Filed by WhiteHawk Income Corp

Pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: PHX Minerals Inc.

Commission File No.: 001-31759

Date: October 15, 2024

NEWS RELEASE

WhiteHawk

Energy Reiterates Proposal to Acquire PHX Minerals, Inc. for $4.00 per Share in an All-Cash Transaction

Proposal

reflects a 19% premium to PHX’s 90 day volume weighted average price, and a 17% premium to PHX’s 30 day volume weighted average

price

WhiteHawk letter

to PHX Board of Directors highlights PHX stockholders suffering from excessive G&A expenses, dilutive acquisitions, minimal dividends,

and as a result, persistent stock price underperformance

WhiteHawk

has acquired and currently owns 946,506 common shares of PHX or approximately 2.5% of the outstanding common stock

Urges the PHX

Board of Directors to engage with WhiteHawk to pursue and complete a transaction following unwillingness to engage over the past 18 months

PHILADELPHIA, Pennsylvania –

October 14, 2024 – WhiteHawk Energy, LLC (together with its subsidiaries, “WhiteHawk”), a natural gas mineral

and royalty company, today sent a letter to Mark Behrman, the Chairman of PHX Minerals, Inc.’s (“PHX”) Board of

Directors, copied in full below, with respect to its proposal to acquire PHX for $4.00 per share. The letter includes details of the

extensive efforts WhiteHawk has made over the past 18 months to engage with PHX to maximize value for stockholders through a transaction.

Under the terms of the proposal, PHX

common stockholders would receive $4.00 per share in cash from WhiteHawk and qualified stockholders of PHX would have the opportunity

to exchange all or a portion of their common shares of PHX for common shares of WhiteHawk, to benefit from the value enhancement of the

combined business. This offer represents a 19% premium to PHX’s 90 day volume weighted average price as of October 11, 2024,

and a 17% premium to PHX’s 30 day volume weighted average price. It also represents a premium to PHX’s 52-week high, and

is greater than PHX’s closing price on 98% of all trading days since 2021.

The non-binding offer was reiterated

in a letter sent today to Mr. Behrman after 18 months of several public and private proposals, as detailed in the letter. WhiteHawk

is making public its continued efforts following months of private conversations in order to bring transparency to the situation and

ensure that all stockholders are fully informed and can advocate for an outcome that maximizes value for everyone involved. WhiteHawk

also disclosed that it now owns approximately 2.5% of PHX’s outstanding common stock.

“We are disappointed that PHX

has been unwilling to engage with WhiteHawk over the past 18 months, which has forced us to make public this proposal. Over that period

of time, we have adjusted our proposals to meet the ever-shifting requests of PHX and provided everything we believe necessary to pursue

a value enhancing transaction for all PHX stockholders,” said Daniel C. Herz, WhiteHawk’s Chairman and Chief Executive Officer.

“We strongly believe that our proposal is in the best interest of all stockholders involved, and believe it is imperative to publicly

illuminate the destruction of value, as compared to the opportunity for a sale at a significant premium. Since 2020, PHX has consumed

over $40 million of cash G&A, while over that same period returning to stockholders less than $12 million in dividends. Additionally,

PHX’s stock price performance has lagged its publicly traded mineral peers, gas weighted E&P producers, and just about every

other index since 2020. We urge PHX’s Board of Directors to finally engage in good faith around our proposal and look forward to

a mutually beneficial transaction.”

The full text of WhiteHawk’s October 14,

2024 letter is included below.

Advisors

WhiteHawk has retained Stephens Inc.

as its financial advisor and Weil, Gotshal & Manges LLP as its legal advisor.

WhiteHawk’s October 14,

2024 Letter to PHX

October 14, 2024

PHX Minerals Inc. Board of Directors

c/o Mark Behrman, Chairman of the Board

of Directors

1320 South University Drive

Suite 720

Fort Worth, Texas 76107

Dear Mark,

We are writing to urge the Board of

Directors of PHX Minerals, Inc. (“PHX”) to engage with WhiteHawk Energy, LLC (together with its subsidiaries, “WhiteHawk”)

to pursue and complete a transaction in which WhiteHawk acquires PHX for $4.00 per share, as described further below. As you know, we

have been attempting to engage in good faith with PHX for over 18 months now, including several proposals whereby WhiteHawk would acquire

all of the outstanding shares of PHX common stock in an all-cash transaction, and offer certain qualified stockholders of PHX the opportunity

to exchange their common shares in PHX for common shares of WhiteHawk. Earlier this year, WhiteHawk provided PHX and its advisors evidence

of financing including a commitment letter and direct conversations with the financing source.

