Taro Pharmaceutical Industries Ltd. (NYSE: TARO) (“Taro” or the

“Company”) today provided unaudited financial results for the

quarter and year ended March 31, 2022.

Quarter ended March 31, 2022 Highlights ─ compared to March

31, 2021 The quarter ended March 31, 2022,

includes one month’s results from the February 28th acquisition of

Alchemee.

- Net sales of $143.3 million decreased $5.1 million.

- Gross profit of $77.3 million (54.0% of net sales) compared to

$76.9 million (51.9% of net sales).

- Research and development (R&D) expenses of $14.9 million

decreased $1.7 million.

- Selling, marketing, general and administrative expenses

(SG&A) of $41.2 million increased $18.9 million.

- Operating income of $21.3 million (14.9% of net sales) compared

to an operating loss of $(41.9) million. Excluding the settlement

and loss contingencies charges, operating income in the prior year

quarter was $38.1 million, (25.7% of net sales).

- Interest and other financial income of $0.7 million decreased

$2.5 million, reflecting the lower global interest rate

environment.

- Foreign Exchange (FX) income of $2.5 million compared to $0.8

million ─ a favorable impact of $1.7 million.

- Tax benefit of $2.4 million compared to tax benefit of $8.9

million in the prior year quarter. Excluding the impact from the

settlement and loss contingencies charges, tax expense and the

effective tax rate in the prior year quarter was $7.8 million and

18.5%, respectively.

- Net income attributable to Taro was $27.4 million compared to

net loss of $(29.8) million, resulting in diluted earnings per

share of $0.73 compared to diluted (loss) per share of $(0.78).

Excluding the impact from the settlement and loss contingencies

charges, net income in the prior year quarter was $31.0 million,

resulting in diluted earnings per share of $0.81.

Year ended March 31, 2022 Highlights ─ compared to March 31,

2021 The year ended March 31, 2022, includes one

month’s results from the February 28th acquisition of

Alchemee.

- Net sales of $561.3 million increased $12.4 million.

- Gross profit of $293.1 million (52.2% of net sales compared to

54.0%) decreased $3.5 million.

- R&D expenses of $54.5 million decreased $5.6 million.

- SG&A of $113.7 million increased $22.3 million.

- Settlements and loss contingencies of $61.4 million consist of

the additional legal contingency of $60.0 million (taken in the

first quarter) related to ongoing multi-jurisdiction civil

antitrust matters and $1.4 million related to the global resolution

with the Department of Justice (“DOJ”) in connection with its

investigations into the U.S. generic pharmaceutical industry. In

the prior year, settlements and loss contingencies of $558.9

million consisted of $418.9 million related to the global

resolution with the DOJ in connection with its investigations into

the U.S. generic pharmaceutical industry and a $140.0 million

provision related to ongoing multi-jurisdiction civil antitrust

matters; however, there can be no assurance as to the ultimate

outcome.

- Operating income of $63.5 million compared to an operating loss

of $(413.8) million. Excluding the settlement and loss

contingencies charges in both periods, operating income was $124.9

million, a decrease of $20.2 million, and as a percentage of net

sales was 22.3% compared to 26.4%.

- Interest and other financial income decreased $12.0 million to

$8.2 million.

- FX income of $2.0 million compared to FX expense of $0.4

million ─ a favorable impact of $2.4 million.

- Tax expense of $19.6 million increased $9.9 million. Excluding

the impact from the settlement and loss contingencies charges in

both periods, the effective tax rate was 9.3% compared to

15.7%.

- Net income attributable to Taro was $58.3 million compared to

net loss of $(386.7) million, resulting in diluted earnings per

share of $1.55 compared to diluted (loss) per share of $(10.12).

Excluding the impact from the settlement and loss contingencies

charges in both years, net income was $126.4 million as compared to

$141.4 million in the prior year: resulting in diluted earnings per

share of $3.36 and $3.70, respectively.

Cash Flow and Balance Sheet Highlights

- Cash flow used in operations for the year ended March 31, 2022,

was $158.7 million. Excluding the impact from the settlement and

loss contingencies charges, cash flow provided by operations was

$165.6 million compared to $130.3 million for the year ended March

31, 2021.

- As of March 31, 2022, cash and cash equivalents and marketable

securities (both short and long-term) decreased $324.9 million to

$1.26 billion from March 31, 2021; reflecting the impact from

payments to the DOJ of $317.6 million ─ as a result of the global

resolution with the DOJ in connection with its investigations into

the U.S. generic pharmaceutical industry, the Alchemee acquisition,

net of cash of $91.9 million and share repurchases of $24.9

million.

Mr. Uday Baldota, Taro’s CEO, stated, “The challenging market

dynamics, including pricing, supply chain and competitive pressures

persist ─ particularly in the U.S. market. However, our strong

balance sheet and strategy will enable us to continue to pursue

future business development opportunities, such as our recent

acquisition of Alchemee and continued R&D investment.”

