Orchid Island Capital Announces November 2024 Monthly Dividend and October 31, 2024 RMBS Portfolio Characteristics

13 November 2024 - 10:40PM

Orchid Island Capital, Inc. (the “Company”) (NYSE: ORC) announced

today that the Board of Directors of the Company declared a monthly

cash dividend for the month of November 2024. The dividend of

$0.12 per share will be paid December 30, 2024 to holders

of record of the Company’s common stock on November 29, 2024, with

an ex-dividend date of November 29, 2024. The Company plans on

announcing its next common stock dividend on December 10, 2024.

The Company intends to make regular monthly cash

distributions to its holders of common stock. In order to qualify

as a real estate investment trust (“REIT”), the Company must

distribute annually to its stockholders an amount at least equal to

90% of its REIT taxable income, determined without regard to the

deduction for dividends paid and excluding any net capital gain.

The Company will be subject to income tax on taxable income that is

not distributed and to an excise tax to the extent that a certain

percentage of its taxable income is not distributed by specified

dates. The Company has not established a minimum distribution

payment level and is not assured of its ability to make

distributions to stockholders in the future.

As of November 13, 2024 and October

31, 2024, the Company had 78,539,645 shares of common stock

outstanding. As of September 30, 2024, the Company

had 78,082,645 shares of common stock outstanding.

Estimated November 8,

2024 Book Value Per Share

The Company’s estimated book value per share as of November 8,

2024 was approximately $8.30 to $8.34, a decrease of 0.7% to

1.0% from the book value per share at September 30, 2024 of $8.40.

The estimated book value per share includes a deduction for today's

dividend declaration that will be paid on December 30,

2024. The Company computes book value per share by dividing

total stockholders' equity by the total number of outstanding

shares of common stock. At November 8, 2024, the Company's

estimated total stockholders' equity was approximately $652.0

million to $655.0 million, with 78,539,645 shares of

common stock outstanding. These figures and the resulting estimated

book value per share are unaudited and will not be verified or

reviewed by the Company’s independent registered public accounting

firm or any third party. The Company is providing these

figures intraperiod due to recent market volatility, and undertakes

no obligation to update or revise such figures or to provide

any such intraperiod updates in the future.

RMBS Portfolio

Characteristics

Details of the RMBS portfolio as of October

31, 2024 are presented below. These figures are

preliminary and subject to change. The information contained herein

is an intra-quarter update created by the Company based upon

information that the Company believes is accurate:

- RMBS Valuation Characteristics

- RMBS Assets by Agency

- Investment Company Act of 1940 (Whole Pool) Test Results

- Repurchase Agreement Exposure by Counterparty

- RMBS Risk Measures

About Orchid Island Capital, Inc.

Orchid Island Capital, Inc. is a specialty

finance company that invests on a leveraged basis in Agency RMBS.

Our investment strategy focuses on, and our portfolio consists of,

two categories of Agency RMBS: (i) traditional pass-through Agency

RMBS, such as mortgage pass-through certificates and collateralized

mortgage obligations issued by Fannie Mae, Freddie Mac or Ginnie

Mae, and (ii) structured Agency RMBS. The Company is managed by

Bimini Advisors, LLC, a registered investment adviser with the

Securities and Exchange Commission.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and other federal securities laws. These

forward-looking statements include, but are not limited to,

statements about the Company’s distributions. These forward-looking

statements are based upon Orchid Island Capital, Inc.’s present

expectations, but these statements are not guaranteed to occur.

