UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-21348

| Name of Fund: |

|

BlackRock Municipal Income Fund, Inc. (MUI) |

| Fund Address: |

|

100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for

service: John M. Perlowski, Chief Executive Officer, BlackRock Municipal Income Fund, Inc., 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 07/31/2023

Date of reporting period: 07/31/2023

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

|

|

|

|

|

|

JULY 31, 2023 |

BlackRock Long-Term Municipal Advantage Trust (BTA)

BlackRock MuniAssets

Fund, Inc. (MUA)

BlackRock Municipal Income Fund, Inc. (MUI)

BlackRock MuniYield Fund, Inc. (MYD)

BlackRock MuniYield Quality Fund,

Inc. (MQY)

|

| |

| Not FDIC Insured • May Lose Value • No Bank

Guarantee |

The Markets in Review

Dear Shareholder,

Despite an uncertain economic

landscape during the 12-month reporting period ended July 31, 2023, the resilience of the U.S. economy in the face of ever tighter financial conditions provided an encouraging backdrop for investors.

While inflation was near multi-decade highs at the beginning of the period, it declined precipitously as commodity prices dropped. Labor shortages also moderated, although wages continued to grow and unemployment rates reached the lowest levels in

decades. This robust labor market powered further growth in consumer spending, backstopping the economy.

Equity returns were solid, as the durability

of consumer sentiment eased investors’ concerns about the economy’s trajectory. The U.S. economy resumed growth in the third quarter of 2022 and continued to expand thereafter. Most major classes of equities advanced, including large- and

small-capitalization U.S. stocks and equities from developed and emerging markets.

The 10-year U.S. Treasury

yield rose during the reporting period, driving its price down, as investors reacted to elevated inflation and attempted to anticipate future interest rate changes. The corporate bond market also faced inflationary headwinds, although high-yield

corporate bond prices fared significantly better than investment-grade bonds as demand from yield-seeking investors remained strong.

The U.S. Federal

Reserve (the “Fed”), acknowledging that inflation has been more persistent than expected, raised interest rates seven times during the 12-month period ended July 31, 2023. Furthermore, the Fed

wound down its bond-buying programs and incrementally reduced its balance sheet by not replacing securities that reach maturity. However, the Fed declined to raise interest rates at its June 2023 meeting, the first time it paused its tightening in

the current cycle, before again raising rates in July 2023.

Supply constraints appear to have become an embedded feature of the new macroeconomic

environment, making it difficult for developed economies to increase production without sparking higher inflation. Geopolitical fragmentation and an aging population risk further exacerbating these constraints, keeping the labor market tight and

wage growth high. Although the Fed has decelerated the pace of interest rate hikes and recently opted for a pause, we believe that the new economic regime means that the Fed will need to maintain high rates for an extended period to keep inflation

under control. Furthermore, ongoing structural changes may mean that the Fed will be hesitant to cut interest rates in the event of faltering economic activity lest inflation accelerate again. We believe investors should expect a period of higher

volatility as markets adjust to the new economic reality and policymakers attempt to adapt.

While we favor an overweight position to developed market

equities in the long term, we prefer an underweight stance in the near-term. Expectations for corporate earnings remain elevated, which seems inconsistent with macroeconomic constraints. Nevertheless, we are overweight on emerging market stocks in

the near-term as growth trends for emerging markets appear brighter. We also believe that stocks with an A.I. tilt should benefit from an investment cycle that is set to support revenues and margins. We are neutral on credit overall amid tightening

credit and financial conditions; however, there are selective opportunities in the near term. For fixed income investing with a six- to twelve-month horizon, we see the most attractive investments in

short-term U.S. Treasuries, U.S. inflation-linked bonds, U.S. mortgage-backed securities, and hard-currency emerging market bonds.

Overall, our view

is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further

insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

|

|

|

|

|

| Total Returns as of July 31, 2023 |

| |

|

|

| |

|

6-Month |

|

12-Month |

|

|

|

| U.S. large cap equities

(S&P 500® Index) |

|

13.52% |

|

13.02% |

|

|

|

| U.S. small cap equities

(Russell 2000® Index) |

|

4.51 |

|

7.91 |

|

|

|

| International equities

(MSCI Europe, Australasia, Far East

Index) |

|

6.65 |

|

16.79 |

|

|

|

| Emerging market equities

(MSCI Emerging Markets Index) |

|

3.26 |

|

8.35 |

|

|

|

| 3-month Treasury

bills

(ICE BofA 3-Month U.S. Treasury Bill Index) |

|

2.34 |

|

3.96 |

|

|

|

| U.S. Treasury securities

(ICE BofA 10-Year U.S. Treasury Index) |

|

(2.08) |

|

(7.56) |

|

|

|

| U.S. investment grade bonds

(Bloomberg U.S. Aggregate Bond

Index) |

|

(1.02) |

|

(3.37) |

|

|

|

| Tax-exempt municipal

bonds

(Bloomberg Municipal Bond Index) |

|

0.20 |

|

0.93 |

|

|

|

| U.S. high yield bonds

(Bloomberg U.S. Corporate High Yield 2%

Issuer Capped Index) |

|

2.92 |

|

4.42 |

|

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an

index. |

|

|

|

| 2 |

|

T H I S P A G

E I S N O T P A R T O F Y O

U R F U N D R E P O R T |

Table of Contents

Municipal Market Overview For the Reporting Period Ended July 31,

2023

Municipal Market Conditions

Municipal bonds posted positive total returns amid heightened volatility. Interest rates rose rapidly early in the period as the Fed continued its

historic hiking cycle but became increasingly rangebound later in the reporting period as economic activity slowed, inflation expectations moderated, and the Fed tempered the magnitude and pace of its policy tightening. Strong credit fundamentals,

bolstered by robust post-pandemic revenue growth and elevated fund balances, drove strong positive excess returns versus comparable U.S. Treasuries. Lower-rated investment grade credits and the 15-year part of

the yield curve performed best.