FDA Approvals and

Filings

The Company recently received approvals from the U.S. Food and

Drug Administration (“FDA”) for the Abbreviated New Drug

Application (“ANDA”) Fluphenazine Tablets 1mg, 2.5mg, 5mg, 10mg.

The Company currently has a total of eighteen ANDAs awaiting FDA

approval, including four tentative approvals.

Taro Acquisition of

Alchemee

On February 28, 2022, Taro completed its acquisition of

Alchemee, formerly The Proactiv Company (TPC), from Galderma for

$91.9 million, net of cash; the acquisition includes Alchemee’s

worldwide business and assets, including the Proactiv® brand.

Proactiv® is a line of topical skin care products with a core acne

indication: the products include cleansers and moisturizers as well

as acne creams.

The Company cautions that the foregoing 2022 financial

information (including Alchemee) is unaudited and is subject to

change.

About Taro

Taro Pharmaceutical Industries Ltd. is a multinational,

science-based pharmaceutical company dedicated to meeting the needs

of its customers through the discovery, development, manufacturing

and marketing of the highest quality healthcare products. For

further information on Taro Pharmaceutical Industries Ltd., please

visit the Company’s website at www.taro.com.

SAFE HARBOR STATEMENT

The unaudited consolidated financial statements have been

prepared on the same basis as the annual consolidated financial

statements and, in the opinion of management, reflect all

adjustments necessary to present fairly the financial condition and

results of operations of the Company. The unaudited consolidated

financial statements should be read in conjunction with the

Company’s audited consolidated financial statements included in the

Company’s Annual Report on Form 20-F, as filed with the SEC.

Certain statements in this release are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements include, but are not limited

to, statements that do not describe historical facts or that refer

or relate to events or circumstances the Company “estimates,”

“believes,” or “expects” to happen or similar language, and

statements with respect to the Company’s financial performance,

availability of financial information, and estimates of financial

results and information for fiscal year 2022. Although the Company

believes the expectations reflected in such forward-looking

statements to be based on reasonable assumptions, it can give no

assurances that its expectations will be attained. Factors that

could cause actual results to differ include general domestic and

international economic conditions, industry and market conditions,

changes in the Company's financial position, litigation brought by

any party in any court in Israel, the United States, or any country

in which Taro operates, regulatory and legislative actions in the

countries in which Taro operates, and other risks detailed from

time to time in the Company’s SEC reports, including its Annual

Reports on Form 20-F. Forward-looking statements are applicable

only as of the date on which they are made. The Company undertakes

no obligations to update, change or revise any forward-looking

statement, whether as a result of new information, additional or

subsequent developments or otherwise.

**Financial Tables Follow**

TARO PHARMACEUTICAL INDUSTRIES LTD. SUMMARY

CONSOLIDATED STATEMENTS OF OPERATIONS (U.S. dollars in

thousands, except share data)

Quarter Ended Year

Ended March 31, March 31,

2022 (1)

2021

2022 (1)

2021

(unaudited)

(unaudited)

(unaudited)

(audited)

Sales, net

$

143,264

$

148,348

$

561,347

$

548,970

Cost of sales

65,919

71,414

268,212

252,314

Impairment

—

—

13

—

Gross profit

77,345

76,934

293,122

296,656

Operating Expenses: Research and development

14,892

16,587

54,540

60,152

Selling, marketing, general and administrative

41,175

22,234

113,676

91,355

Settlements and loss contingencies

—

80,000

61,446

558,924

Operating income (loss) *

21,278

(41,887

)

63,460

(413,775

)

Financial income, net: Interest and other financial income

(685

)

(3,185

)

(8,187

)

(20,174

)

Foreign exchange (income) expense

(2,541

)

(842

)

(1,986

)

365

Other gain, net

512

100

4,226

2,892

Income (loss) before income taxes

25,016

(37,760

)

77,859

(391,073

)

Tax (benefit) expense

(2,388

)

(8,878

)

19,592

9,667

Net income (loss)

27,404

(28,882

)

58,267

(400,740

)

Net income (loss) attributable to non-controlling interest

—

904

—

(14,087

)

Net income (loss) attributable to Taro *

$

27,404

$

(29,786

)

$

58,267

$

(386,653

)

Net income (loss) per ordinary share attributable to

Taro: Basic and Diluted *

$

0.73

$

(0.78

)

$

1.55

$

(10.12

)

Weighted-average number of shares used to compute net

income (loss) per share: Basic and Diluted

37,584,891

38,065,388

37,641,087

38,209,726

May not foot due to rounding.

(1) Includes one month’s results from the

February 28th acquisition of Alchemee.

