Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

30 November 2023 - 10:50PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2023.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ⌧ Form 40-F ◻

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ◻

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ◻

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 30, 2023 | | |

| | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcelo Feriozzi Bacci |

| Name: | Marcelo Feriozzi Bacci |

| Title: | Chief Financial and Investor Relations Officer |

Exhibit 99.1

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

TABLE OF CONTENTS

4TERMS, DEFINITIONS AND ABBREVIATIONS2

5.1.Premises, practices, and formalities6

5.2.Prohibited Transactions9

5.3.1.Related Parties Committee9

5.3.2.Related Parties Identification Template10

10ANNEX I – Form for Reporting of Related Party Transaction16

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

The purpose of this Related Party Policy (“Policy”) is to establish rules and consolidate the procedures to be complied with in the Related Parties Transactions (defined below), and to preserve the interests of Suzano S.A. (“Suzano” or “Company” ), transparency and best Corporate Governance practices.

This Policy applies to Suzano and must be complied with by parties that may be considered Related Parties, and employees.

| ● | CPC 00 (R1) – Conceptual framework for the Preparation and Disclosure of Financial Reporting |

| ● | IAS 24 – Related Party Disclosures |

| ● | CVM Resolution No. 642/2010 - Approves the Technical Pronouncement CPC 05 (R1) of the Accounting Pronouncements Committee - CPC on disclosure of Related Parties |

| ● | Suzano’s Code of Conduct |

| ● | Law 6,404/1976 - Brazilian Corporation Law |

| ● | CVM Resolution No. 80/2022 - Provides for the registration of issuers of securities admitted to trading on regulated securities markets (Annex F - Communication on Related Parties Transactions) |

| ● | Section 13 or 15(d) of the Securities Exchange Act of 1934 (SEC 1852) |

| ● | Conflict of Interest Policy |

4TERMS, DEFINITIONS AND ABBREVIATIONS

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

CPC – Accounting Pronouncements Committee

CVM – Brazilian Securities and Exchange Commission

IASB – International Accounting Standards Board

IFRS – International Financial Reporting Standards

SEC – Securities and Exchange Commission, from the United States of America

Related Party is the person or entity related to Suzano under the accounting and applicable rules, as indicated below:

| (a) | A person or a Close member of their family is related to the Company if: |

(i)has full or shared control of the Company;

| (ii) | has Significant Influence over the Company; or |

| (iii) | is a person considered a Key Management Personnel of the Company or its controlling company. |

| (b) | An entity is related to the Company if any of the conditions below are met: |

| (i) | the entity and the Company are members of the same economic group (which means that the controlling company and each Subsidiary are interrelated, as well as the entities under common control are related to each other); |

| (ii) | the entity is an Affiliate or a joint venture of another entity (or an Affiliate or a Joint Venture of an entity comprising the economic group of which the other entity is a member), provided that the Company is an Affiliate or Subsidiary of that other entity; |

| (iii) | the entity and the Company are under the Joint Control (joint venture) of a third entity; |

| (iv) | one entity is under the Joint Control (joint venture) of a third entity and the |

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

| | other entity is an Affiliate of that third entity; |

| (v) | the entity is a post-employment benefit plan whose beneficiaries are employees of the entity and the Company; |

| (vi) | the entity is a Subsidiary, fully or under Joint Control, of a person identified in item (a) above; |

| (vii) | a person identified in item (a) (i) above has Significant Influence over the entity, or is a member of the entity’s Key Management Personnel (or the entity’s controlling company); and |

| (viii) | the entity, or any member of the group of which it is a part, provides services related to the role of the Company’s Key Management Personnel or the Company’s controlling entity. |

Furthermore, in the definition of Related Party, an Affiliate includes Subsidiaries of that Affiliate; an entity under Joint Control (joint venture) includes Subsidiaries of an entity under Joint Control (joint venture). Therefore, for example, the Subsidiary of an Affiliate and the investor that exercises Significant Influence over the Affiliate are Related Parties to each other.

