemed to be interested in by virtue of Part XV of the SFO to, accept the Offer in respect

of part of such Shares and/or ADSs (details of which are set out under the section headed “H. The Irrevocable Undertakings”

of this announcement); (ii) it will, and will procure the holders of Shares whose Shares it is deemed to be interested in by virtue

of Part XV of the SFO to, vote in favor of the resolution in connection with the Offer at the EGM; and (iii) prior to the earlier

of the Offer closing or lapsing: (a) it will not, and will procure any party acting in concert with it not to, acquire any Share

or ADS or other securities of the Company; and (b) it will not, and will procure any party acting in concert with it not to, sell,

transfer, assign, charge, encumber, grant any option over or otherwise dispose of or permit the sale, transfer, charging or other disposition

or creation or grant of any other encumbrance or option of or over all or any Shares and/or ADSs. The Irrevocable Undertakings are binding

until the closing, lapse or withdrawal of the Offer.

Mr. Zhou has indicated to the Company that

he will procure MO Holding Ltd through which he holds his interests in the Company to vote in favor of the resolution in connection with

the Offer at the EGM.

IMPLICATIONS UNDER THE LISTING RULES AND THE

CODES

As at the date of this announcement, Mr. Zhou,

who is the WVR Beneficiary, beneficially owns an aggregate 17,393,666 Class B Ordinary Shares and 19,460,912 Class A Ordinary

Shares, representing approximately 42.9% of the voting rights in the Company with respect to shareholder resolutions relating to matters

other than the Reserved Matters. Mr. Zhou holds his interests in the Company through MO Holding Ltd. More than 99% of the interest

of MO Holding Ltd is held by South Ridge Global Limited, which is in turn wholly-owned by a trust that was established by Mr. Zhou

(as the settlor) for the benefit of Mr. Zhou and his family. The remaining interest of MO Holding Ltd is held by Zhihu Holdings Inc.,

which is wholly-owned by Mr. Zhou.

|

|

Pursuant to Rule 8A.13 of the Listing Rules,

a listed issuer with a WVR structure must not increase the proportion of shares that carry weighted voting rights above the proportion

in issue at the time of listing. Pursuant to Rule 8A.15 of the Listing Rules, if a listed issuer with a WVR structure reduces the

number of its shares in issue (such as through a purchase of its own shares) the beneficiaries of weighted voting rights must reduce their

weighted voting rights in the issuer proportionately (such as through conversion of a proportion of their shareholding with those rights

into shares without those rights), if the reduction in the number of shares in issue would otherwise result in an increase in the proportion

of the listed issuer’s shares that carry weighted voting rights. Pursuant to Rule 8A.21 of the Listing Rules, any conversion

of shares with weighted voting rights into ordinary shares must occur on a one to one ratio.

Upon completion of the Offer, Mr. Zhou, the

WVR Beneficiary, will simultaneously reduce his WVR in the Company by way of converting his Class B Ordinary Shares into Class A

Ordinary Shares, such that the proportion of shares carrying WVR of the Company shall not be increased.

Taking into account (i) the Maximum Number

of Class A Ordinary Shares subject to the Offer and (ii) the fact that Mr. Zhou, the WVR Beneficiary, will simultaneously

reduce his WVR in the Company by way of converting his Class B Ordinary Shares into Class A Ordinary Shares on a one to one

ratio to the effect that the proportion of shares carrying WVR of the Company shall not be increased, it is expected that full acceptance

of the Offer will not result in change in control of the Company and will not result in acquisition of voting rights by any Shareholder

that gives rise to an obligation to make a mandatory offer in accordance with Rule 26 of the Takeovers Code. The Company intends

to maintain the listing status of the Class A Ordinary Shares on the Stock Exchange and the ADSs on the NYSE.

The Offer constitutes a share buy-back by general

offer by the Company pursuant to the Share Buy-backs Code. Pursuant to Rule 3.1 of the Share Buy-backs Code, the Offer must be approved

by a majority of the votes cast by Shareholders who do not have a material interest in the Offer, which is different from the interests

of all other Shareholders, in attendance in person or by proxy at a general meeting of the Shareholders duly convened and held to consider

the Offer. The Company will convene the EGM by a notice of meeting, which is accompanied by the Offer Document. If the Independent Shareholders

do not approve the Offer at the EGM, the Offer will lapse.

GENERAL

The EGM will be convened and held for the purposes

of considering and, if thought fit, approving the Offer, at which only Independent Shareholders can vote.

Pursuant to the trust deed in respect of

the 2022 Plan, the trustee of the 2022 Plan shall not exercise the voting rights attached to the Class A Ordinary Shares held by

it. As at the Date of this announcement, the trustee of the 2022 Plan held 10,109,451 Class A Ordinary Shares (representing approximately

2.2% of the voting rights in the Company), which will not be voted on at the EGM.

|

|

Mr. Dahai Li, Mr. Zhaohui Li, and Mr. Bing

Yu (each being a non-executive Director), and Mr. Hanhui Sam Sun, Ms. Hope Ni, and Mr. Derek Chen (each being an independent

non-executive Director), comprising all the non-executive Directors who have no interest in the Offer other than as a Shareholder (only

Mr. Dahai Li, Mr. Hanhui Sam Sun, Ms. Hope Ni, and Mr. Derek Chen are Shareholders), have been appointed as members

of the Independent Board Committee to advise the Independent Shareholders in respect of the Offer.

Altus Capital Limited, a corporation licensed

to carry out Type 4 (advising on securities), Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activities

under the SFO, has been appointed as the Independent Financial Adviser to advise the Independent Board Committee in connection with the

Offer as to the fairness and reasonableness of the Offer and as to voting by the Independent Shareholders. Such appointment has been approved

by the Independent Board Committee pursuant to Rule 2.1 of the Takeovers Code.

The Offer will commence on the date when the Offer

Document setting out the full terms of the Offer and an expected timetable is published, subject to Independent Shareholder approval at

the EGM. The Offer Document for the Offer containing, inter alia: (i) further details of the Offer; (ii) the expected timetable

relating to the Offer; (iii) the recommendation from the Independent Board Committee with respect to the Offer; (iv) the advice

of the Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders; (v) a notice convening

the EGM; and (vi) the Form of Acceptance, the ADS Letter of Transmittal, and information relating to the procedures required

for the acceptance of the Offer, will be dispatched to the Shareholders and ADS holders within 21 days from the date of this announcement

or such later date to which the Executive may consent.

WARNING

The Offer is subject to the Condition being

satisfied in full on or before the Long Stop Date. If the ordinary resolution to approve the Offer is not passed by the Independent Shareholders,

the Offer will not proceed and will lapse immediately.

It should be noted that dealings in the Class A

Ordinary Shares and the ADSs will continue notwithstanding that the Condition may remain unfulfilled, and that persons dealing in the

securities of the Company will bear the risk that the Offer may lapse.

Shareholders are advised to consider the detailed

terms of the Offer and read, among other things, the letter from the Independent Board Committee and the letter of advice from the Independent

Financial Adviser to the Independent Board Committee and the Independent Shareholders to be contained in the Offer Document before deciding

whether to vote for or against the ordinary resolution in respect of the Offer to be proposed at the EGM.

|

Shareholders should also note that their voting

decision on the ordinary resolution in respect of the Offer to be proposed at the EGM shall not affect their decision as to whether to

accept the Offer or not.

