UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September 11, 2023

MAGELLAN

MIDSTREAM PARTNERS, L.P.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

1-16335 |

|

73-1599053 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification

No.) |

One

Williams Center

Tulsa,

Oklahoma 74172

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code (918) 574-7000

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange

on Which Registered |

| Common

Units |

|

MMP |

|

New

York Stock Exchange |

Item

8.01 Other Events.

As

previously announced, on May 14, 2023, Magellan Midstream Partners, L.P. (NYSE: MMP), a Delaware limited partnership (“Magellan”),

entered into an Agreement and Plan of Merger (the “Merger Agreement”) with ONEOK, Inc., an Oklahoma corporation (NYSE:

ONEOK) (“ONEOK”), and Otter Merger Sub, LLC, a Delaware limited liability company and a newly formed, wholly owned

subsidiary of ONEOK (“Merger Sub”), pursuant to which, upon the terms and subject to the conditions of the Merger

Agreement, Merger Sub will merge with and into Magellan (the “Merger”), with Magellan continuing as the surviving

entity and a wholly owned subsidiary of ONEOK.

On

September 11, 2023, Magellan issued a press release announcing that its board of directors has declared a special cash distribution payable

on September 25, 2023 to unitholders of record at the close of business on September 21, 2023. A copy of the press release is attached

hereto as Exhibit 99.1 and is incorporated herein by reference.

Cautionary

Statement Regarding Forward-Looking Statements

This

report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included

in this report that address activities, events or developments that ONEOK or Magellan expects, believes or anticipates will or may occur

in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,”

“expect,” “anticipate,” “potential,” “create,” “intend,” “could,”

“would,” “may,” “plan,” “will,” “guidance,” “look,” “goal,”

“future,” “build,” “focus,” “continue,” “strive,” “allow” or

the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion

of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements

are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the Merger, our ability

to generate sufficient free cash flow in excess of ordinary distributions during the four-month period commencing on May 14, 2023, the

expected closing of the Merger and the timing thereof and as adjusted descriptions of the post-transaction company and its operations,

strategies and plans, integration, debt levels and leverage ratio, capital expenditures, cash flows and anticipated uses thereof, synergies,

opportunities and anticipated future performance, including maintaining current ONEOK management, enhancements to investment-grade credit

profile, an expected accretion to earnings and free cash flow, dividend payments and potential share repurchases, increase in value of

tax attributes and expected impact on EBITDA. Information adjusted for the Merger should not be considered a forecast of future results.

There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements

included in this report. These include the risk that ONEOK’s and Magellan’s businesses will not be integrated successfully;

the risk that cost savings, synergies and growth from the Merger may not be fully realized or may take longer to realize than expected;

the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect; the possibility

that shareholders of ONEOK may not approve the issuance of new shares of ONEOK common stock in the Merger or that unitholders of Magellan

may not approve the Merger; the risk that a condition to closing of the Merger may not be satisfied, that either party may terminate

the Merger Agreement or that the closing of the Merger might be delayed or not occur at all; potential adverse reactions or changes to

business or employee relationships, including those resulting from the announcement or completion of the Merger; the occurrence of any

other event, change or other circumstances that could give rise to the termination of the Merger Agreement relating to the Merger; the

risk that changes in ONEOK’s capital structure and governance could have adverse effects on the market value of its securities;

the ability of ONEOK and Magellan to retain customers and retain and hire key personnel and maintain relationships with their suppliers

and customers and on ONEOK’s and Magellan’s operating results and business generally; the risk the Merger could distract

management from ongoing business operations or cause ONEOK and/or Magellan to incur substantial costs; the risk of any litigation relating

to the Merger; the risk that ONEOK may be unable to reduce expenses or access financing or liquidity; the impact of a pandemic, any related

economic downturn and any related substantial decline in commodity prices; the risk of changes in governmental regulations or enforcement

practices, especially with respect to environmental, health and safety matters; and other important factors that could cause actual results

to differ materially from those projected. All such factors are difficult to predict and are beyond ONEOK’s or Magellan’s

control, including those detailed in the joint proxy statement/prospectus (as defined below). All forward-looking statements are based

on assumptions that ONEOK and Magellan believe to be reasonable but that may not prove to be accurate. Any forward-looking statement

speaks only as of the date on which such statement is made, and neither ONEOK nor Magellan undertakes any obligation to correct or update

any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

Important

Additional Information and Where to Find It

In

connection with the Merger, on July 25, 2023, ONEOK, Inc. and Magellan Midstream Partners, L.P. each filed with the Securities and Exchange

Commission (the “SEC”) a definitive joint proxy statement/prospectus (the “joint proxy statement/prospectus”),

and each party has and will file other documents regarding the Merger with the SEC. Each of ONEOK and Magellan commenced mailing copies

of the joint proxy statement/prospectus to shareholders of ONEOK and unitholders of Magellan, respectively, on or about July 25, 2023.

