McGraw-Hill Boosts Investor's Wealth - Analyst Blog

19 Januar 2012 - 1:00PM

Zacks

The McGraw-Hill Companies

Inc. (MHP), a publisher and provider of financial

information and media services, recently broke the news of a

dividend increase, reflecting its plan of utilizing its free cash

to enhance shareholders’ return, thereby boosting investors’

confidence in the stock.

Up Goes

Dividend

New Yorkbased company, McGraw-Hill,

stated a hike in its quarterly dividend by 2% to 25.5 cents from 25

cents a share. The increased dividend will be paid on March 12,

2012, to stockholders of record as of February 27, 2012.

McGraw-Hill started distributing

dividends way back in 1937. Since 1974, the company has boosted its

dividend at a compound annual dividend growth rate of around 9.6%

and is now among those S&P 500 companies (less than 25), which

have raised dividend annually for the 39th straight

year.

However, the news did not provide

much impetus to the stock, as the share price of McGraw-Hill crept

up 1.4% to close at $46.04 on Wednesday. Last year, the company had

raised its quarterly dividend by 6.4% to 25 cents.

Returning Values Now a

Common Trend

Dividend increases and share

repurchases have now become common trends among companies boasting

a stable cash position and healthy cash flows. These strategies not

only enhance shareholders’ return but also raise the market value

of the stock.

General Electric

Company (GE), which operates as a technology, service and

finance conglomerate globally, raised its quarterly dividend by

13.3% to 17 cents a share. Enbridge Inc. (ENB),

which transports and distributes crude oil and natural gas,

increased its quarterly dividend by 15% to 28.25 cents.

AXIS Capital Holdings Limited (AXS), a global

provider of specialty lines of insurance and treaty reinsurance,

announced a 4% increase in its quarterly dividend to 24 cents.

Recently, Target

Corporation (TGT), the operator of general merchandise and

food discount stores, announced a new $5 billion share repurchase

program. For-profit education company, Capella Education

Company (CPLA) also supplemented its existing share

repurchase authorization with an additional sanction of $50

million. The increase in the share buyback program was based on the

$34.8 million remaining at its disposal at the end of the third

quarter of 2011.

Financials &

Future

A dividend hike primarily reflects

the company’s sound financial position and defined future

prospects. This is quite evident from McGraw-Hill’s balance sheet

and cash flow positions. The company ended the third quarter of

2011 with cash and cash equivalents of $1,437.6 million, and

generated free cash flow of $627.3 million during nine-month

period.

The company aims to create two

"focused companies” – McGraw-Hill Financial and McGraw-Hill

Education – with optimal-size capital and cost arrangement for

amplifying client commitment and improving strategic and economic

suppleness while increasing management’s focus and

responsibility.

Currently, we have a ‘Neutral’

recommendation on the stock. However, McGraw-Hill, which competes

with Pearson plc (PSO), holds a Zacks #2 Rank,

which translates into a short-term ‘Buy’ rating.

AXIS CAP HLDGS (AXS): Free Stock Analysis Report

CAPELLA EDUCATN (CPLA): Free Stock Analysis Report

ENBRIDGE INC (ENB): Free Stock Analysis Report

GENL ELECTRIC (GE): Free Stock Analysis Report

MCGRAW-HILL COS (MHP): Free Stock Analysis Report

PEARSON PLC-ADR (PSO): Free Stock Analysis Report

TARGET CORP (TGT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

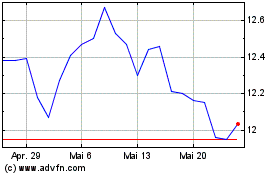

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Jul 2023 bis Jul 2024