If Shareholders are in any doubt as to any

aspect of the Offer or as to the action to be taken, they should seek independent professional advice.

Shareholders and potential investors are advised

to exercise caution when dealing in the securities of the Company and should consult their professional advisers when in doubt.

The Offer has not yet commenced and has

not yet been approved by the Shareholders. This announcement is provided for informational purposes only and is neither an offer to purchase

nor a solicitation of an offer to sell any securities of the Company pursuant to the Offer or otherwise. As soon as practicable on the

date of commencement of the Offer, the Company intends to file a tender offer statement on Schedule TO and related materials, including

the Offer Document, with the SEC in respect of such Offer pursuant to Rule 13e-4 under the U.S. Securities Exchange Act of 1934,

as amended. The Shareholders and ADS holders are advised to carefully read these documents if and when they become available, and any

amendments to these documents, in their entirety before making any decision with respect to the Offer, because these documents will contain

important information. If and when filed, the Shareholders and ADS holders may obtain copies of these documents and other documents filed

with the SEC for free at the SEC’s website at https://www.sec.gov. In addition, if and when filed, the Company will provide copies

of such documents free of charge to the Shareholders and ADS holders.

|

The Board announces that a conditional voluntary

cash offer will be made by Deutsche Bank on behalf of the Company to buy back, subject to fulfilment of the Condition, up to the Maximum

Number, being 46,921,448 Class A Ordinary Shares (including in the form of ADSs), representing approximately 15.9% of the total Shares

(on a one share one vote basis) in issue and outstanding as at the date of this announcement at a cash consideration of HK$9.11 per Class A

Ordinary Share (equivalent of US$3.50 per ADS).

The Offer will be made in full compliance with

the Codes and laws, regulations, and rules of the United States. The consideration for the Offer, being approximately HK$427,454,392

if the Offer is accepted in full, will be paid in cash and will be funded fully by internal resources of the Group.

The principal terms of the Offer are as follows:

| (i) | Deutsche Bank will make the Offer to the Shareholders and ADS holders on behalf of the Company to buy

back up to the Maximum Number of Class A Ordinary Shares (including in the form of ADSs) at the Offer Price; |

| (ii) | the Shareholders and ADS holders may accept the Offer in respect of any number of their Class A Ordinary

Shares (including in the form of ADSs) at the Offer Price up to their entire shareholding (subject to the procedures for scaling down

as described under the section headed “F. Other Terms of the Offer” below); |

| (iii) | the Offer is not conditional upon a minimum number of Class A Ordinary Shares (including in the form

of ADSs) being tendered for buy-backs; |

| (iv) | all Class A Ordinary Shares (including in the form of ADSs) validly tendered will be bought back

to the extent that the aggregate number of Class A Ordinary Shares (including in the form of ADSs) repurchased pursuant to the Offer

will not thereby exceed the Maximum Number, and if the number of Class A Ordinary Shares (including in the form of ADSs) validly

tendered exceeds the Maximum Number, the number of Class A Ordinary Shares (including in the form of ADSs) to be bought back from

each Accepting Shareholder and each Accepting ADS holder will be reduced proportionally so that the number of Class A Ordinary Shares

(including in the form of ADSs) bought back by the Company in aggregate will not exceed Maximum Number – further details of the

procedures for scaling down are described under the section headed “F. Other Terms of the Offer” below; |

| (v) | the withdrawal right with respect to a Form of Acceptance or an ADS letter of transmittal, as applicable,

will be set out in the Offer Document; |

| (vi) | Class A Ordinary Shares will be bought back for cash, free of commission, levies, and dealings charges,

save that the amount of seller’s ad valorem stamp duty due on the Class A Ordinary Shares bought back attributable to

the Accepting Shareholders, calculated at a rate of 0.1% of the market value of the Class A Ordinary Shares to be bought back under

the Offer, or the consideration payable by the Company in respect of relevant acceptances of the Offer, whichever is higher, will be deducted

from the amount payable to the Accepting Shareholders and will be paid by the Company on behalf of the Accepting Shareholders, and ADS

holders will be responsible for applicable fees and charges payable to the ADS depositary; |

| (vii) | the Company may hold certain Class A Ordinary Shares (including in the form of ADSs) bought back

in treasury and if so, such Class A Ordinary Shares (including in the form of ADSs) will be treated as redeemed and will not be entitled

to any dividend declared for any record date set subsequent to the date of their redemption, and, accordingly, the issued and outstanding

share capital of the Company will be diminished by the nominal value of the Class A Ordinary Shares (including in the form of ADSs)

being bought back. In that case, the voting rights attached to those Class A Ordinary Shares (including in the form of ADSs) being

bought back and held in treasury will be suspended. For those Class A Ordinary Shares bought-back that will not be held in treasury,

they will be treated as cancelled and will not be entitled to any dividend declared for any record date set subsequent to the date of

their cancellation; and |

| (viii) | Class A Ordinary Shares (including in the form of ADSs) will be bought back free from all liens,

charges, encumbrances, equitable interests, rights of pre-emption, or other third party rights of any nature, and accordingly, the submission

of a Form of Acceptance (or an ADS Letter of Transmittal) by an Accepting Shareholder (or an Accepting ADS holder) will be deemed

to constitute a warranty by that Accepting Shareholder (or that Accepting ADS holder) to Deutsche Bank and the Company that the Class A

Ordinary Shares (or the ADSs) are being sold free from all liens, charges, encumbrances, equitable interests, rights of pre-emption, or

other third party rights of any nature and together with all rights accruing or attaching thereto, including, without limitation, the

right to receive dividends and other distributions declared, made or paid, if any, on or after the date of their redemption. As at the

date of this announcement, the Company has no outstanding dividend which remains unpaid. As at the date of this announcement, the Company

has no intention to declare any dividends or make any other distributions during the offer period (as defined under the Codes). |

In accordance with the Share Buy-backs Code, the

Offer will be subject to the approval by the Independent Shareholders in a general meeting by a majority of votes by way of poll.

The full terms and details of the Offer will be

set out in the Offer Document.

The Offer Price of HK$9.11 values the entire issued

and outstanding share capital of the Company as at the date of this announcement (being 294,632,386 Shares) at approximately HK$2,684,101,036.

The Offer Price of HK$9.11 in cash per Class A

Ordinary Share represents:

| (i) | a premium of approximately 7.2% over the closing price of HK$8.50 per Class A Ordinary Share

as quoted on the Stock Exchange on July 19, 2024 (being the Last Trading Day); |

| (ii) | a premium of approximately 10.0% over HK$8.28 which is the average closing price per Class A

Ordinary Share as quoted on the Stock Exchange for the five consecutive trading days up to and including the Last Trading Day; |

| (iii) | a premium of approximately 9.6% over HK$8.31 which is the average closing price per Class A

Ordinary Share as quoted on the Stock Exchange for the ten consecutive trading days up to and including the Last Trading Day; |

| (iv) | a premium of approximately 14.9% over HK$7.93 which is the average closing price per Class A

Ordinary Share as quoted on the Stock Exchange for the thirty consecutive trading days up to and including the Last Trading Day; and |

| (v) | a discount of approximately 47.1% to the consolidated net asset value of the Company as at December 31,

2023 of approximately RMB15.61 per Share (equivalent to approximately HK$17.23 per Share) pursuant to the latest audited consolidated

financial statements of the Company, calculated based on the audited consolidated net asset value attributable to the Shareholders of

