FY22 net revenue of €1,063 million, YoY

growth of +31%1 Challenging market situation impacting FY22

profitability Strategic realignment assessment and cost reduction

measures underway

- FY22 includes three quarters of full contribution of

businesses acquired in-period (WiggleCRC and Tennis

Express)

- Active customers of 6.7 million, representing an increase of

+39% YoY

- Net revenue up +28% to €300 million in Q4 FY22 and +31% to

€1,063 million in FY22 YoY; pro forma2 FY22 revenue of €1,199

million

- Gross profit increased YoY by +8% to €95 million in Q4 FY22

and +18% to €369 million in FY22

- Adj. EBITDA at (€29) million in Q4 FY22 and (€66) million in

FY22

- Net loss at (€566) million for FY22, largely impacted by

non-cash goodwill impairment and one-off accounting charges related

to the public listing on NYSE

- Increased financial flexibility as SSU obtains covenant

waivers on its €100 million bank RCF and secures €130 million

commitment from major indirect shareholder

SIGNA Sports United N.V. (“SSU” or the “Company”), a NYSE-listed

specialist sports e-commerce company with businesses in bike,

tennis, outdoor, and team sports, today reported financial results

for the fourth quarter of fiscal year 2022 and full fiscal year

2022 ended September 30, 2022. Q4 FY22 includes full contribution

of businesses acquired in-period, WiggleCRC and Tennis Express

(acquisitions closed on December 14 and December 31, 2021,

respectively).

The past year has seen an unexpected downturn in consumer

sentiment, inflationary pressures and the operating environment as

a whole, impacting SSU’s main markets over the course of FY22.

Nevertheless, SSU achieved several significant milestones in fiscal

year 2022: the Company listed on the NYSE and considerably

augmented the scale of its two main categories, bike and tennis. As

such, the acquisitions which closed in Q1 FY22 enabled SSU to

deliver double-digit net sales YoY growth and to more than double

its net revenue vs. pre-Covid (+123% vs. FY19) on a reported basis.

Similarly, the Company’s reach expanded meaningfully as its

customer base increased by +39% YoY and +146% vs. pre-Covid (FY19)

on a reported basis.

On the profitability side, the combination of supply chain

challenges and the deterioration in consumer confidence coinciding

with the conflict in Ukraine, has resulted in a competitive,

overstocked market significantly impacting margins, particularly in

the bike business and in international territories. The Company is

as such renewing its focus on profitability by leveraging on its

core geographies and assessing selective strategic opportunities to

deliver sustainable long-term value to shareholders.

Stephan Zoll, CEO of SSU, said, "Fiscal 2022 was a year of two

halves, meaningfully increasing our scale through acquisitions

before being affected by the macroeconomic turbulence. We

successfully achieved several operational wins, expanding our Own

brand range, increasing our tennis customer reach and advancing our

plan to enter the US bike market. The unexpected consumer sentiment

deterioration and inflationary pressures due to the conflict in

Ukraine, affected our operations and margins significantly,

particularly in the bike business and in international geographies.

We are thus now shifting our commercial approach to focus on our

core markets, where we enjoy leading positions. We are confident

the strategic realignment currently underway will enable us to

emerge as a more agile and resilient scaled leader, and take

advantage of the many consolidation opportunities arising from

these turbulent times.”

Q4 FY22 and FY22 Consolidated Financial Summary and Key

Operating Metrics (Continuing Operations)

Q4 Q4 YoY YoY FY21 FY22

Growth FY21 FY22 Growth

Key Financials (in EUR millions) Net Revenue

€234

€300

28.2

%

€814

€1,063

30.6

%

Gross Profit

€88

€95

8.0

%

€314

€369

17.6

%

% Margin

37.5

%

31.6

%

(592)bps

38.5

%

34.7

%

(385)bps

Adj. EBITDA

€0

(€29

)

NM

€30

(€66

)

NM

% Margin

0.1

%

(9.6

%)

NM

3.6

%

(6.3

%)

NM

Operating Performance

(in millions) LTM Active

Customers

4.8

6.7

39

%

4.8

6.7

39

%

Total Visits

72.8

79.2

9

%

262.9

319.7

22

%

Net Orders

2.1

2.5

21

%

6.8

9.5

40

%

Net AOV

€95.6

€102.1

7

%

€102.1

€101.8

(0

%)

Note: Financials inclusive of Tennis Express from Jan 1, 2022

and inclusive of WCRC from Dec 15, 2021. FY22 KPIs PF for

acquisitions closed in-period. Please refer to Non-IFRS Financial

Measures section for further detail regarding disclosed metrics.

