As

filed with the Securities and Exchange Commission on July 9, 2024

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

NIO Inc.

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

|

Not Applicable |

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification Number) |

Building 19, No. 1355, Caobao Road

Minhang District, Shanghai 200233

People’s Republic of China

+86

21-6908-2018

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

2024 Share Incentive Plan

(Full title of the plan)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

+1 (800) 221-0102

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Indicate by check mark whether the registrant is

a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934 (the “Exchange Act”).

| |

Large accelerated filer |

x |

|

Accelerated filer |

¨ |

| |

Non-accelerated file |

¨ |

|

Smaller reporting company |

¨ |

| |

|

|

|

Emerging

growth company |

¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

Copies to:

|

Yu Qu

Chief Financial Officer

Building 19, No. 1355, Caobao Road, Minhang

District

Shanghai, People’s Republic of China

+86

21-6908-2018 |

Yuting Wu, Esq.

Skadden, Arps, Slate, Meagher & Flom

LLP

JingAn Kerry Center, Tower II, 46/F

1539 Nanjing West Road

Shanghai 200040

People’s Republic of China

+86 21-6193-8200 |

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

| Item 2. | Registrant Information and Employee Plan Annual Information* |

* Information required by Part I to be contained in the Section 10(a) prospectus

is omitted from this registration statement in accordance with Rule 428 under the Securities Act and the Note to Part I of Form S-8.

The documents containing information specified in this Part I will be separately provided to the participants covered by the 2024

Share Incentive Plan, as specified by Rule 428(b)(1) under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. | Incorporation of Documents by Reference |

The following documents previously filed by the

Registrant with the Commission are incorporated by reference herein:

All documents subsequently filed by the Registrant

pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”), after the

date of this registration statement and prior to the filing of a post-effective amendment to this registration statement which indicates

that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated

by reference in this registration statement and to be part hereof from the date of filing of such documents. Any statement in a document

incorporated or deemed to be incorporated by reference in this registration statement will be deemed to be modified or superseded to the

extent that a statement contained in this registration statement or in any other later filed document that also is or is deemed to be

incorporated by reference modifies or supersedes such statement. Any such statement so modified or superseded will not be deemed, except

as so modified or superseded, to be a part of this registration statement.

| Item 4. | Description of Securities |

Not applicable.

| Item 5. | Interests of Named Experts and Counsel |

Not applicable.

| Item 6. | Indemnification of Directors and Officers |

Cayman Islands law does not limit the extent to

which a company’s articles of association may provide for indemnification of directors and officers, except to the extent any such

provision may be held by the Cayman Islands courts to be contrary to public policy, such as to provide indemnification against civil fraud

or the consequences of committing a crime. The Registrant’s thirteenth amended and restated articles of association, adopted by

a special resolution of its shareholders passed on August 25, 2022 and effective on August 25, 2022, provides that the Registrant

shall indemnify its directors and officers against all actions, proceedings, costs, charges, expenses, losses, damages or liabilities

incurred or sustained by such persons other than by reason of their own dishonesty, willful default or fraud, in or about the conduct

of the Registrant’s business or affairs (including as a result of any mistake of judgment) or in the execution or discharge of their

duties, powers, authorities or discretions, including without prejudice to the generality of the foregoing, any costs, expenses, losses

or liabilities incurred by such persons in defending (whether successfully or otherwise) any civil proceedings concerning the Registrant

or its affairs in any court whether in the Cayman Islands or elsewhere.

Pursuant to the indemnification agreement, the

form of which was filed as Exhibit 10.5 to the Registrant’s registration statement on Form F-1, as amended (File No. 333-226822),

the Registrant has agreed to indemnify its directors and executive officers against certain liabilities and expenses incurred by such

persons in connection with claims made by reason of their being directors or officers of the Registrant.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers or persons controlling the Registrant pursuant to the foregoing provisions,

the Registrant has been informed that in the opinion of the Commission such indemnification is against public policy as expressed in the

Securities Act and is therefore unenforceable.

The Registrant also maintains a directors and

officers liability insurance policy for its directors and officers.

| Item 7. | Exemption from Registration Claimed |

Not applicable.