RMB4,599.81 million as at December 31, 2023 and the total Shares in issue and outstanding as at the date of this announcement. |

The Offer Price of US$3.50 in cash per ADS represents:

| (i) | a premium of approximately 14.4% over the closing price of US$3.06 per ADS as quoted on the NYSE on July 18,

2024 (U.S. Eastern Time) (being the NYSE trading day prior to the Last Trading Day); |

| (ii) | a premium of approximately 11.5% over US$3.14 which is the average closing price per ADS as quoted on

the NYSE for the five consecutive trading days up to and including the NYSE trading day prior to the Last Trading Day; |

| (iii) | a premium of approximately 10.8% over US$3.16 which is the average closing price per ADS as quoted on

the NYSE for the ten consecutive trading days up to and including the NYSE trading day prior to the Last Trading Day; and |

| (iv) | a premium of approximately 14.8% over US$3.05 which is the average closing price per ADS as quoted on

the NYSE for the thirty consecutive trading days up to and including the NYSE trading day prior to the Last Trading Day. |

The Offer Price per Class A Ordinary Share

was determined after taking into account, among other things, the historical prices of the Class A Ordinary Shares traded on the

Stock Exchange and the ADSs traded on the NYSE, historical financial information of the Group and the prevailing market and sentiments,

and with reference to the share buy-back transactions of companies listed on the Main Board of the Stock Exchange or on the NYSE in recent

years. The Offer Price per ADS was determined on the same basis as the Offer Price per Class A Ordinary Share and was calculated

based on the ADS to Class A Ordinary Share ratio (i.e., every one representing three Class A Ordinary Shares) and an exchange

rate of US$1.00 : HK$7.8073, the exchange rate prevailing on the date of this announcement set forth in the H.10 statistical release of

the Federal Reserve Board.

| D. | CONFIRMATION OF FINANCIAL RESOURCES |

The maximum amount of consideration for the Offer,

being approximately HK$427,454,392 if the Offer is accepted in full, will be paid in cash and will be funded fully by internal cash resources

of the Group. Deutsche Bank, being the financial adviser to the Company in respect of the Offer, is satisfied that sufficient financial

resources are available to the Company to satisfy the consideration for the full acceptance of the Offer as described above.

The Offer will be conditional upon the approval

by more than 50% of the votes cast by the Independent Shareholders in attendance either in person or by proxy by way of a poll having

been obtained at the EGM in respect of the Offer on or before the Long Stop Date.

The Condition cannot be waived. Accordingly, if

the Condition is not satisfied on or before the Long Stop Date, the Offer will not proceed.

WARNING

The Offer is subject to the Condition being

satisfied in full on or before the Long Stop Date. If the ordinary resolution to approve the Offer is not passed by the Independent Shareholders,

the Offer will not proceed and will lapse immediately.

It should be noted that dealings in the Class A

Ordinary Shares and ADSs will continue notwithstanding that the Condition may remain unfulfilled, and that persons dealing in the securities

of the Company will bear the risk that the Offer may lapse.

Shareholders are advised to consider the detailed

terms of the Offer and read, among other things, the letter from the Independent Board Committee and the letter of advice from the Independent

Financial Adviser to the Independent Board Committee and the Independent Shareholders to be contained in the Offer Document before deciding

whether to vote for or against the ordinary resolution in respect of the Offer to be proposed at the EGM. Shareholders should also note

that their voting decision on the ordinary resolution in respect of the Offer to be proposed at the EGM shall not affect their decision

as to whether to accept the Offer or not.

If Shareholders are in any doubt as to any

aspect of the Offer as to the action to be taken, they should seek independent professional advice.

Shareholders and potential investors are advised

to exercise caution when dealing in the securities of the Company and should consult their professional advisers when in doubt.

The Offer has not yet commenced and has not

yet been approved by the Shareholders. This announcement is provided for informational purposes only and is neither an offer to purchase

nor a solicitation of an offer to sell any securities of the Company pursuant to the Offer or otherwise. As soon as practicable on the

date of commencement of the Offer, the Company intends to file a tender offer statement on Schedule TO and related materials, including

the Offer Document, with the SEC in respect of such Offer pursuant to Rule 13e-4 under the U.S. Securities Exchange Act of 1934,

as amended. The Shareholders and ADS holders are advised to carefully read these documents if and when they become available, and any

amendments to these documents, in their entirety before making any decision with respect to the Offer, because these documents will contain

important information. If and when filed, the Shareholders and ADS holders may obtain copies of these documents and other documents filed

with the SEC for free at the SEC’s website at https://www.sec.gov. In addition, if and when filed, the Company will provide copies

of such documents free of charge to the Shareholders and ADS holders.

Pursuant to Rule 5.1 of the Share Buy-backs

Code and Rule 15.3 of the Takeovers Code, if the Offer is declared unconditional, Shareholders who have not tendered their Class A

Ordinary Shares (including in the form of ADSs) for acceptance will be able to tender their Class A Ordinary Shares (including in

the form of ADSs) for acceptance under the Offer for a period of 14 days thereafter.

| F. | OTHER TERMS OF THE OFFER |

Shareholders and ADS holders may accept the Offer

in respect of some or all of their respective shareholdings and ADS holdings. If valid acceptances are received for the Maximum Number

or fewer Class A Ordinary Shares (including in the form of ADSs), all Class A Ordinary Shares (including in the form of ADSs)

validly accepted will be bought back. If valid acceptances received exceed the Maximum Number, the total number of Class A Ordinary

Shares (including in the form of ADSs) to be bought back by the Company from each Accepting Shareholder and each Accepting ADS holder

will be determined in accordance with the following formula, save that the Company may in its absolute discretion round such figure up

or down with the intention of avoiding (as far as practicable) Class A Ordinary Shares (including in the form of ADSs) being held

by Accepting Shareholders and Accepting ADS holders in fractional entitlements:

A = 46,921,448 Class A Ordinary

Shares (including in the form of ADSs), being the Maximum Number

B = Total number of Class A Ordinary

Shares (including in the form of ADSs) tendered by all Accepting Shareholders and Accepting ADS holders under the Offer

C = Total number of Class A Ordinary

Share (including in the form of ADSs) tendered by the relevant individual Accepting Shareholder or Accepting ADS holder under the Offer

As a result, it is possible that not all of such

Class A Ordinary Shares (including in the form of ADSs) tendered by an Accepting Shareholder or Accepting ADS holder will ultimately

be bought back. The total number of Class A Ordinary Shares (including in the form of ADSs) that will be bought-back by the Company

under the Offer will not exceed the Maximum Number. The decision of the Company as to any scaling down of acceptances in accordance with

the above formula and as to the treatment of fractions will be conclusive and binding on all Accepting Shareholders and Accepting ADS

holders.

| G. | ODD LOTS OF CLASS A ORDINARY SHARES |

The Class A Ordinary Shares are currently

traded in board lot of 100 Class A Ordinary Shares each on the Stock Exchange. There is no intention to change the board lot size

as a result of the Offer. Accepting Shareholders should note that acceptance of the Offer may result in their holding of odd lots of Class A

Ordinary Shares. The Company will make arrangements to appoint a designated agent to match sales and purchases of odd lot holdings of

