Current Report Filing (8-k)

03 April 2023 - 1:24PM

Edgar (US Regulatory)

0001504461false00015044612023-03-302023-03-300001504461ngl:LimitedPartnersCapitalAccountCommonUnitsMemberexch:XNYS2023-03-302023-03-300001504461us-gaap:PreferredClassBMemberexch:XNYS2023-03-302023-03-300001504461ngl:PreferredClassCMemberexch:XNYS2023-03-302023-03-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 30, 2023

NGL ENERGY PARTNERS LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35172 | | 27-3427920 |

(State or other jurisdiction of

incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

6120 South Yale Avenue

Suite 805

Tulsa, Oklahoma 74136

(Address of principal executive offices) (Zip Code)

(918) 481-1119

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240-14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240-14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbols | | Name of Each Exchange on Which Registered |

| Common units representing Limited Partner Interests | | NGL | | New York Stock Exchange |

| Fixed-to-floating rate cumulative redeemable perpetual preferred units | | NGL-PB | | New York Stock Exchange |

| Fixed-to-floating rate cumulative redeemable perpetual preferred units | | NGL-PC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.01. Completion of Acquisition or Disposition of Assets.

On March 30, 2023, NGL Energy Partners LP (the “Partnership”) completed the sale of all of its marine assets for $111.65 million in cash less estimated expenses of approximately $7.5 million. The transaction was previously reported in a Current Report on Form 8-K filed with the Securities and Exchange Commission on March 6, 2023. The marine assets were part of the Partnership's Crude Oil Logistics segment.

The sale of the marine assets was effected pursuant to two Membership Interest Purchase Agreements, dated as of March 3, 2023, one between NGL Marine, LLC, and Campbell Transportation Company, Inc., and the other between NGL Marine, LLC, and Magnolia Marine Transport Company. Copies of both agreements are filed as Exhibit 2.1 and Exhibit 2.2, respectively, to this Current Report on Form 8-K and incorporated herein by reference.

This Current Report on Form 8-K also includes historical and pro forma financial information as set forth under Item 9.01 below related to the sale of the Partnership's marine assets on March 30, 2023.

Item 8.01. Other Events.

On April 3, 2023, the Partnership announced, in addition to the completion of the sale of its marine assets, that it used a portion of the proceeds from the sale to repay the outstanding marine equipment loan of approximately $39 million with the remaining proceeds being used to repay amounts outstanding under its asset-based revolving credit facility and that it had completed the redemption of its 7.5% unsecured senior notes due in November 2023. In addition, the Partnership announced that at March 31, 2023, its total outstanding debt was slightly below $2.9 billion and that its expected total leverage to be approximately 4.5 times.

A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(b) Pro Forma Financial Statements.

The unaudited pro forma condensed consolidated balance sheet as of December 31, 2022, the unaudited pro forma condensed consolidated statements of operations for the nine months ended December 31, 2022 and the year ended March 31, 2022 of NGL Energy Partners LP and the related notes are filed as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 2.1 | | |

| 2.2 | | |

| 99.1 | | |

| 99.2 | | |

| 101 | | Cover Page formatted as Inline XBRL. |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| NGL ENERGY PARTNERS LP |

| By: | NGL Energy Holdings LLC, |

| | its general partner |

| Date: April 3, 2023 | | By: | /s/ Bradley P. Cooper |

| | | Bradley P. Cooper |

| | | Chief Financial Officer |

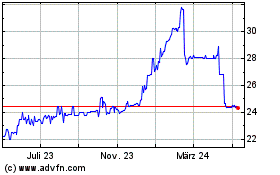

NGL Energy Partners (NYSE:NGL-C)

Historical Stock Chart

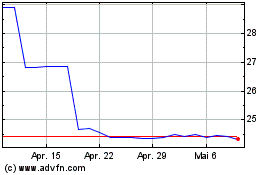

Von Nov 2024 bis Dez 2024

NGL Energy Partners (NYSE:NGL-C)

Historical Stock Chart

Von Dez 2023 bis Dez 2024