The WhiteHawk proposal to acquire PHX

for $4.00 per share represents the following premiums:

| • | a 19%

premium to PHX’s 90 day volume weighted average price of $3.36 as of October 11,

2024; and |

| • | a 17%

premium to PHX’s 30 day volume weighted average price of $3.42 as of October 11,

2024. |

It is important to note that PHX’s

share price has consistently failed to appreciate in more favorable natural gas price environments over the past several years. WhiteHawk’s

$4.00 per share offer not only represents a premium to PHX’s 52-week high, but it is also greater than PHX’s closing price

on 98% of all trading days since 2021. This includes prolonged periods where natural gas prices traded over two times higher than prices

today, yet PHX’s stock has not shown an ability to take advantage of these periods. We remain confident that your existing stockholders

will be supportive of this transaction and will view $4.00 per share as a great outcome in any gas price environment given how the stock

has traded over the last several years.

As described in further detail below,

our efforts to initiate a meaningful dialogue have been met with minimal response. Given our conviction that a transaction represents

a significant opportunity to create value for all of your stockholders, we feel compelled to once again take our efforts public. We believe

that transparency at this juncture is essential to ensure that all of your stockholders are fully informed and can advocate for an outcome

that maximizes their value. As you know, WhiteHawk has been acquiring shares of PHX common stock in the open market over the past several

months, and now owns 946,506 shares or approximately 2.5% of PHX’s outstanding common stock. As a stockholder of PHX, we believe

that our alignment with other stockholders provides a strong foundation for collaboration and a mutually beneficial outcome.

Additionally, we

believe it is crucial to highlight the significant destruction of stockholder value by PHX management since early 2020, when the current

executive leadership was appointed. During this period, management has attempted to steer PHX in a new strategic direction. However,

these efforts have clearly failed to generate value for stockholders. Instead, stockholders have suffered from excessive general and

administrative (“G&A”) expenses, dilutive acquisitions, minimal dividends, and as a result, persistent stock price underperformance.

Since 2020, management has returned

only $11.4 million to stockholders through dividends, while spending $40.1 million in cash G&A, a substantial portion of which has

been paid directly to management. While management claims that low dividends are necessary to reinvest cash flow back into the business,

that reinvestment has yielded minimal returns to stockholders. In fact, the stock price has significantly lagged behind almost every

sector of the market during this period, including its mineral peers, gas-weighted E&P companies, and the broader market, as demonstrated

below. It is evident that the chief beneficiaries of PHX's assets at present are its management team, whose compensation has remained

inappropriately high quarter after quarter when compared with stockholder returns.

| (1) | Includes

BSM, KRP, STR, VNOM. |

| (2) | Includes

AR, CHK, CNX, CRK, CTRA, EQT, GPOR, RRC, SWN. |

Note: Based on public financial information

from earnings press releases and financial statements.

WhiteHawk is not alone in its assessment

of PHX’s mismanagement of its assets. Numerous other PHX stockholders have also expressed concern over PHX’s direction in

recent years, both privately in discussions with WhiteHawk and PHX’s management team and publicly. Despite these ongoing conversations,

there has been no meaningful change in PHX’s business strategy. Given the consistent dissatisfaction voiced by stockholders and

the lack of management engagement with WhiteHawk, we believe it is time to take the next step and update the public on the conversations

that have transpired between WhiteHawk and PHX over the past 18 months, including since the publication of our last public proposal in

August 2023. Furthermore, WhiteHawk is urging PHX’s Board of Directors, management, and their advisors to engage immediately

with WhiteHawk in regards to our proposal.

Overview of Conversations To Date

Between WhiteHawk and PHX

In May 2023, following your CEO’s

unwillingness to meet with the WhiteHawk executive team, WhiteHawk privately submitted a proposal to merge WhiteHawk into PHX and form

a new publicly traded company, which would be larger than PHX, create a more liquid stock, and improve asset quality. Additionally, that

proposed transaction offered a one-time cash dividend in excess of two years’ worth of PHX’s most recent quarterly dividends

at that time, plus significant free cash flow accretion and a substantial increase in dividends per share to PHX’s stockholders.

On June 12, 2023, the PHX Board rejected that proposal, stating both that the proposal undervalued PHX and that PHX did not have

enough information to value WhiteHawk. These statements in and of themselves are in direct opposition, as it is impossible to state that

WhiteHawk had undervalued PHX in an all-stock transaction if PHX itself had not yet evaluated the value of WhiteHawk.