Investors should not place undue reliance upon forward-looking

statements. For further discussion of the factors that could affect

outcomes, please refer to the “Risk Factors” section of the

Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023.

| RMBS

Valuation Characteristics |

|

|

($ in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized |

|

|

Aug-24 - |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oct-24 |

|

|

Oct-24 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net |

|

|

|

|

|

|

|

Weighted |

|

CPR |

|

|

CPR |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted |

|

|

|

|

|

|

|

Average |

|

(1-Month) |

|

|

(3-Month) |

|

Modeled Interest |

|

| |

Current |

|

Fair |

|

% of |

|

Current |

|

Average |

|

|

|

|

|

|

|

Maturity |

|

(Reported |

|

|

(Reported |

|

Rate Sensitivity (1) |

|

|

Type |

Face |

|

Value |

|

Portfolio |

|

Price |

|

Coupon |

|

GWAC |

|

Age |

|

(Months) |

|

in Nov) |

|

|

in Nov) |

|

(-50 BPS) |

|

|

(+50 BPS) |

|

|

Fixed Rate RMBS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 15yr

5.0 TBA |

$ |

50,000 |

|

$ |

49,867 |

|

|

0.93% |

|

|

99.73 |

|

|

5.00% |

|

|

5.89% |

|

|

6 |

|

|

171 |

|

|

n/a |

|

|

|

n/a |

|

$ |

708 |

|

|

$ |

(709 |

) |

| 15yr

Total |

|

50,000 |

|

|

49,867 |

|

|

0.93% |

|

|

99.73 |

|

|

5.00% |

|

|

5.89% |

|

|

6 |

|

|

171 |

|

|

n/a |

|

|

|

n/a |

|

|

708 |

|

|

|

(709 |

) |

| 30yr 3.0 |

|

1,305,404 |

|

|

1,139,084 |

|

|

21.31% |

|

|

87.26 |

|

|

3.00% |

|

|

3.46% |

|

|

43 |

|

|

311 |

|

|

7.1% |

|

|

|

6.4% |

|

|

38,513 |

|

|

|

(32,934 |

) |

| 30yr 3.5 |

|

178,632 |

|

|

162,656 |

|

|

3.04% |

|

|

91.06 |

|

|

3.50% |

|

|

4.04% |

|

|

56 |

|

|

292 |

|

|

7.4% |

|

|

|

7.9% |

|

|

4,851 |

|

|

|

(4,226 |

) |

| 30yr 4.0 |

|

532,180 |

|

|

494,025 |

|

|

9.24% |

|

|

92.83 |

|

|

4.00% |

|

|

4.64% |

|

|

69 |

|

|

284 |

|

|

8.8% |

|

|

|

5.6% |

|

|

13,065 |

|

|

|

(12,364 |

) |

| 30yr 4.5 |

|

310,301 |

|

|

296,031 |

|

|

5.54% |

|

|

95.40 |

|

|

4.50% |

|

|

5.44% |

|

|

28 |

|

|

328 |

|

|

7.7% |

|

|

|

6.9% |

|

|

6,498 |

|

|

|

(6,367 |

) |

| 30yr 5.0 |

|

527,991 |

|

|

514,883 |

|

|

9.63% |

|

|

97.52 |

|

|

5.00% |

|

|

5.93% |

|

|

25 |

|

|

330 |

|

|

5.4% |

|

|

|

7.4% |

|

|

10,308 |

|

|

|

(10,771 |

) |

| 30yr 5.5 |

|

283,161 |

|

|

283,208 |

|

|

5.30% |

|

|

100.02 |

|

|

5.50% |

|

|

6.40% |

|

|

17 |

|

|

339 |

|

|

5.0% |

|

|

|

5.1% |

|

|

5,216 |

|

|

|

(5,879 |

) |

| 30yr 6.0 |

|

1,232,925 |

|

|

1,251,996 |

|

|

23.42% |

|

|

101.55 |

|

|

6.00% |

|

|

6.98% |

|

|

10 |

|

|

346 |

|

|

16.9% |

|

|

|

14.0% |

|

|

17,554 |

|

|

|

(21,618 |

) |

| 30yr 6.5 |

|

764,238 |

|

|

785,164 |

|

|

14.69% |

|

|

102.74 |

|

|

6.50% |

|

|

7.43% |

|

|

10 |

|

|

347 |

|

|

23.7% |

|

|

|

17.4% |

|

|

7,196 |

|

|

|

(10,475 |

) |

| 30yr

7.0 |

|

338,430 |

|

|

353,181 |

|

|

6.61% |

|

|

104.36 |

|

|

7.00% |

|

|

7.94% |

|

|

12 |

|

|

342 |

|

|

39.0% |

|

|

|

31.8% |

|

|

2,215 |

|

|

|

(4,037 |

) |

| 30yr

Total |

|

5,473,262 |

|

|

5,280,228 |

|

|

98.77% |

|

|

96.47 |

|

|

4.93% |

|

|

5.72% |

|

|

28 |

|

|

327 |

|

|

13.6% |

|

|

|

11.1% |

|

|

105,416 |

|

|

|

(108,671 |

) |

|

Total Pass-Through MBS |

|

5,523,262 |

|

|

5,330,095 |

|

|

99.70% |

|

|

96.50 |

|

|

4.93% |

|

|

5.72% |

|

|

28 |

|

|

325 |

|

|

13.6% |

|

|

|

11.1% |

|

|

106,124 |

|

|

|

(109,380 |

) |

|

Structured MBS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| IO 20yr 4.0 |