Class A Ordinary Shares for a reasonable period after completion of the Offer in order to enable such Accepting Shareholders to dispose

of their odd lots or to top up their odd lots to whole board lots. Details of such arrangements will be included in the Offer Document

and will be disclosed by way of separate announcement as and when appropriate.

| H. | THE IRREVOCABLE UNDERTAKINGS |

Each of Innovation Works Shareholders, Qiming

Shareholders and SAIF Shareholder has irrevocably undertaken to the Company that (i) it will, and will procure the holders of Shares

and/or ADSs whose Shares and/or ADSs it is deemed to be interested in by virtue of Part XV of the SFO to, accept the Offer in respect

of part of such Shares and/or ADSs; (ii) it will, and will procure the holders of Shares whose Shares it is deemed to be interested

in by virtue of Part XV of the SFO to, vote in favor of the resolution in connection with the Offer at the EGM; and (iii) prior

to the earlier of the Offer closing or lapsing: (a) it will not, and will procure any party acting in concert with it not to, acquire

any Share or ADS or other securities of the Company; and (b) it will not, and will procure any party acting in concert with it not

to, sell, transfer, assign, charge, encumber, grant any option over or otherwise dispose of or permit the sale, transfer, charging or

other disposition or creation or grant of any other encumbrance or option of or over all or any Shares and/or ADSs. The Irrevocable Undertakings

are binding until the closing, lapse or withdrawal of the Offer.

Pursuant to the Irrevocable Undertakings,

| (i) | Innovation Works Shareholders, Qiming Shareholders and SAIF Shareholder have irrevocably undertaken to

the Company to tender 9,000,000, 5,891,994 and 3,000,000 Class A Ordinary Shares (including in the form of ADSs) for acceptance of

the Offer, respectively, representing approximately 3.1%, 2.0% and 1.0% of the total Shares (on a one share one vote basis) in issue and

outstanding as at the date of this announcement; and |

| (ii) | in respect of the undertaking to vote in favor of the resolution in connection with the Offer at the EGM, Innovation

Works Shareholders, Qiming Shareholders and SAIF Shareholder together hold a total of 34,120,714 Class A Ordinary Shares (including

in the form of ADSs), representing approximately 7.6% of the voting rights in the Company as at the date of this announcement. |

As at the date of this announcement, Innovation

Works Shareholders, Qiming Shareholders and SAIF Shareholder hold 11,889,945, 10,201,891 and 12,028,878 Class A Ordinary Shares (including

in the form of ADSs), representing approximately 4.0%, 3.5% and 4.1% of interest in the total issued and outstanding Shares (on a one

share one vote basis, and excluding the Class A Ordinary Shares issued to the depositary for bulk issuance of ADSs reserved for future

issuances upon the exercise or vesting of awards granted under the 2012 Plan and the 2022 Plan) and approximately 2.6%, 2.3% and 2.7%

of voting rights in the Company, respectively.

Mr. Zhou has indicated to the Company that

he will procure MO Holding Ltd through which he holds his interests in the Company to vote in favor of the resolution in connection with

the Offer at the EGM.

As at the date of this announcement, the trustee

of the 2022 Plan held 10,109,451 Class A Ordinary Shares, which are held on trust for participants under the 2022 Plan to satisfy

the future exercise or vesting of awards granted under the 2022 Plan. Under the trust deed in respect of the 2022 Plan, the trustee shall

not exercise the voting rights in respect of any Class A Ordinary Shares held under the 2022 Plan. Accordingly, such 10,109,451 Class A

Ordinary Shares shall not be voted at the EGM. In accordance with the trust deed in respect of the 2022 Plan, the Board has instructed

the trustee not to accept the Offer.

As at the date of this announcement, save for

the Irrevocable Undertakings, (i) neither the Company nor parties acting in concert with it has received any irrevocable commitment

not to accept the Offer; and (ii) neither the Company nor parties acting in concert with it has received any irrevocable commitment

to accept the Offer.

The making of the Offer to Overseas Shareholders

may be subject to the laws of the relevant jurisdictions. The laws of the relevant jurisdictions may prohibit the making of the Offer

to Overseas Shareholders or require compliance with certain filing, registration, or other requirements in respect of the Offer. The Company

reserves the right, subject to the consent of the Executive and the relevant legal requirements, to make special arrangements with respect

to Overseas Shareholders whose receipt of the Offer Document and the Form of Acceptance is subject to the laws of the overseas jurisdictions.

Details of the Offer in respect of Overseas Shareholders will be set out in the Offer Document. The Company will comply with the requirements

under Rule 8 (subject to Note 3 to Rule 8) of the Takeovers Code in respect of Overseas Shareholders.

It is the responsibility of each Overseas Shareholder

who wishes to accept the Offer to satisfy itself or himself or herself as to the full observance of the laws of the relevant jurisdictions

in that connection, including the obtaining of any government or other consents that may be required or compliance with other necessary

formalities or legal requirements. Any acceptance of the Offer by any Shareholder shall be deemed to constitute a representation and warranty

from such Shareholder to the Company that all applicable local laws and requirements have been observed and complied with. Shareholders

should consult their professional advisers if in doubt.

The Company shall give notice of any matter in

relation to the Offer to the Shareholders by issuing announcements or advertisements in accordance with the Codes and the Listing Rules and,

if so given, shall be deemed to have been sufficient for all effective purposes, despite any failure by any Overseas Shareholders to receive

the same.

| J. | U.S. SHAREHOLDERS AND ADS HOLDERS |

Shareholders (but not ADS holders in respect of

their holdings of ADSs) who are located in the United States and wish to participate in the Offer must follow the instructions applicable

to other Shareholders to be set out in the Offer Document.

ADS holders should refer to the additional instructions

to be set out in the Offer Document in order to participate in the Offer. If the ADSs are held through a broker, dealer, commercial bank,

trust company, or other securities intermediary and the ADS holder wishes to participate in the Offer, such ADS holder should provide

tender instructions in accordance with the instructions provided by such intermediary in sufficient time so as to ensure that such intermediary

can provide such instructions timely according to the Offer Document.

| K. | NOMINEE REGISTRATION OF SHARES |

To ensure equality of treatment of all Shareholders,

those who hold Shares as nominees for more than one beneficial owner should, as far as practicable, treat the holding of each beneficial

owner separately. In order for beneficial owners of the Class A Ordinary Shares, whose investments are registered in nominee names

(including those whose interests in Class A Ordinary Shares are held through CCASS), to accept the Offer, it is essential that they

provide instructions to their nominee agents of their intentions with regard to the Offer.

| L. | IMPLICATIONS UNDER THE LISTING RULES AND THE CODES |

Implications under the Listing Rules

As at the date of this announcement, Mr. Zhou,

who is the WVR Beneficiary, beneficially owns an aggregate 17,393,666 Class B Ordinary Shares and 19,460,912 Class A Ordinary

Shares, representing approximately 42.9% of the voting rights in the Company with respect to shareholder resolutions relating to matters

other than the Reserved Matters. Mr. Zhou holds his interests in the Company through MO Holding Ltd. More than 99% of the interest

of MO Holding Ltd is held by South Ridge Global Limited, which is in turn wholly-owned by a trust that was established by Mr. Zhou

(as the settlor) for the benefit of Mr. Zhou and his family. The remaining interest of MO Holding Ltd is held by Zhihu Holdings Inc.,

which is wholly-owned by Mr. Zhou.