Close member of the family of a person listed in item (a) above, is a member of the family who may be expected to exert influence or be influenced by that person in their dealings with the entity. This concept includes:

| (i) | the person’s children, spouse, or partner; |

| (ii) | the children of the person’s spouse or partner; and |

| (iii) | dependent on the person, their spouse, or partner. |

In the context of this Policy, the following are not Related Parties:

| (i) | two entities having a manager or other member of Key Management Personnel in common, or because a member of the entity’s Key Management Personnel exercises Significant Influence over the other entity; |

| (ii) | two investors sharing Joint Control over a joint venture; |

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

| (iii) | entities that provide financing; unions; entities providing public utility; and State departments and agencies; that do not fully or jointly control or exercise Significant Influence over the reporting entity by their regular dealings with the entity (even if they may affect the entity’s freedom of action or participate in its decision-making process); |

| (iv) | customer, supplier, franchisor, concessionaire, distributor, or general agent with whom the entity maintains a significant volume of business, merely due to the resulting economic dependence. |

Related Parties Transaction is a transfer of goods, rights, funds, services, or obligations between the Company and a Related Party, regardless of whether or not a price is charged in return.

Key Personnel is the people who have authority and responsibility for planning, directing, and controlling the Company’s activities, directly or indirectly, and in the case of Suzano, they will be the members of the Board of Directors and the Company’s Statutory Executive Board.

Subsidiary is considered to be an entity in which its controlling company, directly or through other Subsidiaries, holds shareholder rights that permanently ensure preponderance in corporate resolutions and the power to elect the majority of managers.

Joint Control is considered in the event of sharing of control over a contractually agreed economic activity, or through equivalent equity interest. For this Policy, Joint Control is evidenced, regarding an entity, through the existence of a shareholders’ agreement (or related document) that grants a person the right, permanently, to exercise substantially equivalent rights in corporate and the election of the entity’s managers.

Affiliate is a company in which an entity directly, as a partner or shareholder, has Significant Influence over another entity.

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

Significant Influence is presumed when a person directly, as a partner or shareholder, holds twenty percent (20%) or more of the votes granted by the capital of an entity, without controlling it.

Centralized Purchasing Procedure is the procedure established in the Company’s Centralized Purchasing policy.

1.| 5.1. | Premises, practices, and formalities |

Related Parties Transactions will comply with the following practices and conditions:

| (a) | They will be disclosed clearly and objectively, according to item 8 below, for adequate understanding of their nature by users of this information |

| (b) | They will be governed by the same principles, rules, and market conditions to which other negotiations with independent parties of the Company are subject, being carried out under this Policy, Suzano’s Code of Ethics and Conduct, Law 6,404/76 (Brazilian Corporation Law) and CVM Resolution No. 80//2022, as well as other rules and regulations issued by regulatory bodies to which the Company is subject; |

| (c) | They will be formalized in a written instrument, such as, for example, a corporate act or contractual instrument, as applicable (written instruments must comply with the Company’s hiring policies and, at least, present the conditions to verify whether the hiring criteria meet the conditions allowing such a transaction, such as a price, terms, and guarantees); |

| (d) | They will be preceded by a minimum number of proposals or quotations from companies of similar capacity as provided in the Company’s Centralized Purchasing Procedure. Sales cases must meet the same criteria based on market data; |

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

| (e) | They will be preceded by the Related Parties Committee analysis, which may recommend or not approval of the Related Parties Transaction, under item 5.3 of this Policy; |

| (f) | Related Parties Transactions (or a set of related Transactions) must be approved by the Board of Directors, the total value of which exceeds the lowest of the following values: (x) fifty million reais (BRL 50,000,000); or (y) 1% of the Company’s total assets, calculated based on the latest financial statements or, when applicable, the latest consolidated financial statements disclosed by the Company; |

| (g) | Related parties transactions whose value corresponds to more than fifty percent (50%) of the value of the company’s total assets indicated in the last approved balance sheet must be approved by the General Meeting; |

| (h) | The coordinator of the Related Parties Committee must forward to the Statutory Audit Committee the assessed Transactions that exceed five hundred thousand reais (BRL 500,000.00). In turn, the Statutory Audit Committee must forward to the Board of Directors the Transactions that exceed one million reais (BRL 1,000,000.00) in the aggregate, provided that they involve an entity related to one of the members of the Company’s Board of Directors; and |

| (i) | Equitable treatment of shares of the same type and class must be ensured when dealing with corporate restructuring involving Related Parties. |