This report is not a substitute for the joint proxy statement/prospectus or for any other document that ONEOK or Magellan has filed or

may file in the future with the SEC in connection with the Merger. INVESTORS AND SECURITY HOLDERS OF ONEOK AND MAGELLAN ARE URGED TO

CAREFULLY AND THOROUGHLY READ THE JOINT PROXY STATEMENT/PROSPECTUS, INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO, AND OTHER RELEVANT

DOCUMENTS FILED OR THAT WILL BE FILED BY ONEOK AND MAGELLAN WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ONEOK

AND MAGELLAN, THE MERGER, THE RISKS RELATED THERETO AND RELATED MATTERS.

Investors

can obtain free copies of the joint proxy statement/prospectus and other relevant documents filed by ONEOK and Magellan with the SEC

through the website maintained by the SEC at www.sec.gov. Copies of documents filed with the SEC by ONEOK, including the joint proxy

statement/prospectus, are available free of charge from ONEOK’s website at www.oneok.com under the “Investors” tab.

Copies of documents filed with the SEC by Magellan, including the joint proxy statement/prospectus, are available free of charge from

Magellan’s website at www.magellanlp.com under the “Investors” tab.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Magellan

Midstream Partners, L.P. |

| |

|

|

| |

By: |

Magellan

GP, LLC, |

| |

|

its

general partner |

| |

|

|

| Date:

September 11, 2023 |

By: |

/s/

Jeff L. Holman |

| |

Name: |

Jeff

L. Holman |

| |

Title: |

Executive

Vice President, Chief Financial Officer and Treasurer |

3

Exhibit 99.1

NYSE: MMP

| Date: |

|

Sept. 11, 2023 |

| Contact: |

|

Paula Farrell |

| |

|

(918) 574-7650 |

| |

|

paula.farrell@magellanlp.com |

Magellan Midstream Declares Special Cash Distribution

TULSA, Okla. – The board of directors of Magellan Midstream Partners, L.P. (NYSE: MMP) has declared a special cash distribution expected to equal 24.74 cents per unit payable on Sept. 25 to unitholders of record at the close of business on Sept. 21.

The right to issue this special distribution was

negotiated as part of our pending merger with ONEOK, Inc., providing us the option to pay up to $50 million, or 24.74 cents per unit based

on the 202.1 million units currently outstanding, if the merger has not closed by Sept. 14 and if we have generated sufficient free cash

flow in excess of ordinary distributions since May 14, 2023, the date on which we entered into the merger agreement. Our unitholder meeting

in connection with the pending merger is scheduled to be held virtually at 10:00 a.m. Central Time on Sept. 21.

Magellan investors are encouraged to visit www.MaximizingValueforMMPunitholders.com

for additional information about our pending merger, including transaction benefits, tax considerations and unitholder voting instructions

in advance of our Sept. 21 virtual special meeting.

Magellan’s distributions to foreign investors

are subject to federal income tax withholding at the highest applicable U.S. tax rate plus an additional 10%. Our qualified notice to

nominees is available at www.magellanlp.com/investors/cashdistributionsandqualifiednotice.aspx.

About Magellan Midstream Partners, L.P.

Magellan Midstream Partners, L.P. (NYSE: MMP) is a publicly traded

partnership that primarily transports, stores and distributes refined petroleum products and crude oil. Magellan owns the longest refined

petroleum products pipeline system in the country, with access to nearly 50% of the nation’s refining capacity, and can store more

than 100 million barrels of petroleum products such as gasoline, diesel fuel and crude oil. More information is available at www.magellanlp.com.

###

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of historical fact, included in this communication that address activities, events or developments

that ONEOK, Inc. (“ONEOK”) or Magellan expects, believes or anticipates will or may occur in the future are forward-looking

statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,”

“anticipate,” “potential,” “create,” “intend,” “could,” “would,”

“may,” “plan,” “will,” “guidance,” “look,” “goal,” “future,”

“build,” “focus,” “continue,” “strive,” “allow” or the negative of such terms

or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions,

or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking.