Pursuant to Rule 8A.13 of the Listing Rules,

a listed issuer with a WVR structure must not increase the proportion of shares that carry weighted voting rights above the proportion

in issue at the time of listing. Pursuant to Rule 8A.15 of the Listing Rules, if a listed issuer with a WVR structure reduces the

number of its shares in issue (such as through a purchase of its own shares) the beneficiaries of weighted voting rights must reduce their

weighted voting rights in the issuer proportionately (such as through conversion of a proportion of their shareholding with those rights

into shares without those rights), if the reduction in the number of shares in issue would otherwise result in an increase in the proportion

of the listed issuer’s shares that carry weighted voting rights. Pursuant to Rule 8A.21 of the Listing Rules, any conversion

of shares with weighted voting rights into ordinary shares must occur on a one to one ratio.

Upon completion of the Offer, Mr. Zhou, the

WVR Beneficiary, will simultaneously reduce his WVR in the Company by way of converting his Class B Ordinary Shares into Class A

Ordinary Shares, such that the proportion of shares carrying WVR of the Company shall not be increased.

Implications under the Codes

Taking into account (i) the Maximum Number

of Class A Ordinary Shares subject to the Offer and (ii) the fact that Mr. Zhou, the WVR Beneficiary, will simultaneously

reduce his WVR in the Company by way of converting his Class B Ordinary Shares into Class A Ordinary Shares on a one to one

ratio to the effect that the proportion of shares carrying WVR of the Company shall not be increased, it is expected that full acceptance

of the Offer will not result in change in control of the Company and will not result in acquisition of voting rights by any Shareholder

that gives rise to an obligation to make a mandatory offer in accordance with Rule 26 of the Takeovers Code. The Company intends

to maintain the listing status of the Class A Ordinary Shares on the Stock Exchange and the ADSs on the NYSE.

The Offer constitutes a share buy-back by general

offer by the Company pursuant to the Share Buy-backs Code. Pursuant to Rule 3.1 of the Share Buy-backs Code, the Offer must be approved

by a majority of the votes cast by Shareholders who do not have a material interest in the Offer which is different from the interests

of all other Shareholders, in attendance in person or by proxy at a general meeting of the Shareholders duly convened and held to consider

the Offer. The Company will convene the EGM by a notice of meeting which is accompanied by the Offer Document. If the Independent Shareholders

do not approve the Offer at the EGM, the Offer will lapse.

If the Offer is not approved by the Independent

Shareholders, the Offer will not proceed and will lapse immediately.

As at the date of this announcement, the Company

does not believe that the transactions under the Offer would give rise to any concerns in relation to compliance with other applicable

rules or regulations (including the Listing Rules) in Hong Kong. If a concern should arise after the release of this announcement,

the Company will endeavor to resolve the matter to the satisfaction of the relevant authority as soon as possible but in any event before

the dispatch of the Offer Document.

| M. | CHANGES IN SHAREHOLDING STRUCTURE OF THE COMPANY |

The table below sets out the shareholding structure

of the Company as at the date of this announcement and immediately after the completion of the Offer (assuming that (i) the Maximum

Number of Class A Ordinary Shares are bought-back under the Offer; (ii) Mr. Zhou will simultaneously reduce his WVR in

the Company by way of converting his Class B Ordinary Shares into Class A Ordinary Shares on a one to one ratio pursuant to

the Listing Rules to the effect that the proportion of shares carrying WVR of the Company shall not be increased; (iii) no

outstanding options or restricted share units granted pursuant to the 2012 Plan or the 2022 Plan will be exercised or vested from the

date of this announcement up to and including the date of completion of the Offer; and (iv) none of the Controlling Shareholders,

Director who holds Shares, or parties acting in concert with the Company will accept the Offer):

| | |

Immediately

before completion of the Offer |

| |

Upon

completion of the Offer |

|

| | |

Number

of Shares | |

Approximate %

of interest

in the total

issued and

outstanding

Shares (on a

one

share one

vote basis) | | |

Approximate %

of voting

rights | | |

Number

of Shares | |

Approximate %

of interest

in the total

issued and

outstanding

Shares (on a

one

share one

vote basis) | | |

Approximate %

of voting

rights | |

| Controlling

Shareholders | |

| |

| | |

| | |

| |

| | |

| |

| —MO

Holding Ltd (1) | |

19,460,912 Class A Ordinary Shares | |

6.6 | % | |

4.3 | % | |

22,227,776 Class A Ordinary Shares | |

9.0 | % | |

5.9 | % |

| | |

17,393,666 Class B Ordinary Shares | |

5.9 | % | |

38.6 | % | |

14,626,802 Class B Ordinary Shares | |

5.9 | % | |

38.6 | % |

| Sub-total | |

36,854,578

Shares | |

12.5 | % | |

42.9 | % | |

36,854,578

Shares | |

14.9 | % | |

44.4 | % |

| Director

who holds Shares | |

| |

| | |

| | |

| |

| | |

| |

| —Mr. Dahai

Li (2) | |

2,878,690 Class A Ordinary Shares | |

1.0 | % | |

0.6 | % | |

2,878,690 Class A Ordinary Shares | |

1.2 | % | |

0.8 | % |

| —Mr. Hanhui

Sam Sun (3) | |

7,500 Class A Ordinary Shares | |

0.0 | % | |

0.0 | % | |

7,500 Class A Ordinary Shares | |

0.0 | % | |

0.0 | % |

| —Ms. Hope

Ni (3) | |

7,500 Class A Ordinary Shares | |

0.0 | % | |

0.0 | % | |

7,500 Class A Ordinary Shares | |

0.0 | % | |

0.0 | % |

| —Mr. Derek

Chen (3) | |

5,000 Class A Ordinary Shares | |

0.0 | % | |

0.0 | % | |

5,000 Class A Ordinary Shares | |

0.0 | % | |

0.0 | % |

| Parties

acting in concert with the Company | |

| |

| | |

| | |

| |

| | |

| |

| —Deutsche

Bank Concert Group (4) | |

— | |

— | | |

— | | |

— | |

— | | |

— | |

| Other

Shareholders | |

| |

| | |

| | |

| |

| | |

| |

| Trustee

of the 2022 Plan (5) | |

10,109,451 Class A Ordinary Shares | |

3.4 | % | |

2.2 | % | |

10,109,451 Class A Ordinary Shares | |

4.1 | % | |

2.7 | % |

| Other

shareholders (6) | |

244,769,667

Class A Ordinary Shares | |

83.1 | % | |

54.3 | % | |

197,848,219

Class A Ordinary Shares | |

79.9 | % | |

52.2 | % |

| Total | |

294,632,386

Shares | |

100.0 | % | |

100.0 | % | |

247,710,938

Shares | |

100.0 | % | |

100.0 | % |

Notes:

| (1) | MO Holding Ltd is a company incorporated in the British Virgin Islands. As at the date of this announcement,

more than 99% of the interest of MO Holding Ltd is held by South Ridge Global Limited, which is in turn wholly-owned by a trust that was

established by Mr. Zhou (as the settlor) for the benefit of Mr. Zhou and his family. The remaining interest of MO Holding Ltd

is held by Zhihu Holdings Inc., which is wholly-owned by Mr. Zhou. Upon completion of the Offer, Mr. Zhou, the WVR Beneficiary,

will simultaneously reduce his WVR in the Company by way of converting the Class B Ordinary Shares held by MO Holding Ltd into Class A