The following Related Parties Transactions, provided that they are in the conditions recommended by the areas involved, will be exempt from the practices described in items “b” to “i” above, with the forwarding to the Related Parties Committee being optional:

| (a) | transactions between the Company and its direct and indirect Subsidiaries, performed in the normal course of business, except in cases where there is interest in the Subsidiary’s share capital by the people indicated in item 4.2 (a) above |

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

| (b) | transactions between the Company’s direct and indirect Subsidiaries, performed in the normal course of business, except in cases where there is interest in the Subsidiary’s share capital by the people indicated in item 4.2 (a) above; and |

| (c) | transactions involving management remuneration. |

The Company’s employee involved in the Related Party Transaction or any party interested in said Transaction must report said Transaction to the Related Party Committee. The report to the Related Parties Committee must be performed by sending the form set out in Annex I of this Policy to the email partesrelacionadas@suzano.com.br.

This Policy allows the Related Parties Committee, Statutory Audit Committee, and/or Board of Directors to request, as appropriate and when deemed necessary, before the approval of specific Related Parties Transactions, market alternatives to the Related Parties Transactions in question adjusted by the risk factors involved (item 9 of this Policy).

The Related Parties Committee may request the contracting of independent appraisal reports, prepared without the participation of any party involved in the transaction in question, be it a bank, lawyer, or specialized consultancy company, among others, based on realistic premises and information ratified by third parties, to support the analysis of the terms and conditions of Related Parties Transactions.

In the case of a Related Party Transaction approval process that involves one or more people considered the Company’s Key Personnel, such people must immediately express their conflict of interest and comply with the Company’s Conflict of Interest Policy. Additionally, they must refrain from discussing the topic and voting in any resolution involving the matter. However, if requested by the Chairman of the Board of Directors or the Company’s Chief Executive Officer, such people may partially participate in the discussion to provide further information about the Transaction. In this case, they must be absent from the final part of the discussion, including the voting process on the matter.

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

Any corporate restructuring involving Related Parties must ensure equitable treatment for all shareholders.

5.2.Prohibited Transactions The following Related Parties Transactions are prohibited:

| (a) | those performed under adverse market conditions that adversely affect or harm the Company’s interests; |

| (b) | involving the participation of Key Personnel, in business of a private or personal nature, which interferes or conflicts with the Company’s interests or results from the use of confidential and/or strategic information obtained due to the exercise of the position or function in the Company; |

| (c) | those outside the Company’s corporate purpose or non-compliance with the limits provided in the rules established by the Company’s Bylaws; |

| (d) | granting of loans and guarantees in favor of Key Personnel or Company controllers; and |

| (e) | any form of remuneration of advisors, consultants, or brokers that generate a conflict of interest with the Company, managers, shareholders, or classes of shareholders. |

5.3.1.Related Parties Committee

The Related Parties Committee is an independent, advisory, and permanent board, whose general purpose is: (a) receive information about Related Parties Transactions; (b) validate the Related Party controls that the Company must issue; and (c) evaluate the compliance with Related Parties Transactions with the provisions of this Policy.

The Related Parties Committee will be comprised of people related to the Company, necessarily including one (1) member from each of the following areas of the Company: (a) Compliance; (b) Legal; (c) Controllership; (d) Investor Relations; and (v) SGS Accounting.

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

The Committee will have a coordinator chosen by the members of the Related Parties Committee, among people related to SGS Accounting. Among other duties conferred by the Related Parties Committee, the coordinator will be responsible for (a) proposing agendas, call and act as secretary for the meetings of the Related Parties Committee; (b) forward to the Related Parties Committee the Related Parties Transactions reported through receipt of a form (Annex I of this Policy), sending of information by the party involved in the Transaction or direct identification through the Company’s internal controls and systems; (c) manage and disclose to the Company, whenever necessary, the Related Parties Committee’s communication channel for information about Related Parties via email: partesrelacionadas@suzano.com.br.

The Related Parties Committee will meet quarterly, in an ordinary manner, and whenever necessary to deal with the topics provided in this Policy, extraordinarily. Within its duties, the Related Parties Committee must issue opinions on Related Parties Transactions forwarded to it under the terms of this Policy. In any case, the opinion and/or guideline issued by the Related Parties Committee, through minutes of its meetings, must be accepted by the party(ies) involved in negotiating Related Parties Transactions. If the Related Parties Committee presents its recommendation and the Transaction is concluded differently to that recommended or, in the case of a Transaction not approved by the Committee, the Transaction in question (completed or not) must be forwarded for consideration by the Statutory Audit Committee.