|

|

|

|

|

| During the 12-month period ended July 31, 2023, municipal bond funds

experienced net outflows totaling $52 billion (based on data from the Investment Company Institute), transitioning from the largest outflow cycle on record in 2022 to mixed in 2023. At the same time, the market contended with just

$324 billion in issuance, well below the $422 billion issued during the prior 12-months. However, elevated bid-wanted activity filled some of the gap as

investors raised cash to meet redemptions, portfolio leverage was repositioned, and the Federal Deposit Insurance Corporation (“FDIC”) liquidated collapsed bank assets. |

|

|

|

Bloomberg Municipal Bond Index(a)

Total Returns as of July 31, 2023 6 months:

0.20% 12 months: 0.93% |

|

| |

|

|

|

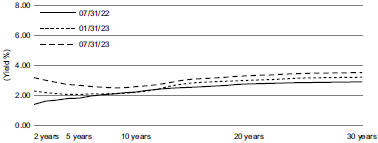

A Closer Look at Yields

|

|

|

|

|

| AAA Municipal Yield Curves

Source: Thomson Municipal Market Data. |

|

|

|

From July 31, 2022, to July 31, 2023, yields on AAA-rated 30-year municipal bonds increased by 62 basis points (“bps”) from 2.89% to 3.51%, ten-year yields increased by 36 bps from 2.21% to 2.57%, five-year yields increased

by 86 bps from 1.80% to 2.66%, and two-year yields increased by 140 bps from 1.60% to 3.00% (as measured by Refinitiv Municipal Market Data). As a result, the municipal yield curve flattened over the 12-month period with the spread between two- and 30-year maturities flattening by 78 bps to a slope of 51 bps. Still, the curve

remained relatively steep compared to the deeply inverted U.S. Treasury curve.

Outperformance throughout the period prompted historically rich

valuations across the curve. Municipal-to-Treasury ratios tightened well through their 5-year averages led by short and

intermediate maturities. |

Financial Conditions of Municipal Issuers

Buoyed by successive federal aid injections, vaccine distribution, and the re-opening of the economy, states and

many local governments experienced revenue growth above forecasts in 2021 and 2022. However, revenue collections through April 2023, particularly personal income tax receipts, have softened or declined in many states, such as California and New

York. A slowing economy could cause more widespread declines in overall revenue collections. While the inflation rate has slowed, higher wages and interest rates in the post-Covid recovery will pressure state and local government costs.

Nevertheless, overall credit fundamentals remain solid, particularly near-record reserve levels. Other sectors also exhibit strong credit fundamentals. Municipal utilities typically benefit from autonomous rate-setting that allows them to adjust for

rising fuel costs. Rising commodity prices over a prolonged period could test affordability and the political will to raise rates to balance operations. State housing authority bonds, flagship universities, and strong national and regional health

systems may also be pressured but are better poised to absorb the impact of the economic shock. Critical providers (safety net hospitals, mass transit systems, airports) with limited resources may still experience fiscal strain from the economic

fallout from high inflation, but aid and demand in the service sector of the economy will continue to support operating results through 2023. Work-from-home policies remain headwinds for mass transit farebox revenue and commercial real estate

values.

The opinions expressed are those of BlackRock as of July 31, 2023 and are subject to change at any time due to changes in market or

economic conditions. The comments should not be construed as a recommendation of any individual holdings or market sectors. Investing involves risk including loss of principal. Bond values fluctuate in price so the value of your investment can go

down depending on market conditions. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not

be able to make principal and interest payments. There may be less information on the financial condition of municipal issuers than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. Some investors may

be subject to Alternative Minimum Tax (“AMT”). Capital gains distributions, if any, are taxable.

| (a) |

The Bloomberg Municipal Bond Index, a broad, market value-weighted index, seeks to measure the performance of the U.S.

municipal bond market. All bonds in the index are exempt from U.S. federal income taxes or subject to the AMT. Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. It is not possible to

invest directly in an index. |

|

|

|

| 4 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

The Benefits and Risks of Leveraging

The Funds may utilize leverage to seek to enhance the distribution rate on, and net

asset value (“NAV”) of, their common shares (“Common Shares”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is

normally lower than the income earned by a Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Fund (including the assets obtained from leverage) are invested in

higher-yielding portfolio investments, each Fund’s shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage (after paying the leverage costs) is paid to shareholders in

the form of dividends, and the value of these portfolio holdings (less the leverage liability) is reflected in the per share NAV.

To illustrate these

concepts, assume a Fund’s Common Shares capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If

prevailing short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, a Fund’s financing costs on the $30 million of proceeds obtained from leverage are based on the

lower short-term interest rates. At the same time, the securities purchased by a Fund with the proceeds from leverage earn income based on longer-term interest rates. In this case, a Fund’s financing cost of leverage is significantly lower than

the income earned on a Fund’s longer-term investments acquired from such leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit Common Shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the

leverage. If interest and other costs of leverage exceed a Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if a Fund had not used leverage. In such circumstance, the investment adviser may

nevertheless determine to maintain a Fund’s leverage if it deems such action to be appropriate. Furthermore, the value of the Funds’ portfolio investments generally varies inversely with the direction of long-term interest rates, although

other factors can influence the value of portfolio investments. In contrast, the amount of each Fund’s obligations under its respective leverage arrangement generally does not fluctuate in relation to interest rates. As a result, changes in

interest rates can influence the Funds’ NAVs positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that a Fund’s intended leveraging strategy will be

successful.