Ordinary Shares on a one to one ratio pursuant to the Listing Rules, such that the proportion of shares carrying WVR of the Company shall

not be increased. |

| (2) | Including (i) 1,673,042 Class A Ordinary Shares held by Ocean Alpha Investment Limited; (ii) 1,106,198

Class A Ordinary Shares held by SEA & SANDRA Global Limited; and (iii) 99,450 Class A Ordinary Shares representing

the ADSs held by Mr. Dahai Li. The entire interest in Ocean Alpha Investment Limited is held by a trust that was established by Mr. Dahai

Li for the benefit of him and his family. SEA & SANDRA Global Limited is wholly-owned by Mr. Dahai Li. Mr. Dahai Li

is therefore deemed to be interested in the Shares held by Ocean Alpha Investment Limited and SEA & SANDRA Global Limited. |

| (3) | The relevant Directors are entitled to receive 10,000 restricted shares (the underlying Shares of

which are Class A Ordinary Shares) pursuant to their respective director agreements with the Company. As at the date of this

announcement, 75%, 75% and 50% of the relevant restricted shares have become vested to Mr. Hanhui Sam Sun, Ms. Hope Ni and

Mr. Derek Chen, respectively. |

| (4) | Deutsche Bank has been appointed as the financial adviser to the Company in respect of the Offer. Accordingly,

Deutsche Bank and persons controlling, controlled by or under the same control as Deutsche Bank (except exempt principal traders and exempt

fund managers, in each case recognised by the Executive as such for the purpose of the Takeovers Code) are presumed to be acting in concert

with the Company in accordance with class 5 of the definition of “acting in concert” under the Takeovers Code. |

Details of holdings, borrowings or lending

of, and dealings in, the Class A Ordinary Shares or ADSs or any other relevant securities (as defined in Note 4 to Rule 22 of

the Takeovers Code) of the Company held by or entered into by other members of the Deutsche Bank group (except in respect of Class A

Ordinary Shares or ADSs held by exempt principal traders or exempt fund managers or Class A Ordinary Shares or ADSs held on behalf

of non-discretionary investment clients of other parts of the Deutsche Bank group), if any, will be obtained as soon as possible after

the date of this announcement in accordance with Note 1 to Rule 3.5 of the Takeovers Code. A further announcement will be made by

the Company if the holdings, borrowings, lending, or dealings of the other members of the Deutsche Bank group are significant and in any

event, such information will be disclosed in the Offer Document. The statements in this announcement as to holdings, borrowings or lending

of, or dealings in, the Class A Ordinary Shares or ADSs or any other relevant securities (as defined in Note 4 to Rule 22 of

the Takeovers Code) of the Company by parties acting in concert with the Company are subject to the holdings, borrowings, lending, or

dealings (if any) of relevant members of the Deutsche Bank group presumed to be acting in concert with the Company.

Notwithstanding that connected exempt

principal traders within the Deutsche Bank group are not acting in concert with the Company:

| (i) | Class A Ordinary Shares or ADSs held by any such connected exempt principal traders must not be assented

to the Offer until the Offer becomes or is declared unconditional as to acceptances in accordance with the requirements of Rule 35.3

of the Takeovers Code, unless (a) the relevant connected exempt principal trader holds the Class A Ordinary Shares or ADSs as

a simple custodian for and on behalf of non-discretionary clients, and (b) there are contractual arrangements in place between the

relevant connected exempt principal trader and its clients that strictly prohibit the relevant connected exempt principal trader from

exercising any discretion over the relevant Class A Ordinary Shares or ADSs, and all instructions shall originate from the client

only, and if no instructions are given, then no action shall be taken on the relevant Class A Ordinary Shares or ADSs held by the

relevant connected exempt principal trader. |

| (ii) | (a) Class A Ordinary Shares or ADSs held by any such connected exempt principal traders shall

not be voted at the EGM in accordance with the requirement of Rule 35.4 of the Takeovers Code, and the Class A Ordinary

Shares or ADSs held by any member of the Deutsche Bank group in the capacity of an exempt principal trader for and on behalf of

non-discretionary investment clients shall not be voted at the EGM unless otherwise confirmed with the Executive. |

| | (b) Class A Ordinary Shares

or ADSs held by such exempt principal traders may, subject to consent of the Executive, be allowed to be voted at the EGM if:

(A) the relevant connected exempt principal trader holds the relevant Class A Ordinary Shares or ADSs as a simple

custodian for and on behalf of non-discretionary clients; (B) there are contractual arrangements in place between the relevant

connected exempt principal trader and its client that strictly prohibit such member of the Deutsche Bank group from exercising any

discretion over the relevant Class A Ordinary Shares or ADSs; (C) all instructions shall originate from such

non-discretionary client only (if no instructions are given, then no action shall be taken on the relevant Class A Ordinary

Shares or ADSs held by the relevant connected exempt principal trader); and (D) such non-discretionary client is not a party

acting in concert with the Company and is an Independent Shareholder. |

| (5) | This represents the Class A Ordinary Shares, which were purchased at the cost of the Company, held

by the trustee of the 2022 Plan on trust for participants under the 2022 Plan to satisfy the future exercise or vesting of awards granted

under the 2022 Plan. |

| (6) | This includes the Shareholders who have given the Irrevocable Undertakings. |

| (7) | The calculation is based on a total number of 277,238,720 Class A Ordinary Shares and 17,393,666

Class B Ordinary Shares issued and outstanding as at July 19, 2024 (excluding the Class A Ordinary Shares issued to the

depositary for bulk issuance of ADSs reserved for future issuances upon the exercise or vesting of awards granted under the 2012 Plan

and the 2022 Plan). In addition, percentage may not add up to 100% due to rounding. |

As at the date of this announcement, save as disclosed

above, neither the Company nor its parties acting in concert holds, owns, controls, or has direction over any Shares, outstanding options,

derivatives, warrants, or securities that are convertible or exchangeable into Shares, or has entered into any outstanding derivatives

in respect of securities in the Company.

| N. | INFORMATION ON THE COMPANY AND THE GROUP |

The Company is an exempted company incorporated

in Cayman Islands with limited liability, which is controlled through weighted voting rights. The Company’s ADSs have been listed

on the NYSE under the symbol “ZH” since March 26, 2021. The Company’s Class A Ordinary Shares have been listed

on the Main Board of the Stock Exchange since April 22, 2022. The Group is a leading online content community in China where people

come to find solutions, make decisions, seek inspiration, and have fun. Since the initial launch in 2010, the Group has grown from a Q&A

community into one of the top comprehensive online content communities and the largest Q&A-inspired online content community in China.

Set out below is a summary of the audited consolidated

financial results of the Group for the two years ended December 31, 2022 and 2023 as extracted from the annual report of the Company

for the year ended December 31, 2023:

| | |

For the Year Ended December 31, | |

| | |

2023 | | |

2022 | |

| | |

RMB’000

(Audited) | | |

RMB’000

(Audited) | |

| Revenue | |

| 4,198,889 | | |

| 3,604,919 | |

| Loss before income tax | |

| (827,696 | ) | |

| (1,564,220 | ) |

| Net loss | |

| (839,528 | ) | |

| (1,578,403 | ) |

| Net loss attributable to the Company’s shareholders | |

| (843,641 | ) | |

| (1,581,157 | ) |

The audited consolidated net asset value attributable

to the Shareholders as at December 31, 2023 was RMB4,599.81 million.