On June 20, 2023, we submitted

a revised private proposal and opened up a data room for PHX to evaluate and conduct diligence on WhiteHawk. After five weeks, at the

end of July, without a single due diligence question asked, PHX again rejected the WhiteHawk proposal, citing factors which clearly indicated

a lack of diligence and understanding of WhiteHawk’s business. On August 8, 2023, WhiteHawk publicly proposed a merger

between WhiteHawk and PHX, including a one-time cash dividend to PHX stockholders, which was more than twice the annualized PHX quarterly

dividends being paid at such time, offering stockholders significant upfront cash, as well as the opportunity to participate in a larger,

more liquid, and improved company, the very elements which PHX’s management team that same day on the second quarter earnings call

stated that they desired. Despite these stated desires, PHX’s Board rejected that proposal on August 15, 2023.

Following several conversations, and

at the request of PHX, on November 22, 2023, WhiteHawk submitted a private cash proposal to acquire PHX for $4.00 per share and

offered the opportunity for qualified stockholders of PHX to exchange their shares in PHX into WhiteHawk to be able to benefit from the

equity of the combined company. WhiteHawk also stated that the purchase price might be increased if PHX entered into a confidentiality

agreement and provided additional due diligence information. Finally, WhiteHawk offered to continue to consider a merger of WhiteHawk

into PHX if the Board determined that was desirable. Following this proposal, PHX’s financial advisor, RBC Capital Markets (“RBC”),

requested a financing support letter for the cash proposal. Following assurances that this was a natural step, WhiteHawk worked to present

an attractive financing support letter for the cash proposal. As such, per RBC’s request, WhiteHawk delivered a private letter

on January 26, 2024 reaffirming our commitment to acquire PHX in an all-cash transaction for $4.00 per share (which reflected a

24% premium to PHX’s share price and a 25% premium to PHX’s 30 day VWAP at such time), and delivered a financing support

letter from a top-tier institutional investor (“Financing Partner”) to finance the transaction. In addition to this financing

support letter, WhiteHawk facilitated a direct call with RBC and WhiteHawk’s Financing Partner to answer any questions relating

to that support letter.

After this proposal, WhiteHawk was advised

on February 20, 2024 that management was unwilling to transact in a low natural gas price environment. However, natural gas prices

for 2025, 2026, and 2027 had remained almost entirely flat from the beginning of discussions in May 2023 until February 2024,

and essentially flat from delivering its previous letter on January 26, 2024 until February 20, 2024. Further, WhiteHawk has

indicated repeatedly the potential to increase its cash offer following diligence information being provided, as well as the opportunity

for PHX stockholders to participate in the combined company. PHX’s unwillingness to engage came despite WhiteHawk increasing its

proposed share price premium to maintain its previous $4.00 per share cash offer from September 14, 2023. Notably, natural gas prices

for 2025, 2026, and 2027 have declined since February 2024, and WhiteHawk remains desirous of a transaction at $4.00 per share.

On April 29, 2024, WhiteHawk delivered

yet another private letter to PHX reiterating its willingness to proceed with either an all-cash transaction to acquire PHX for $4.00

per share or a stock-for-stock merger with a cash component for PHX stockholders. Additionally, WhiteHawk informed PHX at this time that

it had acquired shares of PHX common stock in the open market. Again, WhiteHawk was subsequently told that management was not interested

in pursuing a transaction at this time despite again reiterating on its earnings call that PHX remains open to exploring transformational

transactions.

Finally, during the summer of 2024,

WhiteHawk met with PHX’s financial advisor, RBC, and informed them that if PHX was unwilling to engage, WhiteHawk would be forced

to make public its previous proposals.

Summary & Next Steps

Throughout the last 18 months, WhiteHawk

has constantly indicated its flexibility and strong interest in completing a business combination, reiterating multiple times an all-cash

offer to purchase PHX for $4.00 per share, including the ability for qualified stockholders to exchange their common shares of PHX for

common shares of WhiteHawk. We have listened to your feedback and have delivered everything that you have requested, including a letter

documenting financial support for the transaction. Despite all of these efforts, PHX has consistently refused to participate in good

faith discussions with WhiteHawk and has maintained an unwillingness to meaningfully engage.

WhiteHawk again urges the PHX Board

of Directors to engage with WhiteHawk to complete a transaction. Additionally, WhiteHawk calls on all fellow stockholders to demand that

the PHX Board of Directors pursue the value creating opportunity described in this letter.

As a reminder, WhiteHawk has retained

Stephens Inc. as its financial advisor and Weil, Gotshal & Manges LLP as its legal advisor. We look forward to having the opportunity

to pursue a transaction with you promptly, and we remain available at your convenience to discuss any aspect of our proposal.

Neither this letter

nor the terms of any proposal constitute a binding or enforceable agreement of either WhiteHawk or PHX. Any binding agreement with respect

to either proposal will be reflected solely in definitive documentation to be negotiated, executed and delivered by WhiteHawk and PHX.

