false000147409800014740982023-10-162023-10-160001474098us-gaap:CommonStockMember2023-10-162023-10-160001474098us-gaap:SeriesEPreferredStockMember2023-10-162023-10-160001474098us-gaap:SeriesFPreferredStockMember2023-10-162023-10-160001474098us-gaap:SeriesGPreferredStockMember2023-10-162023-10-160001474098us-gaap:SeriesHPreferredStockMember2023-10-162023-10-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 16, 2023

PEBBLEBROOK HOTEL TRUST

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-34571 | | 27-1055421 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | |

| | |

4747 Bethesda Avenue, Suite 1100, Bethesda, Maryland | | 20814 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (240) 507-1300

| | |

| Not Applicable |

| Former name or former address, if changed since last report |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Shares, $0.01 par value per share | | PEB | | New York Stock Exchange |

| Series E Cumulative Redeemable Preferred Shares, $0.01 par value | | PEB-PE | | New York Stock Exchange |

| Series F Cumulative Redeemable Preferred Shares, $0.01 par value | | PEB-PF | | New York Stock Exchange |

| Series G Cumulative Redeemable Preferred Shares, $0.01 par value | | PEB-PG | | New York Stock Exchange |

| Series H Cumulative Redeemable Preferred Shares, $0.01 par value | | PEB-PH | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

Pebblebrook Hotel Trust (the "Company") issued a press release on October 16, 2023, announcing that it executed a contract to sell the 221-room Hotel Zoe Fisherman's Wharf, located in San Francisco, CA, for $68.5 million to a third party. The property sale is subject to normal closing conditions. The Company offers no assurances that the sale will be completed on these terms or at all. The sale is targeted to be completed later in the fourth quarter of 2023.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference herein.

Forward-Looking Statements

This Current Report on Form 8-K contains certain “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Reform Act of 1995. Forward-looking statements are generally identifiable by the use of forward-looking terminology such as “estimated” and “will” or other similar words or expressions. Forward-looking statements are based on certain assumptions and can include future expectations, future plans and strategies, financial and operating projections and forecasts and other forward-looking information and estimates. The description of the Company’s intention to sell a hotel property and the intended use of proceeds are forward-looking statements. These forward-looking statements are subject to various risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results to differ materially from such statements. These risks and uncertainties include, but are not limited to, the state of the U.S. economy, the operating performance of our hotels and the supply of hotel properties, and other factors as are described in greater detail in the Company’s filings with the Securities and Exchange Commission, including, without limitation, the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. Unless legally required, the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Press release, issued October 16, 2023, announcing the execution of contract to sell Hotel Zoe Fisherman's Wharf, in San Francisco, CA |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | PEBBLEBROOK HOTEL TRUST |

| | |

| October 16, 2023 | By: | /s/ Raymond D. Martz |

| | Name: | Raymond D. Martz |

| | | Title: | Co-President, Chief Financial Officer, Treasurer and Secretary |

4747 Bethesda Avenue, Suite 1100, Bethesda, MD 20814

T: (240) 507-1300, F: (240) 396-5626

www.pebblebrookhotels.com

News Release

Pebblebrook Hotel Trust Executes Contract to Sell Hotel Zoe Fisherman’s Wharf

Bethesda, MD, October 16, 2023 – Pebblebrook Hotel Trust (NYSE: PEB) (the “Company”) announced today that it executed a contract to sell the 221-room Hotel Zoe Fisherman’s Wharf in San Francisco, California for $68.5 million to a third party. The property sale is subject to normal closing conditions. The Company offers no assurances that the sale will be completed on these terms or at all. The sale is targeted to be completed later in the fourth quarter of 2023.

For the trailing twelve months ended September 30, 2023, the hotel’s net loss is estimated at ($1.2) million, its net operating income is estimated at $2.2 million, and its earnings before interest, taxes, depreciation and amortization (“EBITDA”) is estimated at $2.7 million. The $68.5 million sales price reflects a 25.0x EBITDA multiple and a 3.2% net operating income capitalization rate (assuming a capital reserve of 4.0% of total hotel revenues).

Proceeds from the sale of Hotel Zoe Fisherman’s Wharf will be used for general corporate purposes, including reducing the Company’s outstanding debt and repurchasing the Company’s common and preferred shares.

About Pebblebrook Hotel Trust

Pebblebrook Hotel Trust (NYSE: PEB) is a publicly traded real estate investment trust (“REIT”) and the largest owner of urban and resort lifestyle hotels in the United States. The Company owns 47 hotels, totaling approximately 12,200 guest rooms across 13 urban and resort markets. For more information, visit www.pebblebrookhotels.com and follow us at @PebblebrookPEB.