|

7,275 |

|

|

696 |

|

|

0.01% |

|

|

9.57 |

|

|

4.00% |

|

|

4.57% |

|

|

154 |

|

|

80 |

|

|

9.4% |

|

|

|

10.7% |

|

|

(38 |

) |

|

|

(45 |

) |

| IO 30yr 3.0 |

|

2,680 |

|

|

322 |

|

|

0.01% |

|

|

12.00 |

|

|

3.00% |

|

|

3.64% |

|

|

117 |

|

|

233 |

|

|

25.3% |

|

|

|

10.0% |

|

|

(7 |

) |

|

|

(8 |

) |

| IO 30yr 4.0 |

|

72,950 |

|

|

13,700 |

|

|

0.26% |

|

|

18.78 |

|

|

4.00% |

|

|

4.60% |

|

|

122 |

|

|

229 |

|

|

7.5% |

|

|

|

6.8% |

|

|

(501 |

) |

|

|

(171 |

) |

| IO 30yr 4.5 |

|

3,186 |

|

|

597 |

|

|

0.01% |

|

|

18.75 |

|

|

4.50% |

|

|

4.99% |

|

|

172 |

|

|

175 |

|

|

6.6% |

|

|

|

7.4% |

|

|

(17 |

) |

|

|

(15 |

) |

| IO 30yr

5.0 |

|

1,725 |

|

|

354 |

|

|

0.01% |

|

|

20.54 |

|

|

5.00% |

|

|

5.37% |

|

|

172 |

|

|

176 |

|

|

10.6% |

|

|

|

7.4% |

|

|

(13 |

) |

|

|

(7 |

) |

| IO

Total |

|

87,816 |

|

|

15,669 |

|

|

0.29% |

|

|

17.84 |

|

|

4.01% |

|

|

4.60% |

|

|

127 |

|

|

214 |

|

|

8.2% |

|

|

|

7.3% |

|

|

(576 |

) |

|

|

(246 |

) |

| IIO

30yr 4.0 |

|

23,236 |

|

|

248 |

|

|

0.00% |

|

|

1.07 |

|

|

0.00% |

|

|

4.40% |

|

|

85 |

|

|

263 |

|

|

19.5% |

|

|

|

10.6% |

|

|

79 |

|

|

|

(88 |

) |

|

Total Structured RMBS |

|

111,052 |

|

|

15,917 |

|

|

0.30% |

|

|

14.33 |

|

|

3.17% |

|

|

4.55% |

|

|

118 |

|

|

224 |

|

|

10.6% |

|

|

|

8.0% |

|

|

(497 |

) |

|

|

(334 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Mortgage Assets |

$ |

5,634,314 |

|

$ |

5,346,012 |

|

|

100.00% |

|

|

|

|

|

4.90% |

|

|

5.70% |

|

|

30 |

|

|

323 |

|

|

13.5% |

|

|

|

11.1% |

|

$ |

105,627 |

|

|

$ |

(109,714 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Hedge |

|

Modeled Interest |

|

| |

Notional |

|

Period |

|

Rate Sensitivity (1) |

|

|

Hedge |

Balance |

|

End |

|

(-50 BPS) |

|

|

(+50 BPS) |

|

|

3-Month SOFR Futures(2) |

$ |

(455,900 |

) |

Oct-25 |

|

$ |

(5,699 |

) |

|

$ |

5,699 |

|

| 10-Year Treasury

Future(3) |

|

(12,500 |

) |

Dec-24 |

|

|

(394 |

) |

|

|

394 |

|

| Swaps |

|

(3,486,800 |

) |

Jun-30 |

|

|

(87,485 |

) |

|

|

84,461 |

|

|

TBA |

|

(200,000 |

) |

Nov-24 |

|

|

(6,063 |

) |

|

|

5,408 |

|

|

Hedge Total |

$ |

(4,155,200 |

) |

|

|

$ |

(99,641 |

) |

|

$ |

95,962 |

|

|

Rate Shock Grand Total |

|

|

|

|

|

$ |

5,986 |

|

|

$ |

(13,752 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Modeled results from Citigroup Global Markets Inc. Yield Book.