Sincerely,

| /s/ Daniel C. Herz |

|

| |

|

| Daniel C. Herz |

|

| Chairman and Chief Executive Officer |

|

| WhiteHawk Energy, LLC |

|

* * * *

About WhiteHawk Energy

WhiteHawk Energy, LLC is focused on

acquiring mineral and royalty interests in top tier natural gas resource plays, including the Haynesville and Marcellus Shales. The management

team at WhiteHawk Energy has successfully grown over $13 billion of minerals, midstream, and exploration and development companies over

the last 20 years. WhiteHawk Energy currently manages approximately 1,050,000 gross unit acres within core operating areas of the Marcellus

Shale and Haynesville Shale, with interests in more than 3,400 producing horizontal wells. Please go to www.whitehawkenergy.com for more

information.

Additional Information

This press release does not constitute

an offer to buy or solicitation of an offer to sell any securities. This press release relates to a proposal which WhiteHawk has made

for a combination with PHX. In furtherance of this proposal and subject to future developments, WhiteHawk (and, if a negotiated transaction

is agreed, PHX) may file one or more registration statements, proxy statements or other documents with the U.S. Securities and Exchange

Commission (“SEC”). This press release is not a substitute for any proxy statement, registration statement, prospectus or

other document WhiteHawk or PHX may file with the SEC in connection with the proposed transaction.

Investors and security holders of WhiteHawk

and PHX are urged to read the proxy statement(s), registration statement, prospectus and/or other documents filed with the SEC carefully

in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive

proxy statement(s) or prospectus(es) (if and when available) will be mailed to stockholders of PHX, as applicable. Investors and

security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC

by PHX through the website maintained by the SEC at http://www.sec.gov.

This press release is neither a solicitation

of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, WhiteHawk and its executive

officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of

the proposed transactions. Additional information regarding the interests of such potential participants will be included in one or more

registration statements, proxy statements or other documents filed with the SEC if and when they become available. INVESTORS AND SECURITY

HOLDERS OF PHX ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. These documents (if and when available) may be obtained

free of charge from the SEC’s website at http://www.sec.gov.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include projections and estimates

and their underlying assumptions, statements regarding plans, objectives, intentions and expectations with respect to future financial

results, events, operations, services, product development and potential, and statements regarding future performance. Such statements

are based on WhiteHawk’s management’s beliefs and assumptions based on information currently available to WhiteHawk’s

management. All statements in this press release, other than statements of historical fact, are forward-looking statements that may be

identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,”

“should,” “estimates,” and similar expressions. These forward-looking statements involve known and unknown risks

and uncertainties, which may cause WhiteHawk’s or PHX’s actual results and performance to be materially different from those

expressed or implied in the forward-looking statements. Factors and risks that may impact future results and performance include, but

are not limited to those factors and risks described in Part I, Item 1A, “Risk Factors” in PHX’s Annual Reports

on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) for the fiscal year ended December 31,

2023 and in other filings with the SEC. These include, but are not limited to: (i) the ultimate outcome of any possible transaction

between WhiteHawk and PHX, including the possibility that PHX will reject the proposed transaction with WhiteHawk; (ii) uncertainties

as to whether PHX will cooperate with WhiteHawk regarding the proposed transaction; (iii) the effect of the announcement of the

proposed transaction on the ability of WhiteHawk and PHX to operate their respective businesses and retain and hire key personnel and

to maintain favorable business relationships; (iv) the timing of the proposed transaction; (v) the ability to satisfy closing

conditions to the completion of the proposed transaction (including any necessary stockholder approvals); (vi) other risks related

to the completion of the proposed transaction and actions related thereto; (vii) changes in demand for WhiteHawk’s or PHX’s

products or services; (viii) impacts of natural disasters, adverse changes in laws and regulations including governing property

tax, evictions, rental rates, minimum wage levels, and insurance, adverse economic effects from the COVID-19 pandemic, international

military conflicts, or similar events impacting public health and/or economic activity; (ix) adverse impacts to WhiteHawk or PHX

and their respective customers from inflation, unfavorable foreign currency rate fluctuations, changes in federal or state tax laws;

and (x) security breaches, including ransomware, or a failure of WhiteHawk’s or PHX’s respective networks, systems or

technology.

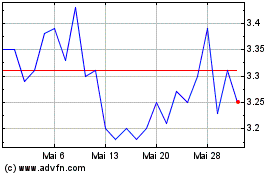

PHX Minerals (NYSE:PHX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

PHX Minerals (NYSE:PHX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024