1.5.3.2.Related Parties Identification Template

| (a) | The Company, with the support of the Secretariat of the Board of Directors, must annually perform, together with Key Management Personnel and Company’s controllers, mapping to identify Related Parties, to prepare the “Related Party Identification Template”, considering the following sources: (i) information sent by the person responsible for the Company’s controlling shareholders, evidencing the identification of the controllers’ Related Parties; (ii) Related Party self-declaration form completed by members of the Company’s Statutory Executive Board and Board of Directors; (iii) information provided by the coordination of the Related Parties Committee, according to information that has been received or assessed by the Committee; |

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

| | and (iv) the Company’s corporate structure, regarding entities Controlled and Jointly Controlled by the Company. |

| (b) | The Related Parties Identification Template must be reviewed by the Executive Manager of the Legal Business area and sent by email to the Internal Controls area and the Related Parties Committee by May 30th of the respective fiscal year. |

| (c) | The data in the Related Party Identification Template will be ratified and/or updated (in case of changes or new additions) by the Company’s Legal Business area, based on the sources described in item (a) above, and in this case, they must also be reviewed by the Executive Manager of the Legal Business area and sent by email to the Internal Controls area and the Related Parties Committee. |

The Company’s Legal department will not be responsible for performing any type of independent check of the topic or investigation, or even assessing the veracity of the information received, regarding the identification of Related Parties.

All people or entities related to this Policy must strictly comply with it, as well as the provisions of the Company’s Code of Ethics and Conduct. Members of the Company’s management must disclose this Policy to employees and other people related to the Company so that they also ensure compliance.

The Related Parties Committee will be responsible for:

| (a) | ensure compliance with this Policy; |

| (b) | discuss and interpret, when required, any doubts about the characterization of a Related Party Transaction or the Related Party status; |

| (c) | guide the procedures arising from this Policy; |

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

| (d) | request further information to support recommendations regarding Related Parties Transactions, when necessary; |

| (e) | not approve/not recommend the performance of Related Parties Transactions that do not comply with the terms of this Policy; |

| (f) | recommend changes, adjustments, or specific actions to complete a Related Parties Transaction under the provisions of this Policy; and |

| (g) | Attest the receipt (or lack of receipt) of the Related Party Identification Template or simple communication in this regard. |

The Company’s Legal Business area will be responsible for:

| (a) | consolidate the Related Party Identification Template; and |

| (b) | together with the Secretariat of the Board of Directors, ensure the completion of the self-declaration to identify Related Parties to prepare the Related Party Identification Template. |

The SGS Accounting Closing Management, with the support of the Internal Controls area, will be responsible for:

| (a) | run internal controls to identify Related Parties Transactions; |

| (b) | establish and execute controls that guarantee the accuracy of financial statements; |

| (c) | disclose Related Parties Transactions, including under the terms of this Policy; and |

| (d) | report to the Related Parties Committee every quarter on Related Parties Transactions that occurred during the period, based on the last update of the Related Party Identification Template. |

The Compliance/Internal Controls area will be responsible for ensuring that the Company’s Code of Ethics and Conduct is under the provisions of this Policy, as well as verifying the control points for the identification of Related Parties and for the disclosure of Related Parties Transactions.

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

The Board of Directors will be responsible for approving and implementing this Policy and the administration, shareholders, employees and other Related Parties described in this Policy will be responsible for its application.

The Company’s legal department, with the support of the Related Parties Committee, will review and update this Policy every two (2) years or whenever necessary, to keep it updated regarding current standards and best market practices on the topic. If the legal department and/or the Related Parties Committee do not recommend updating or changes to the current Policy, its validity will be automatically extended for an equal period of two (2) years.

Related Parties Transactions in progress must be adapted, as appropriate, to the conditions established in this Policy (or subsequent amendments), within ninety (90) days from their approval by the Board of Directors.

Under current regulations, the Company must adequately disclose its relationship and Related Parties Transactions to the market.

The disclosure must be clear and precise in the notes of the Company’s financial statements, complying with the condition to provide sufficient details to identify the Related Parties and any information essential to the Related Parties Transactions mentioned as established in CVM Resolution No. 94 /2022, to provide analysis of information and monitoring of the Company’s management by financial statements’ users.