This press release contains certain “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Reform Act of 1995. Forward-looking statements are generally identifiable by the use of forward-looking terminology such as “estimated” and “will” or other similar words or expressions. Forward-looking statements are based on certain assumptions and can include future expectations, future plans and strategies, financial and operating projections and forecasts and other forward-looking information and estimates. The description of the Company’s intention to sell a hotel property and the intended use of proceeds are forward-looking statements. These forward-looking statements are subject to various risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results to differ materially from such statements. These risks and uncertainties include, but are not limited to, the state of the U.S. economy, the operating performance of our hotels and the supply of hotel properties, and other factors as are described in greater detail in the Company’s filings with the Securities and Exchange Commission, including, without limitation, the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. Unless legally required, the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

For further information about the Company’s business and financial results, please refer to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of the Company’s SEC filings, including, but not limited to, its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, copies of which may be obtained at the Investor Relations section of the Company’s website at www.pebblebrookhotels.com.

All information in this press release is as of October 16, 2023. The Company undertakes no duty to update the statements in this press release to conform the statements to actual results or changes in the Company’s expectations.

###

Contacts:

Raymond D. Martz, Chief Financial Officer, Pebblebrook Hotel Trust - (240) 507-1330

For additional information or to receive press releases via email, please visit our website at

www.pebblebrookhotels.com

| | | | | |

| Pebblebrook Hotel Trust |

| Hotel Zoe Fisherman’s Wharf |

| Reconciliation of Hotel Net Income to Hotel EBITDA and Hotel Net Operating Income |

| Estimated September 2023 Trailing Twelve Months |

| (Unaudited, in millions) |

| |

| |

| Twelve Months Ended |

| September 30, |

| 2023 |

| |

| Hotel net income | ($1.2) | |

| |

| Adjustment: | |

| Depreciation and amortization | 3.9 | |

| |

| Hotel EBITDA | $2.7 | |

| |

| Adjustment: | |

| Capital reserve | (0.5) | |

| |

| Hotel Net Operating Income | $2.2 | |

| |

| |

This press release includes certain non-GAAP financial measures as defined under Securities and Exchange Commission (SEC) rules. These measures are not in accordance with, or an alternative to, measures prepared in accordance with U.S. generally accepted accounting principles, or GAAP, and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the hotel’s results of operations determined in accordance with GAAP.

The Company has presented estimated trailing twelve-month hotel EBITDA and estimated trailing twelve-month hotel net operating income after capital reserves because it believes these measures provide investors and analysts with an understanding of the hotel-level operating performance. These non-GAAP measures do not represent amounts available for management’s discretionary use, because of needed capital replacement or expansion, debt service obligations or other commitments and uncertainties, nor are they indicative of funds available to fund the Company’s cash needs, including its ability to make distributions.

The Company’s presentation of the hotel’s estimated trailing twelve-month EBITDA and estimated trailing twelve-month net operating income after capital reserves should not be considered as an alternative to net income (computed in accordance with GAAP) as an indicator of the hotel’s financial performance. The table above is a reconciliation of the hotel’s estimated trailing twelve-month EBITDA and net operating income after capital reserves calculations to net income in accordance with GAAP. Any differences are a result of rounding.

|

Document and Entity Information Document

|

Oct. 16, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 16, 2023

|

| Entity Registrant Name |

PEBBLEBROOK HOTEL TRUST

|

| Entity Central Index Key |

0001474098

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-34571

|

| Entity Tax Identification Number |

27-1055421

|

| Entity Address, Address Line One |

4747 Bethesda Avenue

|

| Entity Address, Address Line Two |

Suite 1100

|

| Entity Address, City or Town |

Bethesda

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20814

|

| City Area Code |

240

|

| Local Phone Number |

507-1300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Shares, $0.01 par value per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Shares, $0.01 par value per share

|

| Trading Symbol |

PEB

|

| Security Exchange Name |

NYSE

|

| Series E Cumulative Redeemable Preferred Shares, $0.01 par value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Series E Cumulative Redeemable Preferred Shares, $0.01 par value

|

| Trading Symbol |

PEB-PE

|

| Security Exchange Name |

NYSE

|

| Series F Cumulative Redeemable Preferred Shares, $0.01 par value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Series F Cumulative Redeemable Preferred Shares, $0.01 par value

|

| Trading Symbol |

PEB-PF

|

| Security Exchange Name |

NYSE

|

| Series G Cumulative Redeemable Preferred Shares, $0.01 par value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Series G Cumulative Redeemable Preferred Shares, $0.01 par value

|

| Trading Symbol |

PEB-PG

|

| Security Exchange Name |

NYSE

|

| Series H Cumulative Redeemable Preferred Shares, $0.01 par value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Series H Cumulative Redeemable Preferred Shares, $0.01 par value

|

| Trading Symbol |

PEB-PH

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesEPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesFPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesGPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesHPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

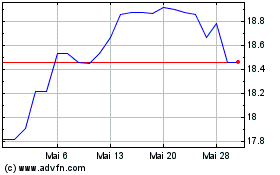

Pebblebrook Hotel (NYSE:PEB-H)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Pebblebrook Hotel (NYSE:PEB-H)

Historical Stock Chart

Von Mai 2023 bis Mai 2024