Navios Maritime Holdings Inc. Announces Definitive Merger Agreement

23 Oktober 2023 - 1:00PM

Navios Maritime Holdings Inc. (the “Company”) (NYSE: NM) and N

Logistics Holdings Corporation (“NLHC”), a company controlled by

the Company’s Chairwoman and Chief Executive Officer, Angeliki

Frangou, announced today that they entered into a definitive merger

agreement (the “Merger Agreement”), pursuant to which NLHC will

acquire all of the outstanding shares of common stock of the

Company not already owned by NLHC (“Common Shares”) for $2.28 per

share in cash, without interest (the “Merger”). The Agreement

follows the offer made by an affiliate of Ms. Frangou on September

13, 2023 to acquire the Common Shares.

The $2.28 per share price represents a premium

of approximately 43% to the closing price of the Company’s common

stock on September 12, 2023, the last trading day before the

Company’s announcement of the September 13th offer.

As previously disclosed, the Company’s Board of

Directors formed a Special Committee, consisting solely of

independent and disinterested directors (the “Special Committee”),

to consider NLHC’s offer.

The Company’s Board of Directors, acting on the

unanimous recommendation of the Special Committee, approved the

Merger Agreement by unanimous vote of the directors not affiliated

with NLHC or its affiliates. The Special Committee, with the

assistance of its independent financial and legal advisors,

exclusively negotiated the terms of the Merger Agreement on behalf

of the Company.

The Merger, which is expected to close no later

than the first quarter of 2024, is subject to approval of the

Merger by the Company’s stockholders at a special meeting of the

Company’s stockholders to be held in due course, as well as other

customary closing conditions. The Merger requires the affirmative

vote of the holders of a majority of the total votes entitled to be

cast by the holders of all outstanding voting shares of the

Company, voting together as a single class. An affiliate of NLHC

that holds shares representing a majority of the Company’s voting

power has agreed to vote the shares of the Company owned by it and

its affiliates in favor of the Merger.

Advisors

Latham & Watkins LLP acted as legal advisor

and Jefferies LLC acted as financial advisor to the Special

Committee. Fried, Frank, Harris, Shriver & Jacobson LLP acted

as legal advisor and S. Goldman Advisors LLC acted as financial

advisor to NLHC.

About Navios Maritime Holdings Inc.

Navios Maritime Holdings Inc. (NYSE: NM) owns a

controlling equity stake in Navios South American Logistics Inc.,

one of the largest infrastructure and logistics companies in the

Hidrovia region of South America and an interest in Navios Maritime

Partners L.P., a US publicly listed shipping company which owns and

operates dry cargo and tanker vessels. For more information, please

visit our website: www.navios.com.

Additional Information and Where to Find It

In connection with the Merger, the Company plans

to file with the Securities and Exchange Commission (the “SEC”) and

mail to its stockholders a proxy statement and other relevant

materials. The proxy statement will contain important information

about the Company, the acquirer, the proposed acquisition and

related matters. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ

THE PROXY STATEMENT CAREFULLY WHEN IT IS AVAILABLE AND THE OTHER

RELEVANT MATERIALS FILED BY THE COMPANY WITH THE SEC BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders

will be able to obtain free copies of the proxy statement and other

relevant materials filed with the SEC by the Company through the

website maintained by the SEC at www.sec.gov or by directing a

request to the contact listed below. In addition, investors and

security holders will be able to obtain free copies of the

documents filed with the SEC on the Company’s website at

www.navios.com.

Forward-Looking Statements

This communication contains forward-looking

statements relating to the proposed transaction involving the

Company, including statements as to the expected timing, completion

and effects of the proposed transaction and statements relating to

the Company’s future success. Statements in this communication that

are not statements of historical fact are considered

forward-looking statements, which are usually identified by the use

of words such as “anticipates,” “believes,” “continues,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “projects,” “seeks,” “should,” “will,” and variations

of such words or similar expressions. These forward-looking

statements are neither forecasts, promises nor guarantees, and are

based on the current beliefs of management of the Company as well

as assumptions made by and information currently available to the

Company. Such statements reflect the current views of the Company

with respect to future events and are subject to known and unknown

risks, including business, economic and competitive risks,

uncertainties, contingencies and assumptions about the Company,

including, without limitation, (i) inability to complete the

proposed transaction because, among other reasons, conditions to

the closing of the proposed transaction may not be satisfied or

waived, (ii) uncertainty as to the timing of completion of the

proposed transaction, (iii) potential adverse effects or changes to

relationships with customers or other parties resulting from the

announcement or completion of the proposed transaction, (iv)

possible disruptions from the proposed transaction that could harm

the Company’s business, including current plans and operations, (v)

unexpected costs, charges or expenses resulting from the proposed

transaction, (vi) uncertainty of the expected financial performance

of the Company following completion of the proposed transaction,

and (vii) the unknown future impact of

the COVID-19 pandemic on the Company’s operations or

operating expenses. More details about these and other risks that

may impact the Company’s business are described under the heading

“Risk Factors” in the reports the Company files with the SEC,

including its Annual Report on Form 20-F and Reports on

Form 6-K, which are available on the SEC’s website at

www.sec.gov. The Company cautions you not to place undue reliance

on any forward-looking statements, which speak only as of the date

hereof. The Company does not undertake any duty to update any

forward-looking statement or other information in this

communication, except to the extent required by law.

Contact:

Navios Maritime Holdings

Inc.+1-345-232-3067+1.212.906.8643investors@navios.com

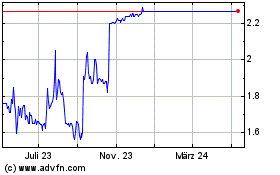

Navios Maritime (NYSE:NM)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

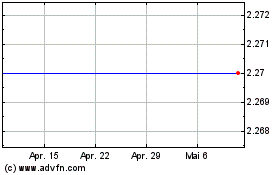

Navios Maritime (NYSE:NM)

Historical Stock Chart

Von Dez 2023 bis Dez 2024