“NM” defined as not meaningful.

Alex Johnstone, the Company’s CFO, said, “As very challenging

market conditions weighed incrementally on our performance

throughout FY22, we are retrenching our focus to our core markets,

where we have strong competitive positions and good unit economics.

This change in commercial approach, coupled with a focused plan to

adapt our operating model and deliver transaction synergies, should

enable the Company to return to run-rate Adj. EBITDA profitability

in FY24. The agreements with our lending group and further capital

commitment provide the required financial flexibility to return the

Company to profitable growth and take advantage of attractive

consolidation opportunities.”

Q4 FY22 Business Highlights / Commentary

- Business Update

- SSU’s scale meaningfully increased thanks to WiggleCRC and

Tennis Express acquisitions, driving double-digit group revenue

growth on a reported basis

- Strong impact of increased customer cost-of-living challenges

and lingering supply constraints across businesses, especially

bike, particularly in our core Germany and UK markets

- Stepped up markdowns in H2 FY22 to manage building inventory

resulting from the severe deterioration in consumer sentiment

caused by the conflict in Ukraine

- Deterioration in gross margin combined with inflationary

pressures, strongly affecting profitability, especially in

international markets

- Key Performance Indicators (KPIs)

- +39% YoY growth to 6.7 million active customers, led by recent

acquisitions and focused marketing spend to drive conversion.

Legacy SSU +3% active customer growth despite deteriorated consumer

sentiment

- Meaningful increase in visits with +9% YoY traffic growth in Q4

FY22 and +22% in FY22 on a reported basis, thanks to acquisitions

closed in FY22. Decline in pro forma organic traffic due to

worsening consumer sentiment, remaining supply constraints and

lapping Covid-19 driven spikes

- Strong +21% reported YoY increase to 2.5 million net order in

Q4 FY22 and +40% to 9.5 million in FY22, thanks to acquisitions

closed in-period. Net order YoY decline on a pro forma basis driven

by the traffic decrease, in the challenging operating

environment

- Net AOV increased by +7% YoY to €102.1 in Q4 FY22 and was

stable YoY at €101.8 in FY22 on a reported basis, due to better

bike availability on the back of easing supply chain constraints on

lower and mid-end ranges

- Pro forma growth vs. pre-Covid (FY19) of active customers

(+27%), conversion (+90 bps), net orders (+16%) and AOV (+3%),

despite lower traffic (-19%) due to Brexit impact on WCRC

- Financial Update

- +28% net revenue YoY growth to €300 million in Q4 FY22 and +31%

to €1,063 million in FY22 on a reported basis. The deteriorated

macroeconomic backdrop combined with prolonged supply chain

constraints on high-end ranges, weighed on the pro forma

performance, and was only partly mitigated by promotional activity

to drive sales and manage overstock. Net revenue stood at -11% YoY

in Q4 FY22 and -12% YoY in FY22, on a pro forma basis. The positive

impact of multiple long-term megatrends supported net revenue pro

forma growth vs. pre-Covid, at +25% vs. FY19

- Gross margin was down -592bps YoY to 31.6% in Q4 FY22 and down

-385bps to 34.7% in FY22, reflecting increased discounting activity

required to drive consumer demand and manage inventory overstock,

especially in H2 FY22

- Adj. EBITDA reached (€29) million in Q4 FY22 and (€66) million

in FY22, with Adj. EBITDA margin standing at (9.6%) in Q4 FY22 and

(6.3%) in FY22, impacted by lower gross profit levels and

inflationary pressures across cost lines in a challenging operating

environment

- Net loss at (€566) million in FY22, broadly due to a (€244)

million goodwill impairment charge and (€122) million one-off

accounting charges related to the public listing on the NYSE. The

goodwill impairment related to the WCRC acquisition mainly stems

from lowered earnings forecasts, due to supply chain and

macroeconomic factors negatively impacting consumer sentiment, as

well as rising inflation and interest rates. Adjusted for both

abovementioned non-cash items and for (€26) million Result from

Discontinued Operations, Net loss for Continuing operations amounts

to (€174) million in FY22

Outlook

The worsening operating environment in FY22 has widely impacted

SSU’s sales, profitability and cash generation. The challenging

macroeconomic backdrop continues to impact our operations and is

forecast to do so through FY23, and continuing inflationary

pressures are expected to weigh on consumer sentiment and

discretionary spending. Overstock in the sports retail market, in

particular in the bike category, is anticipated to last into FY24.