The Company repurchased 3,482,784 ADSs, representing

a total of 1,741,392 Class A Ordinary Shares of the Company based on the then effective ADS to Class A Ordinary Share ratio

of two ADSs representing one Class A Ordinary Share prior to May 10, 2024, in the six-month period prior to the date of this

announcement in accordance with the general mandate to repurchase Shares and/or ADSs that has been granted by the Shareholders to the

Board at the annual general meeting of the Company held on June 30, 2023. The Company will not conduct any on-market share buy-back

from the date of this announcement up to and including the date on which the Offer closes, lapses, or is withdrawn, as the case may be.

| Period of | |

Number and method of | |

| Price paid per Share | | |

| | | |

| Average price | |

| Repurchase | |

Repurchased Shares | |

| Highest | | |

| Lowest | | |

| paid per Share | |

| January 19 to January 31, 2024 | |

1,615,066 on the NYSE | |

| US$ |

1.73 | | |

| US$ |

1.56 | | |

| US$ |

1.66 | |

| February 1 to February 29, 2024 | |

Nil | |

| |

— | | |

| |

— | | |

| |

— | |

| March 1 to March 31, 2024 | |

126,326 on the NYSE | |

| US$ |

1.38 | | |

| US$ |

1.35 | | |

| US$1 |

.37 | |

| April 1 to April 30, 2024 | |

Nil | |

| |

— | | |

| |

— | | |

| |

— | |

| May 1 to May 31, 2024 | |

Nil | |

| |

— | | |

| |

— | | |

| |

— | |

| June 1 to June 30, 2024 | |

Nil | |

| |

— | | |

| |

— | | |

| |

— | |

| July 1 to July 18, 2024 | |

Nil | |

| |

— | | |

| |

— | | |

| |

— | |

As at the date of this announcement:

| (i) | save for the Irrevocable Undertakings, there is no arrangement referred to in Note 8 to Rule 22 of

the Takeovers Code (whether by way of option, indemnity or otherwise) in relation to the Shares and other relevant securities of the Company

which might be material to the Offer; |

| (ii) | there is no agreement or arrangement, to which the Company or any party acting in concert with it is a

party, which relates to circumstances in which it may or may not invoke or seek to invoke a pre-condition or a condition to the Offer

(save as those set out in the section headed “E. Condition of the Offer” in this announcement above); |

| (iii) | neither the Company nor any party acting in concert with it has borrowed or lent any relevant securities

(as defined in Note 4 to Rule 22 of the Takeovers Code) in the Company; |

| (iv) | save for the Irrevocable Undertakings, there is no understanding, arrangement, agreement or special deal

between any Shareholder, on the one hand, and any of the Company and any party acting in concert with it, on the other hand; and |

| (v) | apart from the Offer Price, there is no other consideration, compensation or benefit in whatever form

paid or to be paid by the Company or any party acting in concert with it to any Shareholder or any party acting in concert with any of

them in connection with the Offer. |

| Q. | REASONS FOR AND BENEFITS OF THE OFFER |

The Company believes that the Offer is in the

best interest of the Company and its Shareholders and ADS holders as a whole for the following reasons:

| (i) | The Offer will provide the Shareholders and ADS holders with an opportunity to realize part of their

investments: The Offer Price for Class A Ordinary Share represents a premium of approximately 9.6% over HK$8.31 which

is the average closing price per Class A Ordinary Share as quoted on the Stock Exchange for the ten consecutive trading days up to

and including the Last Trading Day and a premium of approximately 14.9% over HK$7.93 which is the average closing price per Share

as quoted on the Stock Exchange for the thirty consecutive trading days up to and including the Last Trading Day. The Offer Price for

ADS represents a premium of approximately 10.8% over US$3.16 which is the average closing price per ADS as quoted on the NYSE for the

ten consecutive trading days up to and including the NYSE trading day prior to the Last Trading Day and a premiumof approximately 14.8%

over US$3.05 which is the average closing price per ADS as quoted on the NYSE for the thirty consecutive trading days up to and including

the NYSE trading day prior to the Last Trading Day. |

The Offer will provide an opportunity

for the Shareholders and ADS holders either to tender Class A Ordinary Shares (including in the form of ADSs) to realize part of

their investments in the Company at a premium to recent market prices, or to increase their proportionate equity interests in the Company

by retaining their shareholdings and participating in the future prospects of the Group. Therefore, the Offer provides the Shareholders

and ADS holders a mechanism that allows them to decide their preferred investment level in the Company and allows those who wish to stay

to benefit from enhanced Shareholder value.

| (ii) | The Offer will improve the trading dynamics and refresh the Company’s shareholders’ structure:

Considering the thin liquidity of the Class A Ordinary Shares traded on the Stock Exchange and in the form of ADSs traded on

the NYSE, the Company believes that the Offer, if completed, will improve the trading dynamics and refresh the Company’s shareholders’

structure. |

| (iii) | Making the Offer is the best use of the Company’s financial resource: The Company had audited

consolidated net assets attributable to the Shareholders of approximately RMB4,599.81 million (equivalent to approximately HK$5,075.82

million) as at December 31, 2023 and an aggregate of cash and cash equivalents, term deposits and short-term investments was RMB5,462.93

million (equivalent to approximately HK$6,028.26 million) as at December 31, 2023. After evaluating its cash position, the Company

believes that making the Offer is the best use of the Company’s cash and is in the best interest of the Company and its Shareholders

as a whole. |

| R. | INTENTION OF THE COMPANY |

The Company intends to maintain the listing status

of the Class A Ordinary Shares on the Stock Exchange and the ADSs on the NYSE. Assuming that the Offer is accepted in full, the Company

expects to meet the minimum public float requirement as prescribed by the Stock Exchange upon completion of the Offer. It is the intention

of the Company to continue with the existing businesses of the Group upon completion of the Offer. As at the date of this announcement,

the Company does not intend to introduce any major changes by reason only of the Offer to the existing operations and management structure

of the Group, and the employment of the employees of the Group will be continued and the material fixed assets of the Group will not be

redeployed.

The EGM

The EGM will be convened and held for the purposes

of considering and, if thought fit, approving the Offer, at which only Independent Shareholders can vote.

Pursuant to the Irrevocable Undertakings, each

of Innovation Works Shareholders, Qiming Shareholders and SAIF Shareholder has irrevocably undertaken to the Company that, among other

things, it will, and will procure the holders of Shares whose Shares it is deemed to be interested in by virtue of Part XV of the

SFO to, vote in favor of the resolution in connection with the Offer at the EGM. Innovation Works Shareholders, Qiming Shareholders and

SAIF Shareholder together hold a total of 34,120,714 Class A Ordinary Shares (including in the form of ADSs), representing approximately

7.6% of the voting rights in the Company as at the date of this announcement.

Mr. Zhou has indicated to the Company that

he will procure MO Holding Ltd through which he holds his interests in the Company to vote in favor of the resolution in connection with

the Offer at the EGM. As at the date of this announcement, Mr. Zhou, who is the WVR Beneficiary, beneficially owns an aggregate 17,393,666

Class B Ordinary Shares and 19,460,912 Class A Ordinary Shares, representing approximately 42.9% of the voting rights in the

Company with respect to shareholder resolutions relating to matters other than the Reserved Matters.