See the Index to Exhibits attached hereto.

| (a) | The undersigned Registrant hereby undertakes: |

| (1) | To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| (i) | to include any prospectus required by Section 10(a)(3) of the Securities Act; |

| (ii) | to reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth

in this registration statement; and |

| (iii) | to include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to that information in the registration statement; |

provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) above do not apply if the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant

to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this registration statement;

| (2) | That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to

be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering. |

| (b) | The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing

of the Registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable,

each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated

by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein,

and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (c) | Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling

persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the

Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event

that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a

director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by

such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion

of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether

such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication

of such issue. |

EXHIBIT INDEX

| Exhibit Number |

|

Description |

| |

|

|

| 4.1 |

|

Thirteenth Amended and Restated

Memorandum and Articles of Association of the Registrant (incorporated herein by reference to Exhibit 3.1 to the current report

on Form 6-K (File No. 001-38638), furnished with the SEC on August 25, 2022) |

| |

|

|

| 4.2 |

|

Registrant’s Specimen

Certificate for Class A ordinary shares (incorporated herein by reference to Exhibit 4.2 to the registration statement

on Form F-1 (File No. 333-226822), as amended, initially filed with the SEC on August 13, 2018) |

| |

|

|

| 4.3 |

|

Deposit Agreement, dated as

of September 11, 2018, among the Registrant, Deutsche Bank Trust Company Americas, as the depositary, and all holders and beneficial

owners of the American Depositary Shares issued thereunder (incorporated herein by reference to Exhibit 4.3 to the registration

statement on Form S-8 (File No. 333-229952), filed with the SEC on February 28, 2019) |

| |

|

|

| 5.1* |

|

Opinion of Maples and Calder (Hong Kong) LLP, Cayman

Islands counsel to the Registrant, regarding the validity of the Class A ordinary shares being registered |

| |

|

|

| 10.1 |

|

2024 Share Incentive Plan

(incorporated herein by reference to Exhibit 99.1 to the Form 6-K furnished with the SEC on February 7, 2024) |

| |

|

|

| 23.1* |

|

Consent of PricewaterhouseCoopers Zhong Tian LLP |

| |

|

|

| 23.2* |

|

Consent of Maples and Calder (Hong Kong) LLP (included

in Exhibit 5.1) |

| |

|

|

| 24.1* |

|

Power of Attorney (included on signature page hereto) |

| |

|

|

| 107* |

|

Filing Fee Table |

* Filed herewith.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in Shanghai, China, on July 9, 2024.

| |

NIO INC. |

| |

|

|

| |

By: |

/s/ Bin Li |

| |

Name: |

Bin Li |

| |

Title: |

Chairman of the Board of Directors and Chief Executive Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each

person whose signature appears below constitutes and appoints, severally and not jointly, each of Bin Li and Yu Qu, with full power

to act alone, as his or her true and lawful attorney-in-fact, with the power of substitution, for and in such person’s name,

place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this

Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the

Securities and Exchange Commission, granting unto each said attorney-in-fact full power and authority to do and perform each and

every act and thing requisite and necessary to be done as fully to all intents and purposes as he or she might or could do in

person, hereby ratifying and confirming all that each said attorney-in-fact may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in

the capacities set forth below on July 9, 2024.

|

Signature |

|

Title |

|

/s/ Bin Li |

|

Chairman of the Board of Directors and Chief |

| Bin

Li |

|

Executive Officer

(Principal Executive Officer) |

|

/s/ Yu Qu |

|

Chief Financial Officer

|

| Yu Qu |

|

(Principal Financial Officer) |

|

/s/ Lihong Qin |

|

Director and President |

| Lihong Qin |

|

|

|

/s/ Hai Wu |

|

Independent Director |

| Hai Wu |

|

|

|

/s/ Denny Ting Bun Lee |

|

Independent Director |

| Denny Ting Bun Lee |

|

|

|

/s/ Yu Long

|

|

Independent Director |

| Yu Long |

|

|

|

/s/ Yonggang Wen |

|

Independent Director |

| Yonggang Wen |

|

|

|

/s/ Eddy Georges Skaf |

|

Director |

| Eddy Georges Skaf |

|

|

|

/s/ Nicholas Paul Collins |

|

Director |

| Nicholas Paul Collins |

|

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN THE

UNITED STATES

Pursuant

to the Securities Act of 1933, as amended, the undersigned, the duly authorized representative in the United States of NIO Inc., has signed