Against this market backdrop, the Company has developed a focused

plan to return to profitable long-term growth:

- Sharpened focus on core geographies, where SSU enjoys strong

competitive positions and better unit economics.

- Adapting commercial and operating models to ensure efficient

stock management, cost base optimization and improvement in unit

economics.

- Delivering transaction synergies via various operational

measures, such as cross-selling Own brands, procurement, logistics

consolidation and technology.

This change in operating approach is expected to impact the

business in multiple ways in the near-term, leading to a targeted

return to profitability (on a run rate basis) in FY24:

- Changes in the commercial model to result in lower sales,

albeit at a higher contribution

- Significant gross margin YoY contraction expected through H1

FY23, gross margins to start recovering from H2 FY23

- Focus on lean operating processes to result in accelerating

cost benefits from FY24

- Transaction synergies to start accruing from FY24 along with IT

re-platforming, logistics consolidation, and procurement

benefits

- Focused inventory reduction to release over €30-40 million of

capital in FY23

- Capex expected at €35-40 million level in FY23

As the Company implements various adjustments to its operating

model, supported by its strengthened financial flexibility, SSU

remains more than ever committed to delivering long-term

sustainable growth. As such, the Company is currently undergoing a

comprehensive strategic realignment assessment, with a clear focus

on generating significant long-term shareholder value.

In this stressed operating environment, SSU expects multiple

consolidation opportunities. As a scaled leader, SSU is well placed

to implement its renewed strategy and capitalize on increased

opportunities to consolidate customer access and verticalize the

business, by continuing to build out its portfolio of brands. The

Company remains confident in its long-term growth prospects,

supported by the strong global megatrends of health and fitness,

e-mobility and e-commerce, in a growing sports retail market.

Conference Call Information

SSU’s management will host a conference call today at 8:30 a.m.

Eastern Time to discuss the results. Interested parties will be

able to access the conference call by dialing 1-855-9796-654 (in

the United States) or +1-646-664-1960 (outside of the United

States), along with access code 136438. The conference call will be

simulcast and archived on SSU’s website at

https://investor.signa-sportsunited.com/.

Non-IFRS Financial Measures

The press release includes certain non-IFRS financial measures

(including on a forward-looking basis). These non-IFRS measures are

an addition, and not a substitute for or superior to, measures of

financial performance prepared in accordance with IFRS and should

not be considered as an alternative to net income, operating income

or any other performance measures derived in accordance with IFRS.

Please see for our definitions of our non-IFRS measures below.

SSU believes that these non-IFRS measures of financial results

(including on a forward-looking basis) provide useful supplemental

information to investors about SSU. SSU’s management uses

forward-looking non-IFRS measures to evaluate SSU’s projected

financials and operating performance. However, there are a number

of limitations related to the use of these non-IFRS measures and

their nearest IFRS equivalents, including that they exclude

significant expenses that are required by IFRS to be recorded in

SSU’s financial measures. In addition, other companies may

calculate non-IFRS measures differently, or may use other measures

to calculate their financial performance, and therefore, SSU’s

non-IFRS measures may not be directly comparable to similarly

titled measures of other companies. Additionally, to the extent

that forward looking non-IFRS financial measures are provided, they

are presented on a non-IFRS basis without reconciliations of such

forward-looking non-IFRS measures due to the inherent difficulty in

forecasting and quantifying certain amounts that are necessary for

such reconciliations.

Totals have been calculated on the basis of non-rounded euro

amounts and may differ from a calculation based on the reported

million euro amounts.

Forward-Looking Statements

These forward-looking statements include, but are not limited

to, statements regarding future events, the estimated or

anticipated future results and benefits of SSU following the

business combination, future opportunities for SSU, future planned

products and services, business strategy and plans, objectives of

management for future operations of SSU, market size and growth

opportunities, competitive position, technological and market

trends, and other statements that are not historical facts.