The use of leverage also generally causes greater changes in each Fund’s NAV, market price and dividend rates than comparable

portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV and market price of a Fund’s Common Shares than if the Fund were not leveraged. In addition, each Fund may be required to sell

portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Fund to incur losses. The

use of leverage may limit a Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Fund incurs expenses in connection with the use of leverage, all of which are borne by Common Shareholders and

may reduce income to the Common Shares. Moreover, to the extent the calculation of each Fund’s investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to the Funds’ investment

adviser will be higher than if the Funds did not use leverage.

To obtain leverage, each Fund has issued Variable Rate Demand Preferred Shares

(“VRDP Shares” or “Preferred Shares”) and/or leveraged its assets through the use of tender option bond trusts (“TOB Trusts”) as described in the Notes to Financial Statements.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), each Fund is permitted to borrow money (including through the use of TOB

Trusts) or issue debt securities up to 33 1/3% of its total managed assets or equity securities (e.g., Preferred Shares) up to 50% of its total managed assets. A Fund may voluntarily elect to limit its leverage to less than the maximum amount

permitted under the 1940 Act. In addition, a Fund may also be subject to certain asset coverage, leverage or portfolio composition requirements imposed by the Preferred Shares’ governing instruments or by agencies rating the Preferred Shares,

which may be more stringent than those imposed by the 1940 Act.

Derivative Financial Instruments

The Funds may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market,

and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative

financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the

transaction or illiquidity of the instrument. Pursuant to Rule 18f-4 under the 1940 Act, among other things, the Funds must either use derivative financial instruments with embedded leverage in a limited

manner or comply with an outer limit on fund leverage risk based on value-at-risk. The Funds’ successful use of a derivative financial instrument depends on the

investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can

realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

|

|

|

|

|

| T H E B E N E F I

T S A N D R I S K S O F L E

V E R A G I N G / D E R I V A

T I V E F I N A N C I A L I N

S T R U M E N T S |

|

|

5 |

|

|

|

|

| Fund Summary as of July 31, 2023 |

|

BlackRock Long-Term Municipal Advantage Trust (BTA) |

Investment Objective

BlackRock Long-Term Municipal

Advantage Trust’s (BTA) (the “Fund”) investment objective is to provide current income exempt from regular U.S. federal income tax. The Fund seeks to achieve its investment objective by investing, under normal market conditions,

at least 80% of its assets in municipal obligations and derivative instruments with exposure to such municipal obligations, in each case that are expected to pay interest or income that is exempt from U.S. federal income tax (except that the

interest may be subject to the U.S. federal alternative minimum tax). The Fund invests, under normal market conditions, primarily in long-term municipal bonds with a maturity of more than ten years at the time of investment and, under normal market

conditions, the Fund’s municipal bond portfolio will have a dollar-weighted average maturity of greater than 10 years. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

|

|

|

| |

|

| Symbol on New York Stock Exchange |

|

BTA |

| Initial Offering Date |

|

February 28, 2006 |

| Yield on Closing Market Price as of July 31, 2023

($9.71)(a) |

|

5.38% |

| Tax Equivalent Yield(b) |

|

9.09% |

| Current Monthly Distribution per Common Share(c)

|

|

$0.043500 |

| Current Annualized Distribution per Common Share(c)

|

|

$0.522000 |

| Leverage as of July 31, 2023(d) |

|

38% |

| |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing

market price. Past performance is not an indication of future results. |

|

| |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax.

Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

|

| |

(c) |

The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of

capital or net realized gain. |

|

| |

(d) |

Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund,

including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized

by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

|

Market Price and Net Asset Value Per Share Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

07/31/23 |

|

|

07/31/22 |

|

|

Change |

|

|

High |

|

|

Low |

|

|

|

|

|

|

|

| Closing Market Price |

|

$ |

9.71 |

|

|

$ |

12.10 |

|

|

|

(19.75 |

)% |

|

$ |

12.30 |

|

|

$ |

8.71 |

|

| Net Asset Value |

|

|

10.36 |

|

|

|

11.17 |

|

|

|

(7.25 |

) |

|

|

11.31 |

|

|

|

9.25 |

|

GROWTH OF $10,000 INVESTMENT

| |

(a) |

Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or

distributions at actual reinvestment prices. |

|

| |

(b) |

An unmanaged index that tracks the U.S. long term tax-exempt bond market,

including state and local general obligation bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

|

|

|

|

| 6 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

|

|

|

| Fund Summary as of July 31, 2023 (continued) |

|

BlackRock Long-Term Municipal Advantage Trust (BTA) |

Performance

Returns for the period ended July 31, 2023

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Average Annual Total Returns |

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

|

|

|

| Fund at NAV(a)(b) |

|

|

(1.84 |

)% |

|

|

1.65 |

% |

|

|

4.86 |

% |

| Fund at Market

Price(a)(b) |

|

|

(15.07 |

) |

|

|

2.28 |

|

|

|

4.84 |

|

|

|

|

|

| Customized Reference Benchmark(c) |

|

|

0.61 |

|

|

|

2.24 |

|

|

|

N/A |

|

| Bloomberg Municipal Bond Index |

|

|

0.93 |

|

|

|

1.87 |

|

|

|

2.81 |

|

| |

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results

reflect the Fund’s use of leverage, if any. |

|

| |

(b) |

The Fund moved from a premium to NAV to a discount during the period, which accounts for the difference between

performance based on market price and performance based on NAV. |

|

| |

(c) |

The Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged

(75%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (25%). The Customized Reference Benchmark commenced on September 30, 2016. |

|

Performance results may include adjustments made for financial reporting purposes in accordance with U.S.

generally accepted accounting principles.

Past performance is not an indication of future results.

The Fund is presenting the performance of one or more indices for informational purposes only. The Fund is actively managed and does not seek to track or

replicate the performance of any index. The index performance shown is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance.

More information about the Fund’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

Municipal bonds posted slightly positive returns in the annual period. Bond market performance, in general, was dampened by the combination of high

inflation and continued interest rate increases by the Fed. However, the contribution from income outweighed the impact of falling prices.