this registration statement in New York, New York, United States of America on July 9, 2024

| |

Authorized U.S. Representative |

| |

|

| |

Cogency Global Inc. |

| |

|

|

| |

By: |

/s/ Colleen A. De Vries |

| |

Name: |

Colleen A. De Vries |

| |

Title: |

Senior Vice President |

Exhibit 5.1

Our ref LWP/701714-000009/29683410v2

NIO Inc.

Building 19, No. 1355, Caobao Road

Minhang District, Shanghai

People’s Republic of China

9 July 2024

Dear Sirs

NIO Inc. (the “Company”)

We have acted as Cayman Islands legal

counsel to the Company in connection with a registration statement on Form S-8 to be filed with the Securities and Exchange

Commission (the “Commission”) on 9 July 2024 (the “Registration Statement”) relating to

the registration under the United States Securities Act of 1933, as amended, (the “Securities Act”) of an

aggregate of 70,397,553 class A ordinary shares, par value US$0.00025 per share (the “Shares”), issuable by the

Company pursuant to the Company’s 2024 Share Incentive Plan (the “Plan”).

For the purposes of giving this opinion, we have

examined copies of the Registration Statement and the Plan. We have also reviewed copies of the thirteenth amended and restated memorandum

and articles of association of the Company adopted by a special resolution passed on 25 August 2022 and effective on 25 August 2022

(the “Memorandum and Articles”) and the minutes of the meeting (the “Meeting”) of the board of directors

of the Company held on 7 February 2024 (the “Minutes”).

Based upon, and subject to, the assumptions and

qualifications set out below, and having regard to such legal considerations as we deem relevant, we are of the opinion that:

| 1. | The Shares to be issued by the Company and registered under the Registration Statement have been duly

and validly authorized. |

| 2. | When issued and paid for in accordance with the terms of the Plan and in accordance with the Resolutions,

and when appropriate entries are made in the register of members (shareholders) of the Company, the Shares will be validly issued, fully

paid and non-assessable. |

In this opinion letter, the phrase “non-assessable”

means, with respect to the issuance of the Shares, that a shareholder shall not, in respect of the relevant Shares, have any obligation

to make further contributions to the Company’s assets (except in exceptional circumstances, such as involving fraud, the establishment

of an agency relationship or an illegal or improper purpose or other circumstances in which a court may be prepared to pierce or lift

the corporate veil).

These opinions are subject to the qualification

that under the Companies Act (As Revised) of the Cayman Islands, the register of members of a Cayman Islands company is by statute regarded

as prima facie evidence of any matters which the Companies Act (As Revised) directs or authorises to be inserted therein. A third

party interest in the shares in question would not appear. An entry in the register of members may yield to a court order for rectification

(for example, in the event of fraud or manifest error).

These opinions are given only as to, and based

on, circumstances and matters of fact existing and known to us on the date of this opinion letter. These opinions only relate to the laws

of the Cayman Islands which are in force on the date of this opinion letter. We express no opinion as to the meaning, validity or effect

of any references to foreign (i.e. non-Cayman Islands) statutes, rules, regulations, codes, judicial authority or any other promulgations.

We have also relied upon the assumptions, which

we have not independently verified, that (a) all signatures, initials and seals are genuine, (b) copies of documents, conformed

copies or drafts of documents provided to us are true and complete copies of, or in the final forms of, the originals, (c) there

is nothing contained in the minute book or corporate records of the Company (which we have not inspected) which would or might affect

the opinions set out above, (d) the Memorandum and Articles remain in full force and effect and are unamended, (e) the Resolutions

were duly passed in the manner prescribed in the memorandum and articles of association of the Company (including, without limitation,

with respect to the disclosure of interests (if any) by directors of the Company) and have not been amended, varied or revoked in any

respect, (f) there is nothing under any law (other than the laws of the Cayman Islands) which would or might affect the opinions

set out above, and (g) upon the issue of any Shares, the consideration received by the Company shall be not less than the par value

of such Shares.