Forward-looking statements are generally accompanied by words such

as believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “should,” “could,” “would,” “plan,” “predict,”

“potential,” “seem,” “seek,” “future,” “outlook,” “suggests,”

“targets,” “projects,” “forecast” and similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters. These forward-looking statements

are provided for illustrative purposes only and are not intended to

serve as, and must not be relied on, by any investor as a

guarantee, an assurance, a prediction or a definitive statement of

fact or probability. Actual events and circumstances are difficult

or impossible to predict and will differ from assumptions. All

forward-looking statements are based upon estimates and forecasts

and reflect the views, assumptions, expectations, and opinions of

the Company, which are all subject to change due to various factors

including, without limitation, changes in general economic

conditions as a result of the war in Ukraine, significant

inflation, higher financing costs, an increase in energy costs, a

negative consumer sentiment and COVID-19. Any such estimates,

assumptions, expectations, forecasts, views or opinions, whether or

not identified in this document, should be regarded as indicative,

preliminary and for illustrative purposes only and should not be

relied upon as being necessarily indicative of future results.

Forward-looking statements appear in a number of places in this

press release and include, but are not limited to, statements

regarding our intent, belief or current expectations.

Forward-looking statements are based on our management’s beliefs

and assumptions and on information currently available to our

management. Such statements are subject to risks and uncertainties,

and actual results may differ materially from those expressed or

implied in the forward-looking statements due to various factors.

The forward-looking statements in this press release may include,

without limitations, statements about:

- our future financial condition and operating results;

- our ability to remain in compliance with financial covenants

under our financing arrangements;

- our ability to extend, renew or refinance our existing

debt;

- our liquidity and losses from operations and projected cash

flows and related impact on our ability to continue as a going

concern;

- our growth, expansion and acquisition prospects and strategies,

the success of such strategies, and the benefits we believe can be

derived from such strategies;

- our ability to effectively manage our inventory and inventory

reserves;

- impairments of our goodwill or other intangible assets;

- changes in consumer spending patterns and overall levels of

consumer spending;

- our ability to further upgrade our information technology

systems and infrastructure, including our accounting processes and

functions, and other risks associated with the systems that operate

our online retail operations;

- our ability to continue to remedy weaknesses in our internal

controls;

- costs as a result of operating as a public company;

- our assumptions regarding interest rates and inflation;

- changes affecting currency exchange rates;

- continuing business disruptions arising from the on-going war

in Ukraine and in the aftermath of the coronavirus pandemic;

- our financial condition and ability to obtain financing in the

future to implement our business strategy and fund capital

expenditures, acquisitions and other general corporate

activities;

- estimated future capital expenditures needed to preserve our

capital base;

- changes in general economic conditions in the Federal Republic

of Germany (“Germany”), and the European Union and the Unites

States of America, including changes in the unemployment rate, the

level of energy and consumer prices, wage levels, etc.;

- the further development of online sports markets, in particular

the levels of acceptance of internet retailing;

- our behavior on mobile devices and our ability to attract

mobile internet traffic and convert such traffic into purchases of

our goods;

- our ability to offer our customers an inspirational and

attractive online purchasing experience;

- demographic changes, in particular with respect to

Germany;

- changes in our competitive environment and in our competition

level;

- the occurrence of accidents, terrorist attacks, natural

disasters, fires, environmental damage, or systemic delivery

failures;

- our inability to attract and retain qualified personnel,

consultants and collaborators;

- political changes;

- changes in laws and regulations;

- our expectations relating to dividend payments and forecasts of

our ability to make such payments; and

- other factors discussed in “Item 3. Key Information — D. Risk

Factors” in our 20-F filing as of February 7, 2023.

Forward-looking statements are subject to known and unknown

risks and uncertainties and are based on potentially inaccurate

assumptions that could cause actual results to differ materially

from those expected or implied by the forward-looking statements.

Actual results could differ materially from those anticipated in

forward-looking statements for many reasons, including the factors

described in “Item 3. Key Information—D. Risk Factors” in in our

20-F filing as of February 7, 2023. Accordingly, you should not

rely on these forward-looking statements, which speak only as of

the date of this press release. You should, however, review the

factors and risks we describe in the reports we will file from time

to time with the SEC after the date of this press release.