The

Fund’s use of U.S. Treasury futures to manage interest rate risk was a key contributor to performance early in the reporting period, when the Fed was aggressively raising rates to combat inflation. The investment adviser closed out this

position before the end of the period given that yields had already risen significantly.

On a sector basis, tobacco, transportation, and tax-backed state and tax-backed local issues were the leading contributors. With respect to credit tiers, A rated and non-rated bonds

made the largest contributions, followed by those rated AA and BBB. Holdings in bonds with maturities of 20 years and above also contributed. Positions in lower-coupon securities helped results, as well. On the negative side, the Fund was hurt by a

few individual positions that posted negative returns due to credit concerns or their structures.

The Fund’s cash and cash equivalent weighting

was above typical levels at the close of the period, which represented a defensive positioning. The Fund’s duration was longer than that of the benchmark.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or

other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

| Fund Summary as of July 31, 2023 (continued) |

|

BlackRock Long-Term Municipal Advantage Trust (BTA) |

Overview of the Fund’s Total Investments

SECTOR ALLOCATION

|

|

|

|

|

| |

|

| Sector(a)(b) |

|

Percentage of

Total Investments |

|

|

|

| Health |

|

|

14.4 |

% |

| Transportation |

|

|

14.4 |

|

| Corporate |

|

|

14.4 |

|

| County/City/Special District/School District |

|

|

14.2 |

|

| Education |

|

|

12.5 |

|

| State |

|

|

10.8 |

|

| Tobacco |

|

|

7.4 |

|

| Utilities |

|

|

6.8 |

|

| Housing |

|

|

5.1 |

|

CALL/MATURITY SCHEDULE

|

|

|

|

|

| |

|

| Calendar Year Ended December 31,(a)(c) |

|

Percentage |

|

|

|

| 2023 |

|

|

8.1 |

% |

| 2024 |

|

|

6.5 |

|

| 2025 |

|

|

3.4 |

|

| 2026 |

|

|

10.0 |

|

| 2027 |

|

|

11.2 |

|

CREDIT QUALITY ALLOCATION

|

|

|

|

|

| |

|

| Credit Rating(a)(d) |

|

Percentage of

Total Investments |

|

|

|

| AAA/Aaa |

|

|

3.2 |

% |

| AA/Aa |

|

|

17.0 |

|

| A |

|

|

25.5 |

|

| BBB/Baa |

|

|

11.0 |

|

| BB/Ba |

|

|

9.6 |

|

| B |

|

|

3.0 |

|

| N/R(e) |

|

|

30.7 |

|

| (a) |

Excludes short-term securities. |

| (b) |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may

combine such sector sub-classifications for reporting ease. |

| (c) |

Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years.

|

| (d) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either

S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of

BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are

subject to change. |

| (e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but

not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of

July 31, 2023, the market value of unrated securities deemed by the investment adviser to be investment grade represents 1.2% of the Fund’s total investments. |

|

|

|

| 8 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

|

|

|

| Fund Summary as of July 31, 2023 |

|

BlackRock MuniAssets Fund, Inc. (MUA) |

Investment Objective

BlackRock MuniAssets Fund, Inc.’s

(MUA) (the “Fund”) investment objective is to provide high current income exempt from U.S. federal income taxes by investing primarily in a portfolio of medium- to lower-grade or unrated municipal obligations, the interest on which, in

the opinion of bond counsel to the issuer, is exempt from U.S. federal income taxes. The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its assets in municipal bonds exempt from U.S.

federal income taxes (except that the interest may be subject to the federal alternative minimum tax). The Fund invests at least 65% of its assets in municipal bonds that are rated in the medium to lower rating categories by nationally recognized

rating services (for example, Baa or lower by Moody’s Investors Service, Inc. (“Moody’s”) or BBB or lower by S&P Global Ratings, or securities that are unrated but are deemed by the investment adviser to be of comparable

quality at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can

be given that the Fund’s investment objective will be achieved.

Fund Information

|

|

|

| |

|

| Symbol on New York Stock Exchange |

|

MUA |

| Initial Offering Date |

|

June 25, 1993 |

| Yield on Closing Market Price as of July 31, 2023

($10.24)(a) |

|

4.75% |

| Tax Equivalent Yield(b) |

|

8.02% |

| Current Monthly Distribution per Common Share(c)

|

|

$0.040500 |

| Current Annualized Distribution per Common

Share(c) |

|

$0.486000 |

| Leverage as of July 31, 2023(d) |

|

30% |

| |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing

market price. Past performance is not an indication of future results. |

|

| |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax.

Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

|

| |

(c) |

The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of

capital or net realized gain. |

|

| |

(d) |

Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund,

including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized

by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

|

Market Price and Net Asset Value Per Share Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

07/31/23 |

|

|

07/31/22 |

|

|

Change |

|

|

High |

|

|

Low |

|

|

|

|

|

|

|

| Closing Market Price |

|

$ |

10.24 |

|

|

$ |

12.55 |

|

|

|

(18.41 |

)% |

|

$ |

13.18 |

|

|

$ |

9.54 |

|

| Net Asset Value |

|

|

11.28 |

|

|

|

12.53 |

|

|

|

(9.98 |

) |

|

|

12.66 |

|

|

|

10.54 |

|

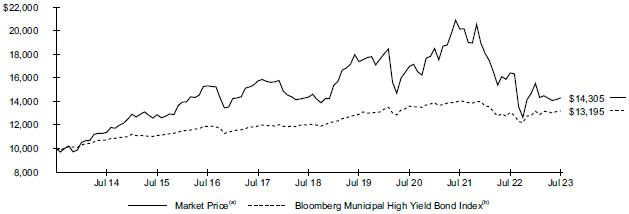

GROWTH OF $10,000 INVESTMENT

| |

(a) |

Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or

distributions at actual reinvestment prices. |

|

| |

(b) |

An index designed to measure the performance of U.S. dollar-denominated high-yield municipal bonds issued by U.S.