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

The Company also must disclosure Related Parties Transactions to the market, under the terms established in the B3 Novo Mercado Listing Regulations regarding the complementary requirements for quarterly information (ITR) and also, within a period of up to seven (7) business days of the execution of the Transaction, under CVM Resolution No. 80/2022, which deals with the Reference Form and its Annex F, specifically regarding the communication about Related Parties Transactions.

Additionally, Related Parties Transactions must be disclosed annually, under applicable regulations, in the CVM Reference Form – RF and in SEC 20-F.

Transactions and balances with Subsidiaries, jointly, are eliminated in the preparation of the Company’s consolidated financial statements.

| (a) | lack of internal procedures regarding the identification and appropriate treatment of Related Parties Transactions of the Company, its Subsidiaries, Affiliates, joint operations, and companies in which the Company, its employees, managers, and shareholders have Significant Influence; |

| (b) | lack of risk management and failure in internal controls that mitigate the risks associated with Related Parties Transactions of the Company, its Subsidiaries, Affiliates, joint operations, and companies in which the Company, its employees, managers, and shareholders have Significant Influence; |

| (c) | distortion of the Company’s financial information, including quarterly information - ITR, annual financial statements, standardized financial statements, Reference Form, including Annex F of CVM Resolution No. 80/2022, and SEC Form 20F, based on incorrect classification and presentation, absent or omitted from Related Parties Transactions involving the Company, its Subsidiaries, Affiliates, joint operations, and companies in |

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

| | which the Company has Significant Influence, under the standards, pronouncements, and interpretations issued by the Accounting Pronouncements Committee (CPC) and by the International Accounting Standards Board (IASB) for IFRS, and approved by the Brazilian Securities and Exchange Commission (CVM), as well as this Policy. Inaccuracy or omission in the disclosure of information on Related Parties Transactions exposes the Company to inspections by regulatory bodies and subjects it to legal and disciplinary sanctions. |

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

10ANNEX I – Form for Reporting of Related Party Transaction

CONTRACTING AREA/CONTRACT MANAGER (name of the area and person responsible for the contract) | CONTRACTING PARTY (name and CNPJ) | CONTRACTOR (name and CNPJ) | RELATED PARTY INVOLVED IN THE TRANSACTION | |

| | | | |

TYPE OF CONTRACT | OBJECT OF THE CONTRACT | MAIN TERMS AND CONDITIONS CONTRACTED (describe the specific conditions of the operation, not limited only to the price) | TYPE OF CONTRACT GUARANTEES GIVEN/RECEIVED (describe whether a guarantee was granted or received and of what type) | |

| | | | |

PURCHASE/CONTRACTION/TRANSACTION DATE (dd/mm/yy) | TERM (dd/mm/yy - dd/mm/yy) | TOTAL CONTRACT VALUE | CONTRACT VALUE TO BE PAID/RECEIVED PER YEAR | |

| | | | |

ADVANCE? | PERIODICITY OF INSTALLMENTS (monthly/quarterly/semi-annual/annual) | VALUE OF INSTALLMENTS | INTEREST/MONETARY UPDATE | |

| | | | |

PAYMENT DATE OF THE 1ST INSTALLMENT | SAP Nº (supplier/client) | PROJURIS Nº | ARE THE TRANSACTION CONDITIONS COMPATIBLE WITH MARKET? | JUSTIFICATION FOR HIRING A RELATED PARTY (describe the reason for having contracted with a related party and not with any other company not related to the Company) |

| | | | |

| | | |

Title: | RELATED PARTY POLICY |

Issuing area: | LEGAL | Date: | November 30, 2023 |

Ref. Document | Prepared by | Approved by | Date | Valid until |

Related Parties Policy | Legal Related Parties Committee | Legal Related Parties Committee Board of Directors | 11.30.2023 | 11.30.2025 extendable |

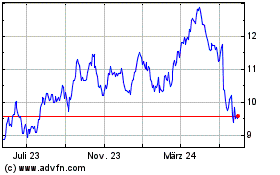

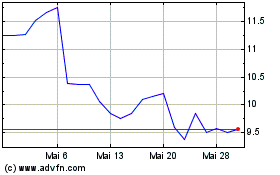

Suzano (NYSE:SUZ)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Suzano (NYSE:SUZ)

Historical Stock Chart

Von Mai 2023 bis Mai 2024