Pearson Drops as Future Darkens -- WSJ

19 Januar 2017 - 9:02AM

Dow Jones News

By Simon Zekaria

LONDON -- Shares in Pearson PLC plunged Wednesday after the

world's largest education company warned of weaker earnings and a

possible dividend cut and said it plans to sell its stake in book

publisher Penguin Random House.

Pearson singled out continuing declines in North American sales

of higher-education course materials for its worsening prospects.

Overall, the company said its revenue fell 30% in the fourth

quarter, capping a full-year decline of 18% that it called

unprecedented.

Growth in employment and increasing education regulation has

reduced higher-education enrollments in the U.S., which has put

pressure on Pearson's business even as it seeks new sources of

growth in emerging economies such as Brazil and China. Pearson is

also grappling with a difficult transition to digital formats from

print for many of its higher-education products.

"There is no getting around how tough it is," Chief Executive

John Fallon said of the education sector in a call with reporters.

He admitted the company got "big calls" wrong on U.S. college

enrollments and revenue forecasting.

Pearson said it still expects its 2016 operating profit to be in

line with its previous guidance. Nonetheless, its shares were off

29% at GBP5.74 ($7.11) in afternoon trading in London.

Pearson said it plans to sell its 47% stake in U.S.-based

Penguin Random House -- one of the world's largest book publishers

-- to bolster its finances and invest in other parts of its

business.

Its joint-venture partner, German media company Bertelsmann SE,

said it was open to raising its stake in the publishing house

"provided the financial terms are fair."

The publishing house was formed in 2013 when the two companies

combined their book-publishing businesses. Three months ago,

Pearson said Penguin Random House was performing better, partly

from movie-tie-in sales for books such as "The Girl on the Train"

by Paula Hawkins in addition to best-selling new work by authors

Colson Whitehead and John Le Carré.

"The ball is very much in Bertelsmann's court," Pearson Chief

Financial Officer Coram Williams told reporters. In the absence of

a deal, Pearson would seek to recapitalize the stake and extract a

dividend, he said.

Pearson's share price has almost halved in the past three years

and the company has laid off thousands of employees amid sales

pressures in key markets. It has sold several assets during the

period, including the Financial Times newspaper and its 50%

noncontrolling stake in the publisher of the Economist magazine,

raising billions of dollars to fund its growth across global

education.

While higher education in North America remains Pearson's

biggest problem, the company also has struggled to capitalize on

the Common Core primary- and secondary-education standards in the

U.S., as that government initiative has faced a backlash in several

states.

"This is a tough time for the company," Mr. Fallon said on

Wednesday. "We have to move decisively and urgently."

Pearson said its 2016 revenue fell 8% on an adjusted basis. It

expects to report an adjusted operating profit, before

restructuring costs, of GBP630 million, in line with previous

forecasts and reflecting GBP55 million in savings on staff

compensation. The comparable figure for 2015 was GBP723

million.

For 2017, it sees operating profit on the same basis of GBP570

million to GBP630 million, with adjusted earnings per share of 48.5

pence to 55.5 pence. Pearson also scrapped its 2018 earnings

target, saying it was beyond reach.

The company sees its 2016 dividend at 52 pence, in line with its

guidance. However, it said that from this year it intends to

"rebase" its dividend to reflect portfolio changes, increased

investment and earnings guidance.

"Management are still clinging to the mantra of a longer-term

stable business, but with visibility so low on their key profit

driver [of] U.S. higher education and given the increasing signs of

structural pressure, we do not see how management can have

confidence they can turn things around," Liberum analyst Ian

Whittaker said.

News Corp, which owns Dow Jones & Co., publisher of The Wall

Street Journal, competes with Pearson's book publishing

operations.

--Ian Walker in London and Ulrike Dauer in Frankfurt contributed

to this article.

Write to Simon Zekaria at simon.zekaria@wsj.com

(END) Dow Jones Newswires

January 19, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

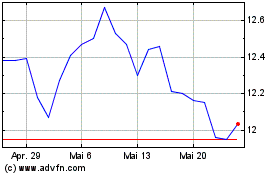

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024