states, the District of Columbia, U.S. territories and local governments or agencies. |

|

|

|

|

| Fund Summary as of July 31, 2023 (continued) |

|

BlackRock MuniAssets Fund, Inc. (MUA) |

Performance

Returns for the period ended July 31, 2023

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Average Annual Total Returns |

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

|

|

|

| Fund at NAV(a)(b) |

|

|

(3.85 |

)% |

|

|

0.61 |

% |

|

|

3.81 |

% |

| Fund at Market

Price(a)(b) |

|

|

(12.86 |

) |

|

|

(0.08 |

) |

|

|

3.64 |

|

|

|

|

|

| High Yield Customized Reference Benchmark(c)

|

|

|

0.39 |

|

|

|

2.60 |

|

|

|

N/A |

|

| Bloomberg Municipal High Yield Bond Index |

|

|

(0.20 |

) |

|

|

2.85 |

|

|

|

4.46 |

|

| |

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results

reflect the Fund’s use of leverage, if any. |

|

| |

(b) |

The Fund moved from a premium to NAV to a discount during the period, which accounts for the difference between

performance based on market price and performance based on NAV. |

|

| |

(c) |

The High Yield Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Rated Baa Index (20%), the

Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (60%) and the Bloomberg Municipal Investment Grade ex BBB Index (20%). The High Yield Customized Reference Benchmark commenced on

September 30, 2016. |

|

Performance results may include adjustments made for financial reporting purposes in accordance with U.S.

generally accepted accounting principles.

Past performance is not an indication of future results.

The Fund is presenting the performance of one or more indices for informational purposes only. The Fund is actively managed and does not seek to track or

replicate the performance of any index. The index performance shown is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance.

More information about the Fund’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

Municipal bonds posted slightly positive returns in the annual period. Bond market performance, in general, was dampened by the combination of high

inflation and continued interest rate increases by the Fed. However, the contribution from income outweighed the impact of falling prices.

The

Fund’s use of U.S. Treasury futures to manage interest rate risk was a key contributor to performance early in the reporting period, when the Fed was aggressively raising rates to combat inflation. The investment adviser closed out this

position before the end of the period given that yields had already risen significantly.

On a sector basis, tobacco, other industries, tax-backed local, education and transportation issues were the largest contributors. Positions in bonds with maturities of 20 years and above also contributed.

Generally speaking, the Fund’s holdings in high yield issues contributed more than its holdings in investment-grade debt. With that said, its

position in the bonds of Puerto Rico Electric Power Authority was a notable detractor. In late June 2023, the bankruptcy court issued a ruling that bondholders can claim a lower-than-expected percentage of the outstanding debt’s value.

Bondholders intend to appeal the ruling.

The Fund’s cash and cash equivalents weighting was above typical levels at the close of the period,

which represented a defensive positioning.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to

change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

| 10 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

|

|

|

| Fund Summary as of July 31, 2023 (continued) |

|

BlackRock MuniAssets Fund, Inc. (MUA) |

Overview of the Fund’s Total Investments

SECTOR ALLOCATION

|

|

|

|

|

| |

|

| Sector(a)(b) |

|

Percentage of

Total Investments |

|

|

|

| State |

|

|

20.5 |

% |

| Education |

|

|

14.7 |

|

| Corporate |

|

|

12.8 |

|

| Transportation |

|

|

11.7 |

|

| County/City/Special District/School District |

|

|

11.2 |

|

| Health |

|

|

10.5 |

|

| Tobacco |

|

|

7.7 |

|

| Housing |

|

|

7.0 |

|

| Utilities |

|

|

3.9 |

|

CALL/MATURITY SCHEDULE

|

|

|

|

|

| |

|

| Calendar Year Ended December 31,(a)(c) |

|

Percentage |

|

|

|

| 2023 |

|

|

14.9 |

% |

| 2024 |

|

|

6.6 |

|

| 2025 |

|

|

2.6 |

|

| 2026 |

|

|

7.9 |

|

| 2027 |

|

|

7.0 |

|

CREDIT QUALITY ALLOCATION

|

|

|

|

|

| |

|

| Credit Rating(a)(d) |

|

Percentage of

Total Investments |

|

|

|

| AAA/Aaa |

|

|

0.3 |

% |

| AA/Aa |

|

|

11.5 |

|

| A |

|

|

14.4 |

|

| BBB/Baa |

|

|

7.8 |

|

| BB/Ba |

|

|

11.5 |

|

| B |

|

|

3.6 |

|

| CCC/Caa |

|

|

0.3 |

|

| N/R(e) |

|

|

50.6 |

|

| (a) |

Excludes short-term securities. |

| (b) |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may

combine such sector sub-classifications for reporting ease. |

| (c) |

Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years.

|

| (d) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either

S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of

BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are

subject to change. |

| (e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but

not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of

July 31, 2023, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1.0% of the Fund’s total investments. |

|

|

|

| Fund Summary as of July 31, 2023 |

|

BlackRock Municipal Income Fund, Inc. (MUI) |

Investment Objective

BlackRock Municipal Income Fund,

Inc.’s (MUI) (the “Fund”) investment objective is to provide common shareholders with high current income exempt from U.S. federal income taxes. The Fund seeks to achieve its investment objective by investing at least 80% of its

assets in municipal bonds exempt from U.S. federal income taxes (except that the interest may be subject to the U.S. federal alternative minimum tax). Under normal market conditions, the Fund invests at least 75% of its assets in municipal bonds

rated investment grade or, if unrated, are deemed to be of comparable quality by the investment adviser, at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

|

|

|

| |

|

| Symbol on New York Stock Exchange |

|

MUI |

| Initial Offering Date |

|

August 1, 2003 |

| Yield on Closing Market Price as of July 31, 2023 ($

11.47)(a) |

|

3.56% |

| Tax Equivalent Yield(b) |

|

6.01% |

| Current Monthly Distribution per Common Share(c)

|

|

$0.034000 |

| Current Annualized Distribution per Common Share(c)

|

|

$0.408000 |

| Leverage as of July 31, 2023(d) |

|

40% |

| |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing

market price. Past performance is not an indication of future results. |

|

| |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax.

Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

|

| |

(c) |

The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of

capital or net realized gain. |

|

| |

(d) |

Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund,

including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized

by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

|

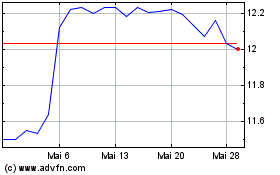

Market Price and Net Asset Value Per Share Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

07/31/23 |

|

|

07/31/22 |

|

|

Change |

|

|

High |

|

|

Low |

|

|

|

|

|

|

|

| Closing Market Price |

|

$ |

11.47 |

|

|

$ |

12.44 |

|

|

|

(7.80 |

)% |

|

$ |

12.80 |

|

|

$ |

10.37 |

|

| Net Asset Value |

|

|

13.23 |

|

|

|

13.64 |

|

|

|

(3.01 |

) |

|

|

13.74 |

|

|

|

11.69 |

|

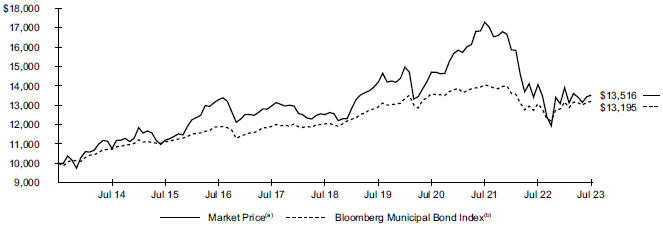

GROWTH OF $10,000 INVESTMENT

| |

(a) |

Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or

distributions at actual reinvestment prices. |

|

| |

(b) |

An unmanaged index that tracks the U.S. long term tax-exempt bond market,

including state and local general obligation bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

|

|

|

|

| 12 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

|

|

|

| Fund Summary as of July 31, 2023 (continued) |

|

BlackRock Municipal Income Fund, Inc. (MUI) |

Performance

Returns for the period ended July 31, 2023

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Average Annual Total Returns |

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

|

|

|

| Fund at NAV(a)(b) |

|

|

1.05 |

% |

|

|

1.60 |

% |

|

|

3.85 |

% |

| Fund at Market

Price(a)(b) |

|

|

(3.95 |

) |

|

|

1.55 |

|

|

|

3.06 |

|

|

|

|

|

| National Customized Reference Benchmark(c)

|

|

|

0.82 |

|

|

|

1.98 |

|

|

|

N/A |

|

| Bloomberg Municipal Bond Index |

|

|

0.93 |

|

|

|

1.87 |

|

|

|

2.81 |

|

| |

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results

reflect the Fund’s use of leverage, if any. |

|

| |

(b) |

The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based

on market price and performance based on NAV. |

|

| |

(c) |

The National Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value

Unhedged (90%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (10%). The National Customized Reference Benchmark commenced on September 30, 2016. |

|

Performance results may include adjustments made for financial reporting purposes in accordance with U.S.

generally accepted accounting principles.

Past performance is not an indication of future results.

The Fund is presenting the performance of one or more indices for informational purposes only. The Fund is actively managed and does not seek to track or

replicate the performance of any index. The index performance shown is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance.

More information about the Fund’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

Municipal bonds posted slightly positive returns in the annual period. Bond market performance, in general, was dampened by the combination of high

inflation and continued interest rate increases by the Fed. However, the contribution from income outweighed the impact of falling prices.

Portfolio

income was a large contributor to the Fund’s total return at a time of negative price performance. The Fund’s use of U.S. Treasury futures to manage interest rate risk added value in the rising-rate environment, with most of the

contribution occurring in the first half of the period. (Prices and yields move in opposite directions.) Positions in bonds with 15- to 25-year maturities contributed,

as well. With respect to credit tiers, A and BBB rated bonds were the largest contributors. Transportation and tax-backed were the best performing sectors.

On the negative side, positions in low-coupon bonds—particularly in the housing sector—detracted.

Holdings in bonds with maturities of 25 years and longer also detracted, as did the Fund’s allocation to high yield bonds.

The views

expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of

future results.

|

|

|

| Fund Summary as of July 31, 2023 (continued) |

|

BlackRock Municipal Income Fund, Inc. (MUI) |

Overview of the Fund’s Total Investments

SECTOR ALLOCATION

|

|

|

|

|

| |

|

| Sector(a)(b) |

|

Percentage of

Total Investments |

|

|

|

| Transportation |

|

|

32.4 |

% |

| State |

|

|

14.2 |

|

| Health |

|

|

12.2 |

|

| County/City/Special District/School District |

|

|

11.3 |

|

| Utilities |

|

|

9.1 |

|

| Corporate |

|

|

9.1 |

|

| Education |

|

|

6.3 |

|

| Tobacco |

|

|

3.2 |

|

| Housing |

|

|

2.2 |

|

CALL/MATURITY SCHEDULE

|

|

|

|

|

| |

|

| Calendar Year Ended December 31,(a)(c) |

|

Percentage |

|

|

|

| 2023 |

|

|

7.2 |

% |

| 2024 |

|

|

6.4 |

|

| 2025 |

|

|

3.3 |

|

| 2026 |

|

|

6.7 |

|

| 2027 |

|

|

9.8 |

|

CREDIT QUALITY ALLOCATION

|

|

|

|

|

| |

|

| Credit Rating(a)(d) |

|

Percentage of

Total Investments |

|

|

|

| AAA/Aaa |

|

|

7.5 |

% |

| AA/Aa |

|

|

40.1 |

|

| A |

|

|

34.7 |

|

| BBB/Baa |

|

|

6.5 |

|

| BB/Ba |

|

|

2.5 |

|

| B |

|

|

0.2 |

|

| N/R(e) |

|

|

8.5 |

|

| (a) |

Excludes short-term securities. |

| (b) |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may

combine such sector sub-classifications for reporting ease. |

| (c) |

Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years.