Pursuant to the trust deed in respect of the 2022

Plan, the trustee of the 2022 Plan shall not exercise the voting rights attached to the Class A Ordinary Shares held by it. As at

the Date of this announcement, the trustee of the 2022 Plan held 10,109,451 Class A Ordinary Shares (representing approximately 2.2%

of the voting rights in the Company), which will not be voted on at the EGM.

Independent Board Committee and Independent

Financial Adviser

Mr. Dahai Li, Mr. Zhaohui Li, and Mr. Bing

Yu (each being a non-executive Director), and Mr. Hanhui Sam Sun, Ms. Hope Ni, and Mr. Derek Chen (each being an independent

non-executive Director), comprising all the non-executive Directors who have no interest in the Offer other than as a Shareholder (only

Mr. Dahai Li, Mr. Hanhui Sam Sun, Ms. Hope Ni, and Mr. Derek Chen are Shareholders), have been appointed as members

of the Independent Board Committee to advise the Independent Shareholders in respect of the Offer.

Altus Capital Limited, a corporation licensed

to carry out Type 4 (advising on securities), Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activities

under the SFO, has been appointed as the Independent Financial Adviser to advise the Independent Board Committee in connection with the

Offer as to the fairness and reasonableness of the Offer and as to voting by the Independent Shareholders. Such appointment has been approved

by the Independent Board Committee pursuant to Rule 2.1 of the Takeovers Code.

Offer Document

The Offer will commence on the date when the Offer

Document setting out the full terms of the Offer and an expected timetable is published, subject to Independent Shareholder approval at

the EGM. The Offer Document for the Offer containing, inter alia: (i) further details of the Offer; (ii) the expected timetable

relating to the Offer; (iii) the recommendation from the Independent Board Committee with respect to the Offer; (iv) the advice

of the Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders; (v) a notice convening

the EGM; and (vi) the Form of Acceptance, the ADS Letter of Transmittal, and information relating to the procedures required

for the acceptance of the Offer, will be dispatched to the Shareholders and ADS holders within 21 days from the date of this announcement

or such later date to which the Executive may consent.

| T. | NUMBER OF RELEVANT SECURITIES OF THE COMPANY |

Details of all classes of relevant securities

(as defined in Note 4 to Rule 22 of the Takeovers Code) issued by the Company and the numbers of such securities in issue as at the

date of this announcement are as follows:

| (i) | a total of 294,632,386 Shares issued and outstanding, which comprised 277,238,720 Class A Ordinary

Shares and 17,393,666 Class B Ordinary Shares issued and outstanding. This total number of issued and outstanding Shares excludes

the Class A Ordinary Shares issued to the depositary for bulk issuance of ADSs reserved for future issuances upon the exercise or

vesting of awards granted under the 2012 Plan and the 2022 Plan, which amounted to 335,565; |

| (ii) | a total of 1,809,712 outstanding options entitling the holders to acquire an aggregate of 1,809,712 Class A

Ordinary Shares under the 2012 Plan; |

| (iii) | a total of 249,741 outstanding restricted shares entitling the holders to acquire an aggregate of 249,741

Class A Ordinary Shares under the 2012 Plan; and |

| (iv) | a total of 17,177,645 outstanding restricted share units entitling the holders to acquire an aggregate

of 17,177,645 Class A Ordinary Shares under the 2022 Plan. |

As at the date of this announcement, save as disclosed

above, the Company has no other outstanding options, derivatives, warrants or securities which are convertible or exchangeable into Shares

and the Company has no other relevant securities (as defined in Note 4 to Rule 22 of the Takeovers Code).

In accordance with Rule 3.8 of the Takeovers

Code, associates (having the meaning given to it under the Takeovers Code, including persons holding 5% or more of a class of relevant

securities (as defined under Note 4 to Rule 22 of the Takeovers Code) of the Company) of the Company are hereby reminded to disclose

their dealings in the relevant securities (as defined under Note 4 to Rule 22 of the Takeovers Code) of the Company pursuant to the

requirements of the Takeovers Code.

In accordance with Rule 3.8 of the Takeovers

Code, the full text of Note 11 to Rule 22 of the Takeovers Code is reproduced below:

“Responsibilities of stockbrokers, banks

and other intermediaries

Stockbrokers, banks and others who deal in

relevant securities on behalf of clients have a general duty to ensure, so far as they are able, that those clients are aware of the disclosure

obligations attaching to associates of an offeror or the offeree company and other persons under Rule 22 and that those clients are

willing to comply with them. Principal traders and dealers who deal directly with investors should, in appropriate cases, likewise draw

attention to the relevant Rules. However, this does not apply when the total value of dealings (excluding stamp duty and commission) in

any relevant security undertaken for a client during any 7 day period is less than $1 million.

This dispensation does not alter the obligation

of principals, associates and other persons themselves to initiate disclosure of their own dealings, whatever total value is involved.

Intermediaries are expected to co-operate with

the Executive in its dealings enquiries. Therefore, those who deal in relevant securities should appreciate that stockbrokers and other

intermediaries will supply the Executive with relevant information as to those dealings, including identities of clients, as part of that

co-operation.”

WARNING: The Offer is conditional upon the

satisfaction of the Condition as described in this announcement in all aspects. Accordingly, the Offer may or may not become unconditional.

Shareholders and/or potential investors of the Company should therefore exercise caution when dealing in the securities of the Company.

Persons who are in doubt as to the action they should take should consult their licensed securities dealers or registered institutions

in securities, bank managers, solicitors, professional accountants or other professional advisers.

In this announcement, the following expressions

have the meanings set out below unless the context requires otherwise.

| “2012 Plan” |

the share incentive plan adopted by the Company in June 2012, as amended from time to time |

| “2022 Plan” |

the share incentive plan adopted by the Company on March 30, 2022, as amended from time to time |

| “Accepting Shareholder(s)” |

Shareholder(s) accepting the Offer |

| “Accepting ADS holder(s)” |

ADS holder(s) accepting the Offer |

| “acting in concert” |

has the meaning ascribed thereto in the Codes, and “parties acting in concert” shall be construed accordingly |

| “ADS(s)” |

American Depositary Share(s), every one representing three Class A Ordinary Shares (upon the ADS to Class A Ordinary Share ratio change taking effect from May 10, 2024). For the avoidance of doubt, prior to the ADS to Class A Ordinary Share ratio change, every two ADSs represent one Class A Ordinary Share |

| “ADS Letter of Transmittal” |

the form of letter of transmittal to accompany the Offer Document to the ADS holders for use by such persons in connection with the Offer |

| “Articles of Association” |

the articles of association of the Company, as amended from time to time |

| “associate(s)’ |

has the meaning ascribed thereto in the Codes |

| “Board” |

the board of Directors |

| “Business Day” |

a day on which the Stock Exchange is open for the transaction of business |

| “CCASS” |

the Central Clearing and Settlement System established and operated by Hong Kong Securities Clearing Company Limited |

| “China” or “PRC” |

the People’s Republic of China , and, unless the context requires otherwise and solely for the purpose of this announcement such as describing legal or tax matters, authorities, entities, or persons, excludes Hong Kong Special Administrative Region, Macao Special Administrative Region, and Taiwan region of the People’s Republic of China |