Interest rate shocks assume instantaneous parallel shifts and

horizon prices are calculated assuming constant

SOFR option-adjusted spreads. These results are for

illustrative purposes only and actual results may differ

materially. |

|

(2) |

Amounts for SOFR futures

contracts represents the average quarterly notional amount. |

|

(3) |

Ten-year Treasury futures

contracts were valued at prices

of $110.47 at October 31, 2024. The market value of

the short position was $13.8 million. |

|

RMBS Assets by Agency |

|

|

|

|

|

| ($ in

thousands) |

|

|

|

|

|

| |

|

|

|

Percentage |

|

| |

Fair |

|

of |

|

|

Asset Category |

Value |

|

Portfolio |

|

| As of October 31,

2024 |

|

|

|

|

|

| Fannie Mae |

$ |

3,627,479 |

|

67.9 |

% |

| Freddie

Mac |

|

1,718,533 |

|

32.1 |

% |

| Total

Mortgage Assets |

$ |

5,346,012 |

|

100.0 |

% |

| |

|

|

|

|

|

| Investment

Company Act of 1940 Whole Pool Test |

|

|

($ in thousands) |

|

|

|

|

|

| |

|

|

|

Percentage |

|

| |

Fair |

|

of |

|

|

Asset Category |

Value |

|

Portfolio |

|

| As of October 31,

2024 |

|

|

|

|

|

| Non-Whole Pool Assets |

$ |

206,643 |

|

3.9 |

% |

| Whole

Pool Assets |

|

5,139,369 |

|

96.1 |

% |

| Total

Mortgage Assets |

$ |

5,346,012 |

|

100.0 |

% |

|

Borrowings By Counterparty |

|

|

|

|

|

|

|

|

|

|

| ($ in

thousands) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Weighted |

|

Weighted |

|

|

| |

|

|

|

% of |

|

Average |

|

Average |

|

|

| |

Total |

|

Total |

|

Repo |

|

Maturity |

|

Longest |

|

As of October 31, 2024 |

Borrowings |

|

Debt |

|

Rate |

|

in Days |

|

Maturity |

| Merrill Lynch, Pierce, Fenner

& Smith |

$ |

376,573 |

|

7.3% |

|

5.15% |

|

20 |

|

11/25/2024 |

| ABN AMRO Bank N.V. |

|

368,037 |

|

7.2% |

|

5.00% |

|

15 |

|

11/15/2024 |

| ASL Capital Markets Inc. |

|

341,650 |

|

6.7% |

|

5.22% |

|

14 |

|

11/15/2024 |

| Cantor Fitzgerald &

Co |

|

281,564 |

|

5.5% |

|

5.01% |

|

8 |

|

11/8/2024 |

| DV Securities, LLC Repo |

|

266,219 |

|

5.2% |

|

5.02% |

|

19 |

|

11/29/2024 |

| Mitsubishi UFJ Securities

(USA), Inc |

|

256,092 |

|

5.0% |

|

4.99% |