In addition, statements such as “we believe” and similar

statements reflect our beliefs and opinions on the relevant

subject. These statements are based on information available to us

as of the date of this press release. And while we believe that

information provides a reasonable basis for these statements, that

information may be limited or incomplete. Our statements should not

be read to indicate that we have conducted an exhaustive inquiry

into, or review of, all relevant information. These statements are

inherently uncertain, and you are cautioned not to rely unduly on

these statements.

Although we believe the expectations reflected in the

forward-looking statements were reasonable at the time made, we

cannot guarantee future results, level of activity, performance or

achievements. Moreover, neither we nor any other person assumes

responsibility for the accuracy or completeness of any of these

forward-looking statements. You should carefully consider the

cautionary statements contained or referred to in this section in

connection with the forward-looking statements contained in this

press release and any subsequent written or oral forward-looking

statements that may be issued by us or persons acting on our

behalf.

Reconciliations (Continuing operations, in EUR

millions)

FY

FY

2021

2022

Net Loss

(€37.7)

(€539.3)

Income tax expense / benefit

(1.6)

26.6

Earnings before tax (EBT)

(€36.2)

(€565.9)

Interest

(4.3)

(4.2)

Depreciation and amortization

(28.5)

(53.9)

EBITDA

(€3.4)

(€507.7)

Impairment loss

0.6

254.9

Other net finance (income) / costs

0.3

(19.5)

Result from investments accounted for at equity

1.3

1.2

Total EBITDA Adjustments

€30.8

€204.7

Transaction related charges

0.5

2.7

Reorganization and restructuring costs

7.2

140.5

Consulting fees

21.6

41.7

Share-based compensation

2.7

17.1

Other material one-time items

(1.2)

2.7

Adj. EBITDA

€29.6

(€66.5)

Note: Impairment loss mainly associated with WCRC acquisition.

Other net finance (income) / costs mainly consist of currency gains

and losses and impact from derivative revaluations. Reorganization

and restructuring costs: include expenses in accordance with IFRS

2, the €122M value of 12.6 million shares issued to Yucaipa

Acquisition Corporation as part of the business combination in

excess of Yucaipa’s net assets must be expensed on SSU’s

consolidated income statement.

Liquidity

On September 28, 2022, the Company entered into a subscription

agreement with its affiliate SIGNA Holding GmbH (“SIGNA Holding”)

to issue €100 million aggregate principal amount of convertible

bonds (the “Initial Convertible Bonds”) to SIGNA Holding with a

closing date on October 4, 2022 and maturing on October 4, 2028.

Bondholders have the right to increase the principal amount of the

Initial Convertible Bonds by an additional aggregate principal

amount of up to €200 million for acquisition purposes as of closing

of the convertible bond issuance and until and including September

30, 2023 in one or more tranches with minimum denominations of €1.0

million (“Upsize Option”).

In addition, on February 6, 2023, the Company received a

commitment from SIGNA Holding to provide SSU with an additional

€130 million from SIGNA Holding in the form of convertible notes

(the “SIGNA Holding Equity Commitment Letter”). Such commitment

provides the Company with the right to issue and sell (put right)

additional convertible bonds to SIGNA Holding, at the same terms

and conditions as the Initial Convertible Bonds, in one or more

tranches until and including September 30, 2024 for an aggregate

additional principal amount of €130 million of newly issued

convertible bonds for general corporate purposes. Any subsequent

exercise of the put right pursuant to the SIGNA Holding Equity

Commitment Letter will reduce Euro for Euro, the available amount

under the €200 million Upsize Option granted by the Company to

SIGNA Holding in connection with the issuance of the Initial

Convertible Bonds.

On January 26, 2023, we received waivers from the lenders under

the €100 million revolving facility agreement with Landesbank

Baden-Württemberg and other financial institutions as lenders

waiving the requirement to comply with the net leverage covenant

through the period ending June 2024 and the minimum EBITDA covenant

for the testing period ending on September 30, 2023 and maintaining

the available liquidity covenant at €30 million for each testing

date after March 31, 2023.

Definitions

Net Online Revenue: Online revenue (excluding sales partners)

equal to net orders (post cancellations and full returns)

multiplied by Net AOV.

Platform Revenue: Revenue derived from non-1P E-commerce

business models (i.e., retail media sales, marketplace).

Gross Profit: Net revenues less cost of materials adjusted to

exclude extraordinary write-offs.