|

| (d) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either

S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of

BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are

subject to change. |

| (e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but

not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of

July 31, 2023, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1.0% of the Fund’s total investments. |

|

|

|

| 14 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

|

|

|

| Fund Summary as of July 31, 2023 |

|

BlackRock MuniYield Fund, Inc. (MYD) |

Investment Objective

BlackRock MuniYield Fund, Inc.’s

(MYD) (the “Fund”) investment objective is to provide shareholders with as high a level of current income exempt from U.S. federal income taxes as is consistent with its investment policies and prudent investment management. The Fund

seeks to achieve its investment objective by investing at least 80% of its assets in municipal bonds exempt from U.S. federal income taxes (except that the interest may be subject to the U.S. federal alternative minimum tax). The Fund invests, under

normal market conditions, at least 75% of its assets in municipal bonds rated investment grade, or deemed to be of comparable quality by the investment adviser, at the time of investment and invests primarily in long-term municipal bonds with a

maturity of more than ten years at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

|

|

|

| |

|

| Symbol on New York Stock Exchange |

|

MYD |

| Initial Offering Date |

|

November 29, 1991 |

| Yield on Closing Market Price as of July 31, 2023 ($

10.50)(a) |

|

4.17% |

| Tax Equivalent Yield(b) |

|

7.04% |

| Current Monthly Distribution per Common Share(c)

|

|

$0.036500 |

| Current Annualized Distribution per Common Share(c)

|

|

$0.438000 |

| Leverage as of July 31, 2023(d) |

|

32% |

| |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing

market price. Past performance is not an indication of future results. |

|

| |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax.

Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

|

| |

(c) |

The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of

capital or net realized gain. |

|

| |

(d) |

Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund,

including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized

by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

|

Market Price and Net Asset Value Per Share Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

07/31/23 |

|

|

07/31/22 |

|

|

Change |

|

|

High |

|

|

Low |

|

|

|

|

|

|

|

| Closing Market Price |

|

$ |

10.50 |

|

|

$ |

11.72 |

|

|

|

(10.41 |

)% |

|

$ |

11.92 |

|

|

$ |

9.53 |

|

| Net Asset Value |

|

|

12.14 |

|

|

|

12.73 |

|

|

|

(4.63 |

) |

|

|

12.83 |

|

|

|

10.70 |

|

GROWTH OF $10,000 INVESTMENT

| |

(a) |

Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or

distributions at actual reinvestment prices. |

|

| |

(b) |

An unmanaged index that tracks the U.S. long term tax-exempt bond market,

including state and local general obligation bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

|

|

|

|

| Fund Summary as of July 31, 2023 (continued) |

|

BlackRock MuniYield Fund, Inc. (MYD) |

Performance

Returns for the period ended July 31, 2023

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Average Annual Total Returns |

|

|

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

|

|

|

| Fund at NAV(a)(b) |

|

|

(0.08 |

)% |

|

|

1.34 |

% |

|

|

4.37 |

% |

| Fund at Market

Price(a)(b) |

|

|

(6.13 |

) |

|

|

(0.11 |

) |

|

|

2.95 |

|

|

|

|

|

| National Customized Reference Benchmark(c)

|

|

|

0.82 |

|

|

|

1.98 |

|

|

|

N/A |

|

| Bloomberg Municipal Bond Index |

|

|

0.93 |

|

|

|

1.87 |

|

|

|

2.81 |

|

| |

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results

reflect the Fund’s use of leverage, if any. |

|

| |

(b) |

The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based

on market price and performance based on NAV. |

|

| |

(c) |

The National Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value

Unhedged (90%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (10%). The National Customized Reference Benchmark commenced on September 30, 2016. |

|

Performance results may include adjustments made for financial reporting purposes in accordance with U.S.

generally accepted accounting principles.

Past performance is not an indication of future results.

The Fund is presenting the performance of one or more indices for informational purposes only. The Fund is actively managed and does not seek to track or

replicate the performance of any index. The index performance shown is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance.

More information about the Fund’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Fund’s absolute performance based on NAV:

Municipal bonds posted slightly positive returns in the annual period. Bond market performance, in general, was dampened by the combination of high

inflation and continued interest rate increases by the Fed. However, the contribution from income outweighed the impact of falling prices.

The

Fund’s use of U.S. Treasury futures to manage interest rate risk added value in the rising-rate environment. At the sector level, tax backed states, transportation, and corporate municipals made the largest contributions. Despite the volatility

throughout the period, low new issuance led to tighter yield spreads for higher-quality securities. Strong fundamental trends in the transportation sectors, especially airports, also helped fuel positive performance. Bonds with maturities of 18 to

25 years were especially notable contributors in this area. Holdings in pre-paid gas securities, typically concentrated in the 5-10 year maturity range, further

contributed positively given their shorter duration and wide yield spreads at the time of purchase.

On the negative side, long-dated securities with

maturities of 25 years and above—particularly those with lower coupons—detracted from performance due to their higher interest rate sensitivity. Some shorter dated bonds, especially one- to five-year

pre-refunded debt, underperformed modestly due to the increase in short term rates coupled with a decline in price to par as they neared maturity.