* Excluding the settlement and loss

contingencies charges of $61.4 million and $558.9 million for the

year ended March 31, 2022 and 2021, Operating income was $124.9

million and $145.1 million, Net income attributable to Taro was

$126.4 million and $141.4 million, and basic and diluted earnings

per share was $3.36 and $3.70, respectively.

TARO PHARMACEUTICAL INDUSTRIES LTD. SUMMARY

CONSOLIDATED BALANCE SHEETS (U.S. dollars in thousands)

March 31,

March 31,

2022

2021

ASSETS (unaudited) (audited) CURRENT ASSETS: Cash and cash

equivalents

$

251,134

$

605,177

Short-term and current maturities of long-term bank deposits

47,586

—

Marketable securities

522,028

418,480

Accounts receivable and other: Trade, net

246,973

213,539

Other receivables and prepaid expenses

59,726

53,347

Inventories

210,439

180,292

TOTAL CURRENT ASSETS

1,337,886

1,470,835

Marketable securities

435,189

557,209

Property, plant and equipment, net

199,692

205,508

Deferred income taxes

124,882

142,007

Other assets

78,712

31,314

TOTAL ASSETS

$

2,176,361

$

2,406,873

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Trade payables

$

68,232

$

61,166

Other current liabilities

363,887

615,135

TOTAL CURRENT LIABILITIES

432,119

676,301

Deferred taxes and other long-term liabilities

32,799

35,115

TOTAL LIABILITIES

464,918

711,416

Taro shareholders' equity

1,711,443

1,703,649

Non-controlling interest

—

(8,192

)

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

$

2,176,361

$

2,406,873

Note: March 31, 2022, includes the

February 28th acquisition of Alchemee.

TARO PHARMACEUTICAL INDUSTRIES LTD. SUMMARY

CONSOLIDATED STATEMENTS OF CASH FLOWS (U.S. dollars in

thousands)

Year Ended March 31,

2022

2021

(unaudited)

(audited)

Cash flows from operating activities: Net income

(loss)

$

58,266

$

(400,740

)

Adjustments required to reconcile net income (loss) to net cash

used in operating activities: Depreciation and amortization

25,915

23,680

Impairment of long-lived assets

13

—

Realized loss on sale of long-lived assets

689

92

Change in derivative instruments, net

(631

)

(236

)

Effect of change in exchange rate on marketable securities and bank

deposits

(449

)

(4,588

)

Deferred income taxes, net

23,200

(38,413

)

(Increase) decrease in trade receivables, net

(6,229

)

21,683

Increase in inventories, net

(2,082

)

(27,219

)

Increase in other receivables, income tax receivables, prepaid

expenses and other

(5,451

)

(16,325

)

(Decrease) increase in trade, income tax, accrued expenses and

other payables

(265,278

)

482,520

Expense from amortization of marketable securities bonds, net

13,339

5,316

Net cash (used in) provided by operating activities

(158,698

)

45,770

Cash flows from investing activities: Purchase of

plant, property & equipment, net

(11,796

)

(16,983

)

Acquisition, net of cash acquired

(91,872

)

—

Investment in other intangible assets

(243

)

(161

)

Investment in short-term bank deposits, net

(47,586

)

—

(Investment in) proceeds from marketable securities, net

(19,084

)

84,885

Net cash (used in) provided by investing activities

(170,581

)

67,741

Cash flows from financing activities: Purchase of

treasury stock

(24,934

)

(24,196

)

Net cash used in financing activities

(24,934

)

(24,196

)

Effect of exchange rate changes on cash and cash

equivalents

170

2,508

(Decrease) increase in cash and cash equivalents

(354,043

)

91,823

Cash and cash equivalents at beginning of period

605,177

513,354

Cash and cash equivalents at end of period

$

251,134

$

605,177

Cash Paid during the year for: Income taxes

$

7,753

$

29,377

Cash Received during the year for: Income taxes

$

2,351

$

4,093

Non-cash investing transactions: Purchase of property, plant

and equipment included in accounts payable

$

1,468

$

2,997

Non-cash financing transactions: Purchase of intangible

assets

$

—

$

15

Purchase of treasury stock

$

—

$

782

Purchase of marketable securities, net

$

3,890

$

9,417

Note: March 31, 2022, includes the

February 28th acquisition of Alchemee.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220526005688/en/

William J. Coote VP, CFO (914) 345-9001

William.Coote@taro.com

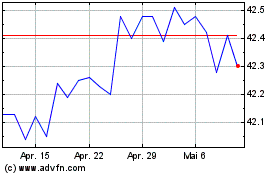

Taro Pharmaceutical Indu... (NYSE:TARO)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Taro Pharmaceutical Indu... (NYSE:TARO)

Historical Stock Chart

Von Dez 2023 bis Dez 2024