Pitney Bowes Provides Additional Detail on Financial Outlook

11 November 2024 - 1:00PM

Business Wire

Expects Q4 2024 Revenue of $505 Million to

$515 Million

Pitney Bowes Inc. (NYSE: PBI), a technology-driven company that

provides SaaS shipping solutions, mailing innovation, and financial

services to clients around the world, today provided supplemental

detail around guidance for the fourth quarter of 2024, long-term

revenue considerations, and debt reduction and refinancing

efforts.

Q4 2024 Revenue Outlook

Detail

The Company announced updated guidance on November 7, 2024,

including a full-year revenue decline in a low-single-digit range

and a full-year Adjusted EBIT increase to $355 million to $360

million. For additional clarity, the Company’s revenue outlook for

the fourth quarter of fiscal year 2024 is in the range of $505

million to $515 million. The Company reported comparable revenue

for the fourth quarter of fiscal year 2023 of $526 million.

Because of the Global Ecommerce exit process, a majority of that

segment is now reported as discontinued operations in the Company’s

Condensed Consolidated Financial Statements. Prior periods have

been recast to conform to the current period’s presentation. The

remaining portion of the Global Ecommerce segment that did not

qualify for discontinued operations treatment is now reported in an

"Other" category. This category comprises (a) a profitable

continuing operation which generated third quarter 2024 revenue of

approximately $18.7 million and (b) unprofitable operations that

the Company is currently exiting, which collectively contributed

$1.6 million to third quarter 2024 revenue.

Long-Term Revenue

Considerations

Although the Company has not provided guidance for fiscal year

2025, it disclosed on November 7, 2024 that it expects SendTech to

continue experiencing minor revenue softness in the coming

quarters, largely in-line with the softness experienced in the

third quarter of 2024, due to factors that include the required

product migration to new IMI technology and a reduction in

equipment sales. The Company expects SendTech’s revenue to flatten

out by the start of fiscal year 2026, and it has identified

long-term opportunities for enterprise-wide revenue growth due to

SendTech’s expansion in the ecommerce shipping category and

Presort’s ability to increase roll-up acquisitions.

Debt Reduction and Refinancing

Progress

The Company also disclosed on November 7, 2024 that it is

evaluating options for reducing and refinancing debt. Through

focusing on paying off and refinancing high-cost debt, the Company

expects to reduce interest payments and free up capital for other

value-enhancing initiatives. Leadership expects to have an update

in the near term on this item.

***

The Company has also made available on its investor relations

website a detailed file showing prior financials on a recast basis

adjusted for the GEC exit.

About Pitney Bowes

Pitney Bowes (NYSE: PBI) is a technology-driven company that

provides SaaS shipping solutions, mailing innovation, and financial

services to clients around the world – including more than 90

percent of the Fortune 500. Small businesses to large enterprises,

and government entities rely on Pitney Bowes to reduce the

complexity of sending mail and parcels. For the latest news,

corporate announcements, and financial results, visit

www.pitneybowes.com/us/newsroom. For additional information, visit

Pitney Bowes at www.pitneybowes.com.

Use of Non-GAAP Measures

Pitney Bowes’ financial results are reported in accordance with

generally accepted accounting principles (GAAP). Pitney Bowes also

discloses certain non-GAAP measures, such as adjusted earnings

before interest and taxes (Adjusted EBIT). Adjusted EBIT excludes

the impact of restructuring charges, goodwill and asset impairment

charges, foreign currency gains and losses on intercompany loans,

certain costs associated with the Ecommerce Restructuring, gains

and losses related to acquisitions and dispositions, gains and

losses on debt redemptions and other unusual items that we believe

are not indicative to our core business operations. We have not

provided a reconciliation of our future expectations as to Adjusted

EBIT as such reconciliation is not available without unreasonable

efforts.

Forward-Looking Statements

This document contains “forward-looking statements” about the

Company’s expected or potential future business and financial

performance. Forward-looking statements include, but are not

limited to, statements about future revenue and earnings guidance,

future events or conditions, and expected cost savings, elimination

of future losses, and anticipated deleveraging in connection with

Pitney Bowes’ announced strategic initiatives. Forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties that could cause actual results to differ

materially from those projected. Factors which could cause future

financial performance to differ materially from expectations

include, without limitation, declining physical mail volumes;

changes in postal regulations or the operations and financial

health of posts in the U.S. or other major markets or changes to

the broader postal or shipping markets; the potential adverse

effects and risks and uncertainties associated with the GEC exit

and wind-down on the Company’s operations, management and

employees, and the ability to successfully implement the Company’s

2024 worldwide cost reduction and optimization initiatives and

realize the expected benefits therefrom, the loss of some of Pitney

Bowes’ larger clients in the Presort Services segments; the loss

of, or significant changes to, United States Postal Service (USPS)

commercial programs, or the Company’s contractual relationships

with the USPS or their performance under those contracts; and other

factors as more fully outlined in the Company's 2023 Form 10-K

Annual Report and other reports filed with the Securities and

Exchange Commission during 2024. Pitney Bowes assumes no obligation

to update any forward-looking statements contained in this document

as a result of new information, events or developments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241111885971/en/

Alex Brown investorrelations@pb.com OR Longacre Square Partners

Joe Germani jgermani@longacresquare.com

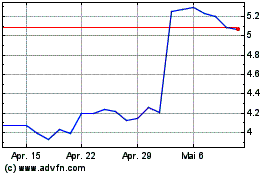

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

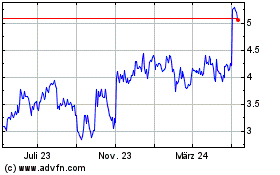

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

Von Nov 2023 bis Nov 2024