The healthcare and housing sectors, especially holdings in lower coupon bonds (those with 4% coupons or below) also detracted from returns. Within the

housing sector, positions in high yield workforce housing securities were the largest detractors. The Fund’s use of leverage, which amplified the effect of falling prices, was another detractor of note.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or

other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

| 16 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

|

|

|

| Fund Summary as of July 31, 2023 (continued) |

|

BlackRock MuniYield Fund, Inc. (MYD) |

Overview of the Fund’s Total Investments

SECTOR ALLOCATION

|

|

|

|

|

| |

|

| Sector(a)(b) |

|

Percentage of

Total Investments |

|

|

|

| Transportation |

|

|

20.5 |

% |

| State |

|

|

16.7 |

|

| Utilities |

|

|

13.4 |

|

| County/City/Special District/School District |

|

|

12.8 |

|

| Corporate |

|

|

12.7 |

|

| Health |

|

|

12.0 |

|

| Education |

|

|

5.2 |

|

| Tobacco |

|

|

4.3 |

|

| Housing |

|

|

2.4 |

|

CALL/MATURITY SCHEDULE

|

|

|

|

|

| |

|

| Calendar Year Ended December 31,(a)(c) |

|

Percentage |

|

|

|

| 2023 |

|

|

7.6 |

% |

| 2024 |

|

|

8.6 |

|

| 2025 |

|

|

4.5 |

|

| 2026 |

|

|

2.5 |

|

| 2027 |

|

|

5.9 |

|

CREDIT QUALITY ALLOCATION

|

|

|

|

|

| |

|

| Credit Rating(a)(d) |

|

Percentage of

Total Investments |

|

|

|

| AAA/Aaa |

|

|

2.6 |

% |

| AA/Aa |

|

|

40.7 |

|

| A |

|

|

35.2 |

|

| BBB/Baa |

|

|

8.2 |

|

| BB/Ba |

|

|

3.9 |

|

| B |

|

|

1.5 |

|

| N/R(e) |

|

|

7.9 |

|

| (a) |

Excludes short-term securities. |

| (b) |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may

combine such sector sub-classifications for reporting ease. |

| (c) |

Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years.

|

| (d) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either

S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of

BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are

subject to change. |

| (e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but

not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of

July 31, 2023, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1.0% of the Fund’s total investments. |

|

|

|

| Fund Summary as of July 31, 2023 |

|

BlackRock MuniYield Quality Fund, Inc. (MQY) |

Investment Objective

BlackRock MuniYield Quality Fund,

Inc.’s (MQY) (the “Fund”) investment objective is to provide shareholders with as high a level of current income exempt from U.S. federal income taxes as is consistent with its investment policies and prudent investment

management. The Fund seeks to achieve its investment objective by investing at least 80% of its assets in municipal bonds exempt from U.S federal income taxes (except that the interest may be subject to the U.S. federal alternative minimum tax). The

Fund invests in municipal bonds which are in the three highest quality rating categories (A or better), or which are deemed to be of comparable quality by the adviser, at the time of investment. The Fund invests primarily in long-term municipal

bonds with maturities of more than ten years at the time of investment. The Fund may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Fund’s investment objective will be achieved.

Fund Information

|

|

|

| |

|

| Symbol on New York Stock Exchange |

|

MQY |

| Initial Offering Date |

|

June 26, 1992 |

| Yield on Closing Market Price as of July 31, 2023 ($

11.86)(a) |

|

4.40% |

| Tax Equivalent Yield(b) |

|

7.43% |

| Current Monthly Distribution per Common Share(c)

|

|

$0.043500 |

| Current Annualized Distribution per Common Share(c)

|

|

$0.522000 |

| Leverage as of July 31, 2023(d) |

|

35% |

| |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing

market price. Past performance is not an indication of future results. |

|

| |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax.

Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

|

| |

(c) |

The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of

capital or net realized gain. |

|

| |

(d) |

Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund,

including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized

by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

|

Market Price and Net Asset Value Per Share Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

07/31/23 |

|

|

07/31/22 |

|

|

Change |

|

|

High |

|

|

Low |

|

|

|

|

|

|

|

| Closing Market Price |

|

$ |

11.86 |

|

|

$ |

13.12 |

|

|

|

(9.60 |

)% |

|

$ |

13.37 |

|

|

$ |

10.62 |

|

| Net Asset Value |

|

|

13.22 |

|

|

|

13.89 |

|

|

|

(4.82 |

) |

|

|

14.02 |

|

|

|

11.79 |

|

GROWTH OF $10,000 INVESTMENT

| |

(a) |

Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or

distributions at actual reinvestment prices. |

|

| |

(b) |

An unmanaged index that tracks the U.S. long term tax-exempt bond market,

including state and local general obligation bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

|

|

|

|

| 18 |

|

2 0 2 3 B L A C

K R O C K A N N U A L R E P O R

T T O S H A R E H O L D E R

S |

|

|

|

| Fund Summary as of July 31, 2023 (continued) |

|

BlackRock MuniYield Quality Fund, Inc. (MQY) |

Performance

Returns for the period ended July 31, 2023

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Average Annual Total Returns |

|

|

|

|

|

| |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

|

|

|

| Fund at NAV(a)(b) |

|

|

(0.11 |

)% |

|

|

1.81 |

% |

|

|

4.41 |

% |

| Fund at Market

Price(a)(b) |

|

|

(5.12 |

) |

|

|

1.72 |

|

|

|

3.84 |

|

|

|

|

|

| National Customized Reference Benchmark(c)

|

|

|

0.82 |

|

|

|

1.98 |

|

|

|

N/A |

|

| Bloomberg Municipal Bond Index |

|

|

0.93 |

|

|

|

1.87 |

|

|

|

2.81 |

|

| |

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results

reflect the Fund’s use of leverage, if any. |

|

| |

(b) |