EBITDA: Calculated as consolidated net income (loss) before

interest, income taxes, depreciation and amortization.

Adjusted EBITDA: Calculated as consolidated net income (loss)

before interest, income taxes, depreciation and amortization,

adjusted for certain items which SSU’s management believes do not

reflect the core operating performance of SSU. Adjusted EBITDA

excludes impairment loss, other net finance income/costs and result

from investments accounted for at equity. Adjustments include

acquisition-related charges, reorganization and restructuring

costs, consulting fees, share-based compensation and other items

not directly related to current operations.

Active Customers: Customers with one or more purchases within

the last 12 months, irrespective of cancellations or returns.

Total Visits: Number of visits including mobile and website.

Cut-off at 30 minutes of inactivity and at date change. Not cut off

at channel change during session.

Net Orders: Orders post cancellations and full returns.

Net AOV: Total online revenue (excluding sales partners) divided

by net orders (post cancellations and full returns).

About SIGNA Sports United:

SIGNA Sports United (SSU) is a NYSE-listed specialist sports

e-commerce company with headquarters in Berlin. It has businesses

operating within bike, tennis, outdoor, and team sports. SSU has

more than 80 online sites and partners with 500 shops serving over

6.5 million customers worldwide. It includes Tennis-Point,

WiggleCRC, Fahrrad.de, Bikester, Probikeshop, Campz, Addnature,

TennisPro and Outfitter.

Further information: www.signa-sportsunited.com.

Consolidated statements of operations

(in EUR millions)

FY FY YoY

2021

2022

Growth Net Revenue

€813.7

€1,062.8

30.6

%

Own Work Capitalized

3.4

5.5

59.7

%

Other Operating Income

3.4

5.2

55.3

%

Cost of Materials

(500.2

)

(694.2

)

38.8

%

Personnel Expense

(82.8

)

(134.8

)

62.7

%

Other Operating Expenses

(207.9

)

(310.9

)

49.6

%

EBITDA Adjustments

(30.8

)

(204.7

)

NM

Depreciation & Amortization

(28.5

)

(53.9

)

89.4

%

Impairment loss

(0.6

)

(254.9

)

NM

Operating Loss

(€30.3

)

(€580.0

)

NM

Share of results of associates

(1.3

)

(1.2

)

(6.3

%)

Finance income

4.8

36.6

NM

Finance costs

(9.4

)

(21.3

)

NM

Pre-Tax Income

(€36.2

)

(€565.9

)

NM

Income Taxes

(1.6

)

26.6

NM

Result from discontinued operations

(8.3

)

(26.4

)

NM

Net Income

(€46.0

)

(€565.7

)

NM

Note: FY21 numbers have been re-presented as a result of the

discontinued operations. Refer to Note 11 – Discontinued

Operations. Cost of Materials, Personnel Expense and Other

Operating Expenses inclusive of adjustments.

Consolidated statements of financial

position (in EUR millions)

FY21

FY22

Non-current assets

Intangible assets and goodwill

€326.8

€677.3

Property, plant and equipment

€37.7

€48.5

Right of use assets

€60.6

€139.6

Equity accounted investees

€0.0

€0.0

Other non-current financial assets

€1.4

€5.1

Current assets

Inventories

181.9

299.0

Trade receivables

26.3

25.1

Other current financial assets

24.0

20.1

Other current assets

33.4

51.8

Cash and cash equivalents

50.7

43.0

Total assets

€742.9

€1,309.5

Owners net investment

373.4

617.3

Equity attributable to non-controlling interests

–

–

Total equity

€373.4

€617.3

Non-current liabilities

Non-current provisions

0.1

2.4

Non-current financial liabilities

140.4

317.2

Non-current trade payables

–

0.6

Other non-current liabilities

1.0

7.9

Deferred taxes

40.2

40.9

Current liabilities

Current provisions

4.9

1.0

Trade payables

102.7

194.9

Other current financial liabilities

27.7

42.4

Other current liabilities

47.9

75.6

Contract liabilities

4.7

9.3

Total liabilities

€369.5

€692.2

Total equity and liabilities

€742.9

€1,309.5

Consolidated statements of cash flows

(in EUR millions)

FY21

FY22

NET CASH FLOW FROM OPERATING ACTIVITIES Loss

before taxes from continuing operations

(€36.2

)