These forward-looking statements include, but are not limited to, statements regarding the proposed transaction between ONEOK and Magellan

(the “proposed transaction”), our ability to generate sufficient free cash flow in excess of ordinary distributions during

the four-month period commencing on May 14, 2023, the expected closing of the proposed transaction and the timing thereof and as adjusted

descriptions of the post-transaction company and its operations, strategies and plans, integration, debt levels and leverage ratio, capital

expenditures, cash flows and anticipated uses thereof, synergies, opportunities and anticipated future performance, including maintaining

current ONEOK management, enhancements to investment-grade credit profile, an expected accretion to earnings and free cash flow, dividend

payments and potential share repurchases, increase in value of tax attributes and expected impact on EBITDA. Information adjusted for

the proposed transaction should not be considered a forecast of future results. There are a number of risks and uncertainties that could

cause actual results to differ materially from the forward-looking statements included in this communication. These include the risk that

ONEOK’s and Magellan’s businesses will not be integrated successfully; the risk that cost savings, synergies and growth from

the proposed transaction may not be fully realized or may take longer to realize than expected; the risk that the credit ratings of the

combined company or its subsidiaries may be different from what the companies expect; the possibility that shareholders of ONEOK may not

approve the issuance of new shares of ONEOK common stock in the proposed transaction or that unitholders of Magellan may not approve the

proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied, that either party may terminate

the merger agreement or that the closing of the proposed transaction might be delayed or not occur at all; potential adverse reactions

or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction;

the occurrence of any other event, change or other circumstances that could give rise to the termination of the merger agreement relating

to the proposed transaction; the risk that changes in ONEOK’s capital structure and governance could have adverse effects on the

market value of its securities; the ability of ONEOK and Magellan to retain customers and retain and hire key personnel and maintain relationships

with their suppliers and customers and on ONEOK’s and Magellan’s operating results and business generally; the risk the proposed

transaction could distract management from ongoing business operations or cause ONEOK and/or Magellan to incur substantial costs; the

risk of any litigation relating to the proposed transaction; the risk that ONEOK may be unable to reduce expenses or access financing

or liquidity; the impact of a pandemic, any related economic downturn and any related substantial decline in commodity prices; the risk

of changes in governmental regulations or enforcement practices, especially with respect to environmental, health and safety matters;

and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult

to predict and are beyond ONEOK’s or Magellan’s control, including those detailed in the joint proxy statement/prospectus

(as defined below). All forward-looking statements are based on assumptions that ONEOK and Magellan believe to be reasonable but that

may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and neither ONEOK

nor Magellan undertakes any obligation to correct or update any forward-looking statement, whether as a result of new information, future

events or otherwise, except as@ required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed transaction, on July 25, 2023, ONEOK,

Inc. and Magellan Midstream Partners, L.P. each filed with the Securities and Exchange Commission (the “SEC”) a definitive

joint proxy statement/prospectus (the “joint proxy statement/prospectus”), and each party has and will file other documents

regarding the proposed transaction with the SEC. Each of ONEOK and Magellan commenced mailing copies of the joint proxy statement/prospectus

to shareholders of ONEOK and unitholders of Magellan, respectively, on or about July 25, 2023. This communication is not a substitute

for the joint proxy statement/prospectus or for any other document that ONEOK or Magellan has filed or may file in the future with the

SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF ONEOK AND MAGELLAN ARE URGED TO CAREFULLY AND

THOROUGHLY READ THE JOINT PROXY STATEMENT/PROSPECTUS, INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO, AND OTHER RELEVANT DOCUMENTS FILED

OR THAT WILL BE FILED BY ONEOK AND MAGELLAN WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ONEOK AND MAGELLAN, THE

PROPOSED TRANSACTION, THE RISKS RELATED THERETO AND RELATED MATTERS.

Investors can obtain free copies of the joint proxy statement/prospectus

and other relevant documents filed by ONEOK and Magellan with the SEC through the website maintained by the SEC at www.sec.gov. Copies

of documents filed with the SEC by ONEOK, including the joint proxy statement/prospectus, are available free of charge from ONEOK’s

website at www.oneok.com under the “Investors” tab. Copies of documents filed with the SEC by Magellan, including the joint

proxy statement/prospectus, are available free of charge from Magellan’s website at www.magellanlp.com under the “Investors”

tab.

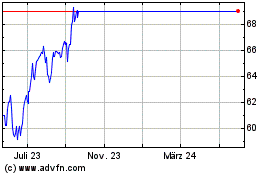

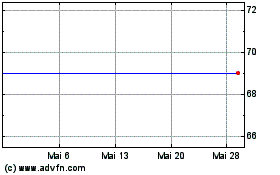

Magellan Midstream Partn... (NYSE:MMP)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Magellan Midstream Partn... (NYSE:MMP)

Historical Stock Chart

Von Mai 2023 bis Mai 2024