We consent to the use of this opinion as an exhibit

to the Registration Statement and further consent to all references to us in the Registration Statement and any amendments thereto. In

giving such consent, we do not consider that we are “experts” within the meaning of such term as used in the Securities Act,

or the rules and regulations of the Commission issued thereunder, with respect to any part of the Registration Statement, including

this opinion as an exhibit or otherwise.

Yours faithfully

/s/ Maples and Calder (Hong Kong) LLP

Maples and Calder (Hong Kong) LLP

Exhibit 23.1

Consent of Independent Registered Public Accounting

Firm

We hereby consent to the incorporation by reference

in this Registration Statement on Form S-8 of NIO Inc. of our report dated April 9, 2024 relating to the financial statements

and the effectiveness of internal control over financial reporting, which appears in NIO Inc.’s Annual Report on Form 20-F

for the year ended December 31, 2023.

/s/PricewaterhouseCoopers Zhong Tian LLP

Shanghai, the People’s Republic of China

July 9, 2024

Exhibit 107.1

Calculation of Filing Fee Table

Form S-8

(Form Type)

NIO

Inc.

(Exact Name of Registrant as Specified in its Charter)

Newly Registered Securities

Security

Type | |

Security Class

Title(1) | |

Fee

Calculation

Rule | |

Amount Registered(2) | | |

Proposed Maximum Offering

Price Per Share | | |

Maximum Aggregate Offering Price | | |

Fee Rate | | |

Amount of Registration Fee(1) | |

| Equity | |

Class A Ordinary Shares, par value $0.00025 per share | |

Rule 457(c)

and Rule 457(h) | |

| 14,397,553 | (3) | |

$ | 4.38 | (3) | |

$ | 63,061,282.14 | | |

$ | 0.0001476 | | |

$ | 9,307.85 | |

| Equity | |

Class A Ordinary Shares, par value $0.00025 per share | |

Rule 457(c)

and Rule 457(h) | |

| 56,000,000 | (4) | |

$ | 4.38 | (4) | |

$ | 245,280,000.00 | | |

$ | 0.0001476 | | |

$ | 36,203.33 | |

| Total Offering Amounts | |

| 70,397,553 | | |

| | | |

$ | 308,341,282.14 | | |

| | | |

$ | 45,511.17 | |

| Total Fee Offsets | |

| | | |

| | | |

| | | |

| | | |

| — | |

| Net Fee Due | |

| | | |

| | | |

| | | |

| | | |

$ | 45,511.17 | |

| (1) | These shares may be represented by the Registrant’s American depositary shares (“ADSs”), each of which represents

one ordinary share. The Registrant’s ADSs issuable upon deposit of the ordinary shares registered hereby have been registered under

a separate registration statement on Form F-6 (333-227062). |

| (2) | Represents Class A ordinary shares issuable upon exercise of options and pursuant to other awards granted under the 2024 Share

Incentive Plan (the “2024 Plan”). Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities

Act”), this registration statement also covers an indeterminate number of additional shares which may be offered and issued to prevent

dilution from share splits, share dividends or similar transactions as provided in the 2024 Plan. |

| (3) | Represents Class A ordinary shares issuable upon the

vesting of outstanding restricted share units granted under the 2024 Plan as of the date of this registration statement. The proposed

maximum offering price per share, which is estimated solely for the purposes of calculating the registration fee under Rule 457(c) and

Rule 457(h) under the Securities Act, is based on $4.38 per ADS, the average of the high and low prices for the Registrant’s

ADSs as quoted on the NYSE on July 1, 2024. |

| (4) | Represents Class A ordinary shares that are reserved

for future award grants under the 2024 Plan. The proposed maximum offering price per share, which is estimated solely for the purposes

of calculating the registration fee under Rule 457(c) and Rule 457(h) under the Securities Act, is based on $4.38

per ADS, the average of the high and low prices for the Registrant’s ADSs as quoted on the NYSE on July 1, 2024. |

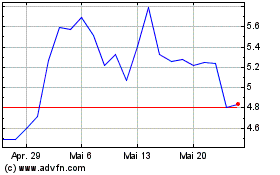

NIO (NYSE:NIO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

NIO (NYSE:NIO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025