(€565.9

)

Loss before taxes from discontinued operations

(€8.3

)

(€26.4

)

Loss before taxes for the total operations

(€44.4

)

(€592.3

)

Adjustments to reconcile losses before taxes to net cash from

operating activities Depreciation, amortization and impairment

29.1

308.8

(Income) loss from investments accouted for using the equity method

1.3

1.2

Net finance costs (income)

4.6

(15.0

)

Equity-based compensation expense

2.7

17.1

Other non-cash income and expenses

(3.9

)

1.7

Listing expenses (IFRS 2 service charge)

–

121.9

Change in other non-current assets

(0.7

)

1.3

Change in other non-current liabilities

0.7

8.9

Change in: Inventories

(29.2

)

(40.4

)

Trade receivables

(4.6

)

3.3

Other current financial assets

(10.7

)

(0.1

)

Other current assets

(12.2

)

(9.9

)

Current provisions

2.0

(3.9

)

Trade payables

19.0

32.4

Other current financial liabilities

7.8

(0.4

)

Other current liabilities

5.1

(46.1

)

Contract liabilities

(1.0

)

2.9

Income tax payments and refunds

0.1

(1.8

)

Cash flow used in continuing operating activities

(€26.1

)

(€183.9

)

Cash flow used in discontinued operating activities, net

(€4.3

)

(€6.6

)

Net cash flow used in operating activities

(€30.4

)

(€190.5

)

NET CASH FLOW FROM INVESTING ACTIVITIES Purchase of

intangible assets and property, plant and equipment

(24.4

)

(45.5

)

Proceeds from the sale of intangible assets and propertly, plant,

and equipment

1.5

0.9

Acquisition of subsidiaries, net of cash acquired

(7.5

)

(192.9

)

Cash flow used in continuing investing activities

(€30.4

)

(€237.5

)

Cash flow used in discontinued investing activities, net

(€1.2

)

(€0.6

)

Net cash flow used in investing activities

(€31.6

)

(€238.1

)

NET CASH FLOW FROM FINANCING ACTIVITIES Proceeds from

capital contributions

–

402.7

Repayments of financial liabilities to related parties

(1.3

)

–

Proceeds from financial liabilities to related parties

–

80.1

Proceeds from financial liabilities to financial institutions

75.0

27.0

Repayment of financial liabilities to financial institutions

(30.9

)

(78.5

)

Transaction costs related to the lisiting

–

(5.9

)

Proceeds from the recapitalization

–

23.6

Acquisition of NCI

(4.7

)

–

Proceed of other loans

0.2

–

Repayment of other loans

–

(0.7

)

Payments for lease liabilities

(10.1

)

(19.1

)

Interest paid

(3.4

)

(5.9

)

Cash flow from continuing financing activities

€24.8

€423.3

Cash flow used in discontinued financing activities, net

(€7.7

)

(€0.5

)

Net cash flow from financing activities

€17.1

€422.8

Effect of exchange rate changes on cash and cash equivalents

–

(1.9

)

Net increase (decrease) in cash and cash equivalents

(€44.8

)

(€7.7

)

Note: FY21 numbers have been re-presented as a result of the

discontinued operations. Refer to Note 11 – Discontinued

Operations.

1 All metrics are presented for continuing operations only, as a

result of the discontinued operations related to Athleisure (refer

to Note 11 - Discontinued Operations of our consolidated financial

statements for the fiscal year ended September 30, 2022), unless

otherwise stated. 2 Pro forma metrics include the impact of Midwest

Sports, WiggleCRC and Tennis Express acquisitions, assuming

ownership for the entire period. Including discontinued operations

related to Athleisure (refer to Note 11 - Discontinued

Operations).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230207005239/en/

SSU Investors Alima Levy a.levy@signa-sportsunited.com

+49 174 730 4938

SSU Media Justine Powell j.powell@signa-sportsunited.com

+49 1523 464 9843

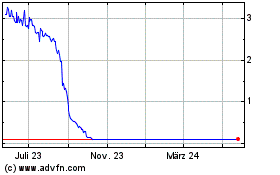

SIGNA Sports United NV (NYSE:SSU)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

SIGNA Sports United NV (NYSE:SSU)

Historical Stock Chart

Von Dez 2023 bis Dez 2024