|

21 |

|

11/25/2024 |

| J.P. Morgan Securities

LLC |

|

247,234 |

|

4.8% |

|

5.03% |

|

8 |

|

11/25/2024 |

| Banco Santander SA |

|

246,554 |

|

4.8% |

|

5.33% |

|

18 |

|

11/18/2024 |

| Daiwa Securities America

Inc. |

|

241,139 |

|

4.7% |

|

5.00% |

|

24 |

|

11/25/2024 |

| Wells Fargo Bank, N.A. |

|

236,880 |

|

4.6% |

|

5.00% |

|

18 |

|

11/18/2024 |

| Citigroup Global Markets

Inc |

|

236,331 |

|

4.6% |

|

4.93% |

|

25 |

|

11/25/2024 |

| ING Financial Markets LLC |

|

225,593 |

|

4.4% |

|

5.01% |

|

8 |

|

11/8/2024 |

| Marex Capital Markets

Inc. |

|

218,101 |

|

4.3% |

|

5.00% |

|

21 |

|

11/21/2024 |

| Goldman, Sachs & Co |

|

202,206 |

|

3.9% |

|

5.02% |

|

18 |

|

11/18/2024 |

| Bank of Montreal |

|

200,535 |

|

3.9% |

|

5.03% |

|

14 |

|

11/14/2024 |

| Clear Street LLC |

|

193,535 |

|

3.8% |

|

5.21% |

|

17 |

|

11/20/2024 |

| South Street Securities,

LLC |

|

190,161 |

|

3.7% |

|

4.97% |

|

41 |

|

1/24/2025 |

| Mirae Asset Securities (USA)

Inc. |

|

189,233 |

|

3.7% |

|

5.08% |

|

18 |

|

11/18/2024 |

| StoneX Financial Inc. |

|

155,898 |

|

3.0% |

|

5.01% |

|

21 |

|

11/21/2024 |

| The Bank of Nova Scotia |

|

147,479 |

|

2.9% |

|

5.03% |

|

15 |

|

11/15/2024 |

| RBC Capital Markets, LLC |

|

143,022 |

|

2.8% |

|

5.31% |

|

14 |

|

11/14/2024 |

| Nomura Securities

International, Inc. |

|

73,140 |

|

1.4% |

|

4.90% |

|

46 |

|

12/16/2024 |

| Lucid Prime Fund, LLC |

|

47,591 |

|

0.9% |

|

5.03% |

|

14 |

|

11/14/2024 |

| Wells Fargo Securities,

LLC |

|

22,686 |

|

0.4% |

|

4.88% |

|

84 |

|

1/23/2025 |

| Lucid

Cash Fund USG LLC |

|

17,131 |

|

0.3% |

|

5.03% |

|

14 |

|

11/14/2024 |

| Total

Borrowings |

$ |

5,124,584 |

|

100.0% |

|

5.06% |

|

18 |

|

1/24/2025 |

| |

|

|

|

|

|

|

|

|

|

|

Contact:

Orchid Island Capital, Inc.Robert E. Cauley3305

Flamingo Drive, Vero Beach, Florida 32963Telephone: (772)

231-1400

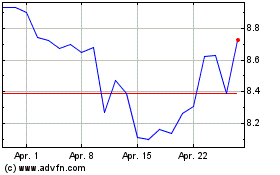

Orchid Island Capital (NYSE:ORC)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Orchid Island Capital (NYSE:ORC)

Historical Stock Chart

Von Feb 2024 bis Feb 2025