The McGraw-Hill Companies Inc. (MHP), a

publisher and provider of financial information and media services,

recently posted soft third-quarter 2011 results. The quarterly

earnings of $1.21 a share missed the Zacks Consensus Estimate by

couple of cents, and remained flat from the prior-year quarter’s

earnings.

McGraw-Hill now expects to achieve earnings in the range of

$2.81 to $2.86 in fiscal 2011 from its earlier earnings guidance

range of $2.79 to $2.89 per share.

McGraw-Hill’s total revenue of $1908 million fell short of the

Zacks Consensus Estimate of $2,041 million, and shrinked 2.5% from

the prior-year quarter.

Sluggishness in global credit market and lower state new

adoption sales dragged down the revenues at Standard & Poor's

and McGraw-Hill Education, respectively. However, the revenue

decline was offset by healthy performance across McGraw-Hill

Financial and Information & Media segment.

Segment Details

McGraw-Hill Financial segment revenue grew

18.4% to $348.5 million, driven by an increase of 15.6% in

subscription revenue to $251.8 million and 26.4% in

non-subscription revenue to $96.7 million. Excluding, the

acquisition of TheMarkets.com, revenue jumped 14.6% to $336.2

million.

The acquisition of TheMarkets.com by Capital IQ strengthened its

position in the highly competitive financial data provider sector.

The acquisition facilitates Capital IQ to provide a comprehensive

research package to its buy-side clients, which not only include

fundamental and quantitative research as well as analysis solutions

but also cover equity and market research reports and earnings

estimates with valuation models from leading brokers.

Capital IQ had a client base of over 3,800 at the end of the

quarter, reflecting a growth of 17.7% from the prior-year.

The company also witnessed increase in the number of

exchange-traded funds (ETFs) on S&P indices, which currently

stands at 359, portraying a recovery in the worldwide market and

fresh investments from investors. McGraw-Hill launched 11 new ETFs

during the quarter under review.

Standard & Poor’s (S&P’s) segment

revenue climbed 1.8% to $409.9 million during the quarter.

Transaction revenue, which includes ratings of publicly issued debt

and bank loan, and corporate credit estimates, came down 19.5% to

$131.2 million, whereas non-transaction revenue, which includes

annual contracts, surveillance fees and subscriptions, grew 9.5% to

$278.7 million.

The European sovereign crisis, increasing credit spreads and

waning economy dented S&P’s transaction revenue. On the

contrary, McGraw-Hill notified that increase in new corporate

credits under surveillance and revenue gains at its non-issue based

analytical services and at CRISIL benefited the non-transaction

revenue.

The Education segment experienced a drop of

11.1% in revenue to $937.3 million, reflecting revenue decline of

21.4% to $420.4 million at McGraw-Hill School Education Group.

While, McGraw-Hill Higher Education, Professional and International

Group’s revenue remained approximately flat at $516.9 million.

The higher education and professional market witnessed strong

double-digit growth rate across digital products and services, and

the increase in demand for online study tools (e.g. McGraw-Hill

Connect series, McGraw-Hill Create).

Information & Media segment revenue rose

11.9% to $228.5 million driven by a 25% increase in Platts’

revenue. The company stated that the reported quarter reflects the

reclassification of the Broadcasting Group as discontinued

operation.

McGraw-Hill has decided to dispose its Broadcasting Group with

an aim to re-evaluate its portfolio of businesses and concentrate

more on global brands, and thereby enhance shareholder value

through proper capital allocation. The company entered into $212

million cash conformity with The E. W. Scripps

Company (SSP) on October 3, 2011 to sell its Broadcasting

arm.

McGraw-Hill added that it expects to close the deal in 2012.

Unlocking the Value

With the intent of boosting the shareholders value McGraw-Hill

announced extensive growth and value measures, including the

separation of the company into two independent companies,

McGraw-Hill Markets and McGraw-Hill

Education.

Since last year, the company has been reviewing its business

segments as the company lost a substantial market value in last 5

years and its rating agency was under fire for its latest

U.S.downgrade.

Moreover, the New York-based hedge fund Jana Partners and the

Ontario Teachers' Pension Plan, holding approximately 5.2% joint

stake in the company, were pushing McGraw-Hill to split into four

separate companies.

Going with its plan, the company aims to create two "focused

companies” with optimal-size capital and cost arrangement for

amplifying client commitment and improving strategic and economic

suppleness while increasing management’s focus and

responsibility.

Further, the company added that it will focus on abridging costs

by $100 million in coming 15 months to ensure competent operating

channels and will also accelerate the pace of share buybacks to a

total of $1 billion for the fiscal year 2011.

McGraw-Hill expects to complete the transaction by the end of

2012 through a tax-free spin-off while the separation plan is

subject to the approval by the board of directors.

McGraw-Hill added that it has engaged The Goldman Sachs

Group Inc. (GS) and Evercore Partners

Inc. (EVR) as the financial advisors to guide the company

during the evaluation period.

Financial Aspects

McGraw-Hill ended the quarter with cash and cash equivalents of

$1,437.6 million, long-term debt of $1,198 million, and

shareholders’ equity of $2,288.1 million. The company incurred

capital expenditures of $69.6 million and generated free cash flow

of $627.3 million during nine-month period.

During the quarter under review, McGraw-Hill repurchased 9.0

million shares for $355 million. Year-to-date, the company

repurchased 16.7 million shares for approximately $655 million. The

company plans to purchase the remaining of $1billion shares in the

fourth quarter of 2011.

Currently, we have a long-term Neutral rating on McGraw-Hill,

which competes with Pearson plc (PSO). Moreover,

the company holds a Zacks #3 Rank, which translates into a

short-term Hold recommendation.

EVERCORE PARTNR (EVR): Free Stock Analysis Report

GOLDMAN SACHS (GS): Free Stock Analysis Report

MCGRAW-HILL COS (MHP): Free Stock Analysis Report

PEARSON PLC-ADR (PSO): Free Stock Analysis Report

EW SCRIPPS CO (SSP): Free Stock Analysis Report

Zacks Investment Research

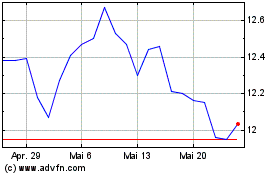

Pearson (NYSE:PSO)

Historical Stock Chart

Von Aug 2024 bis Sep 2024

Pearson (NYSE:PSO)

Historical Stock Chart

Von Sep 2023 bis Sep 2024